- with readers working within the Construction & Engineering industries

When the G20 picked up the problem of "systemically important financial institutions" or "SIFIs", the original emphasis was on the question of the "too big to fail" problem arising when the failure of a SIFI leaves public authorities with no option but to bail it out using public funds to avoid financial instability and economic damage. Whilst the issue is relatively clear regarding, for example, banks, the issues are less clear in relation to asset managers and investment funds.

Unfortunately there still seems to be two potential strands of thought: the US FSOC approach running on a distinct track from the international initiatives led by the Financial Stability Board (FSB). It will be interesting to see if these two strands start to converge. Certainly, since the initial papers in 2013, we have helpfully moved from considering the pure size issue into a slightly more sophisticated debate.

The international picture

The latest FSB document was published on 4 March 20151 as its Second Consultative Document. It looks at assessment methodologies for identifying non-bank and non-insurer globally systemic important financial institutions.

A sector specific methodology is suggested it proposes to focus on identifying globally systemic important individual investment funds and a separate methodology for identifying globally systemic important individual asset managers. The methodologies regarding investment funds on the one hand and asset managers on the other hand are to be applied separately. This means that one group could have several funds identified as SIFIs without their asset manager being identified as such and vice versa.

- Investment

funds

In relation to investment funds, there is an increased focus on leverage taking into account the comments noting that higher leverage implies greater inter-connectedness through borrowing.

By investment funds they encompass collective investment schemes that include authorised and registered open-ended schemes as well as closed-ended ones. This covers disparate fund categories from public funds including sub-categories such as common mutual funds, money market funds and exchange traded funds to private funds including hedge funds, private equity funds and venture capital funds.

In the March 2015 Consultation, the proposed methodology now reflects an increased focus on leverage in addition to size:

- For private funds, e.g. hedge funds and private equity, the proposed threshold would be US $400 billion of gross national exposure. The idea is that all private funds which meet the US $400 billion test will need to be assessed further against the various indicators for assessing systemic importance – size, interconnectedness, substitutability, complexity and number of jurisdictions in which a fund invests.

- For traditional investment funds,

i.e. those other than private funds, two options are being

considered:

- Option 1: US $30 billion in net asset

value and balance sheet financial leverage of three times NAV with

a size only backstop of US $100 billion net assets under

management.

This introduces the leverage metric as the initial filter but also maintains the size metric as a backstop to catch a large potentially unleveraged open-ended funds for more detailed assessment as to whether they may affect the global financial system through fire sales of their assets, especially when they are relatively large players in certain market segments. - Option 2: which is US $200 billion in

gross assets under management unless it can be demonstrated that

the investment fund is not a dominant player in its markets (e.g.

substitutability ratio below 0.5% or fire sale ratio below

5%).

Option 2 uses gross assets under management as an indicator that captures both leverage and size factors so that very large unleveraged funds may still be captured for detailed assessment. In addition, it tries to limit the focus on very large funds that may be dominant in market segments in which they invest (i.e. dominant market player) by excluding those funds for which it can be demonstrated that their potential impact on the markets is negligible). Under this option therefore unleveraged funds that are very large in absolute terms but are relatively small in the relevant market segment (e.g. such as major stock index tracking funds) may be excluded from the detailed assessment.

- Option 1: US $30 billion in net asset

value and balance sheet financial leverage of three times NAV with

a size only backstop of US $100 billion net assets under

management.

- Based on the analysis of consultative responses as well as other qualitative and quantitive analysis, the FSB and IOSCO will set the thresholds for both private funds and traditional investment funds including the level of such thresholds.

- Asset Managers

Asset managers are also referred to as investment advisers or financial entities that generally manage client assets for individual accounts and/or investment funds. Their core function is of managing assets as agent on behalf of others in accordance with the specified investment mandate or the investment strategy defined in its prospectus for the investment fund that it manages. They must follow investment guidelines set out in an agreement with each client or strategy in the prospectus for an investment fund as the client assumes the risk of investing.

Given the variety of types of funds, it is acknowledged that there are a variety of types of asset managers who follow various and varied investment strategies including various securities, products and instruments.

