The much anticipated "A review of corporate governance in UK banks and other financial industry entities (BOFIs)" led by Sir David Walker (the "Walker Review" or "Review") was published on 16 July 2009 and outlines significant recommendations for changes to the governance of BOFIs in the UK. We welcome the opportunity for debate that has been created by this Review, which should enable some important steps to be taken towards the re-establishment of an appropriate level of trust in banks and other systemically important financial institutions.

The Review calls for a behavioural shift to achieve more effective governance, rather than for new prescriptive rules which could lead to "box-ticking conformity". Organisations that attempt to tick the box on Walker may be missing the point. The outcomes sought for BOFIs are instead the adoption of a clear value-maximising long-term strategy, with risks effectively managed, developed by well motivated executives, challenged by competent and well informed non-executive directors (NEDs) and overseen by active and engaged investors.

The Walker Review follows the Turner Review which signalled that "the FSA's supervisors will be testing rigorously whether firms' risk management and governance arrangements are in practice delivering the right outcomes". This anticipated increase in regulatory scrutiny is in our view likely to crystallise the themes within the Walker Review. Those organisations that fail to respond risk falling behind both market and regulatory expectations and whilst the Review will now take comment and reaction from interested parties we do not expect major revision ahead of the publication of Sir David's final conclusions in November.

During 2008 Deloitte issued a research study, "In Control?", examining leading practices in risk governance and controls. It was noted that governance structures within certain financial institutions suffered from a lack of clearly defined accountabilities and leadership.

For example just 41% of the 33 major global institutions surveyed stated their audit committees or boards of directors have defined mandates to exercise a complete and unambiguous enterprise-wide oversight of governance and controls. Bringing clarity to reporting and leadership was held to be key in creating an enterprise-wide view of risk, an integrated approach and a change in risk culture across institutions. Early findings from our latest research study resonate with the recommendations of the Walker Review, suggesting that in 2009 the industry continues to report issues relating to the effective embedding of enterprise-wide risk management, a lack of clarity around reporting lines and that accountability for risk governance frameworks often remains unclear.

In that context we see considerable practical challenges associated with changing remuneration practices, risk processes, and external disclosures in line with the recommendations in the review; and in combination with the desired evolution of the operating culture in BOFI boards, this means that organisations need to start their preparations now if they are to be in shape before the end of this year and for the annual reporting season in the Spring.

Whilst the recommendations apply equally to banks and other financial institutions, the implementation challenges will vary across sectors; for example major insurers will need carefully to determine how their developing approach to Solvency II compliance is impacted by the risk governance recommendations in the review. We would also expect that some of the proposals will be used as a blueprint for change in due course across other non-financial services sectors.

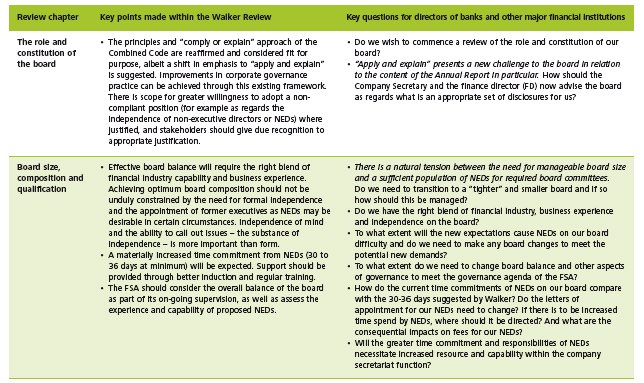

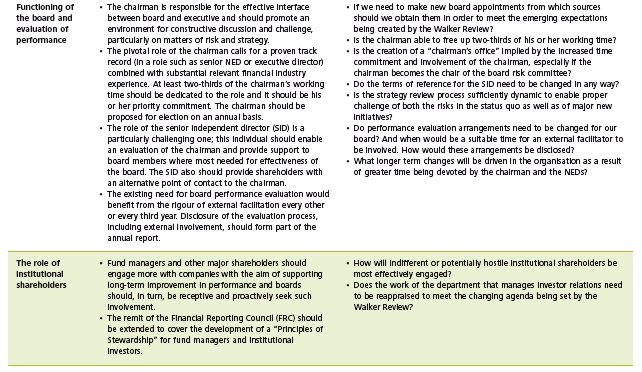

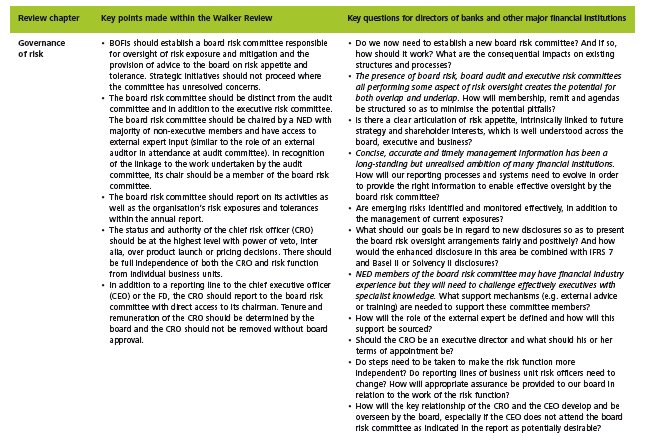

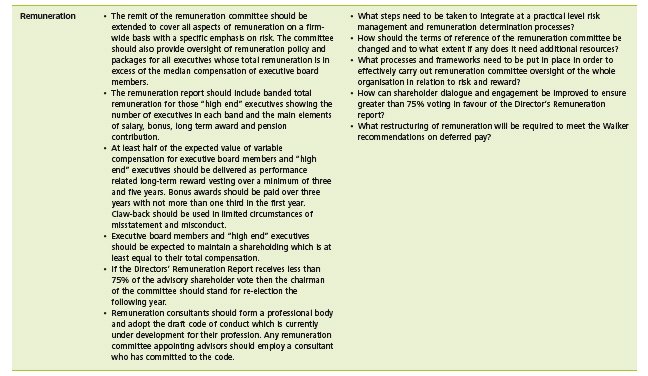

Below is a summary of the key themes as well as our perspective on some of the key questions that firms should be addressing and/or considering as they plan for implementation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.