- within Corporate/Commercial Law topic(s)

- in United States

- within Media, Telecoms, IT and Entertainment topic(s)

On July 18, 2023, the U.S. Small Business Administration (SBA) published a Final Rule to modernize the Small Business Investment Company (SBIC) Program as part of the President Biden's Investing in America Agenda. Effective as of August 17, 2023, the Final Rule implements sweeping modifications to the SBIC program, aiming to enhance access and broaden funding options for American small businesses. The Final Rule introduces significant changes, encompassing the addition of a new Accrual Debenture, alterations to distribution structures, changes to the licensing process and minimum capital requirements, application fee restructuring, streamlined licensing for subsequent funds, new management team qualification criteria, relaxed capital call line approvals, updated reporting requirements, the introduction of a watchlist program, and a number of other operational and clarifying changes.

Creation of Accrual Debenture

One of the most significant changes included in the Final Rule is the creation of a new Accrual Debenture Program. The Accrual Debenture Program was designed to align with the cash flows of equity-oriented investment funds and will be available to "Accrual SBICs" (SBICs that are approved by SBA to use Accrual Debentures) and "Reinvestor SBICs" (SBICs that make equity investments in certain underserved reinvestors that, in turn, make financings solely to small businesses, i.e., a fund of funds). The Accrual Debenture Program was designed to encourage investment in early stage U.S. small businesses and expand access to the SBIC Program for venture capital, growth capital, and buyout investment firms, unlocking the potential for increased capital investment in small businesses.

In order to qualify as a Reinvestor SBIC, applicants must demonstrate an underserved need in their business plan. Reinvestor SBICs have the ability to invest equity capital in certain underrepresented entities, such as non-SBA leveraged limited partnerships, SBICs, or non-SBIC funds. These entities must fund businesses that adhere to SBA's small business size standards, are owned and operated by U.S. citizens or U.S.-based entities, and have a minimum of 50% of their workforce located in the United States at the time of investment. Notably, SBA's prior written approval is not necessary for Reinvestor SBIC co-investments in a business if an unrelated and unaffiliated third-party investor is making an equity investment in the same business alongside the Reinvestor SBIC at the same time and on the same terms.

The new Accrual SBIC (discussed in more detail in our alert available here) was designed to encourage participation in the SBIC Program by funds with venture and growth equity strategies, but would also be available to funds with credit and buy-out strategies.

Accrual SBICs are eligible for 1.25 tiers of leverage and Reinvestor SBICs are eligible for 2 tiers of leverage. In contrast to existing Standard Debentures which have a current interest pay component requiring interest payments semi-annually, Accrual SBICs and Reinvestor SBICs will be issued Accrual Debentures which will accrue interest over their 10-year term with principal and interest payable at maturity. The maximum amount of leverage an Accrual SBIC or a Reinvestor SBIC is permitted to have outstanding will be determined by aggregating total principal and ten years of accrued interest over the life of the debenture.

For example, if an Accrual SBIC or a Reinvestor SBIC has $100 million in qualifying limited partner capital commitments, the total Accrual Debenture principal it may be approved for may be only $118 million if the forecasted interest would accrue to approximately $57 million over a ten-year timeframe at a 4% interest rate, since higher amounts would result in SBA guaranteeing outstanding leverage amounts in excess of $175 million, the current statutory maximum for leverage available to a single SBIC.

When making distributions, SBICs with Accrual Debentures will be required to follow to the below distribution waterfall:

First, payment of annual charges and accrued interest associated with outstanding leverage;

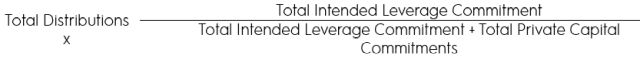

Second, repayment of outstanding leverage an amount equal to total distributions multiplied by the ratio of total intended leverage commitment to the sum of total intended leverage commitment and total private capital commitments;

Third, distributions to private investors of the remaining amount.

Updated Eligibility Criteria and Minimum Capital Requirements

The Final Rule also made changes to the eligibility requirements for receiving an SBIC License with the goal of enabling a more diversified group of investment teams and a wider range of investment strategies to participate in the SBIC program. When assessing applicants, the SBA takes into account various qualifications, including the management team's prior investment performance, demonstrated investment expertise, and a successful track record of collaborative teamwork. In addition to the existing criteria, the SBA will now also consider two additional factors: (i) relevant industry operational experience, which can complement investment skills to demonstrate managerial capability, and (ii) if applicable, the managers' experience in overseeing a regulated business, including their past adherence to statutory and regulatory SBIC program requirements. SBA considers the totality of experience of the investment team of the applicant during the licensing process.