As with investment funds, the approach is that the proposed asset manager methodology will include a materiality threshold that provides an initial filter of asset managers of the asset managers universe to define the pool of firms for which more detailed data will be collected and to which the methodology will be applied.

Currently two options are being considered either exclusively or in combination:

- Option 1: A particular value, e.g. US $100 billion in "balance sheet total assets" for determining the entities that will be assessed in detail by the assessment methodology;

- Option 2: A particular value, e.g. US

$1 trillion in assets under management for determining the entities

that will be assessed in detail by the relevant assessment

methodology.

The three transmission channels that are of concern are where an asset manager faces distress or forced failure, concern exposure/counterparties; the asset liquidation/market; and the critical function or service/substitutability.

The separate methodology in relation to asset managers focuses on activities that, if conducted by a particular asset manager, may have the potential to generate systemic risk and warrant consideration.

The overall arching objective regarding asset managers is to identify, on the basis of the activities they carry out, those whose distress or disorderly failure could cause significant disruption to the global financial system and economic activity across jurisdictions.

The March 2015 Consultation does not propose any specific entities for designation or any policy measures that would apply to non-bank and non-insurer globally systemically important financial institutions (NBNIG-SIFIs). This document only completes the end of Phase 1 of the work.

Phase 2 is then the FSB, in cooperation with IOSCO and other relevant bodies, working on an FSB SIFI policy framework (Phase 2). In a recent speech, David Wright (Secretary General of IOSCO) identified various issues in various areas of work for the FSB/G20 work streams concerning:

- conduct risk – misbehaviour: The UK's Fair and Effective Markets Review was due to be published in ten days' time and this was likely to go global to FSB and G20 areas.

- CCPs: Are these central counterparties fit for purpose?

- measurement effort: Have initiatives worked?

- in the asset management space, is there systemic risk and, if so, what should we do about it.

Following Phase 2 work, the FSB and IOSCO are to establish an international oversight group that would coordinate/oversee the actual assessment process conducted by its members in order to maintain international consistency in applying the NBNIG-SIFI methodologies and begin the process for determining a list of NBNIG-SIFIs – Phase 3.

The US approach from FSOC

Somewhat semi-detached from the FSB and IOSCO initiatives, the US Financial Stability Oversight Council (FSOC) has powered its own course. FSOC is a panel of financial regulators led by the Secretary to the US Treasury which has the power to name as SIFIs non-bank financial firms that could pose a threat to the broader economy should they fail.

In its January 2015 Notice, a step forward is that FSOC recognises that asset management is an important component of the financial services industry and that there are meaningful differences within the asset management industry with diverse investment strategies, corporate structures, regulatory regimes and customers. FSOC is therefore seeking public comment to understand whether and how certain asset management products and activities could propose potential risks to the US financial stability.

FSOC ask questions regarding potential risk in the asset management industry, looking at liquidity and redemptions, leverage (interestingly the US Investment Company Act constrains the amount of leverage that may be employed by mutual funds and other registered funds to indebtedness bank borrowings of 300% asset coverage (with closed-ended registered funds also subject to the 300% asset coverage requirement on indebtedness although closed-ended funds may borrow both from banks and non-bank lenders and closed-ended funds are permitted to enter preferred stock subject to a 200% asset coverage requirement); operational risk – the risk arising from inadequate or failed processes or systems, human errors or misconduct, or adverse external events – e.g. business disruptions or failures in systems and processes either within a firm or at an external service provider relied upon by a firm; and resolution – looking at the extent to which the failure or closure of an entity would have an adverse impact on financial markets or the economy.

Having started in November 2013, with FSOC determining to investigate some major US asset managers for potential non-bank SIFI designation, the emphasis now is to look in a more sophisticated way and, as with the FCB initiatives, acknowledge that there is a move away from studying the potential dangers lurking with individual giant asset management firms to looking at potential problems with activities they undertake and the products they offer customers.

The 60 day period for comments on FSOC's January Notice closed in March 2015. It will be interesting to see whether their thoughts in some way align with the FSB work. FSOC does not seem to be predicting the outcome of its work, and it is certainly now focusing on products and activities.

The UK position

One would expect the UK regime to align with the FSB and IOSCO work in due course.

