- within Environment topic(s)

- in United States

- within Environment topic(s)

- within Tax, Privacy and Finance and Banking topic(s)

Carbon Credits (CCs) are a type of regulatory currency that allows a business or government to emit some amount of carbon dioxide or other greenhouse gas (GHG). They are usually purchased from a regulatory organizer (typically the United Nations, or national and state governments)

Most CC systems are cap-and-trade systems, where governments or regulatory bodies set a cap on the total number of credits issued, with the total value of the cap declining over time. Companies that release more than a certain amount of GHGs each year are forced to purchase CCs to compensate for their emissions, with the collected funds typically being invested back into green energy production, local energy affordability, or local community development.1 Companies can also trade unused carbon credits to those that are exceeding acceptable levels of GHGs production. Finally, carbon offsets also exist, which are credits or monetary sums paid to projects and businesses that avoid or actively remove GHGs.2 However, many regulatory bodies limit the use of carbon offsets as a carbon credit substitute.

Carbon credits are typically leveraged as a market-based,

incentive-oriented strategy to shift to more renewable forms of

energy, especially in contrast to more direct government

regulations. While no federal carbon credit trading program

currently exists in the United States, the Regional Greenhouse Gas

Initiative (RGGI) and the California Air Resources Board

Cap-and-Trade Program are two of the most prominent trading

programs in the nation today.3

Regional Greenhouse Gas Initiative (RGGI)

The Regional Greenhouse Gas Initiative is a mandatory market-based

program comprising the states of Connecticut, Delaware, Maine,

Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode

Island, Vermont, and Pennsylvania,4 that aims to reduce

power sector CO2 emissions.5 The RGGI

implements a cap on yearly power plant CO2 emissions,

measured in "CO2

allowances"6 (businesses must purchase one

RGGI CO2 allowance per short ton of CO2

emitted). All fossil fuel-based power plants that are 25 megawatts

or greater must acquire enough RGGI allowances to cover the

entirety of their emissions.7 The RGGI runs on

three-year "control periods". Each year, regulated power

plants must surrender half of their annual CO2 emissions

in allowances, but must surrender allowances for all

emissions in year three, plus all remaining emissions from years

one and two (essentially forcing a soft recent at the end of each

period).

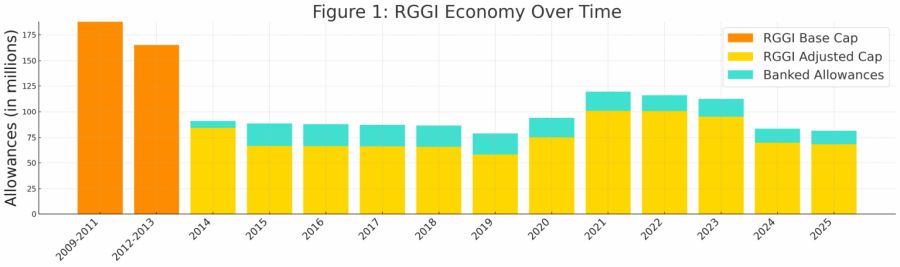

Like other cap-and-trade systems, the RGGI caps its CO2

allowances. The total 2025 RGGI allowance base budget

cap for the eleven participating states is

151,879,674 CO2allowances (81,347,784

allowances, excluding Pennsylvania). 8 However, a

certain number of these allowances are banked in Set-Aside

Programs, "which allow a state to hold a limited number of CO2

allowances in set-aside accounts to retire, allocate, or otherwise

distribute outside of the RGGI auctions process."9

Some allowances might also be banked by companies themselves, if

unused in previous years. The Allowance Adjusted

Budget can be calculated with the following formula:

New State CO2 Allowance Base Budget – Estimation of previous Banked Allowances = CO2 Allowance Adjusted Budget10

