- within Transport topic(s)

The Commodity Futures Trading Commission (CFTC or Commission) is moving forward with plans to regulate voluntary carbon markets (VCMs). On December 4, the CFTC issued a proposed guidance (Proposed Guidance) that would apply to designated contract markets (DCMs) listing physically-settled, voluntary carbon credit (VCC) derivative contracts.1 The CFTC has requested comment by February 16, 2024. The Proposed Guidance continues the CFTC's efforts to address the development of VCMs and, in the words of Chairman Behnam, take "thoughtful and deliberate next steps toward building a financial system that provides effective tools in achieving emission reductions."

The Proposed Guidance instructs DCMs to consider additional, prescriptive factors when designing and listing VCC derivative contracts. The Commission refers to these additional VCC factors, or unique attributes of underlying VCCs, as "VCC commodity characteristics." In summary, DCMs should consider the following with respect to a VCC derivative contract:

- VCC commodity characteristics when addressing quality, delivery point/facility, and inspection provision standards, including review of relevant carbon crediting programs (or "crediting programs"),2 in the design of a new product (i.e., contract) listing.

- Continually monitoring the contract's terms and conditions for appropriateness as they relate to the underlying VCC market.

- Including qualitative explanations, analysis, and complete and thorough supporting documentation, evidence, and data to meet contract submission requirements.3

The action is also notable for what it does not propose. The Proposed Guidance does not, for example, further pursue the CFTC's previous request for information on whether a separate registrant category should be created for entities trading in VCMs. However, the Proposed Guidance does contemplate applying its considerations to all CFTC-registered exchanges.

In addition to DCMs, the Proposed Guidance would apply to swap execution facilities (SEFs) submitting swap contracts to the Commission for review, as the guidance instructs SEF registrants to consider its provisions, particularly with respect to anti-manipulation protections. The CFTC is also considering, but has not committed to, applying the Proposed Guidance to foreign boards of trade (FBOTs) seeking to offer VCC derivative contracts to US persons.4Requiring FBOTs to consider the guidance when listing VCC derivative contracts would impose more prescriptive requirements on the existing contract approval process and mark a significant deviation from existing contract approval requirements.

The release follows two years of information gathering by the Commission and marks a notable development in the agency's oversight of VCC derivative contracts. The Proposed Guidance builds on earlier efforts by the Division of Enforcement to combat environmental fraud and misconduct, and aims to support the development of legitimate VCMs by enhancing underlying VCC integrity and standardization. As stated by CFTC Chairman Behnam in the press release announcing the Proposed Guidance, "Our goal all along has been to help shape standards in support of integrity, which will lead to transparency, liquidity, and ultimately price discovery – all established hallmarks of CFTC regulated markets."5

The CFTC's information gathering and recent actions impacting VCMs include:

- Issuing a Request for Information (RFI)6regarding climate-related risk, seeking public comment on VCMs, among other topics (June 2022)

- Holding the Voluntary Carbon Markets Convening, the first of two carbon markets convenings (June 2022)

- Issuing a whistleblower alert on environmental fraud through the CFTC Division of Enforcement (June 2023)

- Creating an Environmental Fraud Task Force within the CFTC Division of Enforcement (July 2023)

- Holding the second Carbon Markets Convening (July 2023)

