- within Compliance topic(s)

No rest for the weary. Unlike our friends in investment banking and corporate M&A who are enjoying leisurely holidays (albeit with smaller bonuses), the heady days and nights of dealmakers working on joint ventures and partnerships show no signs of relenting.

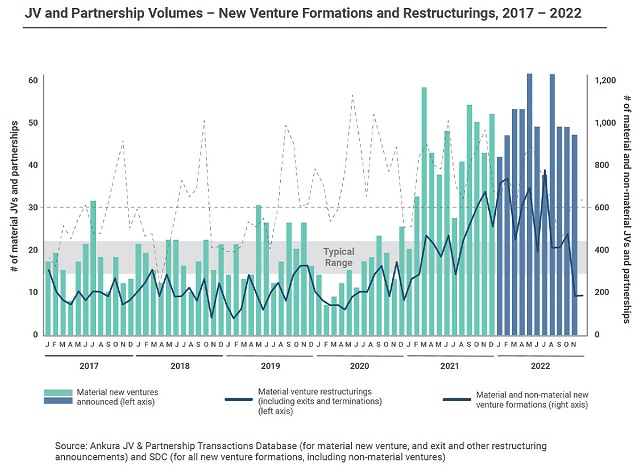

Bucking the year's step-back in M&A, the volume of new joint ventures and partnerships remained strong across the year, with 2022 outpacing 2021, which shattered historic records. We see no signs of this changing as we enter 2023, where the macro forces driving partnerships remain in place.

The year included some extremely large transactions, including GSK and Pfizer IPO'ing their consumer health joint venture, Haleon, that valued the venture at approximately $36.5 billion, making it Europe's biggest listing in a decade. It also saw a series of restructurings and exits, including the rapid unwinding of many joint ventures in Russia by companies like Ford, Shell, and Uber. And Volkswagen emerged as our Dealmaker of the Year, based on a combination of large new transactions and exits.

Read our recap of the year that was 2022.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.