- with readers working within the Banking & Credit and Securities & Investment industries

- within International Law, Corporate/Commercial Law, Food, Drugs, Healthcare and Life Sciences topic(s)

Key takeaways

- A higher bar for FDIC and OCC enforcement actions based on safety and soundness

- A higher bar for MRAs

- but with a lower standard than the new enforcement standard

- MRAs based on violations of law would require actual

- not merely potential

- violations and could not be based on immaterial violations of nonbanking regulations or laws

- Application of the standards would be tailored to the underlying financial risks of the bank

- FDIC- and OCC-supervised banks should expect a narrowed scope of enforcement activity

- Nonbinding FDIC and OCC examiner suggestions will be truly nonbinding

- Downgrades of bank composite ratings would be tied to material financial risks

- but no similar changes for Management component

- Codified prohibition on the use of reputation risk

A deeper dive on each key takeaway is provided beginning on slide 10.

What should banks do now?

FDIC- and OCC-supervised banks could immediately benefit from the agencies' shift in supervisory approach.

- Banks should consider how they could immediately adapt their existing practices to the proposals.

- The proposed definition of "unsafe and unsound

practice" would apply prospectively only.

- Even so, banks should assess how they might reduce the burden of remediating existing enforcement actions and MRAs.

- Banks should engage with their supervisory teams, since any narrowing of existing action plans would need to be confirmed by their examiners.

- Some questions to consider:

- Are there MRAs for which the bank has completed its remediation, but is awaiting closure because the agency verification and validation process is ongoing?

- Could some MRAs be narrowed or eliminated entirely because, for example, they were not focused on material financial risk, were, wholly or in part, based on reputational risk, or were driven by the bank's non-adoption of an examiner's non-binding suggestion?

- Do action plans include steps that are not focused on material financial risk, that address reputational risk, or that otherwise would not be acceptable under the proposals? If so, can they be simplified?

- Given the agencies' intention not to bring enforcement actions and MRAs based on concerns related to "policies, process, documentation and other nonfinancial risks," can the bank's checklist, process and policy workload be lightened?

- Banks should likewise review their policies and procedures with respect to reputation risk, with special attention to debanking considerations and the agencies' view that BSA/AML concerns can be used inappropriately as a pretext for reputation risk.

Summary of proposals

Background

The FDIC and OCC have jointly proposed to codify key changes to their supervisory frameworks through two notices of proposed rulemaking, which we refer to as the Supervisory Standards Proposal and the Reputation Risk Proposal (together, the Proposals).

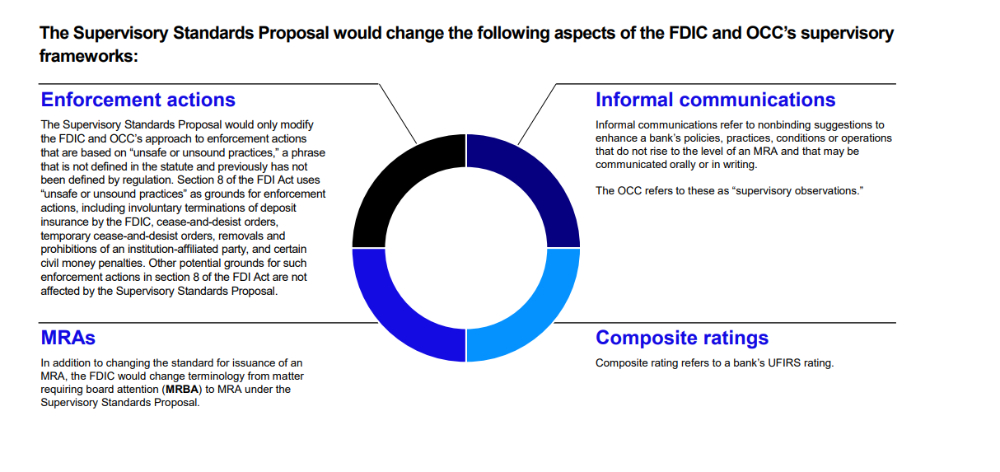

- The Supervisory Standards Proposal would introduce new standards for when the FDIC and OCC will take an enforcement action based on an "unsafe or unsound practice" under section 8 of the Federal Deposit Insurance Act (FDI Act) or issue a matter requiring attention (MRA) to a bank. The proposed standards reflect a narrowed supervisory approach focused on material financial risks.

- The Reputation Risk Proposal would codify the elimination of reputation risk from the FDIC and OCC's supervisory programs in those agencies' regulations.

- Notably, the Federal Reserve Board did not join the Proposals, and it remains to be seen what, if any, parallel changes it will make to its supervisory framework.

- Comments on both Proposals are due 60 days after publication in the Federal Register.

Areas affected by the Supervisory Standards Proposal

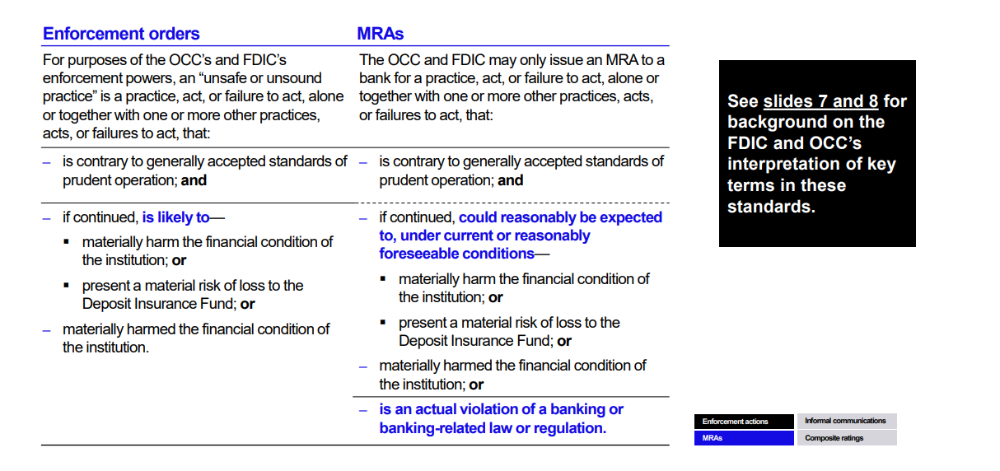

Comparing the proposed standards for unsafe or unsound practices and MRAs

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.