- within Finance and Banking topic(s)

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- with readers working within the Banking & Credit industries

Introduction

Banks pioneered the fund finance market – private credit will be an integral part of its growth going forward. Private credit funds and their sponsors have gained significance in fund finance, extending beyond the role of consumers of capital, to now increasingly serving as lenders and transaction arrangers. Fund lending by private credit funds can take many forms, but often these transactions involve a stratification of risk whereby banks lend at the top of the capital structure, and the higher-return, higher-leverage tranche is originated by or transferred to private credit funds.

This trend in fund finance is just one component of a broader credit industry rearrangement in the roles of, and relationships between, banks and private credit funds. By sourcing locked-in long-term lending capital from diverse sources and deploying it in innovative structures, private credit is positioned to be a key component in the future development of fund finance. This chapter explores the role of private credit in fund finance and the implications for the industry going forward.

Fund finance: from esoteric asset class into the mainstream

Fund finance describes debt solutions provided to funds across private equity, private credit, real estate, infrastructure, venture capital funds, and other strategies. Taking several forms, these debt solutions help funds manage liquidity needs and optimise returns by providing customisable, cost-efficient debt capital.

Foundational to fund finance, subscription facilities have become a standard tool for institutional private funds across the globe. These loans are secured by unfunded investor capital commitments and are supported by lender rights to call, collect, and enforce the payment of investor capital commitments. Because of the low-risk nature of the financing, banks have historically been the primary provider of this capital, servicing subscription facility demand by providing revolving loans.

Over time, fund finance products have broadened to meet other needs. Net asset value (NAV) loans, secured by a fund's portfolio assets and typically used later in the fund life cycle, have come to serve as an important liquidity management option, allowing sponsors to raise capital against fund assets without necessitating a sale. NAV loans also serve as return-enhancing leverage when the cost of funds on the loan, which generally benefits from referencing a diversified portfolio, prices inside the return generated by those investments. Hybrid facilities combine subscription and NAV collateral into a single financing and can service the full lifecycle of a closed-end fund by primarily relying on capital commitments early in the fund's existence and transitioning to relying on the value of fund assets as the fund accumulates investments over time.

Beyond these core products, the fund finance toolkit further includes management company and general partner (GP) stake loans, which are loans to fund managers or GPs secured by management fee income streams or fund investment interests. Finally, fund investors also make use of fund finance through portfolio loans, preferred equity issuance, and collateralised fund obligations to raise capital against fund investments to free up liquidity and enhance returns.

Bringing all of these together, fund finance has emerged from its status as a niche product serviced by a few specialised bank lenders into a mainstream asset class characterised by widespread fund-side adoption, increased standardisation, a diversifying lender base, institutional investor participation, and a well-developed ratings framework.

Exhibit: fund financing in its many forms

| Transaction structure | Collateral | Purpose from fund perspective |

| Subscription facilities | Unfunded capital commitments of limited partners (LPs). | Bridging investments, managing fund cash flow, optimising LP capital deployment for internal rate of return management. |

| NAV facilities | Existing portfolio of illiquid investments (loans, debt instruments, and equity stakes) held by the fund. | Providing liquidity for distributions, recycling capital, adding incremental fund-level leverage, bridging exits, and recapitalisations. |

| Warehouse facilities | Newly originated loans or assets (e.g., corporate loans, consumer loans, and mortgages) before securitisation or long-term financing. | Interim financing to accumulate assets for subsequent securitisation (e.g., collateralised loan obligations and asset-backed securities) or permanent financing; scaling origination volume. |

| Asset-based lending (ABL) | Specific, identifiable liquid or semi-liquid assets held by the fund/special purpose vehicle (SPV) (e.g., receivables and inventory). | Providing liquidity against traditional ABL-eligible assets held by the fund or its dedicated SPV; less common for diversified private credit funds. |

| Back leverage facilities | Equity or junior debt interests held by the fund/sponsor in underlying investments. | Financing a portion of the fund's/sponsor's equity contribution; optimising capital structure; enhancing returns on equity; and providing liquidity at the holding company level. |

| Loan-on-loan facilities | Specific underlying direct loans originated or acquired by the private credit fund. | Leverage on individual loans or small pools of loans; increasing investment capacity; and managing liquidity for fund-level deployment. |

| Repo facilities (repurchase agreements) | Underlying debt securities (e.g., corporate loans and bonds) held by the private credit fund. | Short-term financing for the fund's holdings; managing liquidity; and temporarily adjusting exposure to specific assets. |

| Credit risk transfer (CRT) | The underlying portfolio of loans on the bank's balance sheet (here, the loans are not "collateral" in the traditional sense, but are rather "reference obligations" in a derivative transaction, pursuant to which the bank sells a risk tranche to the private credit fund). | Access to diversified credit risk with attractive yields without loan-level front-office origination. |

| Securitisation | GP's or LP's fund investments. | Term financing of an identified pool of fund investments. |

| GP stakes financing | GP's interest in management fees and carried interest from the fund. | Providing liquidity/capital to the GP for firm operations, strategic initiatives, or acquisitions. |

Transaction volume and overall lender commitments underscore the development of fund finance into a mainstream asset class. Cadwalader, Wickersham & Taft LLP represented 85 lenders on 1,142 transactions globally in 2024, consisting of new originations, maturity extensions, and increases in capital commitments, for total lender commitments of $274.5 billion.

