- within Technology topic(s)

- within Technology, Antitrust/Competition Law and Consumer Protection topic(s)

- with readers working within the Banking & Credit industries

The overall strength of the crypto asset markets in 2024 resulted in a year with significantly less crypto securities class action litigation than in recent years. Despite this decrease, the nature of the allegations made by class action plaintiffs in 2024 remains similar to those in previous years. This report explores the 2024 crypto securities class action litigation trends, including the decrease in the number of cases filed, the geographical distribution of the cases, the current stages of litigation, the types of defendant entities and allegations, and stock or asset price drops following company disclosures, short seller reports, or government announcements.

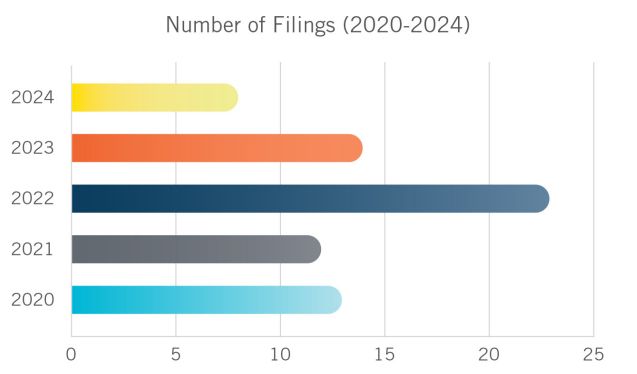

2024 Decrease in Cases Filed Correlates with Crypto Asset Markets Strength

There were only eight crypto-related securities class action litigation actions filed in 2024. This presents a stark decrease in the number of crypto-related securities class action cases as compared to 2023 (14 cases), 2022 (23 cases), 2021 (12 cases), and 2020 (13 cases).1 This decrease is likely a result of the dramatic recovery and resilience of the crypto asset markets in 2024.2 Historical trends indicate that fewer lawsuits are filed during crypto bull runs, when investors are making profits.3 Conversely, more lawsuits are filed as investors incur losses during "crypto winter," a period characterized by low crypto asset prices.4

