- within Cannabis & Hemp topic(s)

The Home Office has confirmed that sponsor licence revocations have more than doubled in the first 12 months since the current government took office. The number of illegal working civil penalties has also climbed.

Sponsor licence revocation has serious consequences, including the cancellation of sponsored workers' permission and an exclusion period from rejoining the sponsor register.

If your business holds a sponsor licence, you should regularly review your overall compliance position, including right to work compliance, and address any deficiencies to minimise the risk of enforcement action.

Latest statistics show rises in compliance activity under current government

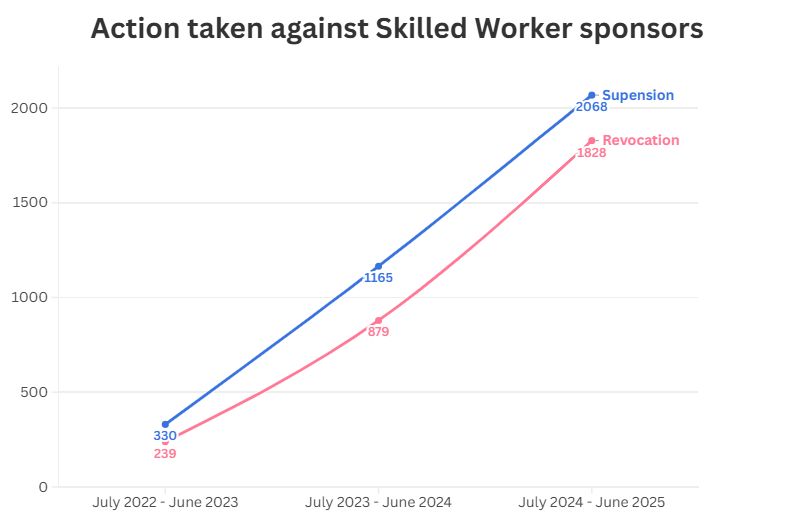

For the year ending June 2025, the Home Office suspended 2,068 Skilled Worker sponsor licences and revoked 1,948. The revocation figure is more than double the 937 licences revoked in the last year of the previous government. It also continues the general upward trend seen over the past few years.

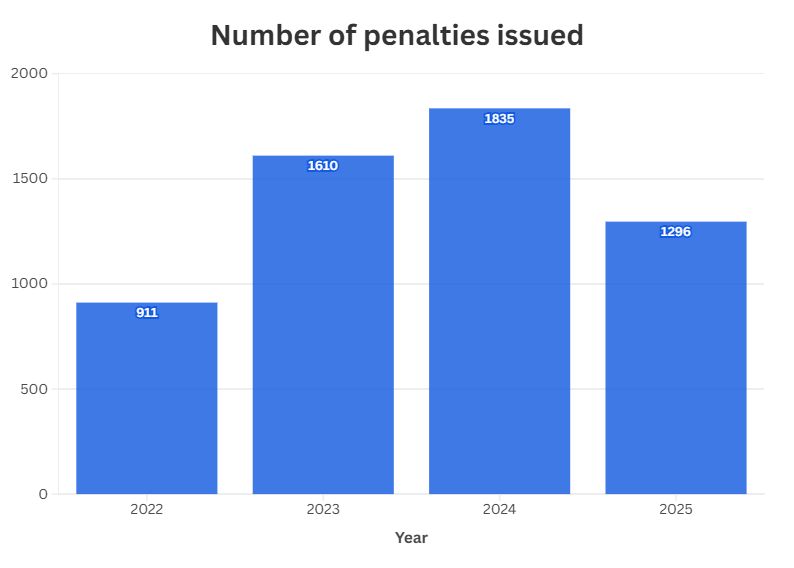

2,151 illegal working civil penalties were issued for the year ending June 2025, in comparison with 1,676 for the previous year to June 2024. This reflects the government's commitment to illegal working enforcement, which includes bringing forward legislation to increase the scope of the illegal working regime.

The social care, hospitality, retail and construction sectors have some of the highest levels of non-compliance according to the Home Office's information. If you operate in these sectors, you should be aware of the increased risk of receiving a Home Office audit or additional requests for information. This does not mean there's reason for complacency in other sectors – we are also seeing increased compliance activity across the board, often prompted by cross-checks with Companies House and HMRC data.

Examples of common compliance issues

We regularly carry out mock audit work for our clients and monitor trends and risk areas in sponsor licence compliance. Examples of common compliance issues that can arise in the Skilled Worker sponsorship context include:

- Misunderstanding the genuine employment requirement;

- Misunderstanding the restrictions on sponsored workers working for a client of the sponsor;

- Non-compliance with other UK laws, in particular employment law, tax laws and local authority requirements;

- Misunderstanding what types of remuneration can (and can't) be included to meet the salary requirements for sponsorship – including the rules around subtracting business costs, immigration costs and investments in the sponsoring business or a related organisation;

- Changes to sponsored workers' employment conditions that take them outside the scope of their sponsored role;

- Failing to report other changes in sponsored workers' circumstances;

- Failing to report changes to your business's circumstances, including (but not limited to) corporate restructuring;

- Inadequate record keeping practices; and

- Non-compliance with the illegal working regime.

Where non-compliance has occurred, we are able to advise on options to address the issue and to minimise the risk of future breaches.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.