Private credit: what is old is new again

At the outset, it is important to clarify that the definition of private credit varies widely and market size estimates diverge accordingly. Historically, the label was used primarily to describe middle-market corporate lending by alternative asset managers deploying capital raised through closed-end funds. While this concept still describes a significant share of private credit lending today, the market has developed well beyond this definition in recent years. A more representative framing also includes: (1) capital sourced from direct investments by insurance companies, asset managers, pension funds, business development companies, and separately managed accounts; (2) investments in a broader set of asset classes that includes asset-backed finance, venture debt, structured credit, distressed, and special situations; and (3) the magnifying impact of leverage on total assets under management (AUM). This broader definition points to a market that well exceeds most estimates. (It also suggests that, given the blurred lines and inherent limitations in the private credit label, the market may be better served by clearer defined terms centred on providers, instrument types, and asset classes.)

As private credit fund AUM has expanded at double-digit annual rates over the past two decades, the demand for subscription financing – often in the form of large, syndicated transactions to support large flagship fundraises – NAV loans, and a growing spectrum of products to serve evergreen fund structures has concurrently increased.

More material to the outlook for fund finance has been the growing role of private credit funds as providers of capital in fund finance. These funds are increasingly active in providing subscription financing – particularly in transactions that do not fit easily into a bank credit box – NAV loans that generally provide higher returns, CRT transactions, and other risk participation arrangements with banks.

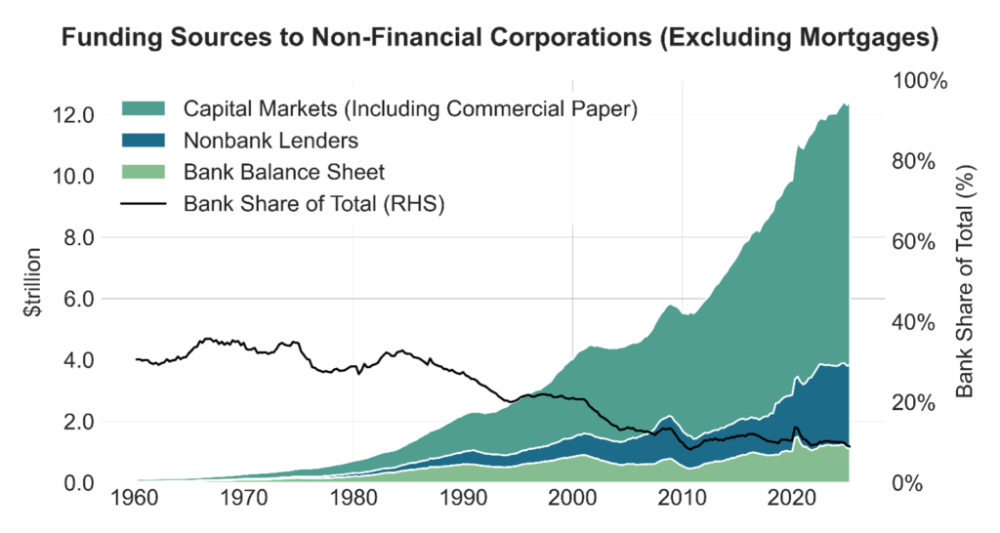

While the developing role of private credit funds still feels new and exciting, the fund finance experience is an extension of a long-established trend. Since the 1980s, bank balance sheets have undergone cycles of disintermediation, over time becoming partially displaced by debt capital markets and securitisation as funding sources iteratively in corporate lending, residential mortgages, commercial mortgages, and consumer receivables. As the pattern unfolded in each case, the reliance on bank balance sheets as the primary source of funding gave way to third-party origination channels while banks maintained a central role by evolving dual-channel originate-to-hold and originate-to-distribute strategies.

Exhibit: disintermediation illustrated – U.S. bank balance sheet lending to non-financial businesses

Funding sources to non-financial corporations (excluding mortgages)

Source: Board of Governors of the Federal Reserve System Financial Accounts of the United States and Cadwalader, Wickersham & Taft LLP.

