- within Immigration and Corporate/Commercial Law topic(s)

- with Finance and Tax Executives

- with readers working within the Automotive, Basic Industries and Healthcare industries

As detailed in a previous alert, on December 31, 2016, the hourly rate for "food service workers" in New York City is expected to increase to $7.50 with a $3.50 tip credit for a total of $11.00 for large employers (11 or more employees); and to $7.50 with a $3.00 tip credit for a total of $10.50 for small employers (10 or fewer employees). A "food service worker" eligible for this tip credit must be employed in a position that customarily and regularly receives tips, including but not limited to: server, busser, food runner and bartender.

The Hospitality Wage Order, however, specifically states that the term "food service worker" does not include delivery workers. Instead, delivery workers must be paid at the "service employee" tip credit rate. Moreover, the service employee tip credit rate now includes an hourly "tip threshold," which must be met in order for employers to avail themselves of the tip credit. If a service employee's weekly average of tips does not meet the hourly tip threshold rate, an employer may not pay that employee at the tip credit rate.

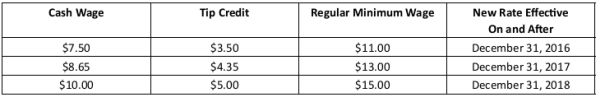

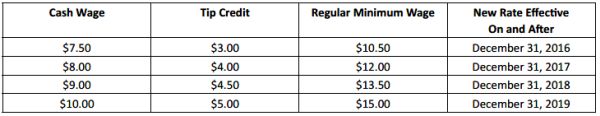

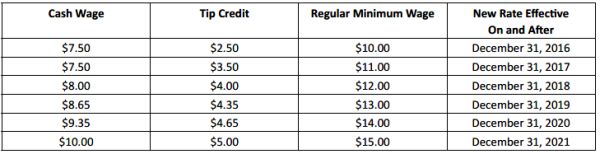

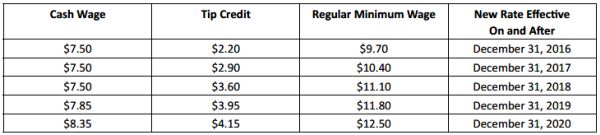

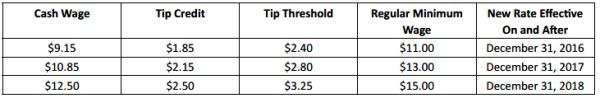

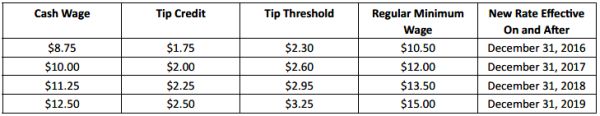

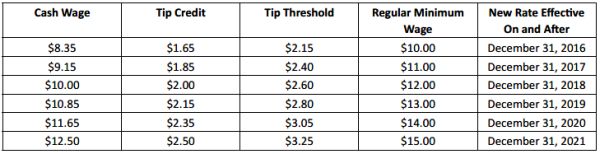

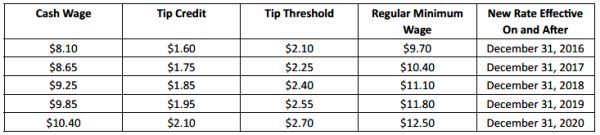

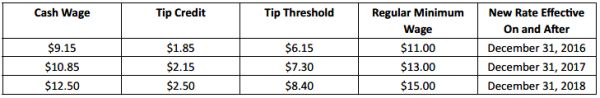

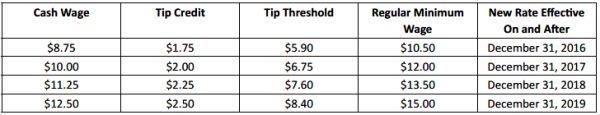

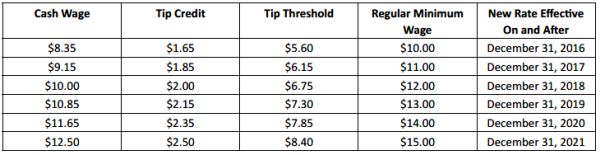

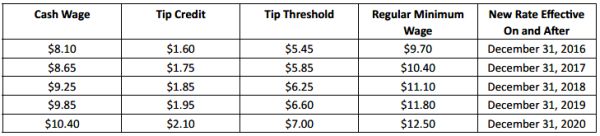

The charts below detail the Hospitality Wage Order's proposed increases for "food service workers," "service employees" other than at resort hotels (which includes delivery workers) and "service employees" at resort hotels.

Food Service Workers

New York City Large Employers (11 or More Employees):

New York City Small Employers (10 or Fewer Employees):

Remainder of Downstate (Nassau, Suffolk and Westchester Counties):

Remainder of State (Outside of New York City, Nassau, Suffolk and Westchester Counties):

Service Employees (Other than at Resort Hotels, including Delivery Workers)

New York City Large Employers (11 or More Employees):

New York City Small Employers (10 or Fewer Employees):

Remainder of Downstate (Nassau, Suffolk and Westchester Counties):

Remainder of State (Outside of New York City, Nassau, Suffolk and Westchester Counties):

Service Employees at Resort Hotels

New York City Large Employers (11 or More Employees):

New York City Small Employers (10 or Fewer Employees):

Remainder of Downstate (Nassau, Suffolk and Westchester Counties):

Remainder of State (Outside of New York City, Nassau, Suffolk and Westchester Counties):

New York employers in the hospitality industry will need to comply with the above minimum wage increases over the next several years and maintain accurate records reflecting tip credit and tip threshold compliance. Employers should work closely with counsel in order to properly implement these regulations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.