- within Finance and Banking topic(s)

- within Food, Drugs, Healthcare and Life Sciences topic(s)

Fund manager M&A has been a hot topic in recent years and we have seen high levels of interest from both acquirors and target managers. The increase in the number of "GP stakes" investors has been particularly noteworthy and there are now a large number of firms active in the space, covering a wide range of geographies, sectors and target assets under management (AUM).

This note looks at the two of the most common types of transaction, which sit at either end of the spectrum of potential deals: on the one hand, GP stakes firms deploying LPs' capital to acquire minority interests in managers and, on the other hand, strategic acquirors buying managers onto their own balance sheets, typically acquiring an initial majority stake with a mechanism to acquire sole ownership over time.

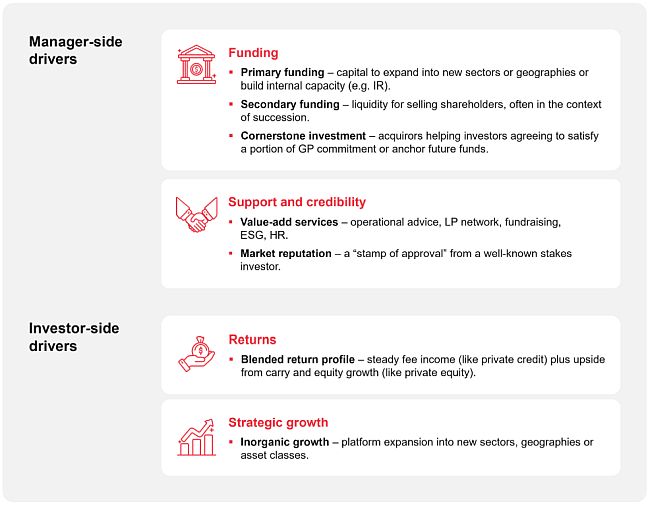

What are the drivers behind these deals?

A combination of factors tends to drive managers' interest in

seeking a transaction:

- Primary funding: i.e. funding contributed by the investor to the manager, often to expand the sector, geography or product offering, or where there is a need to invest to develop internal capacity, such as an expanded IR function.

- Secondary funding: i.e. funding retained by the selling shareholders, which can be used to fund GP commitment requirements but is often sought in the context of succession planning, either by senior executives anticipating retiring in the medium term or by executives (often founders) who have taken a step back operationally but retain a disproportionate equity interest for which they are seeking liquidity.

- Value-add services: GP stakes firms usually offer value-add services, including access to LP networks, fundraising advice and operational assistance in areas such as IR, ESG and HR best practice.

- Market reputation: investment by a GP stakes firm, particularly if well known, can be seen in the market as a vote of confidence in the target manager. This is primarily useful in a fundraising context but can also be relevant for recruitment and, occasionally, capital deployment.

- Cornerstone investments: in a best-case scenario, strategic acquirors may also commit to be cornerstone LPs in future funds and/or to directly satisfy a portion of GP commitment requirements.

Some of the key drivers from an investor's perspective include:

- Returns profile: fund managers can present a compelling returns profile for both GP stakes firms and strategic acquirors, offering a long-term investment which blends consistent, steady returns from management fees (not unlike private credit) with upside exposure from performance fee returns and more significant capital returns on an eventual exit (not unlike private equity). If a strategic acquiror is committing to be an LP or to provide GP commit, they may also be incentivised by the prospect of access to fund returns at preferable or nil fee rates.

- Expansion: in addition to the returns profile, strategic acquisitions can be driven by another manager's desire for inorganic growth, often into new geographies or sectors, or by other financial institutions seeking greater exposure to the particular asset class than can be achieved as a limited partner.

Main areas to consider

1. Structuring

What is the investor buying?

Is the investor taking a true equity stake of everything in the business (and so benefitting from management fees, house carry and other income streams), or will the investment be more akin to a "net fee-related earnings" deal, i.e. the investor receives a certain percentage of net revenues distributed out to them each year and only reinvests in the business in certain circumstances?

Is the intention to carve anything out of the deal, for example, any particular cashflows?

