- within Strategy topic(s)

Highlights

- This alert by the Holland & Knight Greenwashing Mitigation Team offers insights regarding the Commodity Futures Trading Commission's (CFTC) newly Proposed Guidance about the listing of voluntary carbon credit derivatives on CFTC‑regulated exchanges.

- The Proposed Guidance is intended to ensure that CFTC‑regulated exchanges list only those derivatives where the underlying voluntary carbon credits meet certain standards.

- In conjunction with recent CFTC enforcement guidance regarding carbon markets, the Proposed Guidance shows that, despite limitations to its statutory authority, the CFTC is actively attempting to set standards for voluntary carbon credit markets.

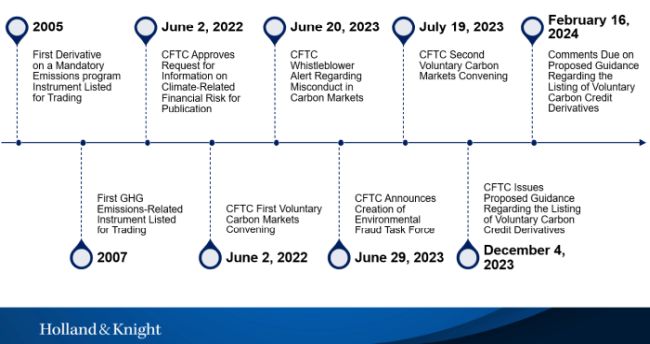

The Commodity Futures Trading Commission (CFTC) issued proposed guidance (the Proposed Guidance) regarding the listing of voluntary carbon credit (VCC) derivatives on CFTC-regulated exchanges on Dec. 4, 2023.1 The CFTC's goal is "to advance the standardization of voluntary carbon credit derivative contracts in a manner that fosters transparency and liquidity, accurate pricing, and market integrity."2 Over the past few years – ramping up especially in 2023 – the CFTC has been attempting to impose standards on the voluntary carbon market with limited statutory authority (see the timeline below). The Proposed Guidance is one way the CFTC can do so within its authority.

The Proposed Guidance addresses a number of common critiques about the quality of the voluntary carbon market – as highlighted in previous Holland & Knight alerts – to the extent the CFTC's jurisdiction allows.3 To do so, the Proposed Guidance outlines several factors that the exchanges must, in practice, consider in connection with product design and listing of VCC derivatives.

Timeline: Ramping Up CFTC Action in Carbon Markets

What Does the CFTC Say in the Proposed Guidance?

The Proposed Guidance outlines particular matters that exchanges should consider to help ensure compliance with existing regulations governing the products that an exchange can list when listing a VCC derivative.

The Proposed Guidance defines VCCs as "a tradeable intangible instrument that is issued by a carbon crediting program. The general industry standard is for a VCC to represent a [greenhouse gas] (GHG) emissions reduction to, or removal from, the atmosphere equivalent to one metric ton of carbon dioxide." There are futures contracts on various types of VCCs, many of which allow physical delivery of the VCCs at settlement. There are currently three actively traded futures contracts on VCCs listed on CFTC‑regulated exchanges.4 Prices are based on the spot price of VCCs that meet certain criteria.5

Specifically, exchanges are permitted to list only derivatives that are not readily susceptible to manipulation.6 To ensure that they do so, exchanges must, among other things, make sure the crediting programs and counterparties can describe or define economically significant characteristics and attributes of the commodity underlying the listed contract. The Proposed Guidance states that exchanges should consider the following VCC commodity integrity characteristics when selecting one or more crediting programs from which counterparties may deliver eligible VCCs at the listed derivative's expiration:

- Transparency. The exchange should provide information that readily specifies the crediting programs and the specific types of projects underlying the VCC derivative.

- Additionality. The exchange should verify that

VCCs are credited only for projects or activities that result in

GHG emission reductions or removals that would not have been

developed and implemented in the absence of the added monetary

incentive created by the revenue from the sale of the VCC. The

exchange should consider whether a crediting program can

demonstrate that it has procedures in place to assess or test for

additionality.