Under existing SBIC Program regulations, an SBIC applicant is required to raise at least $5 million of capital from limited partners, but SBA is permitted to lower this requirement to $3 million, in SBA's sole discretion and based on special circumstances and "good cause," if the applicant (i) meets its licensing standards with the exception of minimum capital, (ii) has a viable business plan reasonably projecting profitable operations and (iii) has a reasonable timetable for achieving at least $5 million capital from limited partners. Under the Final Rule, the SBA specifies that being headquartered in an "Underlicensed State" is one example of "good cause." If an applicant is licensed on this basis, the licensee could potentially access up to 1 tier of leverage until the applicant reaches the mandatory minimum capital requirement of $5 million. Notably, the "good cause" exception is not limited solely to geographical considerations. Consistent with existing regulations, the "good cause" factors may be applied in a non-exclusive manner, taking existing criteria into account.

The term "Underlicensed State" means a State in which the number of operating licensees per capita is fewer than the median number for all States. To determine the per capita per State, SBA will use the most recent resident population from the U.S. Census as of the date of the calculation. SBA will publish the list of Underlicensed States periodically on the SBIC website.

Introduction of Streamlined Licensing Process for Subsequent Funds

In an effort to streamline the licensing process, the Final Rule created an expedited licensing process for certain, qualifying subsequent funds. Applicants that meet all of the eligibility criteria described below will be able to submit a "Short-Form Subsequent Fund MAQ" which will be reviewed as part of an expedited licensing process:

- Consistent strategy and fund size. The targeted fund size is less than or equal to 133% the size of the applicant's most recent SBIC fund and will target the same asset class and investment strategy as most recent license.

- Clean Regulatory History. There have been no major findings, significant "other matters" or unresolved "other matters" related to licensees managed by the principals of applicant in the previous ten years.

- Consistent LP-GP Dynamics. No new limited partner will represent 33% or more of the private capital of the licensee upon reaching final close at target fund size or hard cap. The two largest investors in terms of committed capital have verbally committed to invest in the new fund pending receipt of license. The most recent Limited Partnership Agreement of the active Licensee and all Side Letters will have no substantive changes for the applicant fund.

- Investment Performance Stability. The most recent licensee net distributions to paid-in capital and net total value to paid-in capital are at or above median vintage year and strategy performance benchmarks for the prior three quarters. The principals of the applicant are not managing a licensee in default or with high capital impairment .

- Consistent or Reduced Leverage Management. The applicant is requesting a leverage to private capital ratio less than or equal to the current or most recent SBIC licensee at target fund size or hard cap.

- Firm stability. Subject to SBA's determination, no material changes to the broader firm, to include resignations, terminations, or retirements by members of the General Partner, investment committee, broader investment team, or key finance and operations personnel that have a material adverse impact on the stability of the SBIC.

- Promotions from within. Applicant demonstrates a commercially reasonable effort of promoting internal investment team talent from within the firm/organization sponsoring the license.

- Inclusive equity. Applicant demonstrates a commercially reasonable effort of the appropriate/increased sharing of carry and/or management company economics with promoted talent or distribution of equitable or increasingly equitable economics among the partnership.

- Clear Background Checks. The sponsoring entity and all principals of the Licensee do not have an FBI criminal record and do not have IRS violations from the date of their most recent SBIC fund licensure.

- No Outstanding or Unresolved Material Litigation Matters. There are no outstanding or unresolved litigation matters involving allegations of dishonesty, fraud, or breach of fiduciary duty as to a prior Licensee, the prospective Applicant's general partner, or any other person who was required by SBA to complete a personal history statement in connection with the license application.

- No Outstanding Tax Liens. There are no outstanding tax liens on the principals applying to manage the licensee, the most recent or active licensee, or on the sponsoring entity of the licensee.

Updates to Reporting and Monitoring

The Final Rule also introduced several changes to the reporting requirements for SBICs. Portfolio Financing Reports on SBA Form 1031 will now be a quarterly submission filed within 30 calendar days of the calendar year quarter following the closing date of the Financing. For example, if a Licensee closes a financing on February 10, 2024, the Licensee will need to submit the related Form 1031 no later than April 30, 2024. All SBICs with leverage are required to value their loans and investments quarterly and all licenses, SBICS (including those without leverage) must report valuations annually. SBICs required to provide quarterly valuations will have 45 days after the close of each quarter to complete the quarterly valuation report, and in a confirming change, SBA Form 468 will be required to be submitted within 45 calendar days of each calendar year quarter.

