- within Strategy topic(s)

Final Guidance Is the First by a Federal Regulator Aimed at Setting Specifications for Voluntary Carbon Credits (VCCs) by Establishing Quality Standards for Futures Contracts That Settle Via Physical Delivery of VCCs

Highlights

- This alert by Holland & Knight's Greenwashing Mitigation Team offers insights regarding the Commodity Futures Trading Commission's (CFTC) newly finalized guidance about the listing of voluntary carbon credit (VCC) derivatives on CFTC‑regulated exchanges.

- This guidance is intended to ensure that CFTC‑regulated exchanges list only derivatives where the underlying VCCs meet certain standards.

- In conjunction with CFTC enforcement guidance regarding carbon markets issued in 2023, the final guidance shows that, despite limitations to its statutory authority, the CFTC is actively attempting to set standards for VCC markets.

The Commodity Futures Trading Commission (CFTC) on Sept. 20, 2024, finalized guidance (the Final Guidance) regarding the listing of voluntary carbon credit (VCC) derivatives on CFTC‑regulated exchanges. The CFTC previously proposed guidance in December 2023 (Proposed Guidance).1 The agency largely finalized the guidance as proposed.

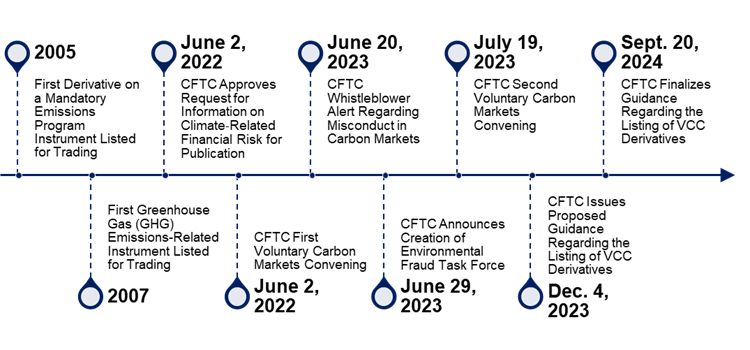

The CFTC's goal is to "advance the standardization of VCC derivative contracts in a manner that fosters transparency and liquidity."2 Over the past few years – ramping up especially in 2023 – the CFTC has attempted to impose standards on the voluntary carbon market with limited statutory authority (see the timeline below). The Final Guidance is one way the CFTC can likely do so while remaining within its authority.

The CFTC defines VCCs as "a tradeable intangible instrument that is issued by a carbon crediting program [that] represent[s] a [greenhouse gas] (GHG) emissions reduction to, or removal from, the atmosphere equivalent to one metric ton of carbon dioxide."3 There are futures contracts on various types of VCCs, many of which allow physical delivery of the VCCs at settlement. There are currently three actively traded futures contracts on VCCs listed on CFTC‑regulated exchanges.4 Prices are based on the spot price of VCCs that meet certain criteria.5

The Final Guidance addresses a number of common critiques about the quality of the voluntary carbon market – as highlighted in previous Holland & Knight alerts – to the extent the CFTC's jurisdiction allows.6 To do so, the Final Guidance outlines several factors that the exchanges must, in practice, consider in connection with product design and listing of VCC derivatives. The Final Guidance does not require exchanges that list VCC futures contracts to actively investigate or confirm the validity of the VCCs underlying the relevant futures contracts. Rather, the guidance provides a high-level framework and set of expectations regarding what those exchanges should consider when determining whether the diligence done by third parties and standards set by verification providers provide grounds for the exchanges to conclude that the CFTC's core principles for listing futures contracts are satisfied.

Timeline: Ramping Up CFTC Action in Carbon Markets

What Does the CFTC Say in the Final Guidance?

The Final Guidance outlines factors for consideration by CFTC‑regulated exchanges when addressing certain provisions of the Commodity Exchange Act (CEA) and CFTC regulations that are relevant to the listing of VCCs.

