After commercial Chapter 11 filings soared to their highest levels in more than a decade in 2020, the numbers gradually came back to Earth in the latter part of 2020 and, in 2021, fell well below annual averages. The primary driver of this reversal was twofold: swift and robust central bank intervention around the world and readily available and affordable capital from banks, private equity, and hedge funds. Companies were able to amass liquidity by tapping into existing lines of credit, undertaking major capital structure reconfigurations, and leveraging previously unencumbered assets in order to finance existing debt obligations and maintain operations during the pandemic. While this has temporarily abated anticipated increases in restructuring activity, increased interest rates, uncertainty regarding the pandemic's impact on market demand, inflation, and government intervention will all factor into whether restructuring trends return to more "normal" historical ranges or continue their current below-average trajectory.

Future restructuring trends will likely turn on, among other things, whether high-yield issuances remain steady or continue to slow in the coming year and whether liquidity remains readily available and affordable. These macro and micro factors will likely impact the ability of many borrowers to afford existing debt and limit borrowers' optionality in the future, and could prompt an increase in court-supervised restructurings.

EXECUTIVE SUMMARY

After commercial Chapter 11 filings soared to their highest levels in more than a decade in 2020, the numbers gradually came back to Earth in the latter part of 2020 and, in 2021, fell well below annual averages. The primary driver of this reversal was twofold: swift and robust central bank intervention around the world and readily available and affordable capital from banks, private equity, and hedge funds. Companies were able to amass liquidity by tapping into existing lines of credit, undertaking major capital structure reconfigurations, and leveraging previously unencumbered assets in order to finance existing debt obligations and maintain operations during the pandemic. While this has temporarily abated anticipated increases in restructuring activity, increased interest rates, uncertainty regarding the pandemic's impact on market demand, inflation, and government intervention will all factor into whether restructuring trends return to more "normal" historical ranges or continue their current below-average trajectory.

Future restructuring trends will likely turn on, among other things, whether high-yield issuances remain steady or continue to slow in the coming year and whether liquidity remains readily available and affordable. These macro and micro factors will likely impact the ability of many borrowers to afford existing debt and limit borrowers' optionality in the future, and could prompt an increase in court-supervised restructurings.

2020: PEAK YEAR OF RESTRUCTURING

Chapter 11 Filings Reach Historic Highs

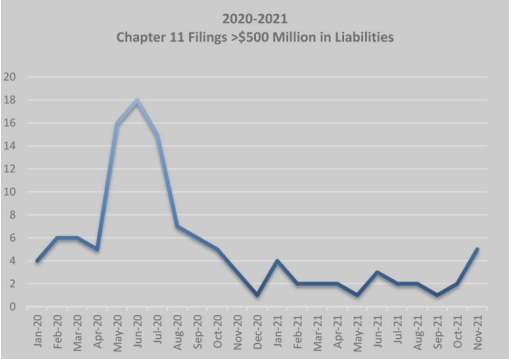

During 2020, bankruptcy filings reached their highest levels since the 2009 financial crisis.1 Ninety-two companies with liabilities in excess of $500 million filed for bankruptcy.2 This number constituted an 88% increase from 2019, and a 272% increase over the national annual average since 2005.3 Sixty companies with liabilities exceeding $1 billion filed Chapter 11, representing a 170% increase over the annual average between 2005 and 2020.4 Chapter 11 filings peaked in July 2020 after three consecutive months of record numbers of filings.5 Fiftyone companies with liabilities exceeding $1 billion filed from January 1 to June 30, while only nine restructured in the final six months of 2020.6 For companies with liabilities exceeding $500 million, only 22 filed for Chapter 11 from approximately July 1 to December 31, a substantial drop from the 70 filings in the first half of the year.7 The second half of 2020 therefore experienced a more rapid recovery than that following the Lehman Brothers filing in 2009.8 Indeed, by October 2020, monthly bankruptcy filings returned to historical averages.9

Footnotes

1 2021 Transactions Year in Review, BankruptcyData.com, https:// info.bankruptcydata.com/midyear2021-0?utm_medium=email&_ hsmi=148251860&_hsenc=p2ANqtz-9HzGechSmp0rRgoMKwKgTyo-yUou8-7FJcwZH5mQy53o_FeJwWbrNbcxAvLkeuktJYXlozt3u8AKG3_siuvYk1MRvJg&utm_content=148251860&utm_ source=hs_email.

2 According to BankruptcyData.com.

3 Id.

4 See Trends in Large Corporate Bankruptcy and Financial Distress: Midyear 2021 Update, Cornerstone Research, 1, https://www.cornerstone.com/Publications/Reports/Trends-in-Large-CorporateBankruptcy-and-Financial-Distress-Midyear-2021-Update.

5 Eight or more companies with assets exceeding $1 billion filed for chapter 11 in May, June, and July 2020. The previous record of eight filings was set in May 2009. Id. at 2.

6 See BankruptcyData.com, supra note 2.

7 See BankruptcyData.com, supra note 2.

8 See Cornerstone Research, supra note 4, at 2.

9 Id. at 3.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.