Proposed Guidance: Designing VCC Derivative Contracts

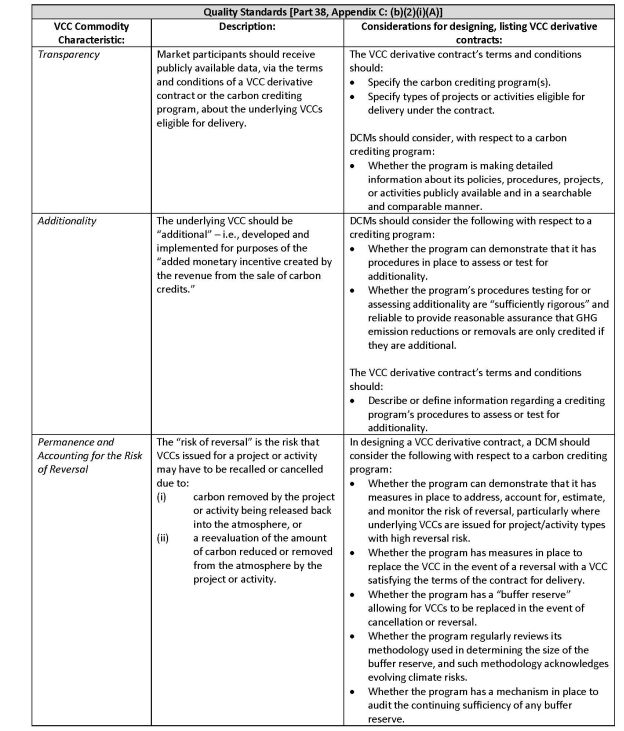

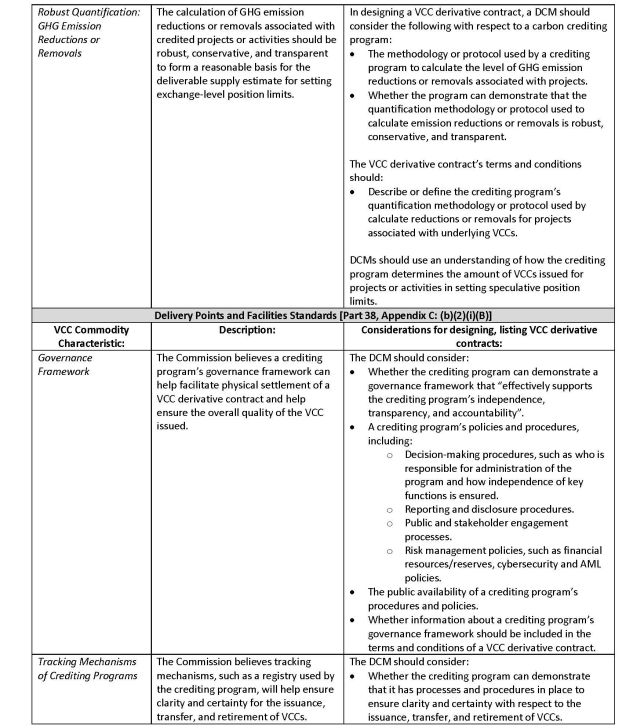

The VCC commodity characteristics are based on existing DCM Core Principle 3 and Appendix C, which require firms to list and demonstrate that a contract is "not readily susceptible to manipulation." Specifically, when designing a VCC derivative contract, DCMs should consider the specified VCC commodity characteristics when addressing the (1) quality, (2) delivery point and facility, and (3) facilities and inspection criteria.

Each of the three criteria would require the DCM to familiarize itself with, closely review, and consider controls and processes of the carbon crediting program when issuing underlying VCCs. Accordingly, DCMs will need to closely familiarize themselves with underlying carbon crediting programs.

When applying quality standards criteria to VCC derivative contracts, DCMs should consider transparency, additionality (explained below in relation to carbon offsets), permanence and risk of reversal, and robust quantification. In general, the Commission considers transparency to exist where information is made publicly available by (i) the DCM in the terms and conditions of a VCC derivative contracts, and (ii) relevant crediting programs with respect to underlying VCCs. Additionality would be present where the underlying project or activity results from the monetary incentive of selling the carbon credit. The CFTC suggests that the absence of additionality with respect to the underlying VCC is significant and may be a fatal flaw in the process of listing a VCC derivative contract.

"Permanence and accounting for the reversal of risk" is a characteristic for listing-DCMs to consider with respect to carbon crediting programs and their ability to estimate, monitor and address risk when a project is recalled, canceled or reevaluated. And "robust quantification" tasks DCMs with considering whether carbon crediting programs have robust, conservative, and transparent quantitative methodologies that accurately reflect the level of greenhouse gas (GHG) emissions.