Specifically, exchanges are permitted to list only derivatives that are not readily susceptible to manipulation.7 To ensure that they do so, exchanges must, among other things, make sure the economically significant characteristics and attributes of the commodity underlying the listed contract can be described or defined. As in the Proposed Guidance, the Final Guidance states that exchanges should consider the following VCC commodity integrity characteristics when selecting one or more crediting programs from which counterparties may deliver eligible VCCs at the listed derivative's expiration:

- Transparency. The exchange should provide information that readily specifies the crediting programs and the specific types of projects underlying the VCC derivative. VCCs must accurately represent the nature of GHG emission reductions or removals they are intending to represent. Contracts should specify what types of VCCs are deliverable and the extent to which VCCs are associated with a specific category of mitigation activity (e.g., nature-based, carbon capture, etc.).

- Additionality. The Final Guidance recognizes that additionality is a "cornerstone" characteristic of a high-quality VCC.8 Although the CFTC specifically asked for comments regarding whether its characterization of additionality "as the reduction or removal of GHG emissions resulting from projects or activities that are not already required by law, regulation, or any other legally binding mandate applicable in the project's or activity's jurisdiction" in the Proposed Guidance, the CFTC decided not to finalize a definition given that the comments it received indicated that there is variation regarding the definition across the voluntary carbon markets.9 However, the Final Guidance does direct exchanges to "consider whether a crediting program has procedures to assess or test for additionality – and whether those procedures provide a reasonable assurance that GHG emission reductions or removals are credited only if they are additional."10

- Permanence and Risk of Reversal. Exchanges should evaluate whether the crediting program for underlying VCCs has measures in place to address and account for the risk of reversal (i.e., the risk that VCCs issued for a project or activity may be recalled or canceled due to carbon removed by the project or activity being released back into the atmosphere, or due to a reevaluation of the amount of carbon reduced or removed from the atmosphere by the project or activity).11 The Final Guidance notes that exchanges should consider whether a crediting program has a buffer reserve and/or other measures in place to address such risk.

- Robust Quantification. The CFTC warns that crediting programs should conservatively quantify GHG emissions reductions or removals underlying VCC derivatives. Quantification methodology should be robust, conservative and transparent. For listed derivative contracts, exchanges are required to adopt, as necessary and appropriate, exchange‑set position limits for speculators.12

- Governance. Exchanges should consider whether the crediting program for underlying VCCs has a governance framework in place that supports the crediting program's independence, transparency and accountability and whether the crediting program makes this framework publicly available. A crediting program's registry may be used as a delivery point to facilitate physical settlement for a VCC derivative contract. Exchanges should evaluate the program's decision-making procedures, how the independence of key functions is ensured, reporting and disclosing procedures, public and stakeholder engagement processes, risk-management policies, appeals mechanisms and financial resources.13

- Tracking. Exchanges should consider whether the crediting program for the underlying VCCs has processes and procedures in place to track the issuance, transfer and retirement of VCCs, identify who owns or retires a VCC and ensure that each VCC is uniquely and securely identified and associated with a single emission reduction or removal of one metric ton of carbon dioxide equivalent.14

- Prevention of Double-Counting. Exchanges should consider whether the crediting program for the underlying VCC can demonstrate that it has effective measures in place that provide reasonable assurance that credited emission reductions or removals are not double-counted – in other words, that the VCCs representing the emission reductions or removals are issued to only one registry and cannot be used after retirement or cancellation. "Reasonable assurance" could include procedures for conducting cross‑checks across multiple carbon registries.15

- Inspection Provisions, Including Third-Party Validation and Verification. VCC derivatives' terms and conditions should clearly specify any inspection or certification procedures for verifying compliance with quality requirements or any other related delivery requirements for physically settled VCC derivatives. Exchanges should ensure that these terms and conditions are consistent with the latest procedures in voluntary carbon markets. Exchanges should consider whether the crediting program has up‑to‑date, robust and transparent validation and verification procedures, including whether those procedures contemplate validation and verification by a reputable, disinterested party or body.16

- Monitoring. The Final Guidance instructs exchanges to monitor a derivative's terms and conditions as they relate to the underlying commodity market through market surveillance, compliance and enforcement practices and procedures.17

Why Is the Final Guidance Important?

As described in Holland & Knight's previous alert, the CFTC does not have the statutory authority to directly impose standards on the VCC market. Instead, the CFTC grounds its authority to issue the Final Guidance in both its broad anti‑fraud and anti‑manipulation authority18 and its authority over CFTC‑regulated exchanges, which is in part enforced through a set of 23 statutory core principles.19 The Final Guidance represents the CFTC's interpretation of how those core principles apply in the specific context of VCC derivatives.

