- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law, Litigation and Mediation & Arbitration topic(s)

INTRODUCTION

The last 12 months have tested the resilience of European businesses as elevated interest rates, waning consumer confidence and political instability weighed heavily on corporate performance.

2025 began with cautious optimism for a moderate recovery, driven by ongoing disinflation and bets that easing rates would support growth. But the U.S. announcement of sweeping tariffs in April dealt a fresh blow to corporate outlooks. Global growth projections have since been revised downwards, with the World Bank recently lowering its 2025 forecast to 2.3%, the slowest rate since 2008, citing trade disruptions and uncertainty.1

If tariffs are fully implemented, industries highly exposed to global trade, such as automotive and chemicals, are expected to face earnings pressures from rising input costs and lower demand. Many more sectors may be indirectly affected, as the uncertain economic outlook hits consumers spending and business investment.

Meanwhile, rising geopolitical tensions, including the ongoing war in Ukraine, and escalating conflicts in the Middle East, threaten to drive up global energy prices and exacerbate inflation risks.

In such turbulent times, business leaders and financial stakeholders face critical questions: how financially sound is my business to weather this new wave of challenges? How resilient are balance sheets in withstanding these and other potential economic shocks?

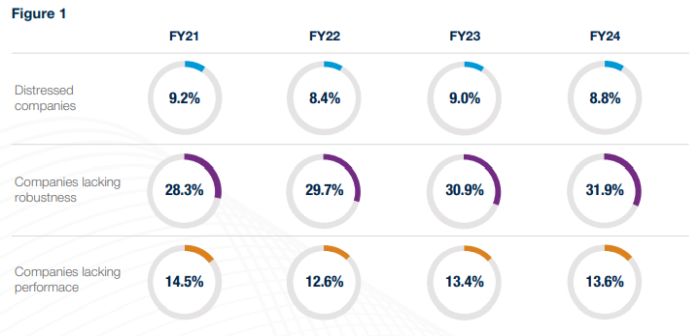

The A&M Distress Alert aims to provide insights that can help answer these questions. The latest data, based on the financial analysis of nearly 8,000 businesses, reveals that 32% of European corporates had fragile balance sheets even before the introduction of tariffs, the highest proportion since 2021. Businesses with weak capital structures may tip into distressed territory sooner rather than later in an environment of earnings deterioration resulting from high tariffs and inflation.

While distress levels stabilised year-on-year, they are still higher than two years ago. Nearly 700 businesses, or 8.8% of the companies, were classified as distressed in 2024, vs 8.4% in 2022.

The findings highlight vulnerabilities in sectors most exposed to tariffs, such as Automotive and Manufacturing, which have experienced some of the largest increases in distress levels across Europe. It also reveals cracks in industries like Business Services, Media, Entertainment & Media Services, and Healthcare.

As profitability and cash flows pressures intensify amid the current tariff volatility, highly leveraged businesses may struggle to meet their financial obligations. Those facing upcoming maturities face additional challenges as increasing volatility in debt capital markets complicates refinancing plans.

Reflecting these risks, Fitch Ratings raised its 2025 default rate forecast for European leveraged borrowers in May.2

We view this tumultuous period as an opportunity for companies to pursue simultaneous enhancements in balance sheets and operational efficiency, positioning them to come out stronger in the future.

In this report, we explore the key findings of our latest analysis and discuss how the current economic outlook is likely to shape corporates' financial health through the rest of 2025 and beyond.

EXECUTIVE SUMMARY

01 Distress levels plateau in respite before tariff turmoil

Levels of financial distress have stabilised year-on-year, with 8.8% of companies in the dataset of nearly 8,000 firms classified as distressed in 2024. This equates to 695 businesses, a little under the 713 from the year before. Notably, corporate financial health has deteriorated in eight out of 16 sectors and in several major markets, including Germany and France, two of Europe's largest economies.

02 Nearly a third of balance sheets are in a precarious state

Since 2020, the share of businesses lacking balance sheet robustness has steadily increased, reaching a record 32% of our dataset last year, which represents over 2,500 corporates. This trend highlights the persistent challenge of generating sufficient cash and profits to service corporate debt in an environment of higher interest rates and heightened uncertainty. With earnings likely to deteriorate in the wake of tariffs, more companies in this category may tip into distress.

