The UK market for personal motor insurance is among the most competitive in the world.

Over time, some marked characteristics have emerged, including:

- the surge of price comparison websites (PCW) as the dominant distribution channel, creating unprecedented price transparency, but also amalgamating significant market power into a few hands;

- a race among underwriters to build the most sophisticated pricing algorithms, leveraging data and technology to drill into customer behavior and claim projections; and

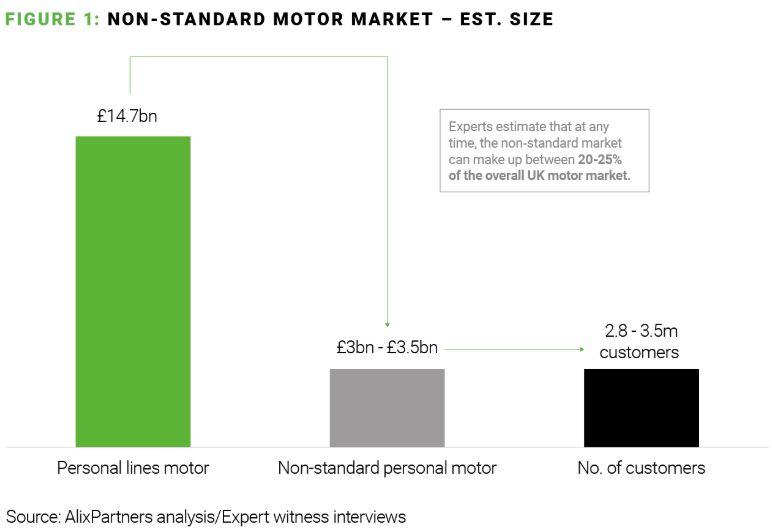

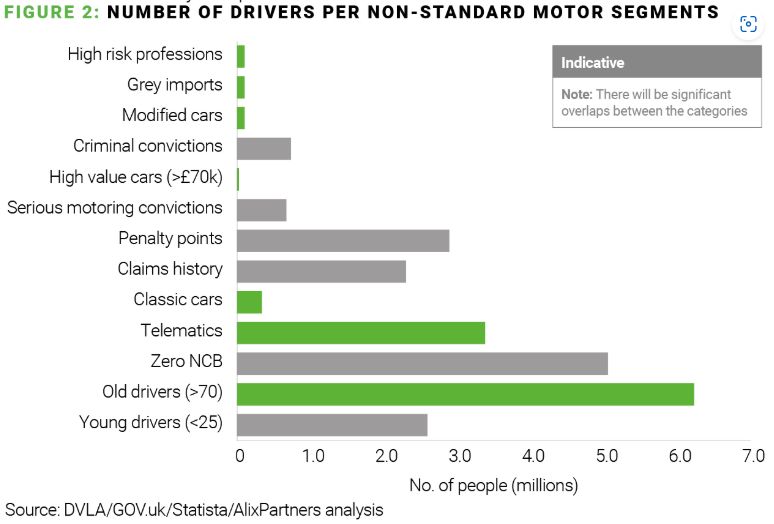

- the singling out of a significant part of the market as

"non-standard", due to elevated, less

predictable risk profiles, e.g. young or older drivers, drivers

with convictions or recent accidents, or a restrained availability

of standard data, as in the case for vintage or high value

cars.

Non-standard risks have emerged as a buoyant and profitable playground for brokers and MGAs, who provide their services to customers that would not find cover easily online. Yet the playground seems under pressure, and there is speculation regarding what its future may look like.

The post-pandemic double whammy

The pandemic put its mark on many industries, and the impact for motor insurance was particularly nuanced. As countries closed down, accident numbers dropped and motor insurers saw profits skyrocket, only to be overwhelmed by a sudden inflationary surge as societies started moving back to normal. Financial cushions built during the pandemic (and not yet burned in a price war) disappeared as a result of sky-rocketing motor parts prices, a rate-fueling shortage of repair shop capacity, and higher costs for medical services – none of which had been factored appropriately into premiums.