Will the manager be selling just an interest in the operating business, or will a strip of the carried interest and/or co-investment also be sold? There is an important distinction between carried interest that has already been allocated and an entitlement to future allocations of carried interest, with the latter being included much more frequently than the former. This is primarily because investors price allocate carried interest on a net present value basis, taking into account its anticipated payout value, timing, risk and the information asymmetry, which typically results in an unattractive discount compared to the seller's expectations of the payout value. One circumstance where historical carried interest may be included, however, is where the investor has a minimum cheque size which is not met by the available stake in the operating business.

What are the tax consequences?

A UK resident individual selling all or part of their interest

in the target manager will typically expect to pay capital gains

tax (currently at 24%, subject to the availability of business

asset disposal relief, which reduces that rate for the first

£1m of gains). However, the overall effective tax rate

depends on precisely what is being sold. In particular:

- where the investor is purchasing a share of any existing carried interest allocations – either directly or because it is purchasing a stake in a tax transparent entity which receives those allocations – the consideration attributable to those entitlements may be taxed at a higher rate under the carried interest tax regime (currently 32% but expected to increase to circa 34% from 6 April 2026). In principle, those rules should not apply to consideration attributable to an entitlement to participate in future (rather than existing) allocations of carried interest. However, care should be taken in both the structuring and the drafting of the transaction documents, to ensure that is the case; and

- where the investor is purchasing a share of existing team co-investment, the tax treatment of the attributable portion of the consideration will depend on both the structure of that co-investment and the nature of the underlying portfolio interests.

Where the consideration package includes an earn-out, care should be taken to ensure that this is treated as part of the capital proceeds of the sale for tax purposes. If it is instead treated as part of a seller's ongoing remuneration, this can have adverse tax consequences both for the seller and the target group.

Similarly, if a seller enters into put or call options to sell a further portion of their interest in the future (as considered below in more detail), it is important to ensure that the exercise of those options does not trigger employment tax charges – for example, due to the exercise price exceeding the market value of the interests to be sold.

There may be additional complexity where sellers are subject to

tax in other jurisdictions. For example, where an individual seller

is a US citizen, they will need to consider both:

- will any deferred element of the consideration (including on the exercise of a put or call option) is subject to tax under the instalment method of reporting? Where this is the case, US tax on the deferred consideration is not due until that consideration is received. However, (i) a portion of the deferred consideration will be reclassified as imputed interest income (and so taxed at a higher rate) and (ii) interest will accrue on the amount of the tax during the period of deferral. As a result, sellers may prefer to opt out of the US instalment regime, accelerating the tax but avoiding the increase in their effective rate of tax; and

- will any part of the consideration will be treated as an "excess parachute payment" under the Section 280G regime? Where this is the case, receipt of that amount can trigger additional tax charges for the recipient.

For many transactions, the primary target operating entity will be a tax transparent vehicle such as a limited liability partnership. Where this is the case, the target entity itself will not typically pay direct taxes on its profits – rather, those taxes will be paid by its owners on a look-through basis. Accordingly, when a prospective investor models the anticipated return on their investment, it is important that they appreciate that the financial figures shown in a transparent target entity's accounts will be gross of tax and so the investor will need take into account the tax that will apply on their future share of those profits. This will also be relevant to the sellers at term sheet stage when negotiating any performance-related transaction terms, such as an earn-out.

2. Alignment

There are several alignment issues that are particularly relevant on these transactions:

Exit

In a GP stake deal it is important to understand early on how and when the GP stakes fund intends to exit its investment, and its potential strategies for doing so. This is particularly relevant in the context of some of the innovative liquidity solutions which GP stakes firms have been using over recent years (discussed further below).

Incentivisation

Strategic investors will want to consider whether management's previous equity holdings were a significant component of their incentivisation and, if so, whether they will remain incentivised without that equity. A large payout for senior executives may also make other components of their incentive package, such as carry, relatively less important for them and so less effective as a means of incentivisation. Concerns such as these are one reason why strategic transactions are often structured on a "buy now, buy later" basis, where the investor initially acquires a majority stake with put and call arrangements to allow this stake to be increased to 100% over a certain period (typically between three and ten years), with the pricing determined based on the target's performance during that period. A new management incentive plan can also be put in place, however if the acquiror is not intending to sell or list the target manager or itself in the future then thought will need to be given as to how management will benefit from liquidity in relation to the plan. This usually means that either the plan is structured as a cash bonus scheme based on achieving particular metrics (such as fee-related earnings growth) or a form of internal market is required for the incentive equity issued under the plan, giving management a means to obtain liquidity on an ongoing basis.