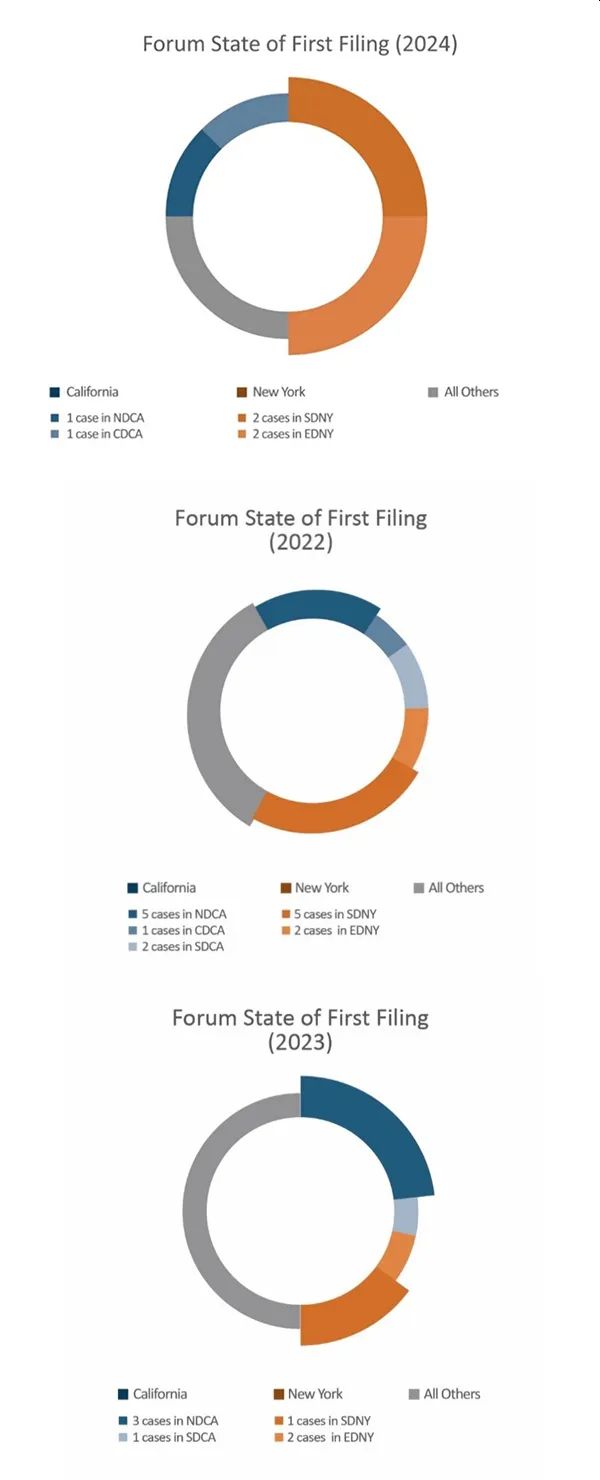

Jurisdiction of First Filed Cases and Stages of Litigation

Given the relatively few crypto securities class action cases this past year, the 2024 class actions have not been as geographically widespread as in recent years.5 The cases in 2024 have been filed in New York, California, New Jersey, and Pennsylvania: two in the Southern District of New York, two in the Eastern District of New York, one in the Northern District of California, one in the Central District of California, one in the District of New Jersey, and one in the Eastern District of Pennsylvania.6 Interestingly, New York and California continue to be the most favored forums, which may be indicative of the strong crypto business presence and/or recoveries in prior cases in those states.

As in previous years, the majority of defendants in crypto class actions in 2024 were headquartered (or located) in the U.S. In 2021, 8 of 12 defendants were headquartered in the U.S.; in 2022, 21 of 23 defendants were headquartered in the U.S.; and in 2023, 9 of 14 defendants were headquartered in the U.S.7 In 2024, half of the defendants central to the allegations were headquartered in the U.S., including Future FinTech Group Inc., Hut 8 Corp., Dolce & Gabbana USA Inc., and Midnight Hub. In addition, one case involves a high-profile celebrity defendant residing in the U.S., Caitlyn Jenner.8 Exceptions to U.S. headquarters or individual locations include Iris Energy Limited, headquartered in Australia; overHere Limited, headquartered in Hong Kong; and Coinbase Global, Inc., which is remote-first and does not maintain a headquarters although its CEO, Brian Armstrong, is a resident in the U.S.

All eight cases filed in 2024 are unresolved and in the early stages of litigation, and it is likely that these cases will continue being litigated well into 2025 and beyond. It is unclear whether the U.S. Securities and Exchange Commission's ("SEC") reported decision to withdraw its ongoing litigation against Coinbase will have any impact on the class action against the company, or on any other crypto-related class action litigation.9

Types of Crypto Allegations and Defendants

Crypto securities class actions were filed against a variety of defendants in 2024, including crypto miners10, a financial services company11 also involved in crypto mining and crypto asset market data, a crypto asset trading platform12, a Web3 streaming platform13 which also created and sold non-fungible tokens ("NFTs"), an NFT issuer14 from the fashion industry, a Web3 launchpad platform15 (used for a meme coin), and an international celebrity16 (alleged to have promoted a meme coin). Notably, three of the eight 2024 cases include a defendant involved in a crypto-related platform, and two relate to defendants connected to NFTs. This number is in line with recent years where the most common defendants have been crypto exchanges/platforms, and NFT-related companies.17

As our brief discussion of these securities class action cases below suggests, the most common issues raised in the 2024 complaints included alleged violations of Section 10(b) of the Securities Exchange Act of 1934 (the "Exchange Act") and Rule 10b-5 thereunder (both anti-fraud provisions) and Section 20(a) of the Exchange Act (which provides for the liability of "control persons"). Another common allegation (especially in the meme coin/ NFTs context) was the purported unregistered offer and sale of securities in violation of Sections 5 and 12(a)(1) of the Securities Act of 1933 (the "Securities Act").