03 France sees surge in distress; German firms remain strained

France recorded the sharpest increase in distress levels in 2024, rising to 10.5% from 8.1% the year before. The surge reflects an economic environment of subdued growth, deteriorating business and consumer sentiment, a weak labour market as well as political and fiscal challenges. Meanwhile, Germany, struggling with minimal growth over the past few years, emerged as the most distressed market in the analysis, with 11.5% companies in the dataset classified as distressed.

04 Rising distress in Entertainment & Media Services, Fashion Retail, Automotive

As in previous editions of this report, Media, Entertainment & Media Services (including fibre and alternative network providers) and Fashion Retail remain the most distressed sectors across countries. The latest data also shows a marked increase in distress among Automotive, Business Services, Commodities and Manufacturing companies. Additionally in the Automotive sector, balance sheet issues are a major concern, with four in ten businesses burdened by weakened capital structures.

05 Tariffs pose threat to growth and refinancing prospects

Volatility in the public debt markets, coupled with an economy impacted by tariffs and heightened geopolitical instability is expected to intensify operational and financial challenges for corporates going forward. The pressure will be particularly acute for lower-rated companies with debt maturing in the next six to 12 months, as they struggle to access the credit market to push out their maturity walls. We anticipate this will result in increased restructuring activity in the months and year ahead.

SECTOR TRENDS

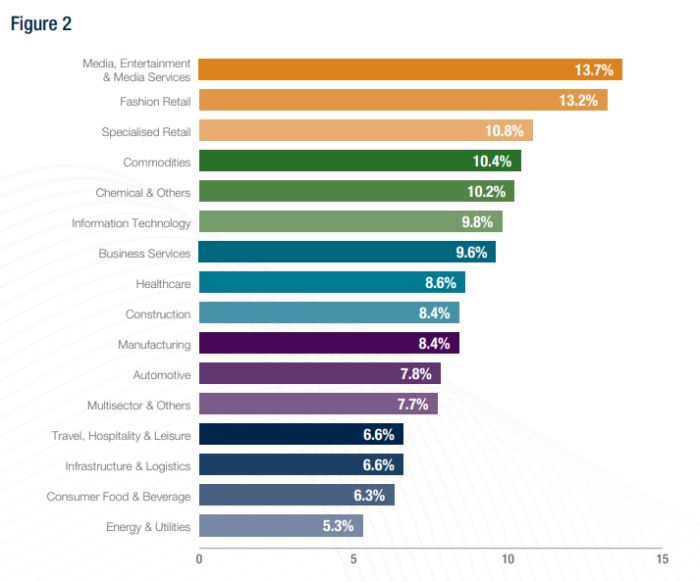

The latest data shows Media, Entertainment & Media Services as the most distressed sector across countries, followed by Fashion Retail and Specialised Retail3 .

Corporate health in the Automotive, Business Services, Commodities and Manufacturing sectors saw the most significant deterioration in the period analysed. Overall, eight out of 16 sectors experienced heightened distress in 2024 compared to the prior year.

MEDIA, ENTERTAINMENT & MEDIA SERVICES

- The Media, Entertainment & Media Services sector – which includes subindustries such as Alternative Carriers, Wireless Telecommunication Services, Advertising and Publishing – stands out as the most distressed among all sectors in the dataset, with 13.7% of all Media & Entertainment companies in the study classified as being in distress. In France, the U.K. and Spain, the sector is among the top three most distressed sectors.

- Around 38% of companies in the industry lack balance sheet robustness, one of the highest levels in the analysis, reflecting higher interest burdens faced by leveraged corporates.

- Firms in the sector continue to struggle with the reduction in discretionary spending on media services such as streaming subscriptions. The 2023 writers' strike in the U.S. is still reverberating, with disrupted film and TV production, delays in delivery timelines and increased costs.

- The Media landscape is increasingly congested, with numerous players competing for audience attention, leading to a highly fragmented market. This fragmentation, combined with changing audience behaviours, has made it more challenging for large legacy players to capture market share. As a result, the industry is experiencing varying levels of profitability and heightened share price volatility

- In addition, many of the large studios are exiting and disposing of businesses, typically to improve free cash flow, profits or pay down debt given high cost of capital, as well as removing noncore business distractions.

- The fibre and alternative network (altnet) providers in the U.K. and Europe are grappling with rising costs, intense competition and a funding freeze. Many smaller operators are struggling to achieve profitability due to low customer uptake and high debt costs, leading to a shift from rapid expansion to survival strategies like cost-cutting, operational efficiency and right sizing of the balance sheet.

