- with readers working within the Business & Consumer Services industries

- within Government and Public Sector topic(s)

A regular briefing for the alternative asset management industry.

Since taking office in July, the UK government's message has been clear: economic growth is a "national mission". Unfortunately, several tax announcements in October's budget could work in opposition to that mission – for example, the hikes to employer's national insurance and capital gains tax, reforms to the taxation of carried interest, and abolition of the "non-dom" regime.

That puts even more pressure on the initiatives that aim to underpin growth.

Many of those growth supporting measures were also announced in the budget, but several more were unveiled this month at the annual Mansion House speech, in which the Chancellor presented proposals on structural and regulatory reforms to the UK's financial services community. Alternative asset managers will be affected by these changes, and they were broadly welcomed by the BVCA (which has, in fact, worked tirelessly to secure many of them).

Pension reform was at the heart of the Mansion House announcements. And although the changes are about a lot more than alternative asset classes, the government has subscribed to the BVCA's mantra that private capital is a "partner for growth". Like the previous administration, it wants to find ways to encourage pension funds to invest more.

On the day of the Mansion House speech, the Department for Work and Pensions published a report which confirms that investment in private markets supports economic growth – and also finds evidence that private markets funds invest a greater proportion of their assets in the UK than some other asset classes. The report argues that size matters: pension funds of £25-50 billion benefit from economies of scale, but also make more productive investments. The largest pension funds should be better placed to run a private markets programme.

One of the most eye-catching proposals was the creation of eight local government pension scheme "megafunds, to be run by professional fund managers. 86 existing local government pension funds will pool their resources by March 2026, and the increased scale will facilitate more productive investment, drawing comparisons with Canada and Australia. Although many of the existing pools have been working on consolidation for some time, the government has grasped the nettle by fixing the next key milestone in this process.

This significant reform was widely welcomed, but the industry must continue to work with policymakers as they implement it. It will be important to ensure that the new megafunds are able to access private funds in practice – including the smaller private funds, and those with a regional focus, that could benefit most from the additional capital.

Another set of pensions proposals focus on the defined contribution (DC) schemes used for "auto-enrolment" – a policy which has driven a huge increase in pension saving by British workers. These schemes will also need to achieve a minimum size, while employers and their advisers must focus more holistically on outcomes for beneficiaries, rather than only on costs.

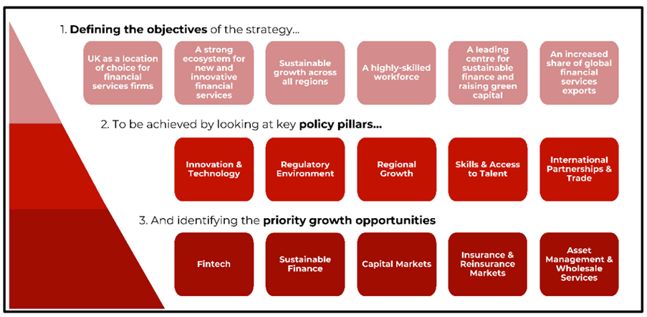

Pension funds were not the only discussion topic at the Mansion House banquet; the government is also keen to ensure that UK financial services are given the right opportunities to prosper. Indeed, the UK's emerging Industrial Strategy, Invest 2035, will include a strong focus on financial services. Work has started on a Financial Services Growth and Competitiveness Strategy.

Given that asset management has been identified as one of the five "priority growth opportunities", suggestions for reform of the regulatory framework are likely to get a sympathetic hearing. Such suggestions will include simplifications of the UK's Alternative Investment Fund Managers regime, relaxation of regulatory requirements for some smaller asset managers, and more proportionate capital requirements.

The Mansion House speech also included an announcement that the government intends to abolish the Certification Regime – a particularly bothersome part of FCA's Senior Managers and Certification Regime (SMCR), which has applied to most UK-regulated private markets firms since 2019. Originally introduced for banks and other large financial institutions following the global financial crisis, the SMCR is a conduct and governance regime that replaced its predecessor Approved Persons regime with a more comprehensive rulebook. As well as including a requirement for "senior managers" to be approved as "fit and proper" by the regulator, the rules also include conduct rules for most staff and a certification regime for staff with a significant impact on the firm, its customers or the market. The initial reference checks and annual reviews required for certified individuals are time consuming and, many argue, unnecessarily burdensome. The government will consult on a "more proportionate" regime that will be less costly to operate. Details remain scant, but this looks like good news for asset managers.

"The good news for the UK private capital sector is that the government recognises that private capital can support growth, and policymakers will work to facilitate it."

The capital markets will also have to get used to a new acronym: PISCES – the Private Intermittent Securities and Capital Exchange System. This new type of regulated trading platform – brainchild of the previous government and confirmed by this one – will operate as a secondary market facilitating on-market trades during intermittent trading windows. This will be available for institutional, high-net worth and sophisticated investors and employees of the participating companies. Although it is not yet entirely clear how many venture-backed companies will take advantage of PISCES, it could provide some liquidity while widening access to high-growth companies.

The new UK government is approaching its 150th day in office, and it has not been an easy ride. While the impact of many of its tax and spending decisions will be felt immediately – and provoke headline-grabbing protests – its growth agenda will have a longer tail. The good news for the UK private capital sector is that the government recognises that private capital can support growth, and policymakers will work to facilitate it.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.