Hut 8 Corp. Securities Litigation involves a case against Hut 8 Corp., a crypto asset and data mining company, which was formed in November 2023 following a merger of Hut 8 Mining Corp. and U.S. Data Mining Group, Inc. d/b/a US Bitcoin Corp. ("USBTC").18 The amended complaint alleges that the defendants made materially false and/or misleading statements about USBTC's financial condition and cash flows and failed to disclose that:

- USBTC was on the brink of bankruptcy; and

- USBTC's King Mountain joint venture, in which USBTC held a 50% interest, involved a crypto asset mining site that "has historically failed to provide energy and high speed-internet."19

The plaintiff claims that a short seller published a report that revealed the "truth."20 As crypto-related companies gain mainstream acceptance and the number of publicly traded crypto companies grows, short seller reports purportedly driving down asset prices are likely to persist as a common market dynamic.21

Iris Energy Limited Securities Litigation is another case brought against a crypto mining company where the plaintiff also alleges that a short seller report revealed the so-called "truth" to the market.22 Specifically, the plaintiff alleges that:

- "Defendants overstated Iris Energy's prospects with data centers and high performance computing, in large part as a result of material deficiencies in Iris Energy's Childress County, Texas site"; and

- "as a result, Defendants' statements about its business, operations, and prospects, were materially false and misleading and/or lacked a reasonable basis at all relevant times."23

Future FinTech Group Inc. Securities Litigation is the only 2024 crypto securities class action filed against a primarily financial services company.24 The plaintiff alleges the defendants violated Sections 10(b), 20(a) and 9(a) of the Exchange Act (which prohibits various types of exchange-based manipulative conduct). Specifically, the plaintiff alleges the defendants made false and/or misleading statements and/or failed to disclose that:

- its CEO manipulated the stock price of Future Fintech (the "Company");

- its CEO and the Company lied about the nature of the CEO's ownership of the Company's stock;

- the Company understated its regulatory and compliance related legal risk caused by the CEO's stock price manipulation; and

- the CEO undertook unlawful measures including manipulative trading to prop up the Company's stock price.25

The plaintiff claims the "truth" emerged on January 11, 2024 after the SEC filed a complaint against the Company's CEO and issued a press release to that effect.26 As compared to the previous administration, the federal government in 2025 is anticipated to exercise greater caution in initiating enforcement actions against crypto-related companies.27

Coinbase Global, Inc. Securities Litigation is the only case involving a crypto asset exchange/trading platform as a defendant and also demonstrates the international nature of the crypto industry. In a case alleging violations of Section 10(b) of the Exchange Act, the plaintiff claims defendants made false and/or misleading statements and/ or failed to disclose that:

- in 2020 the United Kingdom's Financial Conduct Authority ("FCA") found Coinbase Global, Inc.'s British unit, CB Payments Limited ("CBPL") had not taken adequate measures to prevent criminals from using its platform;

- CBPL had agreed with the FCA to put requirements in place "designed to prevent high risk customers from using CBPL's platform" but had breached this undertaking, allowing thousands of high risk individuals access to the platform; and

- this had resulted in undisclosed heightened regulatory risk.28

Coinbase's stock allegedly fell by US$13.52 per share, or 5.52%, on a July 25, 2024 announcement by the FCA that CBPL had been fined and a Reuters article published the same day titled "Coinbase UK unit fined for breaching financial crime requirements."29

Dolce & Gabbana USA Inc. NFTs Securities Litigation is one of the two NFT-related securities class actions filed in 2024. In 2022, Dolce & Gabbana USA Inc., an international fashion house, entered into a joint venture with NFT marketplace UNXD Inc. to create and market a crypto asset project called DGFamily.30 The 2022 boom in fashion NFTs31 was followed by a bust in both popularity and value—like most NFTs in this period, DGFamily Products declined in value.32 The plaintiff claims the "public offer and sale of DGFamily Products was an unlawful offering of unregistered securities" and seeks to recover damages under causes of action under state law as well as the Exchange Act or alternatively the Commodity Exchange Act.33 Among other claims, the plaintiff alleges the delivery of the NFTs was delayed and they never received most of the benefits advertised including "digital rewards, physical products, and exclusive access to events, along with the support of an online ecosystem to use and market DGFamily Products."34

In the other 2024 case involving NFTs, Midnight Hub Securities Litigation, defendants created and sold two NFTs to promote the Midnight Hub Web3 ecosystem.35 Plaintiff alleges that the offer and sale of these NFTS were unregistered offers and sales of securities in violation of Sections 5 and 12(a)(1) of the Securities Act.36