More specifically, the Final Guidance is an attempt by the CFTC to indirectly, via the exchanges it regulates, impose standards on the VCC market. By requiring exchanges to engage in significant due diligence of the verification and accreditation providers and their policies and procedures, the CFTC is imposing regulatory liability specific to VCCs on a key part of the VCC market infrastructure. The CFTC's likely hope is that this will result in the exchanges applying more pressure on accreditation and verification providers specifically and the voluntary market generally to adhere to high standards.

Conclusion

As shown in the timeline above and in previous Holland & Knight alerts, carbon markets are an increasing area of focus for the CFTC. A number of the CFTC's recommendations in the Final Guidance align with the specific types of misconduct that the CFTC has indicated it is on the lookout for in carbon markets. In conjunction with the CFTC's previous Whistleblower Alert and creation of the Environmental Fraud Task Force on the enforcement side, the Final Guidance illustrates that the CFTC is also exercising its jurisdiction over carbon markets on the exchange side, taking a similar approach to improve the overall quality of derivatives of VCCs listed on exchanges and prevent potential misconduct.

This Final Guidance represents the definitive interpretation of how the CFTC will exercise its statutory authority over the listing of VCC derivatives on CFTC-regulated exchanges. The Final Guidance will lead to a higher degree of diligence, transparency and rigor in physical VCC markets overall and may help prevent potential misconduct, including greenwashing. The fact that the CFTC issued the Final Guidance prior to the presidential election shows that the CFTC is prioritizing carbon markets comprised of robust, high-quality VCCs and their derivatives while an administration with similar goals is in office.20

Footnotes

1 Commission Guidance Regarding the Listing of Voluntary Carbon Credit Derivative Contracts; Request for Comment, 88 Fed. Reg. 89410, Dec. 27, 2023.

2 "CFTC Approves Final Guidance Regarding the Listing of Voluntary Carbon Credit Derivative Contracts," Release No. 8969-24, Sept. 20, 2024.

3 Final Guidance at 9.

4 These include the NYMEX CBL Global Emissions Offset (GEO) futures contract, the NYMEX CBL Nature‑Based Global Emissions Offset (N-GEO) futures contract and the NYMEX CBL Core Global Emission Offset (C-GEO) futures contract. See CBL Global Emissions Offset.

5 For example, the NYMEX CBL GEO futures contract provides delivery of physical carbon offsets that meet standards set by the Carbon Offsetting and Reduction Scheme for International Aviation and the CBL Standard Instruments Program. See NYMEX Rulebook, Chapter 1269, CBL Global Emissions Offset Futures.

6 See Holland & Knight's previous alerts, "CFTC Moves to Set Voluntary Carbon Market Standards," Dec. 13, 2023; "Double Jeopardy for Double Counting? CFTC and FTC Both Scrutinize Fraud in Carbon Markets," Aug. 14, 2023; "FTC Proposes to Clarify Green Guides for Climate Claims Based on Carbon Offsets," June 29, 2023; "FTC Seeks Input on Potential Updates to Its Green Guides," Dec. 19, 2022.

7 See 17 C.F.R. § 38.200 ("Core Principle 3: The board of trade shall list on the contract market only contracts that are not readily susceptible to manipulation.").

8 Final Guidance at 87.

9 Final Guidance at 44, 87.

10 Final Guidance at 47–88.

11 Final Guidance at 88–89.

12 Final Guidance at 90–91.

13 Final Guidance at 92–93.

14 Final Guidance at 93.

15 Final Guidance at 93–94.

16 Final Guidance at 94–95.

17 Final Guidance at 95–97.

18 7 U.S.C. § 9(1) prohibits any person from using or employing, or attempting to use or employ, in connection with a contract for sale of any commodity in interstate commerce, any manipulative or deceptive device or contrivance, in contravention of rules and regulations promulgated by the CFTC; 7 U.S.C. § 13(a)(2) makes it a felony for any person to manipulate or attempt to manipulate the price of any commodity in interstate commerce; 17 C.F.R. part 180.

19 17 C.F.R. § 38.100–.1201; Appendix B to Part 38.

20 See "Fact Sheet: Biden-Harris Administration Announces New Principles for High-Integrity Voluntary Carbon Markets," May 28, 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.