Figure 1: Graph Depicting RGGI Allowance Economy Over Time11 12 13

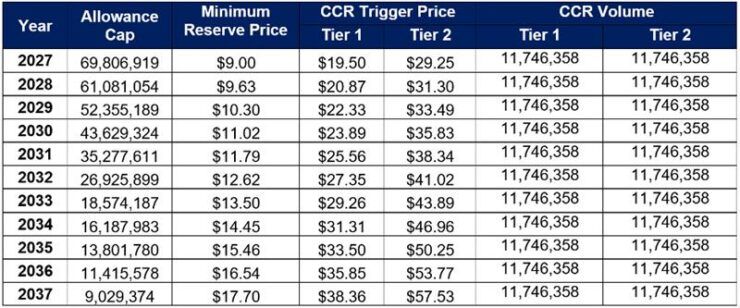

RGGI allowances are primarily distributed through auctions, which occur quarterly.14 To ensure a more stable market, RGGI auctions have a Minimum Reserve Price ($2.62 in 2025),which is the minimum price allowances can be sold at. 15 RGGI auctions have two additional mechanisms for controlling supply: the Cost Containment Reserve (CCR) and Emissions Containment Reserve (ECR).CCR allowances are injected if allowance prices rise above a certain trigger point ($17.03 in 2025), while ECR allowances are withheld if allowances fall below a certain trigger point ($7.86 in 2025). Both CCRs and ECRs increase by 7% yearly, with the CCR being composed of 10% of the regional cap and the ECR being composed of 10% of implementing states' RGGI budgets.16

The RGGI serves as the sole 'seller' during auctions. Buyers are classified into two major groups: Compliance-Oriented Entities (entities that acquire allowances to satisfy compliance obligations) and Investors without Compliance Obligations (firms without compliance obligations.)17 Some compliance-oriented entities will also invest or actively partake in allowance trading. RGGI classifies these entities as Investors with Compliance Obligations.

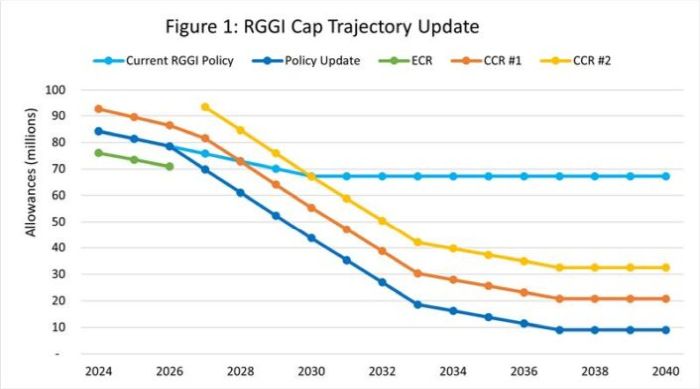

In 2025, the RGGI conducted its third annual Program Review, which introduces several changes into the program. Most notably, the RGGI Cap is now to be decreased at a steeper rate in order to strongly encourage a shift away from GHGs, with a new average decline of 8,538,789 allowances per year (~10.5% of the 2025 base cap) from 2027 through 2033.18 From 2033 through 2037, the cap will decline by an additional 2,386,204 tons per year (~3% of the 2025 budget).19 To meet grid reliability needs and protect against cost volatility, a second Cost Containment Reserve allowance will be implemented starting in 2027. CCR #1's trigger price will match the current CCR's price trajectory of $19.50, while CCR #2's trigger price will be set to $29.25 (increasing 7% annually thereafter). CCR #2s will only be sold if all initial allowances and CCR #1's have been sold.20 The new RGGI cap trajectory will also update according to CCR movement. If all CCR #1s are sold, the cap projection will be reduced by only 74% by 2037 (relative to the 2025 cap). If all CCR #1s and #2s are sold, the cap projection will be reduced by only 60% by 2037 (also relative to 2025).

Figure 2: Graph Depicting Potential RGGI Cap Trajectories.

The 2025 Review also eliminated the Emissions Containment Reserve starting 2027, with the Minimum Reserve Price being increased to $9.00 in 2027 (and increasing 7% annually thereafter). If allowances fall below this amount, additional allowances will simply be withheld.

Finally, offsets will now be removed from this system.