The last two cases are high profile ones involving meme coins. The first is the $HAWK meme coin connected to celebrity Haliey Welch37 (though she has not been directly named a defendant), while the other is the $JENNER meme coin connected to international celebrity Caitlyn Jenner, a defendant in the case.38 Both cases involve allegations (among others) regarding the unlawful offer and sale of the respective meme coins without proper registration, and in both cases the defendants allegedly promoted the meme coins on X (formerly Twitter).39 Meme coins frequently rely on the promotion or leveraging of celebrity status through social media, and are often accompanied by dramatic increases and decreases in price in a short time frame, making them particularly attractive to financially unsophisticated investors.40 These coins gain public and investor interest during crypto bull markets, but they have been described by some traders as "gambling" or similar to "buying a lottery ticket."41 Unlike most crypto assets that are alleged to be securities, however, meme coin issuers and promoters are rarely involved in the building out or development of any network or ecosystem around these coins, or in which these coins play any part. This fact, among others, may make it harder to sustain a claim that such coins are securities.42 If the crypto bull market ends in 2025, it is likely that there will be more crypto securities class actions brought against companies or celebrities connected to meme coins that crash in value.43

Footnotes

1. This report depends primarily on data from the Stanford Law School Securities Class Action Clearinghouse. Current Trends in Securities Class Action Filings, Stanford Law School Securities Class Action Clearinghouse (last accessed Feb. 10, 2025).

2. See Nikita Tambe and Aashika Jain, Why Is the Crypto Market Rising Today?, Forbes Advisor (Oct. 25, 2024); Jamie Crawley & Omkar Godbole, First Mover Americas: Bitcoin Bulls Eye $70K After Return to $66K, CoinDesk (July 17, 2024).

3. See Dechert LLP, Cryptocurrency Securities Class Action Litigation 2023 Year Review (Feb. 29, 2024).

4. See Dechert LLP, Cryptocurrency Securities Class Action Litigation 2022 Year Review (Mar. 27, 2023); Farshad Ghodoosi, Crypto Litigation: An Empirical View, Yale Journal on Regulation (Nov. 28, 2022).

5. According to data from 2021-2024 for filings of crypto securities class actions. Current Trends in Securities Class Action Filings, supra note 1.

6. Labelle, et al. v. Future Fintech Group Inc., et al. ("Future FinTech Group Inc. Securities Litigation"), 2:24-CV-00247 (D.N.J. Jan. 16, 2024), CAC. In re Hut 8 Corp. Securities Litigation ("Hut 8 Corp. Securities Litigation"), 1:24-CV-00904 (S.D.N.Y June 14, 2024), CACAC. Castle, et al. v. Coinbase Global, Inc., et al. ("Coinbase Global, Inc. Securities Litigation"), 2:24-cv-04850 (E.D. Pa. Sept. 13, 2024), CAC. Brown, et al. v. Dolce & Gabbana USA Inc., et al. ("Dolce & Gabbana USA Inc. NFTs Securities Litigation"), 1:24-CV-03807 (S.D.N.Y. Sept. 25, 2024), ACAC. Williams-Israel, et al. v. Iris Energy Limited, et al. ("Iris Energy Limited Securities Litigation"), 1:24-CV-07046 (E.D.N.Y. Oct. 7, 2024), CAC. Hermann, et al. v. Midnight Hub, et al. ("Midnight Hub Securities Litigation"), 3:24-cv-07704 (N.D. Cal. Nov. 5, 2024), CAC. Azad, et al. v. Caitlyn Jenner, et al. ("Jenner Securities Litigation"), 2:24-cv-09768 (C.D Cal. Nov. 13, 2024), CAC. Mena, et al. v. OverHere Limited, et al. ("OverHere Limited Securities Litigation"), 1:24-CV-08695 (E.D.N.Y. Dec. 20, 2024), CAC. Please note that herein "CAC" refers to the "Class Action Complaint," "CACAC" refers to "Consolidated Amended Class Action Complaint," and "ACAC" refers to "Amended Class Action Complaint" for the corresponding citations.