Viewed in this context, the evolving role of private credit funds in fund finance is just the latest iteration of a half-century-long trend. But that may be an oversimplification. A deeper question at play is, when the structure and ultimate home for loans is determined by private credit fund managers, whether other core advisory and arranger functions still need to be housed at banks. The emerging verdict of the market is "not necessarily". For bank lenders, this has meant that the relationship to private credit is not simply collaborative, but instead also entails a competition for capital formation functions historically dominated by banks.

Exhibit: traditional capital formation functions are migrating to private sponsors

Services provided by private fund managers

| Financing | Capital markets | Advisory | Asset servicing |

|

" Securitisation

" Warehouse lending " Securities repo " Mergers and acquisitions and Initial Public Offering advice " Securities underwriting " Loan syndication |

|

|

Source: Cadwalader, Wickersham & Taft LLP.

Banking: not quite what it used to be

Historically, leading with balance sheet has been the calling card for bank lenders in fund finance. This has particularly been the case for subscription facilities, where investment-grade loan margins, the revolving nature of loans, and frequent demand for large facilities uniquely positioned banks to lean into a balance-sheet-forward approach that provided an onramp for other fund-related revenue opportunities. As the fund finance market has evolved, however, a full spectrum of financing solutions have become more relevant, demanding multi-product dexterity from lenders.

At the same time that banks developed integrated approaches to servicing more sophisticated finance needs from funds, growth in the private credit market positioned these alternative lenders to compete with banks in meeting the demand. With the rapid rise in private credit fund AUM, the aperture for asset classes also expanded. In fact, asset diversification became a strategic imperative to sustaining active capital deployment, generating differentiated risk-adjusted returns, mitigating the concentration risks inherent in traditional direct corporate lending, and to supporting fundraising.

As a result, a simultaneously competitive and cooperative relationship between banks and non-bank lenders is emerging. Having grown in scale, private credit funds are competing with banks across lending categories that include fund finance, and yet are often relying on financing from banks to fuel this expansion.

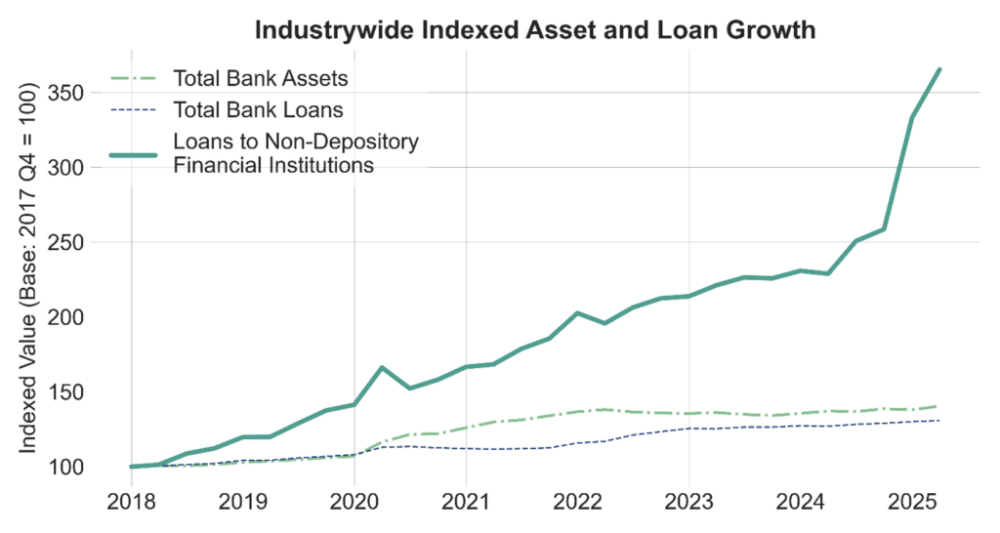

This new balance is readily apparent in disclosures on bank lending to non-depository financial institutions (NDFIs). The NDFI loan-type category in quarterly bank call reports (filed by U.S. banks and savings associations as well as U.S. branches of foreign banks) is intended to capture bank lending to non-bank financial institutions. While the information quality of the NDFI loan category is limited by its catch-all nature – loans to insurance companies, business development companies, real estate investment trusts, mortgage lenders, marketplace lenders, and private funds are all included in the category – the data points to a rapid rise in bank lending to the non-bank financial sector.

Exhibit: bank lending to NDFIs

Industrywide indexed asset and loan growth

Source: Federal Financial Institutions Examination Council (FFIEC), Consolidated Reports of Condition and Income (Call Reports) and Cadwalader, Wickersham & Taft LLP.