Figure 3: Chart Depicting Potential RGGI Econometrics Data Over Time21

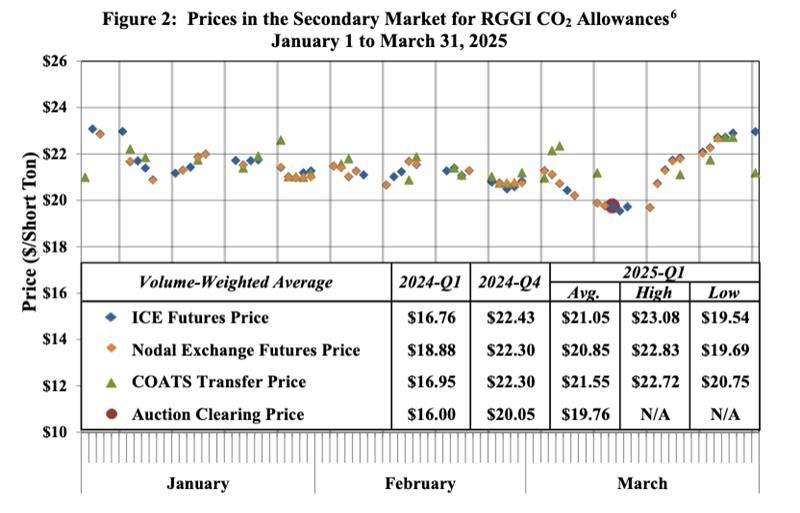

The Secondary Market

RGGI allowances can also be traded on a secondary market, which gives companies flexibility and protects against volatility.22 In 2025 Q1, allowance transfers on the secondary market totaled 36 million, a 15% decrease from 2024 Q1. The average allowance hovered between $20.50 and $22 for most of the year, particularly during the middle of February, before dropping to $19.76 (the 2025 Q1 auction-clearing price). Allowances then rose steadily through March.

The RGGI secondary market is primarily composed of forwards, call options, and put options.23 They are standardized to various degrees, with both 'Exchange-Traded' and 'Over-The-Counter' contracts offered. Only 56% of the 128 million allowances are still held by power plants for compliance purposes, leaving a substantial share of the market open to outside investors.24 In Q1 2025, option-implied volatility25 has doubled, which offers new economic opportunities.

The RGGI secondary market operates primarily from two different exchanges. The largest exchange is the Intercontinental Exchange (ICE), which allows companies to buy ICE Futures. In Q1 2025, the average ICE Futures price was $21.05 with a high of $23.08 and a low of $19.54.26 Standard ICE futures trade at 1,000 allowances per contract.27 The other primary market is Nodal Exchange, of which RGGI is one of its best-performing futures.28 In Q1 2025, the average Nodal Exchange Futures price was $20.85, with a high of $22.83 and a low of $19.69. These futures typically trade at around 50 cents less than the COATS29 transfer price.30

Options contract-clearing prices can help to provide insight into market beliefs of the future. For instance, an increase in call options accompanied by a decrease in put options may signal an expected increase in value. Note that the Emissions Containment Reserve and Cost Containment Reserve typically serve as upper limits. However, the lack of the CCR in the March 2025 auction (CCR, having been exhausted, will only be available again come March 2026) saw a steady increase in prices following the auction.31

Analysis

With the implementation of the 2025 RGGI Program Review, specifically the greater annual drop in the RGGI base cap from 2027 onward, the supply of allowances will sharply decrease over the next few control periods. With Compliance-Oriented Entities winning 54% of shares in Auction 68,32 it is reasonable to assume that a drastic shift away from GHGs (and a corresponding drop in RGGI allowance value) is unlikely for at least the next few years. At the same time, 46% of shares in Auction 68 were purchased by Investors without Compliance Obligations,33 demonstrating entry potential for prospective brokers.

Overall, there is no single, consistent pattern when examining the price of RGGI futures and allowances within a given quarter. Barring Q3 2023, the price of RGGI allowances has almost always experienced a slight dip heading into an auction. Including Q3 2023 but barring Q3 2024, the price of RGGI allowances has risen steadily following an auction—normally peaking around one month to six weeks post-auction. This price increase is typically followed by a slight downturn or lull during the last few weeks of a quarter's second month, before dropping to auction clearing prices.

An Analysis of Variance over the past five years of auction data shows that there is insufficient evidence to suggest the specific monthly auction (March, June, September, December) affects allowances clearing prices. Recall, however, that because powerplants must surrender half of all allowances at the end of year, making March auction prices relatively high compared to other seasonal auctions. While most futures prices have historically followed similar trends to allowances traded on COATS, it remains to be seen how the implementation of the 2027 cap will affect these patterns. As of now, it is reasonable to believe that using current RGGI allowance trends as indicators for both ICE Future Prices and Nodal Exchange Futures prices will remain a valid trading strategy.