- The CFTC asks for comment regarding whether the CFTC should revise the definition of additionality from the any "added monetary incentive" definition as stated above to a definition that would recognize projects as additional where they reduce or remove GHGs that law, regulation or other legally binding mandate do not already require the projects to reduce or remove.

- Permanence and Risk of Reversal. The exchange should consider whether the crediting program for the underlying VCCs can demonstrate that it has measures in place to address and account for the risk of reversal (i.e., the risk that VCCs issued for a project or activity may be recalled or canceled due to carbon removed by the project or activity being released back into the atmosphere, or a reevaluation of the amount of carbon reduced or removed from the atmosphere by the project or activity). The exchange should verify whether the crediting program has measures in place that provide reasonable assurance that, in the event of a reversal, the VCC will be replaced by a VCC of comparably high quality that meets the specifications of the contract (i.e., "buffer reserves" or "the buffer pool").

- Robust Quantification. The CFTC warns that crediting programs should conservatively quantify GHG emissions reductions or removals underlying VCC derivatives. Exchanges should consider whether the methodology used to calculate the level of GHG emission reductions or removals associated with credited projects or activities is robust, conservative, transparent and accurate.

- Governance. The Proposed Guidance states that counterparties to a VCC derivative may use carbon registries as a physical delivery point to facilitate settlement of the derivative. The CFTC notes that effective crediting programs will operate or make use of a registry that has appropriate governance measures in place to facilitate the physical settlement of a VCC derivative. Exchanges should consider including information about the crediting program's governance framework in the terms and conditions of a physically settled VCC derivative.

- Tracking. Exchanges should consider whether the crediting program operates or makes use of a registry that has measures in place to effectively track the issuance, transfer and retirement of VCCs, to identify who owns or retires a VCC, and to make sure that each VCC is uniquely and securely identified and associated with a single emission reduction or removal of one metric ton of carbon dioxide equivalent.

- Prevention of Double-Counting. Exchanges should consider whether the crediting program for the underlying VCC can demonstrate that it has effective measures in place that provide reasonable assurance that credited emission reductions or removals are not double counted; in other words, that the VCCs representing the emission reductions or removals are issued to only one registry and cannot be used after retirement or cancellation. "Reasonable assurance" could include procedures for conducting cross‑checks across multiple carbon registries.

- Inspection Provisions, Including Third-Party Validation and Verification. VCC derivatives' terms and conditions should clearly specify any inspection or certification procedures for verifying compliance with quality requirements or any other related delivery requirements for physically settled VCC derivatives. Exchanges should ensure that these terms and conditions are consistent with the latest procedures in voluntary carbon markets. Exchanges should consider whether the crediting program has up‑to‑date, robust and transparent validation and verification procedures, including whether those procedures contemplate validation and verification by a reputable, disinterested party or body.

- Monitoring. The Proposed Guidance instructs exchanges to monitor a derivative's terms and conditions as they relate to the underlying commodity market. Exchanges should continually monitor the appropriateness of the contract's terms and conditions, including monitoring to ensure that the underlying VCC conforms or updates to reflect the latest certification standard(s) applicable for that VCC.

Why Is the Proposed Guidance Important?

The CFTC does not have the statutory authority to directly impose standards on the VCC market. Instead, the CFTC grounds its authority to issue the Proposed Guidance in both its broad anti‑fraud and anti‑manipulation authority7 and its authority over CFTC‑regulated exchanges, which is in part enforced through a set of core principles.8 The Proposed Guidance represents the CFTC's interpretation of how those core principles apply in the specific context of VCC derivatives. The Proposed Guidance supplements Appendix C to Part 38 of the CFTC's regulations, which instructs exchanges on how they can demonstrate their compliance with the requirement that a derivative is not readily susceptible to manipulation.

In short, the Proposed Guidance is an attempt by the CFTC to indirectly impose standards on the VCC market via the exchanges it regulates. In fact, much of what is set out in the Proposed Guidance is likely already part of the exchanges' diligence process for listing VCC derivatives. However, the Proposed Guidance is a clear statement from the CFTC that exchanges that list VCC contracts need to do extensive diligence on the deliverable VCCs, including a careful review of the relevant accreditation and verification providers, or face regulatory scrutiny if issues arise with the derivatives they list. This will result in the exchanges applying more pressure on accreditation and verification providers to approve or verify higher‑quality VCCs.