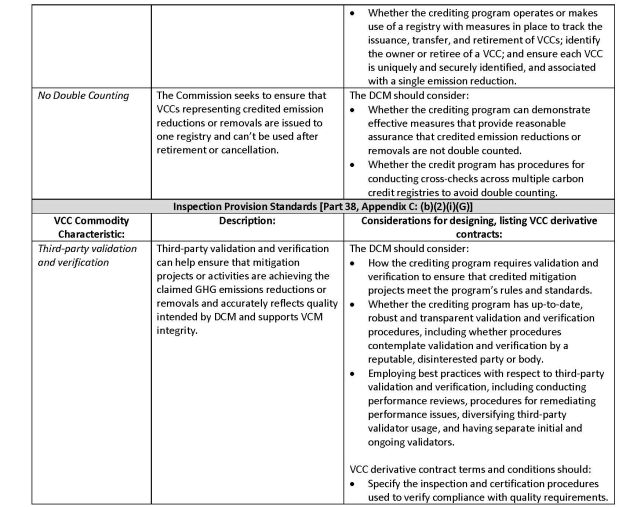

Additionally, when applying delivery point and facility standards criteria to VCC derivative contracts, DCMs should consider the governance framework, tracking mechanisms and the ability to prohibit "double counting" by carbon crediting programs used in the delivery process for relevant VCCs.

Finally, when applying inspection provisions standards criteria for VCC derivative contract listings, DCMs should consider the crediting program's validation and verification of relevant credited projects or activities.

The table at the end of this alert provides a comprehensive list of relevant considerations for DCMs proposing to list VCC derivative contracts, as outlined in the Proposed Guidance.

Proposed Guidance: Listing VCC Derivative Contracts

DCMs seeking to list a new derivative contract can do so by either seeking (and obtaining) pre-approval from the Commission or by self-certifying the contract. Either route to successfully list a derivatives contract for trading requires a DCM to submit prescribed information to the CFTC, such as the contract's terms and conditions, an explanation and analysis of the contract, supporting documentation, and additional evidence or information demonstrating satisfaction of CFTC requirements.

The Proposed Guidance states that "qualitative explanations" and analysis should be given when submitting a VCC derivative contract for certification under CFTC Part 40. It also provides that DCMs should submit "complete and thorough" information to the Commission when listing a VCC derivative contract.

Proposed Guidance: Ongoing Duties of Listed VCC Derivative Contracts

The Proposed Guidance would expand a DCM's ongoing compliance responsibilities with respect to listed physically-settled VCC derivative contracts. Specifically, the guidance states that DCMs should engage in the "continual monitoring" of the appropriateness of the listed contract's terms and conditions to ensure the underlying VCC conforms to the latest certification standards and reflects changes to the crediting program or types of projects associated with the underlying VCC.

The Commission believes that the nascent status of VCC derivative contracts and the fact that "standardization and accountability mechanisms for VCCs are still being developed" warrant the heightened monitoring standard set forth in the Proposed Guidance. If the DCM identifies or detects changes in the underlying VCC, such as where new standards or certifications are found to apply, the exchange should appropriately amend the contract's terms and conditions.

Lastly, the Proposed Guidance reminds market participants that DCMs must have rules requiring them to keep records of trading activity, including for VCC derivative contracts. Market participants, including registrants, clearing members, and others executing trades on the DCM, should note that CFTC recordkeeping rules require that documents supporting underlying commodity trades must be made available to the DCM and CFTC upon request.

Table A: Compliance considerations and guidance for VCC derivative contracts

Footnotes

1. "Commission Guidance Regarding the Listing of Voluntary Carbon Credit Derivative Contracts; Request for Comment." RIN 3038-AF40 (Oct. 4, 2023). Available at https://www.cftc.gov/media/9831/federalregister120423/download.

2. See "The Integrity Council for the Voluntary Carbon Market Carbon Core Principles," Section 5 Definitions, defining a carbon-crediting program as "A standard-setting program that registers mitigation activities and issues carbon credits."

available at: https://icvcm.org/wp-content/uploads/2023/07/CCP-Section-5-R2-FINAL-26Jul23.pdf

3. CFTC Rules 40.2(a) and 40.3(a).

4. Id. at 38, Request for Comment No. 5: "Should the VCC commodity characteristics that are identified in this proposed guidance as being relevant to the listing by a DCM of VCC derivative contracts, also be recognized as being relevant to submissions with respect to VCC derivative contracts made by a registered foreign board of trade under CFTC regulation 48.10?"

5. CFTC Press Release No. 8829-23 (Oct. 4, 2023). Available at https://www.cftc.gov/PressRoom/PressReleases/8829-23.

6. Request for Information on Climate-Related Financial Risk, 87 Fed. Reg. 34856 (June 8, 2022).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.