The most likely deviation from the current trend will be one in which the reduced cap further increases the price of allowances. In such a scenario, it may be worth purchasing during the nearest Year 3 (2026), holding to observe the post-cap decrease trends of 2027, and finally selling as the price of allowances theoretically peak midway between auctions.

A more delayed schedule would likely result if all CCR #1s were to be sold, which would shift the cap trajectory to the CCR #1 cap trajectory.34 This would result in a 2027 cap greater than the current RGGI policy 2027 cap by around 5 million allowances.35 This flood in supply would likely decrease allowance price, though it is worth noting that 2027 being the beginning of a new control period may also drive up prices to an extent (half of unused credits can still be transferred over to the following two years, and the more drastic decrease in cap going forward might incentivize companies into buying in the moment). The CCR #1 cap would equalize the current RGGI policy cap by 2028,36 and subsequently decrease annually at the same rate as the original policy update (a 10.5% decrease of the 2025 budget annually, until 2033).37

The most drastic possibility would occur if all CCR #2s were to be sold, which would shift the cap trajectory to the CCR #2 cap trajectory.38 This would result in a 2027 cap greater than the current RGGI policy 2027 cap by around 17 million allowances.39 This flood in supply would drastically decrease allowance price, though prices may once more be driven up with the beginning of the control period. The CCR #2 cap would only equalize the current RGGI policy cap by 2030,40 and subsequently decrease annually at the same rate as the original Policy Update (a 10.5% decrease of the 2025 budget annually, until 2033).41

Finally, RGGI asset prices will likely be heavily influenced by energy trends on the national and northeastern level, including but not limited to energy usage, green energy investment, and GHG regulation. With conflicting interests between state and federal administrations, it remains to be seen how American energy use will evolve in this next chapter of RGGI history.

Conclusion

The Regional Greenhouse Gas Initiative is a greenhouse gas credits program composed of ten northeastern states. The Initiative compels power plants to purchase allowances that cover their yearly emissions. RGGI allowances can be purchased during quarterly auctions, stored and resold on a secondary market, and are limited by an ever-decreasing cap. After a three-year control period, unused credits are absorbed back into the RGGI and declared null.

With the implementation of the RGGI's 2025 project review, the Initiative is looking to sharply decrease its total base cap starting 2027. While RGGI allowances are likely to rise in the next few years, the gradual diminishing of supply and volatile futures market suggests that there are ways to capitalize on both short and long-term levels.

Footnotes

1. Typically regulated by the issuing bodies themselves, which will penalize any company that exceeds acceptable GHG limitations without possessing the associated CCs.

2. Angelo Gurgel, Carbon Offsets, MIT Climate Portal (Nov. 8, 2022), https://climate.mit.edu/explainers/carbon-offsets (accessed July 23, 2025).

3. U.S. Environmental Protection Agency, Emissions Trading Programs, https://www.epa.gov/emissions-trading/emissions-trading-programs (accessed July 24, 2025).

4. Kate Huangpu, Key Pa. Senator Says Bipartisan Energy Bills on Hold Until Contested Climate Program Settled, Spotlight PA (June 9, 2025), https://www.spotlightpa.org/news/2025/06/pennsylvania-clean-energy-bills-rggi-court-ruling-delay/ (accessed July 24, 2025) (Despite originally joining the RGGI in April 2022, Pennsylvania's involvement was declared unconstitutional by the Pennsylvania Commonwealth Court. As of July 20, 2025, the Pennsylvania Supreme Court is currently debating an appeal).

5. Regional Greenhouse Gas Initiative, RGGI 101 Fact Sheet, 1, (updated Jan. 2025), https://www.rggi.org/sites/default/files/Uploads/Fact%20Sheets/RGGI_101_Factsheet.pdf (accessed July 24, 2025).

6. Id.

7. Id. (apart from New York, which regulates any power plant 15 megawatts or greater under the RGGI).

8. Regional Greenhouse Gas Initiative, Program Overview and Design: Elements, RGGI, Inc., https://www.rggi.org/program-overview-and-design/elements (accessed July 24, 2025).

