- within Finance and Banking topic(s)

- in United States

- within Family and Matrimonial, Privacy and Environment topic(s)

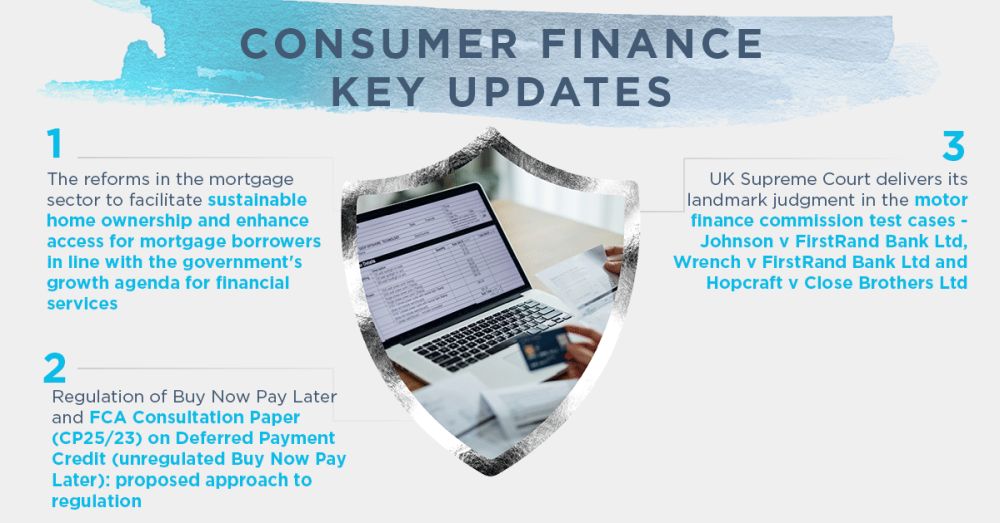

Last month was significant for developments in financial services with the announcement of the Leeds Reforms and the Chancellor's Mansion House speech. The Leeds Reforms mentioned radical changes in the UK mortgage regime to facilitate sustainable home ownership and enhance access for mortgage borrowers in line with the Government's growth agenda for financial services. In this issue we discuss some of these reforms and relevant considerations for firms to assess how these changes may impact their systems and processes for mortgage lending. This newsletter also covers an update on the upcoming regulation of Buy Now Pay Later (BNPL) including the recent consultation from the Financial Conduct Authority setting out the proposed regulatory regime for BNPL. Last but not the least, we share our insights into the landmark Motor Commission Supreme Court Judgment - Hopcraft and another v Close Brothers Limited where we explore the judgment in greater detail, including key takeaways, broader implications, and the potential impact on future motor finance litigation.

Mortgage reforms to boost sustainable home ownership and access

Last month was significant for developments in financial services with the announcement of the Leeds Reforms and the Chancellor's Mansion House speech. The Leeds Reforms mentioned radical changes in the UK mortgage regime to facilitate sustainable home ownership and enhance access for mortgage borrowers in line with the Government's growth agenda for financial services. In this issue we discuss some of these reforms and relevant considerations for firms to assess how these changes may impact their systems and processes for mortgage lending.

Read our insights on these key reforms and possible impacts on relevant firms

Regulation of Buy Now Pay Later and FCA consultation

Significant progress has been made in the last two months in shaping the regulation of Buy Now Pay Later (BNPL). The Government passed legislation on 14 July to bring Deferred Payment Credit (DPC), commonly known as BNPL, under regulation starting 15 July 2026 for third-party lenders, and on 18 July the Financial Conduct Authority (FCA) published a Consultation Paper (CP25/23) on the proposed regulatory regime for BNPL.

Read more here on the FCA's proposed regime for BNPL and the upcoming milestones

Motor Commission Supreme Court Judgment - Hopcraft and another v Close Brothers Limited

On Friday 1 August, the UK Supreme Court handed down its long-awaited judgment in the conjoined appeals of Hopcraft v Close Brothers, Johnson v FirstRand Bank t/a MotoNovo Finance, and Wrench v FirstRand Bank t/a MotoNovo Finance ([2025] UKSC 33). The Court held that car dealers arranging motor finance do not owe fiduciary duties to customers, meaning lenders are not liable for bribery or dishonest assistance. However, undisclosed commissions may still render agreements unfair under section 140A of the Consumer Credit Act, depending on the facts. In our p below, we explore the judgment in greater detail, including key takeaways, broader implications, and the potential impact on future motor finance litigation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.