Conclusion

As shown in the timeline above and in previous Holland & Knight alerts and podcasts, carbon markets are an increasing area of focus for the CFTC. A number of the CFTC's recommendations in the Proposed Guidance aim to address the specific types of misconduct that the CFTC has indicated it is on the lookout for in carbon markets.9 In conjunction with the CFTC's previous Whistleblower Alert and creation of the Environmental Fraud Task Force on the enforcement side,10 the Proposed Guidance illustrates that the CFTC is also exercising its jurisdiction over carbon markets on the exchange side, taking a similar approach to improve the overall quality of derivatives of VCCs listed on exchanges and prevent potential misconduct, including greenwashing claims related to an entity's use of VCCs or VCC derivatives.11

It is important to understand that the Proposed Guidance is not finalized or binding in and of itself. However, once final, the Proposed Guidance will represent the definitive interpretation of how the CFTC will exercise its statutory authority over the listing of VCC derivatives on CFTC-regulated exchanges. The CFTC likely expects that the Proposed Guidance will lead to a higher degree of diligence, transparency and rigor in physical VCC markets overall.

Comments on the Proposed Guidance are due on Feb. 16, 2024. Businesses seeking to trade VCCs and derivatives of VCCs, as well as businesses wishing to make environmental claims based on trading VCC and VCC derivatives, should be aware of the Proposed Guidance and consider submitting comments in advance of the deadline.

Footnotes

1. See Commission Proposed Guidance Regarding the Listing of Voluntary Carbon Credit Derivative Contracts; Request for Comment, Federal Register, Dec. 4, 2023.

2. CFTC Issues Proposed Proposed Guidance Regarding the Listing of Voluntary Carbon Credit Derivative Contracts, Release No. 8829-23, Dec. 4, 2023.

3. See Holland & Knight's previous alerts, "Double Jeopardy for Double Counting? CFTC and FTC Both Scrutinize Fraud in Carbon Markets," Aug. 14, 2023; "FTC Proposes to Clarify Green Guides for Climate Claims Based on Carbon Offsets," June 29, 2023; and "FTC Seeks Input on Potential Updates to Its Green Guides," Dec. 19, 2022.

4. These include the NYMEX CBL Global Emissions Offset (GEO) futures contract, the NYMEX CBL Nature‑Based Global Emissions Offset (N-GEO) futures contract and the NYMEX CBL Core Global Emission Offset (C-GEO) futures contract.

5. For example, the NYMEX CBL GEO futures contract provides delivery of physical carbon offsets that meet standards set by the Carbon Offsetting and Reduction Scheme for International Aviation and the CBL Standard Instruments Program. See NYMEX Rulebook, Chapter 1269, CBL Global Emissions Offset Futures.

6. See 17 C.F.R. § 38.200: "Core Principle 3: The board of trade shall list on the contract market only contracts that are not readily susceptible to manipulation."

7. 7 U.S.C. § 9(1) (prohibits any person from using or employing, or attempting to use or employ, in connection with a contract for sale of any commodity in interstate commerce, any manipulative or deceptive device or contrivance, in contravention of rules and regulations promulgated by the CFTC); 7 U.S.C. § 13(a)(2) (makes it a felony for any person to manipulate or attempt to manipulate the price of any commodity in interstate commerce); 17 C.F.R. part 180.

8. 17 C.F.R. § 38.100–.1201; Appendix B to Part 38.

9. See "CFTC Whistleblower Alert: Blow the Whistle on Fraud or Market Manipulation in the Carbon Markets," June 20, 2023.

10. See "CFTC Division of Enforcement Creates Two New Task Forces," Release No. 8736-23, June 29, 2023.

11. Greenwashing occurs when a company makes false or misleading claims about the environmental benefits of its products or services. In the context of VCCs and VCC derivatives, greenwashing could occur, for example, if a company claims to offset 100 percent of its emissions based on its trade in VCC derivatives where the underlying VCC does not meet additionality standards or risks reversal, etc.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.