This article aims to highlight the key valuation triggers that stem from the application of various International Financial Reporting Standards (IFRS) and outline the valuation-specific differences between IFRS and the Accounting Standards Codification (ASC). The comprehensive analysis presented here would give readers a broad understanding of the valuation practices under IFRS as well as the nuances that differentiate valuations under IFRS from that of ASC.

IFRS – 1 (First-Time Adoption)

This standard sets out the procedures that an entity must follow when it adopts International Financial Reporting Standards (IFRS) for the first time as the basis for preparing its general-purpose financial statements.

Valuation Trigger

A first-time adopter may elect to measure individual items at their fair value as on the date of transition to IFRS.

Measurement at Fair Value

Assets carried at cost may be measured at their fair value as on the date of transition.

Exceptions:

- The entity must revalue assets under previous GAAP either to their fair value or to a price-index-adjusted cost.

- The entity must make a one-time revaluation of assets or liabilities to fair value due to privatization or an initial public offering.

Differences between IFRS & ASC

ASC does not have a dedicated standard for first-time adoption. Instead, guidance for first time adoption is available within the respective standards.

IFRS – 2 (Share-Based Payments)

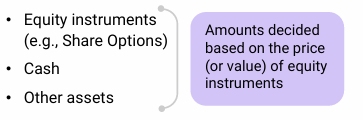

Share-based payments is a transaction in which an entity receives goods or services in exchange for consideration in the form of:

Valuation Trigger

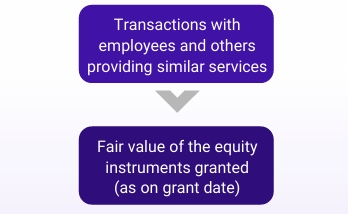

1. Transactions with employees and others providing similar services: Fair value as on grant date.

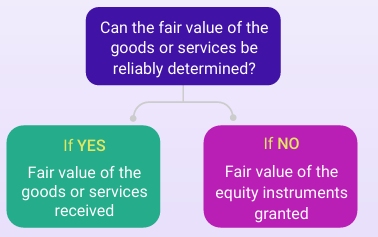

2. Receipt of goods or services in exchange for equity instruments: Fair value as on the date of receipt of goods/services.

#

Measurement at Fair Value

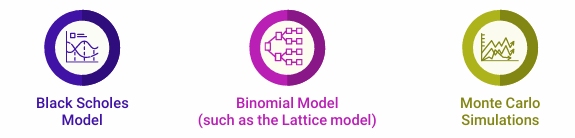

The fair value of instruments should be determined using an appropriate option-pricing models such as:

For complex financial instruments, advanced models such as the Binomial or Monte Carlo models are to be used.

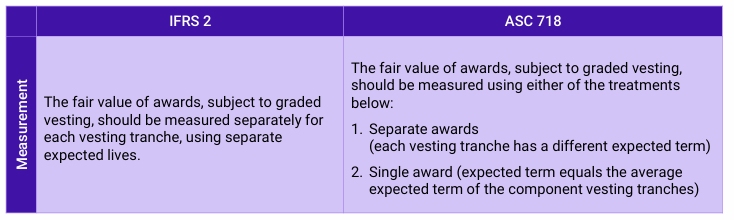

Differences between IFRS & ASC

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.