For the present though, one should note that there is already some recognition of the underlying issue with the designation of some investment firms for prudential supervision by the Prudential Regulation Authority pursuant to the PRA's March 2013 Statement of Policy in this regard. This though was not looking generally or particularly at asset managers in relation to their agency activities. Indeed the designation conditions are where the PRA "considers that it is desirable that the activity of dealing in investments as principal when carried on by the [eligible investment firm] should be a PRA regulated activity (Article 3(1)(c) of the PRA Regulated Activities Order)". It may consider this in relation to eligible firms for which the firm has, or has applied for, permission to deal in investments as principal and has, or would have, if it were authorised, a minimum capital of Euros 730,000 or is a broadly analogous European economic area (EEA) passporting firm or non EEA firm.

The list of firms which have been designated are limited to bank related firms (Barclays Capital Securities, Citi Group Global Markets, Credit Suisse Securities (Europe), Goldman Sachs International, Merrill Lynch International, Morgan Stanley & Co International plc and Morgan Stanley Securities Limited, Nomura International and Mitsubishi UFJ Securities International. The designation of SIFIs would be a much wider exercise than this, and could pick up on major agency businesses.

IMF

Interestingly a recent IMF paper, IMF Global Financial Stability Report: Navigating Monetary Policy Challenges and Managing Risks, April 20152, identifies that financial intermediation through asset management firms has many benefits but in principle even plain vanilla funds can pose financial stability risks. It recommends that oversight of the industry should be strengthened with better macro prudential supervision of risks and through the adoption of a macro prudential orientation. Securities regulators should shift to a more hands on supervisory model supported by global standards on supervision and better data and risk indicators. The role on adequacy of existing risk management tools including liquidity requirements, fees and fund share pricing rules should be re-examined, taking into account the industry's role in systemic risk and the diversity of its products.

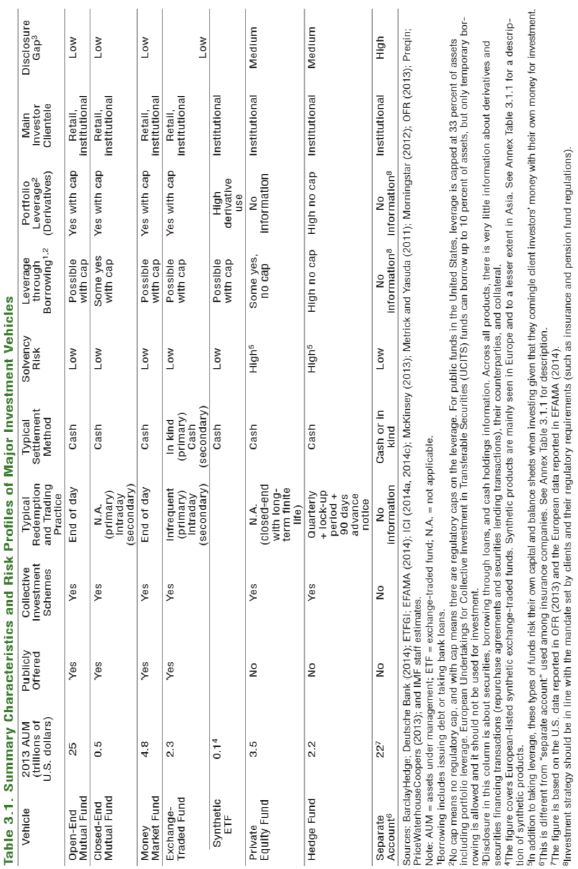

The IMF summarised the characteristics and risk profiles of major types of investment vehicles as set out in the attachment.

Somewhat curiously, the delegation of investment management decisions is seen as introducing incentive problems between end investors and portfolio managers that could destabilise behaviour and amplify shock. The assertion that investors cannot directly observe managers' daily actions or their skills, when in fact probably the main selling feature is the investment manager's track record etc and the variance in structures around the world as to whether or not investors can remove managers (take, for example, the US version), makes the IMF comment somewhat surprising. In the end, the products of the asset manager's products and the incentivisation might be somewhat more sophisticated than these comments make out.