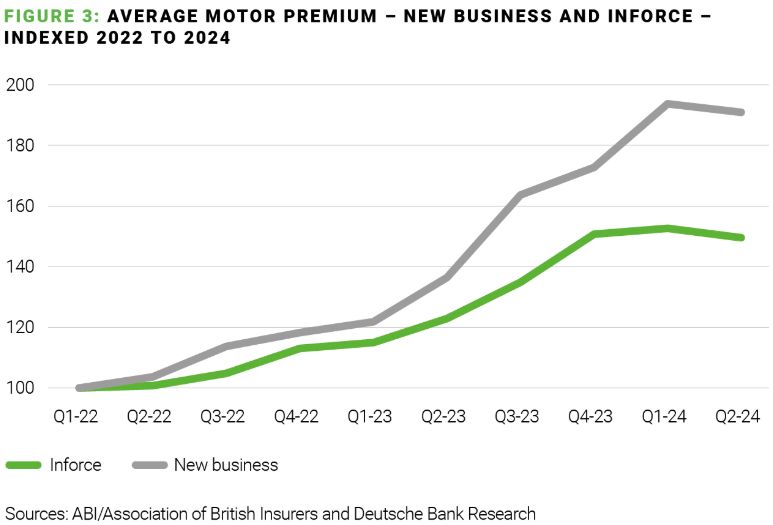

In the UK, huge inflationary pressure was exacerbated by newly-introduced pricing regulation. UK motor insurers (as with most of the industry globally) have spread new business from renewal premiums, banking on customers' propensity not to churn, while cashing in on the ageing benefits inherent to the business. In 2022, the UK regulator put an end to this practice, leveling down the flow of subsidies from renewal premiums into new business prices, a corrective shift that topped up on the already heightened inflationary premium uplift. The public outcry on perceived premium increases north of 40% still seems to hang in the halls of Westminster, and the challenge for the industry navigating its combined ratio is obvious.

There is therefore little surprise that underwriters focused on the hard-to-write, non-standard risk segments, some of which had exposed adverse claims patterns during the pandemic. When everyone stayed home, lower-income blue collar and healthcare workers – allegedly overrepresented in non-standard segments – switched from public transport to their cars– translating into an increasing claims frequency. Insurance carriers responded by cutting capacity for the most difficult non-standard segments.

Data – The hidden force at play

While the underwriting economics at play are obvious, the impact of data is less so. COVID-19 also weighed on the PCW business. In times of uncertainty, customers are less likely to churn. This has driven a drop in business volumes for PCWs, who in turn were seeking untapped territory and found: Non-standard motor.

The race for pricing sophistication not only entailed a surge in tools and algorithms, but also a growing number of data sources built, maintained, and tapped across the industry over the past years, including ABI and MOT databases, LexisNexis etc. With richer and better-quality data at hand, PCWs have started to push for replacing traditional underwriting of non-standard motor risks with online quote and bind processes akin to standard business, thereby creating enhanced price transparency for a growing number of non-standard subsegments. And with carriers holding capacity tight, the pressure is now on intermediary margins; the once buoyant playground for brokers and MGAs is at stake.

The future of non-standard motor

There are a number of lessons to be learned.

For sure, capacity will return, as claims frequency normalises and inflation comes down. However, the unexpected turns driven by the pandemic have unraveled the vulnerability of overly niche propositions. While specialisation and deep expertise are at the very heart of superior underwriting, restraining one's business on too narrow a field is dangerous. Size matters, when it comes to securing access to well-priced markets.

Secondly, data wins. Selecting and pricing risks is first and foremost about leveraging data to gauge what the burning cost for claims will be. With AI in ascendency, the need to invest in new sources of data and the sophistication of algorithms cannot be underestimated. Digitisation of the non-standard motor space is set to continue and expand into further sub-segments. Players with superior capabilities in aggregating data across multiple data sources and deploying high quality pricing models are set to stay – and win. However, such capabilities do not come cheap, which is another reason why scale increasingly matters in non-standard motor.

That said, subsegments in non-standard do not lend themselves to a "one-size-fits-all" approach – the ability to build out differentiated models and cater to the nuances is key to success in this field. This limits large industry players to cater to this part of the market beyond some obvious adjacencies of their core business. Non-standard motor – or large part of it – is hence set to remain a remit of specialised brokers and MGAs – provided they bring the scale and skill needed for a digitised underwriting and transaction model.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.