In an effort to proactively identify and manage programmatic risk, the Final Rule also implements SBA's Watchlist Program. Although being added to the Watchlist will not necessarily result in enforcement action, if added to Watchlist, an SBIC will be required to file Portfolio Financing Reports and valuation reports more frequently, may be required to participate in regular portfolio review meetings with SBA, and will be required to have more frequent communication with SBA. Watchlist triggers include (a) consummation of an investment that is a direct violation of the fund's stated investment policy; (b) the key person clause in in the fund's limited partnership agreement (or other governing agreement) is invoked ; (c) the fund or the fund's general partner has been named as a party in litigation proceedings brought by a Federal agency, involving felony charges, or allegations of dishonesty, fraud, or breach of fiduciary duty; (d) violation of a material provision of the fund's limited partnership agreement (or other governing agreement) or any side letter agreement; (e) ranking in the bottom quartile for the primary strategy benchmark, as identified by the Licensee at the time of licensure, by vintage year, defined as the year in which the fund was licensed as an SBIC, after three years based on the private investor's total value to paid-in capital; (f) leverage coverage ratio falls below 1.25; (g) a default on interest payment and failure to pay within 30 days of the date it is due; or (h) outstanding or unresolved regulatory matters. A fund may be removed from the Watchlist if the issues identified by SBA are resolved to SBA's satisfaction.

Fees and Charges

As part of the Final Rule, SBA modified its Licensing fee structure to lower financial barriers for new funds. Initial licensing fees that are submitted with a fund's application will now depend on their sequence: First time funds will pay a fee of $5,000, second time funds will pay a fee of $10,000, third time funds will pay a fee of $15,000, fourth time funds and beyond will pay a fee of $20,000.

Final licensing fees will be calculated by taking the final licensing base fee plus 1.25 basis points and multiplying by the leverage dollar amount requested by the applicant. Final licensing base fees for first time funds are $10,000, $15,000 for second-time funds, $25,000 for third-time funds, and $30,000 for fourth time funds and beyond. For example, a fourth time fund seeking $175 million in Leverage would pay a Final Licensing Base Fee of $51,875, computed as $30,000 plus 1.25 basis points times $175 million. In addition, the SBA has introduced an application resubmission penalty fee of $10,000 for applicants who have previously withdrawn their application or have not received approval for a license, in addition to the Initial and Final Licensing Fees.

SBA is also implementing a minimum Annual Charge to 0.40% which will be phased in over five years.

Permitted Capital Call Lines

Under the Final Rule, the SBA exempts capital call lines from the mandatory approval requirement in the existing regulations, provided that certain conditions are met. Firstly, the maximum amount available under the Capital Call Line must not exceed the SBIC's unfunded Regulatory Capital, as reported on the SBIC's most recent Capital Certificate. Additionally, the SBIC's payment obligations under this line may be secured, but solely by the SBIC's unfunded Regulatory Capital. The Capital Call Line lender, may have the right to debit the SBIC's deposit account under specific circumstances, limited to defaults in principal, interest, or fees, and only up to the amount of such payment default. Each borrowing from the Capital Call Line must be fully repaid within 120 days of borrowing, and the line's term may not exceed 12 months, although it can be renewable in 12-month intervals, contingent on continued rule compliance. Importantly, the terms of the capital call line cannot grant the lender control over when capital calls are made or direct operations of the Licensee. However, the capital call line agreement may authorize the lender, in the event of a payment default, to endorse checks and other forms of payment in the Lender's possession on behalf of the SBIC and apply proceeds to rectify the Default, with any remaining proceeds promptly returned to the SBIC.

Other Operational and Clarifying Changes

The Final Rule also made dozens of other operational and clarifying changes, including modifying certain definitions, clarifying prepayment restrictions, updating the process for calculating capital impairment, updating valuation policy requirements, changing ownership diversification requirements, adding exceptions to the affiliation rule, and a number of other technical and clean up changes.

The final rule will have a significant and far-reaching influence on the SBIC program, impacting both current and prospective SBIC managers and investors.

Originally published 17 August 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.