Listen now or read the full briefing below

KEY INSIGHTS

SFDR overhaul: The European Commission is proposing stricter fund categorisation and lighter regulation in its revised sustainable finance regime, although new rules are unlikely to be effective before 2028.

UK experience may be instructive: UK sustainability labels offer marketing value and bolster sustainability credentials, yet regulatory hurdles and market structure have limited adoption, especially among private funds.

Investor demands will guide strategy: There is likely to be investor demand for labelled products and alternative asset managers will want to meet that demand, but they will need to design their funds carefully to avoid undue investment restrictions.

A regular briefing for the alternative asset management industry.

Last week, a leaked draft of the European Commission's proposals for reform of its landmark sustainable finance law, the Sustainable Finance Disclosure Regime (SFDR), was circulating widely. After a two-year review, the Commission has learnt from the significant shortcomings of SFDR 1.0. It now wants to move towards a more formal fund categorisation scheme, while also reducing the burden of the rules. (Our detailed note on the leaked draft of SFDR 2.0 is here.)

The Commission's proposals are largely welcome, although there are some important open questions. There is plenty of time to ponder those – the new rules are unlikely to come into effect before 2028, and it remains to be seen how much the draft changes as it goes through the EU's multi-stage legislative process.

But between now and 2028, many private fund managers will need to ponder the question: should my next fund have a sustainability label? If previous funds were "Article 8" or "Article 9" – the existing SFDR disclosure categories – should the next one adopt one of the more formal labels that are currently in gestation?

In part, the answer to that question will depend on the detailed secondary legislation that has not yet been drafted – and in part on how easy it is to take advantage of the opt-out for funds sold only to institutional investors (and, indeed, whether that opt out makes it into the final law). There are likely to be some marketing advantages in Europe for firms that choose to use a label, to be balanced against the negative views among some US investors and the investment constraints that the labels will impose – for example, on investments that do not meet, and are unlikely ever to meet, EU-mandated sustainability standards.

"The few private fund managers that have used a UK label see it as helpful confirmation of their sustainability credentials."

As they ponder this question, alternative asset managers might look to the British (and other European) experience, where fund labels are already in use.

The UK's ESG rulebook is now fully operational. It includes an anti-greenwashing rule that applies to all UK-authorised financial firms who make sustainability-related claims about their products, restrictions on the use of sustainability-related terms in the names and marketing materials of funds facing a retail audience, and fund-level sustainability disclosure requirements. UK firms with more than £5 billion under management also have entity-level reporting requirements, which for many firms will require them to issue their first report next year.

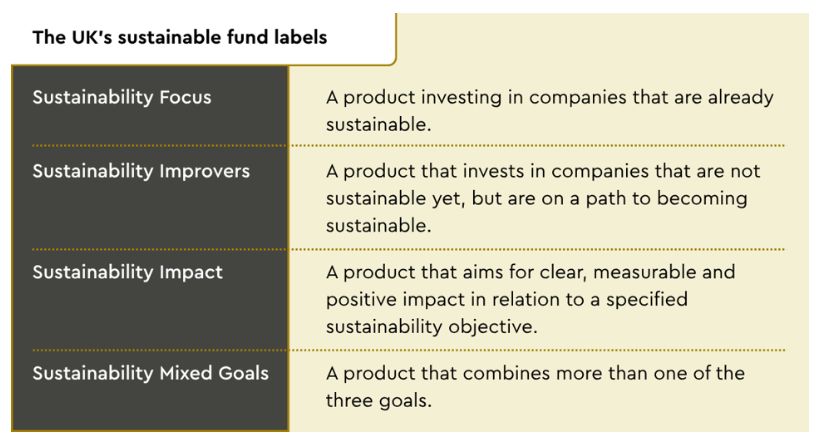

Importantly, UK-regulated managers have also had the chance to label their UK funds under this new regime for around a year – but, so far, only a few private capital fund managers have done so. In fact, take up of the labels has been slower across the board than anticipated. According to a UKSIF report issued last month, around 150 funds have adopted one of the four possible labels – far fewer than the 280 the UK regulator, the FCA, initially expected. In part, that is because the regulator has deliberately set the bar very high, and in part because the regime is new. Asset managers reported that getting FCA approval to use a label was tougher than expected, but there is no doubt that it is getting easier as practice develops.

Although the labels are squarely aimed at retail investors, and primarily designed for funds investing in listed securities, they are available for institutional-only funds investing in private capital. The few private fund managers that have used a UK label (including a buyout fund that we have recently advised) see it as helpful confirmation of their sustainability credentials. As UK pension funds and retail investors get more exposure to private equity and venture capital, it is likely that more firms will look at the marketing benefits.

But take up of the UK labels will remain sporadic in private markets. One reason is that many private fund managers are no longer UK-regulated, having moved their manager to Luxembourg, Ireland or elsewhere in the EU. Those EU managers cannot (yet) use a UK label, since the FCA only permits them to be used by a UK based fund.

More generally, rules which tightly control asset allocation for the duration of the fund's investment period are not well-suited to most private funds. The UK rules do allow flexibility, which has made that aspect manageable. SFDR 2.0 will impose limits on investible assets for labelled funds; the secondary legislation will determine how rigid those limits are – which, in turn, will determine how many private capital funds adopt them.

If there is enough investor demand – which, in Europe, seems highly likely – firms will adopt a UK or EU label (or other national equivalents) in the coming years. Sadly, there is not going to be a single regime that covers both markets. The EU labels will be similar to the UK ones, but will have different criteria. They are clearly going to be more widely adopted than their UK equivalents – although for UK-focused funds the British label is worth considering.

But before jumping in to either regime, firms will need to design their product carefully to ensure they have enough flexibility in the investment policy, and a sustainability approach that matches the investible universe of the fund.

Our podcast: "Should my next fund be Article 8", recorded in May this year, is available here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.