- with readers working within the Advertising & Public Relations industries

PRELUDE

Popularized in the 1980s by famed broadcaster Brent Musberger, the phrase "March Madness" is one that many sports fans associate with college basketball, specifically the NCAA Division I men's and women's tournaments. As a college basketball fan, I look forward to every March and spend many hours watching tournament games. While I enjoyed both tournaments this year, I found both to be less exciting than they were in years past, as seven of the eight top ranked men's and women's teams advanced to the Elite Eight (quarter finals). This year, the phrase "March Madness" seemed more relevant in describing global financial market moves. The U.S. stock market sold off sharply amid investor concerns about new tariffs and the possibility of a slowing U.S. economy. While U.S. stocks moved lower during March, bonds and international equities generated mixed results.

GLOBAL EQUITY

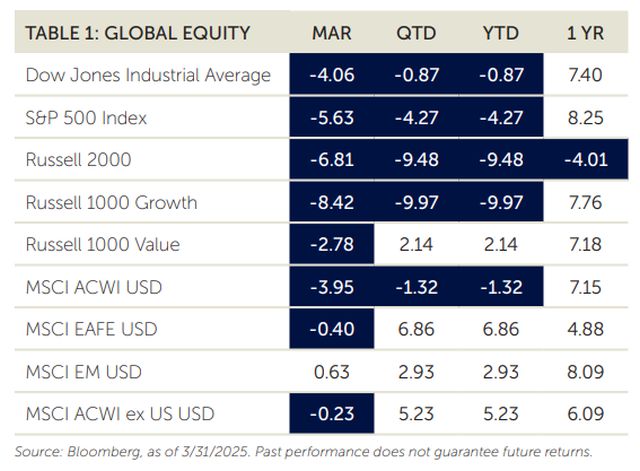

U.S. stocks declined for a second consecutive month as several major U.S. equity market indexes fell between -2.8% and -8.4%, cumulatively. Uncertainty surrounding global trade policy remained a focal point throughout March as the U.S. administration signed new tariffs on several raw material imports and imported vehicles, as well as additional tariffs on Chinese imports. Consumer sentiment, as measured by both the Conference Board Consumer Confidence Index and the University of Michigan Consumer Sentiment Index, also fell during March as consumers grappled with the potential impact of tariffs on their day-to-day lives. Amid such unease, the more domestically focused Russell 2000 Index fell -6.8% during the month and briefly entered bear market territory. As a refresher, investors define bear market territory as a 20% or greater decline from a prior peak (the Russell 2000 peaked on November 25, 2024). Large cap growth companies also moved lower again during March as the Magnificent Seven companies were anything but magnificent, with all seven companies declining between -5.4% and -13.7%, cumulatively.

International markets generated mixed returns in March despite the U.S. Dollar's continued depreciation versus other major currencies. Developed international markets, as represented by the MSCI EAFE Index, returned -0.4% for the month. While concerns about global trade policy weighed on developed markets, several European companies experienced sharp declines due to business specific issues. Novo Nordisk, the Danish manufacturer of diabetes and weight-loss drug Ozempic, was one example as the stock fell -23.1% during March. Disappointing trial results from its next generation weight loss drug and increasingly viable competition from U.S. pharmaceutical companies pushed the stock lower. Emerging markets outperformed their developed market counterparts in March, as the MSCI EM Index returned +0.6%. Indian stocks were among the top contributors to performance, led by the nation's Financials sector. Chinese stocks also moved higher despite concerns about U.S. tariffs. Tencent was among the best performers within the Chinese equity market, returning +3.4% amid optimism surrounding the company's developing capabilities within artificial intelligence. As a reminder, Tencent is a Chinese technology conglomerate and the largest company in the Chinese stock market, as well as the second largest company in the MSCI EM Index at a 5.3% weight.

FIXED INCOME

The U.S. Treasury yield curve steepened during March (short-term rates fell and long-term rates rose), resulting in mixed fixed income returns as the Bloomberg U.S. Aggregate stayed roughly flat. Short term Treasury yields fell during the month as investors remained cautious about the economic impact of tariffs. Additionally, the Federal Reserve's decision to keep interest rates unchanged at its March meeting, as well as its expectations for higher prices and lower economic growth in 2025, led investors to prefer shorter dated bonds. While short-term Treasuries generated positive returns, the 30-year Treasury yield rose during March, leading to negative returns at the longer end of the Treasury curve. The divergent performance between short-term and long-term Treasuries was not surprising in our view, as investors often prefer the safety and relatively lower interest rate sensitivity (also known as duration) of shorter-dated bonds compared to their longer-dated counterparts. Outside of the Treasury market, investment grade and high yield corporate bonds generated negative returns during March as spreads widened amid the equity market selloff.

POSTLUDE

Returning to basketball, if you are a fan of the sport, you have likely seen instances where a team falls behind in the first quarter, only to rally later and perhaps even win the game. The first quarter of 2025 is in the books for global financial markets and the S&P 500 certainly fell behind, returning -5.6%, its worst first quarter since 2020, or since 2009 if you exclude 2020, which is admittedly discouraging. However, it is worth nothing that the S&P 500 rallied through the final three quarters of both 2020 and 2009, finishing those years up +18.4% and +26.5%, respectively. While we are not making a broad market call for the remainder of 2025 here, we still have three quarters of the year ahead of us and just like in a basketball game, momentum can reverse quickly and to a similar degree. We do not know how the balance of 2025 will unfold but regardless, we are coaching our clients to stick to their long-term game plans for now.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]