Growth in NDFI loans in part reflect a trend toward an outsourced lending model. In this model, the bank becomes a wholesale capital provider to a private credit fund that, in effect, acts as the outsourced lender. There are compelling reasons for banks to embrace this approach:

- Cost efficiency: In the outsourced model, the bank makes one loan to a private credit fund, while the underlying collateral may consist of a diversified pool of loans that the private credit fund sources. This simplifies the resource allocation for the bank because the underlying loans are originated and administered by the private credit sponsor.

- Structural alignment: Banks typically attach at a senior secured level, taking the senior-most tranche of risk on a pool of private credit loans, while controlling collateral quality by structuring eligibility criteria and maintenance covenants into the loan documents.

- Capital optimisation: In lending to a private credit fund, a bank can structure for securitisation treatment, which is more capital efficient than directly holding a pool of corporate loan exposures.

- Origination flexibility: Leverage lending activity by banks is subject to interagency guidance on leveraged lending and focused regulatory scrutiny through the Shared National Credit review programme. Supervisory examinations, stress testing, and risk-sensitive regulatory capital requirements all further inform bank leverage lending. Private credit funds are not similarly constrained. In a private credit partnership, a bank can lend at a senior secured level while gatekeeping eligible collateral, and structure loan tenure to allow for review at renewal.

In addition to these financing structures, banks in the U.S. are increasingly forming strategic partnerships and co-lending arrangements with private credit funds. These can involve the bank originating loans and then selling a portion of the loans to a private credit fund or placing the loans into a joint securitisation structure. Alternatively, the bank co-lends alongside a private credit fund with the understanding that the private credit fund's portion (or even the bank's retained portion) may eventually be securitised. While configurations vary, these partnerships all service the cost efficiency, structural alignment, capital optimisation, and origination flexibility motivations listed above.

CRT transactions: partnership in action

Bank CRTs provide one of the clearest illustrations of the collaborative risk stratification trend between banks and funds. These transactions involve a bank synthetically transferring a slice of credit risk on a defined pool of loans to external investors using a derivative. The result is a reduction in the bank's regulatory capital requirements.

Labels vary: in Europe and the UK, these structures fly under the label significant risk transfer (SRT), reflecting the EU Capital Requirements Regulation and Basel securitisation framework requirements that an originator must show that "significant" credit risk has moved off its balance sheet in order to obtain a lower capital charge. In the U.S., CRT is the more common moniker (sometimes also labelled "capital relief trades"), and traces its history to the Fannie Mae & Freddie Mac CRT programmes, dating back to 2013, in which the government-sponsored enterprises securitised a layer of credit loss risk on reference pools of single-family mortgages to third-party investors.

The key point here is that these transactions involve real risk transferring off bank balance sheets. Investors in CRT typically assume the first-loss or mezzanine position on a defined pool of loans, and typically enter the transaction on a funded basis, thereby minimising the bank's counterparty credit risk.

CRT attracts a diverse array of investors, including asset managers, hedge funds, insurance companies, and pension funds seeking access to high-quality, bank-originated assets on a structurally leveraged basis. Private credit sponsors are raising dedicated capital for CRT strategies, responding to the compelling asset class diversification and return profile of the product and the potential for growth as adoption spreads. Bank respondents to a survey by the International Association for Credit Portfolio Managers reported a 37% increase in SRT transactions in the EU in 2024 and a 16% increase globally, to reach an aggregate 650 transactions issued between 2016 and 2024.

In the U.S., CRT transactions have generally been structured synthetically (typically, using bilateral credit default swaps or credit-linked notes), while European and UK transactions have used both cash and synthetic structures. Subscription loan portfolios have been a target of transactions across jurisdictions because of the credit quality of the asset class, the ability to gain exposure to what has historically been a bank product, and the added ability to access the asset class on a levered return basis achieved by attaching lower in the capital structure.

CRT demonstrates how, by bringing in broader sources of capital and stratifying risk, private credit involvement in fund finance results in a fund finance market that is larger and more dynamic than what would be possible in a bank-only market.

Conclusion

The expanding footprint of private credit in fund finance reflects larger systemic trends that will only gain significance over time. A common thread is a stratification of the market with a higher-leverage, higher-return slice of risk more naturally landing at private credit funds. But for banks, the competitive pressure is broader: bank lenders are challenged to respond to private credit competitively through a broad integrated fund finance product offering and cooperatively by exploring the benefits of joint private credit arrangements, all while servicing private credit funds as clients. A variety of adaptions are bound to emerge and promise to deliver interesting content for future editions of GLI – Private Credit.

Editor's Note

This chapter has been written by a member of GLI's international panel of experts, who has been exclusively appointed for this task as a leading professional in their field by Global Legal Group, GLI's publisher. GLI's in-house editorial team carefully reviews and edits each chapter, updated annually, and audits each one for originality, relevance and style, including anti-plagiarism and AI-detection tools.

Originally published by Global Legal Group

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.