7. Dechert LLP, Cryptocurrency Securities Class Action Litigation 2023 Year Review (Feb. 29, 2024).

8. Jenner Securities Litigation, CAC at ¶ 13.

9. Coinbase Global, Inc., Form 8-K, U.S. Securities and Exchange Commission (Feb. 21, 2025).

10. Hut 8 Corp. and Iris Energy Limited. Cryptocurrency mining is "a process of creating new digital 'coins.'" Shivam Arora, What is Bitcoin Mining? How Does It Work, Proof of Work and Facts You Should Know, Simplilearn (Feb. 23, 2023).

11. Future FinTech Group Inc.

12. Coinbase Global, Inc.

13. Midnight Hub.

14. Dolce & Gabbana USA Inc.

15. overHere Limited.

16. Caitlyn Jenner.

17. See Dechert LLP, Cryptocurrency Securities Class Action Litigation 2022 Year Review (Mar. 27, 2023); Dechert LLP, Cryptocurrency Securities Class Action Litigation 2023 Year Review (Feb. 29, 2024).

18. Hut 8 Corp. Securities Litigation, CACAC at ¶ 3.

19. Id. at ¶¶ 7, 9, 113, 116, 118, 125, 150.

20. Id. at ¶¶ 9, 113-121.

21. See Alan Suderman, Emboldened crypto industry seeks to cement political influence and mainstream acceptance, The Seattle Times (Feb. 17, 2025).

22. Iris Energy Limited Securities Litigation, CAC at ¶¶ 8, 57-87.

23. Id. at ¶ 56.

24. Future FinTech Group Inc. is involved in "supply chain financial services and trading, asset management and cross-border money transfer services" and "cryptocurrency mining and cryptocurrency market data and information service[s]." Future FinTech Group Inc. Securities Litigation, CAC at ¶ 7.

25. Future FinTech Group Inc. Securities Litigation, CAC at ¶ 37, 34.

26. Id. at CAC at ¶¶ 38-45.

27. See Dechert LLP, U.S. Crypto Regulation: Key Developments in Trump's First Week (Jan. 30, 2025).

28. Coinbase Global, Inc. Securities Litigation, CAC at ¶¶ 2, 106, 107-125; 137-151.

29. Id. at ¶¶ 107-127.

30. Dolce & Gabbana USA Inc. NFTs Securities Litigation, ACAC at ¶¶ 2, 37, 43.

31. 2022 was dubbed "a year of fashion NFTs" by Vogue Business, with many fashion houses, such as Gucci, Paco Rabanne, and Louis Vuitton, among others, rushing to capitalize on their brand recognition and exclusivity in the crypto market. Madeleine Schulz, 2022: A Year of Fashion NFTs, Vogue Business (Dec. 20 2022).

32. See Dolce & Gabbana USA Inc. NFTs Securities Litigation, ACAC at ¶ 36.

33. Id. at ¶¶ 5, 11, 214.

34. Id. at ¶¶ at 1, 10, 52.

35. Midnight Hub Securities Litigation, CAC at ¶¶ 1-2, 5, 7, 107-15.

36. Id.

37.Kalhan Rosenblatt and Angela Yang, 'Hawk Tuah Girl' says she's 'cooperating' with lawyers in suit related to crash of meme crypto, NBC News (Dec. 20, 2024).

38. OverHere Limited Securities Litigation, CAC at ¶¶ 2, 4, 5, 7-8, 33-36; Jenner Securities Litigation, CAC at ¶ 1, 13.

39. See OverHere Limited Securities Litigation, CAC at ¶¶ 1, 11, 17, 60, 64, 110-14; Jenner Securities Litigation, CAC at ¶ 1, 7, 52-58, 62-69, 83, 85, 93, 102-12.

40. David Kushner, Inside the shady world of celebrity meme coins, Business Insider (Feb. 2, 2025).

41. Jasper Jolly, Melania Trump launches meme coin as crypto conflicts worry experts, The Guardian (Jan. 20, 2025). Notably, U.S. President Trump and First Lady Melania Trump have been connected to the recently launched $Trump and $Melania meme coins, respectively.

42. See Dechert LLP, SEC's Division of Corporation Finance Clarifies Stance on Meme Coins (Mar. 6, 2025).

43. See Jack Kubinec, A crypto lawyer predicts a 'dramatic increase' in memecoin lawsuits, Blockworks (Oct. 18, 2024

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.