9. Regional Greenhouse Gas Initiative, Summary of State Set‑Aside Programs (Oct. 2021), https://www.rggi.org/sites/default/files/Uploads/Allowance-Tracking/States_Set-Aside_Accounts.pdf (accessed July 24, 2025).

10. Maryland Department of the Environment, The Regional Greenhouse Gas Initiative (RGGI) Overview (May 27, 2016), https://mde.maryland.gov/programs/Air/ClimateChange/RGGI/Documents/RGGI05272016.pdf (accessed July 24, 2025).

11. Supra, note 4.

12. Supra, note 7 (Before 2014, RGGI managed its allowance economy purely off its base cap and did not track banked allowances. Starting in 2014, however, the RGGI began using an adjusted cap to factor in the amount of allowances that had been banked by companies in years prior.)

13. Major increases or decreases in Base Cap are often caused by additional states joining RGGI. For instance, New Jersey joined RGGI in 2020, while Virginia joined in 2021 (the state left in 2023).

14. Regional Greenhouse Gas Initiative, About Auctions, RGGI, Inc., https://www.rggi.org/auctions/about-auctions (accessed July 28, 2025).

15. Id.

16. Supra, note 7 (noting how Maine and New Hampshire are not participating in the ECR).

17. Regional Greenhouse Gase Initiative, Auction 68, RGGI Inc., https://www.rggi.org/Auction/68 (accessed August 7, 2025)

18. Regional Greenhouse Gas Initiative, Program Review, RGGI Inc., https://www.rggi.org/program-overview-and-design/program-review (accessed July 25, 2025).

19. Id.

20 Id.

21. Id.

22. Potomac Economics, Report on the Secondary Market for RGGI CO₂ Allowances: First Quarter 2025, at 3 (May 23, 2025), https://www.rggi.org/sites/default/files/Uploads/Market-Monitor/Quarterly-Reports/MM_Secondary_Market_Report_2025_Q1.pdf (accessed July 28, 2025).

23. Id. 4.

24. Id. 6.

25. Id. 6-7 (RGGI defines volatility as the expected standard deviation of allowance price distribution one year in the future. E.g. If the expected value one year in the future is $1, a 25% option-implied volatility "implies the probability that the price will be within 25 percent of $1 (i.e. between $0.75 and $1.25))."

26. Id. 10.

27. Intercontinental Exchange, Regional Greenhouse Gas Initiative Allowance Auction Clearing Price contract specifications (2025), https://www.ice.com/products/71090479/regional-greenhouse-gas-initiative-allowance-auction-clearing-price (accessed July 28, 2025).

28. Nodal Exchange, Nodal Exchange Achieves New August Volume Records in Power (Up 58%) & Environmental (Up 189%) Markets (Sept. 5, 2024), https://www.nodalexchange.com/nodal-exchange-achieves-new-august-volume-records-in-power-up-58-environmental-up-189-markets/ (accessed July 28, 2025).

29. The official market mechanism used to purchase, hold, and sell RGGI allowances.

30. Potomac Economics, Report on the Secondary Market for RGGI CO₂ Allowances: First Quarter 2025, at 3 (May 23, 2025), https://www.rggi.org/sites/default/files/Uploads/Market-Monitor/Quarterly-Reports/MM_Secondary_Market_Report_2025_Q1.pdf (accessed July 28, 2025), 11.

31. Id.13.

32. Potomac Economics, Ltd., Market Monitor Report for Auction 68 (June 6, 2025), https://www.rggi.org/sites/default/files/Uploads/Auction-Materials/68/Auction_68_Market_Monitor_Report.pdf (accessed Aug. 1, 2025).

33. Id.

34. Supra, note 20.

35. Id. (observing that the current RGGI policy cap trajectory is around 76 million allowances in 2027, whereas the CCR #1 cap trajectory reaches around 81 million allowances).

36. Id. (observing that both the current RGGI policy cap trajectory and CCR #1 cap trajectory reach around 73 million allowances by 2028).

37. Id.

38. Id.

39. Id. (observing that the current RGGI policy cap trajectory is around 76 million allowances in 2027, whereas the CCR #2 cap trajectory reaches around 93 million allowances).

40. Id. (observing that both the current RGGI policy cap trajectory and CCR #2 cap trajectory reach around 69 million allowances by 2030).

41. Id.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.