- in United States

- with readers working within the Construction & Engineering industries

- within Law Practice Management topic(s)

Healthcare professionals working part-time or irregular hours can still qualify under the Skilled Worker visa, provided their salaries meet the required thresholds. For example, many dentists will work on a self-employed basis and take a profit share but typically will not have stipulated hours.

For immigration purposes, hours do need to be confirmed on the certificate of sponsorship so that the Home Office can ensure the role meets both the relevant SOC code minimum hourly rate as well as the minimum salary threshold.

This article outlines how to prorate healthcare roles listed in Table 3 of Appendix Skilled Occupations, using the example of a Band A dentist who works irregular hours and wants to understand both how many hours they would need to work and the minimum hourly rate per the Skilled Worker salary requirements.

Step-by-Step Guide to Prorating Healthcare Roles

- Identify the Relevant Band in the SOC Code to identify the minimum annual salary

The first step is to identify the appropriate band for the healthcare role based on the relevant Standard Occupational Classification (SOC) code so that we can then calculate the minimum hourly rate.

For this example, we are using Band A of SOC code 2253 Dental Practitioners, which applies to certain dental professionals. This code stipulates the minimum annual salary is £47,653 per annum for 37.5 hours per week.

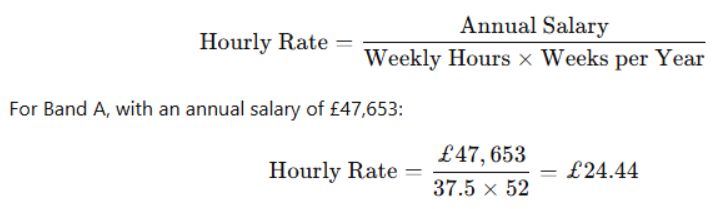

- Calculate the Hourly Rate

The hourly rate for a Band A role is derived from the full-time annual salary found in Table 3 of Appendix Skilled Occupations, divided by the standard working hours. As above, the minimum annual salary is £47,653 per annum and 37.5 hours per week.

The formula for the calculation therefore is:

- Ensure the Minimum Salary Threshold is Met

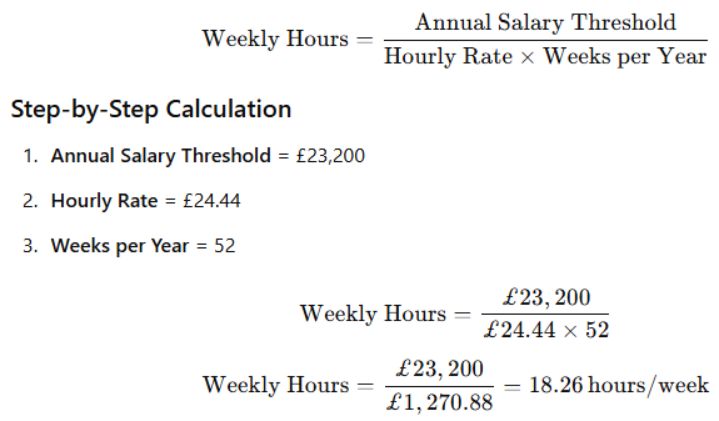

Now we understand the minimum hourly rate for the SOC code is £24.44, we need to ensure that the general annual salary threshold is also met. We can then advise the dentist what the minimum hours he can work per week to meet the rules.

In the example, the dentist role is an eligible healthcare role that enjoys a minimum annual salary threshold of £23,200 (as opposed to the general threshold of £38, 700).

To ensure the role meets this requirement, we now need to calculate the minimum hours required:

In this example, a Band A dentist would need to be paid a minimum of £24.44 per hour for a minimum of circa 18.5 hours per week to ensure compliance with the Skilled Worker visa requirements for both hourly and annual salary thresholds.

- Completing the Certificate of Sponsorship (CoS)

When submitting a Certificate of Sponsorship for a healthcare role, include:

- The salary figure, provided as either an annual amount or an hourly rate.

- The expected weekly hours the worker will undertake.

The Home Office will use this information to verify that the job meets both the hourly rate and annual salary requirements. Employers can choose whether to provide the payment rate in hourly or per-annum terms, depending on what best represents the job.

Key Takeaways

- Accurate Calculations: Use the correct hourly rate and ensure the total annual hours meet the relevant salary thresholds.

- Flexibility on CoS: Employers can choose to present either hourly or annual salary figures but must include weekly hours for Home Office verification.

- Part-Time Workers: For part-time roles or those with irregular hours, carefully prorate the salary to ensure compliance with visa requirements.

By following these steps, employers can effectively sponsor healthcare workers with irregular hours while meeting all Skilled Worker visa conditions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.