Clearly though the IMF is looking at financial stability risks emanating from intermediation through asset managers even in the absence of leverage and guaranteed returns. Further, that the risks, although not new, have become increasingly important with structural changes in the financial sectors of advanced economies. The relative importance of the asset management industry has grown, and banks have also retrenched from money market making activities, contributing to a reduction in market liquidity. The role of fixed income funds which entail larger contagion risks than traditional equity investments has expanded considerably. A broader range of products is allegedly available to less sophisticated investors (although with the EU and UK initiatives, one might wonder if this is indeed the case). The prolonged period of low interest rates in advanced economies has resulted in a search for yield which has led funds to invest in less liquid assets.

The IMF's five main policy messages are as follows:

- First, securities regulators should enhance micro prudential supervision of risks stemming from individual institutions building on regulators own risk analysis and stress testing, supported by global standards for supervision and better data and risk indicators.

- Second, regulatory and supervisory reforms are needed to incorporate a macro prudential approach.

- Third, liquidity rules, the definition of liquid assets, investment restrictions and reporting and disclosure rules need to be enhanced.

- Fourth, consideration should be given to the use of tools adequately priced in the cost of liquidity including minimum redemption fees, improvements in illiquid asset valuation and mutual fund share pricing rules.

- Fifth, given that the industry is diverse and that differences in investment focus seemed to matter significantly for funds contribution to systemic risk, a product or activity based emphasis seems to be important.

Growth in the asset management sector

Of course all this work rightly identifies the much wider issues arising from developments in the asset management industry generally. The industry's assets under management have grown fairly rapidly with assets under management roughly doubling over the past decade:

- The asset management industry should grow because the pool of prospective global savers has become larger, older and richer.

- There has been a sharp rise in the ratio of global wealth to income and the global asset management industry is likely to continue its upwards march absolutely and relative to the economy.

- There has been a strong growth in funds active and specialist often illiquid markets.

- There has been a rise in the importance of passively managed funds including ETFs and other index tracking strategies.

- And as a mirror of the last two trends, there has been a declining share of actively managed funds operating in large cap equity and global fixed income markets. Their slice of the global assets under management pie has fallen sharply from two-thirds to around a half. This though links with the institutional investors' de-equitisation and other pensions drivers.

All of this needs to be understood from the end investor perspective where trends include:

- the shift in who carries the risk – notably in relation to pensions where, with a shift from DB to DC schemes, it has moved to the end investor;

- UK life insurers' balance sheets now focusing on unit linked products which is a marked change.

To quote from a UK Bank of England speech3 given by Andrew Haldane who is an Executive Director on Financial Stability and a Member of the Financial Policy Committee (April 2014), he reaches an interesting conclusion: which is that the asset management industry has fundamentally changed shape: it is now large and is set to get larger still. "The assets it manages are increasingly being allocated to illiquid assets or indexed strategies. And the risks on these asset allocations are increasingly being borne by (perhaps trigger happy) end investors." ...

"Compared to banks, asset managers generate a completely different risk and opportunity set. But they too are special both for the financial system and the wider economy. As they grow in scale and importance, that specialness is likely to increase further. The age of asset management may be upon us."

Conclusion

The general evolvement of focus from looking at purely size to the real issues which might affect financial stability should be welcome but there is still some way to go. To quote again from the UK Bank of England speech given by Andrew Haldane:

"We are in the intellectual foothills when understanding and scaling the transmission channels through which asset managers could generate systemic risk. And given the recent changes in the scale and structure of the industry – a world of less liquid assets and runnier liabilities – these channels may be more potent tomorrow than they were yesterday. ..."

It is good news therefore to hear that regulators will be climbing the mountain so as to understand what is involved before deciding how to manage any systemic risks that are identified and drafting any new prudential regulation for asset managers.

Source: Table 3.1, Page 98 of IMF Paper, "Global Financial Stability Report: Navigating Monetary Policy Challenges and Managing Risks" (April 2015)

Footnotes

2. http://www.imf.org/external/pubs/ft/gfsr/2015/01/pdf/text.pdf

3. http://www.bankofengland.co.uk/publications/Documents/speeches/2014/speech723.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.