Communications with LPs

Irrespective of whether LPs' consent to the transaction is required under the target manager's fund documents, all target managers will be concerned about how the transaction may be viewed by their LPs. Although the number of such deals over recent years has meant that LPs are increasingly comfortable with them, consideration should still be given as to how to present the transaction to LPs, particularly the narrative around: (i) day-to-day control remaining with the existing management team; (ii) the use of primary funding; (iii) why key executives will remain incentivised notwithstanding any windfall from the transaction; (iv) the quantum of carry and performance fees retained by the management team (irrespective of whether they were sellers in the transaction); and (v) any succession planning. The timing of communications will also be key, with target managers typically seeking to avoid needing to tell LPs about a transaction in the middle of a fundraise or too close to an investors' day.

3. Preparation

As with any potential transaction, preparation is key. Target managers should be particularly focussed on:

- Building relationships early, before the need for capital arises: this ensures that initial conversations are had from a position of strength and allows trust to be built over time, helping to allay concerns that the investor may have about the executive team (including any succession proposals) and which might otherwise cause it to reconsider investing or to seek greater contractual protection.

- Consent rights: fund documents will need to be reviewed to confirm whether any LPs have consent or consultation rights in respect of the proposed transaction. Any impact of the proposed transaction on existing debt arrangements and other manager-level material contracts should also be considered, although, in our experience, most managers take a view on the potential impacts on equity documents at portfolio level.

- Regulatory review: regulatory, national security, foreign direct investment (FDI) and competition consents and notifications will need to be considered as early as possible, including at portfolio company level. Managers often do not have the relevant information to hand or may only have information from the time of their investment into a portfolio company, and this can be a significant roadblock to getting a deal executed quickly. This is particularly the case with national security and FDI requirements, which in most jurisdictions have become more onerous over recent years. These often apply in unexpected ways and can have significant consequences for non-compliance.

- Buyside diligence: buyside legal due diligence on fund manager deals is typically less involved than for operational businesses in other sectors (with investors taking a particularly light touch approach to non-regulatory portfolio matters and, depending on the size of the investment, fund document terms). However, managers will still need to ensure that they have key documents to hand and should expect a thorough tax and financial due diligence exercise, including:

- Tax: areas of focus are likely to include salaried member rules, employment related securities (particularly where there have been late awards of carry), loans to employees from entities that are not the employing entity, and off-payroll workers; and

- Regulatory capital: any position taken on regulatory capital should be reviewed critically, as managers will typically have taken the most lenient approach where there is any uncertainty as to the regulations, whereas diligence providers will be reporting on a much more conservative basis.

Key transaction terms

Transactions in this space are typically more bespoke than most M&A deals, although the structure and execution of GP stakes deals (as opposed to strategic acquisitions) are now quite well established. Key terms typically cover:

Governance

Management will want to ensure that they are able to continue to run the business as they see fit on a day-to-day basis and will need to demonstrate this to their LPs. As a result, while investors may have board representation and are often on remuneration committees, they usually do not get seats (or, at least, votes) on investment committees.

Consent rights

Investors will look to protect their economic interests by including consent rights over significant changes to the business and matters affecting value. For GP stakes funds, these are likely to be limited to "anti-circumvention" controls, preventing the manager from taking actions which divert value away from the investor in a manner which is contrary to the agreed deal, such as issuing equity to entities in which the investor does not have a direct or indirect interest. For the same reason, investors often benefit from controls over increases in remuneration (other than through equity holdings) above pre-agreed rates, either for any of the senior management team or just for those team members who hold equity alongside the investor. Investors are also likely to seek negative control over any proposal to amend or waive any restrictive covenants that apply to the senior management team.

Strategic acquirors holding a majority interest will understandably be able to negotiate more far-reaching controls over strategic decisions, including in relation to key matters concerning the conduct of the business, such as debt incurrences and disposals of material assets. Where a "buy now, buy later" mechanism is used, enhanced governance and consent rights often ratchet-up as the investor increases its stake over time, although in any scenario – and irrespective of what the documents say – the management team is likely to retain significant degree of control in practice, given the human capital nature of these businesses.