Key findings

| Movies and Entertainment | Publishing | Wireless Telecommunication Services | ||

| Worst sectors |

27.2% Wireless Telecommunication Services |

16.7% Communications Equipment |

15.8% Movies and Entertainment |

|

| Worst trend sectors |

10.5pp FY21 |

7.7pp FY22 |

1.2pp FY23 |

FY24 |

| Distress in % |

11.8% FY21 |

11.5% FY22 |

14.8% FY23 |

13.7% FY24 |

| Lacking performance in % |

15.1% FY21 |

17.6% FY22 |

19.7% FY23 |

18.0% FY24 |

| Lacking robustness in % | 33.8% | 35.8% | 38.6% | 37.6% |

FASHION RETAIL

- 13.2% of Fashion Retail companies in our dataset are classified as distressed, a slight decline from 14.5% a year earlier but still one of the highest levels among sectors. Both performance and balance sheets remain fragile with 16.5% and 31% of Fashion businesses classified as lacking performance or lacking robustness, respectively.

- Top-line growth in the sector is faltering due to restrained consumer spending and evolving buying behaviours, including a shift toward online shopping as well as a preference for discounted items and more sustainable products.

- Additionally, the sector struggles with a relatively high cost base – including expenses for personnel, marketing and rents – and the need for significant investments to enhance operational efficiency such as IT and cybersecurity upgrades. These factors contribute to increasingly thin profit margins.

- In the U.K., pressures on operating expenses have been exacerbated by increases in national insurance contributions and the national living wage, announced in the Autumn Budget and implemented this year, as well as other regulatory costs like new packaging taxes.

| Apparel, Accessories and Luxury Goods | Apparel Retail | Textiles | ||

| Worst sectors |

14.4% Textiles |

14.2% Apparel, Accessories and Luxury Goods |

5.1% | |

| Worst trend sectors |

2.6pp FY21 |

1.1pp FY22 |

FY23 |

FY24 |

| Distress in % |

16.5% FY21 |

9.5% FY22 |

14.5% FY23 |

13.2% FY24 |

| Lacking performance in % |

24.7% FY21 |

12.0% FY22 |

18.6% FY23 |

16.5% FY24 |

| Lacking robustness in % | 30.9% | 26.0% | 31.8% | 31.0% |

AUTOMOTIVE

- The Automotive sector has experienced the biggest year-onyear increase in distress levels across Europe (from 4.6% to 7.8%), driven by global competitive pressures, the transition to electromobility, as well as tariff-driven supply chain disruptions and cost increases.

- On top of worsening performance, auto businesses are burdened by weakened capital structures, with four in 10 lacking balance sheet robustness in our analysis.

- Carmakers and auto parts manufacturers have suffered amidst competitive pressure from Chinese and U.S. rivals, which has been compounded by escalating tariff wars more recently. German OEMs in particular have seen their market share decline as Chinese consumers increasingly prefer domestic brands, a trend that has intensified price competition and reduced margins.

- The sector remains heavily dependent on global supply chains for critical components such as batteries and semiconductors, making it vulnerable to geopolitical and trade disruptions.

- Given their long and global value chains, auto companies are severely exposed to U.S. tariff measures. We expect unavoidable cost increases driven by higher tariffs and trade disruptions to further increase financial pressure and weaken the sector's financial stability. Fitch Ratings forecast European OEMs' free cash flow generation and profitability will fall in 2025 as a result of tariffs.4

| Tires and Rubber | Automotive Parts and Equipment | Automobile Manufacturers | ||

| Worst sectors |

25% Tires and Rubber |

9.2% Automotive Parts and Equipment |

6.4% Automobile Manufacturers |

|

| Worst trend sectors |

25.0pp FY21 |

2.5pp FY22 |

2.2pp FY23 |

FY24 |

| Distress in % |

9.5% FY21 |

8.2% FY22 |

4.6% FY23 |

7.8% FY24 |

| Lacking performance in % |

13.1% FY21 |

11.7% FY22 |

7.1% FY23 |

9.9% FY24 |

| Lacking robustness in % | 30.7% | 31.6% | 31.3% | 40.8% |

To view the full pdf, click here.

Footnote

3. Specialised Retail includes Computer and Electronics Retail, Consumer Electronics, Drug Retail, Home Furnishings, Home Improvement Retail, Household Appliances, among other sub-sectors.

Originally published 10 July, 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.