Information rights

Investors will be focussed on their information rights for monitoring purposes and to fulfil their own reporting obligations, especially GP stakes investors who will need to ensure consistent reporting across their portfolio.

Key person provisions

Given the importance of personal relationships to these businesses and the prevalence of strong leaders in the industry, there will be significant focus on certain key individuals remaining with the business for a period of time post-completion. If a key individual leaves or if the GP is removed from a particular fund (for cause or, less frequently, due to no-fault removal):

- minority investors may have redemption or put rights allowing them to exit the investment. If so, careful thought will need to be given as to how that redemption/put right will be funded – typically this is with some combination of balance sheet cash, loan notes and/or a disproportionate share of distributions until the redemption/put price has been paid; and

- on strategic deals structured on a "buy now, buy later" basis, there may be accelerated call rights in favour of the investor.

Direct transfer provisions

Managers usually seek to restrict minority investors from transferring their interests (other than to affiliates or with the manager's consent) via lock-up provisions, typically for three to five years post-investment. Those restrictions may fall away on a particular date or may become less restrictive in stages over a period of time. Even after that period, transfers are usually subject to: (i) a right of first offer (ROFO) or right of first refusal (ROFR) provision in favour of the manager and/or the other equityholders and (ii) a prohibition on transfers to competitors without the manager's consent. Defining who constitutes a competitor for these purposes can be challenging, with the investor usually asking for a blacklist of specific prohibited competitors and the managers usually seeking a more dynamic definition which will also capture future competitors. Adjusting this list and the definitions used is one of the ways in which transfer restrictions can fall away over time, e.g. by having a more expansive and dynamic "grey list" which then reduces to a more specific blacklist after a certain period.

As with any equity investment, tag-along and drag-along rights are also seen in these transactions. Where the investor is not acquiring a majority stake in the manager they will often seek to negotiate protections around the exercise of the drag-along right, such as a prohibition on its use within a certain period post-investment and/or unless the consideration that the investor receives when dragged meets certain minimum return thresholds. Ideally these thresholds will be expressed in simple money multiple terms, and managers should exercise caution before agreeing to indefinite thresholds which have an IRR component, given the fact that these will be time-dependent and increasingly difficult to satisfy if growth is flat for a period.

"Buy now, buy later" arrangements

As mentioned above, strategic acquisitions of managers are often structured as the acquisition of a majority stake on day one, with the remaining minority interest capable of being sold or acquired pursuant to put and call options. These options tend to be exercisable either at the end of a set period in respect of 100% of the remaining equity or, more commonly, on particular anniversaries of completion in respect of a specified portion of the remaining equity. In each case, the intention is that by the end of the period – usually between three and ten years from completion – the investor will have acquired 100% of the manager.

Pricing is always a key area of negotiation in respect of these arrangements. One method is to ascertain the enterprise value based on comparables and performance at the time, then use a completion accounts process to deal with any balance sheet adjustments. This method requires the least upfront negotiation and should, in theory, respond to changes in market conditions between completion of the original transaction and the time of the put/call. However this is time consuming to implement, risks disagreement between the parties and means that, when exercising the put/call the parties don't necessarily have visibility over what the price will be. As a result, this method is used more often when there is a single put/call option in respect of all of the remaining stake, rather than a series of put/call options which are exercisable over time.

Another method is to fix the pricing formula at completion, most commonly by reference to an agreed multiple of fee-related earnings (house performance fees are sometimes taken into account as well, although then the calculation tends to be based on the annual growth in hypothetical performance fees if all fund assets were realised at NAV, with a lower multiple applied to reflect the theoretical nature of that calculation). The multiple to be used can be fixed or can vary depending on performance against the business plan, and there can also be a balance sheet adjustment to reach an equity value. This method provides more certainty as to pricing before put/call options are exercised, however the agreed multiple(s) won't change with market conditions (which may be a good or a bad feature). Careful thought should also be given at the time of entering into the documents as to how various hypothetical assets and liabilities will be dealt with in the balance sheet adjustment and whether any earnings should be excluded or subject to a lower multiple. It is worth noting that any pricing mechanic using historical balance sheet information is effectively a locked box mechanic, so some form of leakage protection – albeit usually quite simple – may be required for the period from the balance sheet information to the put/call completion.

These "buy now, buy later" arrangements are effectively earn-outs, so typical earn-out protections are usually sought by the minority shareholder(s) in relation to the integration of the manager's business into that of the strategic acquiror or the operational control that the acquiror will have over the manager. These protections may relate to matters such as cost recharges, non-arm's length transactions with the acquiror or its group, material changes to the nature of the manager's business, removal or reallocation of senior staff, and actions to divert business or resources to the acquiror's group where the related revenue won't be recognised in the pricing mechanic.

The exercise of any options will also need to be considered in the context of any regulatory, national security, FDI and competition consents and notifications. Provided the original acquisition was for more than 50% of the manager, consents are typically not required, but the position will still need to be rechecked each time, especially if the relevant facts – such as the composition of each party's portfolios – or the applicable regulatory frameworks have changed since the last transaction.

Liquidity solutions

One of the main areas of development in the GP stakes industry over the last five or so years has been the rise in innovative liquidity solutions for investors. These include:

- Securitisations: diverting a portion of the management fee income streams from multiple managers into a new vehicle, which borrows against those income streams by issuing a bond (or entering into a transaction with a comparable effect, but generally without recourse to the equity interests in the underlying manager). The funds that the new vehicle receives from this are then transferred to LPs in the GP stakes fund, allowing them to receive early liquidity at the cost of the coupon on the securitised bond.

- Portfolio listings: listing a portfolio of GP stakes as a standalone entity, with LPs receiving shares in the listed entity.

- Strip sales: these are akin to the syndication of a GP stakes fund's interest in a manager but, instead of selling an interest in one manager, the purchaser will be acquiring interests in a number of managers from across the fund's portfolio of interests.

Fund managers are generally comfortable with GP stake investors achieving liquidity by these means – especially if it takes away some of the pressure on them to help procure a direct exit – provided that the investor retains an economic interest in the manager's performance to ensure alignment. However, managers will typically seek protection in a few areas:

- Managers will want to ensure that these indirect transfer provisions are not a backdoor means to circumvent the agreed restrictions on direct transfers. That could mean requiring, for example, that if there is a strip sale of a portfolio of interests, that portfolio must comprise a certain minimum number of other managers and that the manager in question does not comprise more than a certain portion of the value of that portfolio.

- Managers may seek protections to ensure that interests are not sold to their direct competitors in a strip sale or similar transaction. This has become more relevant over time as alternative asset managers become more complex in their strategies and the types of assets that they hold, which increases the risk that, particularly for a larger manager, one of its competitors could be a potential acquiror in the strip sale transaction. In that case, there is typically a debate over a blacklist of prohibited acquirors, potentially with some flexibility over time to include new competitors, and often with a ROFR or ROFO to enable the manager to opt to instead buy back the interest proposed to be sold, either in all cases or if the acquiror meets certain criteria.

- Managers will need to pay careful attention to what information rights they have given the GP stakes fund and how those translate into information flows to third parties after a liquidity transaction. For example, what information would need to become publicly available after an IPO and is the manager comfortable with that? Likewise, in the case of a strip sale of a portfolio of interests, what information would the buyer receive and is the manager just as happy providing that information to an unknown buyer as it was to the GP stakes fund? That may result in step-downs of information rights in the event of certain liquidity transactions or a requirement to give the manager comfort that any competing acquiror has appropriate information barriers in place.

What's next?

The fund manager M&A market is poised for continued growth over the coming years, with increasing activity in the mid and lower mid-market in particular as GP stakes funds and strategic investors hunt for growth potential in lower AUM ranges than before.

We anticipate a rise in more hybrid investment models, for example strategic acquirors taking minority stakes; this has been a niche part of the market so far, but LPs in GP stakes funds are increasing asking themselves whether they are capable of making direct investments themselves, particularly where they may already be an LP in the underlying manager's funds. Similarly, we expect to see an increasing number of quasi-GP stakes funds, which invest a mixture of external and captive funding (particularly family wealth) and so are able to commit to become LPs and provide funding for GP commit alongside an equity interest in the manager.

We also expect an increasing focus on backing spin-outs and team moves where investors seed new managers. This has been a feature of the market for a while, but we anticipate it to grow in importance as an increasing number of managers that spun-out or launched in the aftermath of the global financial crisis reach a size and maturity which means they themselves are incubating further spin-outs or team moves.

For further information, please contact one of our team listed below, or your usual Macfarlanes contact.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.