- in United States

- within Corporate/Commercial Law topic(s)

- within Transport, Employment and HR and Antitrust/Competition Law topic(s)

- with Inhouse Counsel

This consolidated update gives a brief overview of developments in UK public M&A in the last six months.

We discuss:

- recent market activity, including the bidders driving the increase in activity and competitive situations;

- legal and regulatory developments, including two new Practice Statements published by the Takeover Panel and its consultation paper on dual class share structures; and

- our publications and resources, including our video series on top tips for navigating public M&A in the UK and our latest podcasts.

Recent market activity

2025) Public M&A activity in the UK

After a slow start to 2025, there has been steady growth in public M&A activity, with 17 firm offers in Q2 and 23 in Q3. This may be attributable to the easing of concerns about international trade and tariffs.

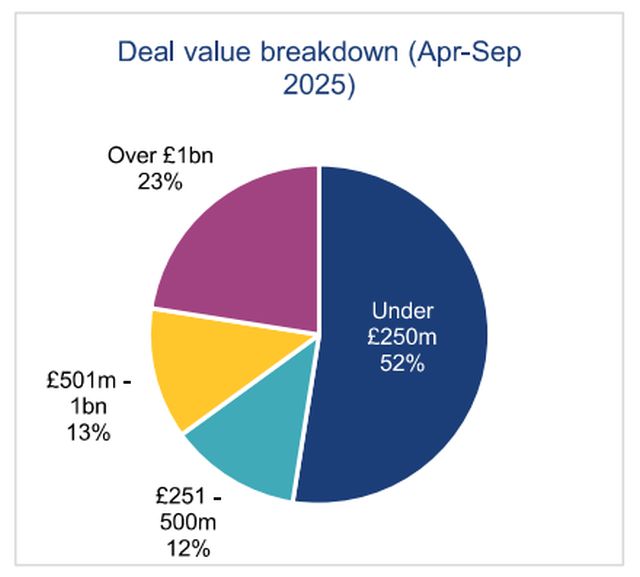

As in the previous six-month period, the majority of deals were for £250 million or less, but there was a marked increase in the number of large deals, with nine worth over £1 billion compared to just three in Q4 2024 and Q1 2025.

The bidders

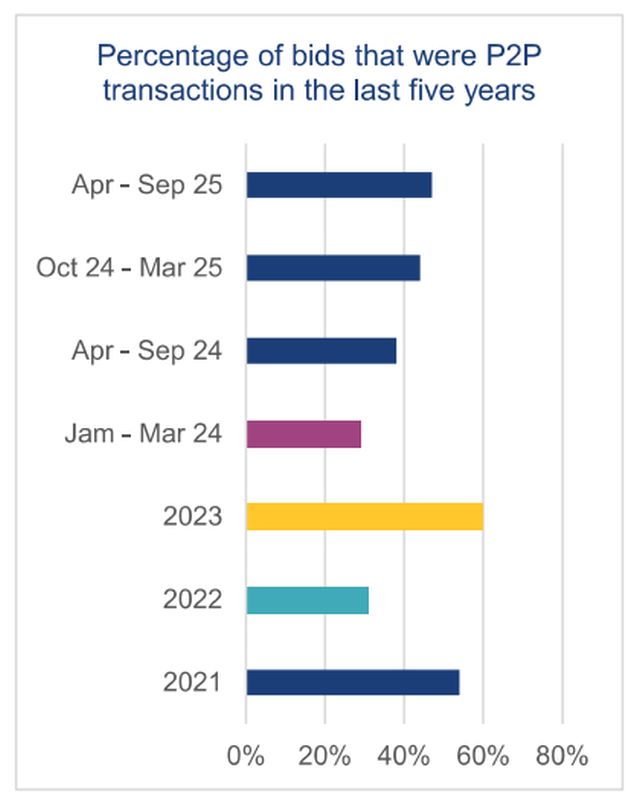

There was a modest increase in the number of firm offers that were public to private – rising from 44% in Q4 2024 and Q1 2025 to 48% in Q2 and Q3 2025 – suggesting that sponsor bidders are still seeing opportunities to purchase undervalued assets. The most valuable of these offers (at £4.2 billion) led to the American private equity giant KKR's acquisition of the scientific instruments maker Spectris.

Strategics remain strong, and it was interesting (and unusual – see the section on Competing Offers below for details of the Warehouse REIT bid) that on the competing offers for Assura, a cash and share offer by Primary Health Properties, a strategic, won out over a cash offer from KKR.

Competing offers

There has been an increase in the number of competitive situations, with as many in the last six months as there were across the whole of 2024. There are several forces which may be behind the increase. One is the large number of strategic bidders in the market. Another is the activity of private equity sponsors, especially large US firms spotting value opportunities in the UK.

Both Blackstone and Tritax Big Box (BBox) made offers for Warehouse REIT in June 2025. As neither had declared their offer final ahead of Day 46 of the offer timetable, the Takeover Panel announced that an auction procedure would be used to resolve the situation (using the default procedure in Appendix 8 of the Takeover Code as the parties had not agreed an alternative). However, before the auction commenced, BBox (the bidder with the lower offer) announced that it would not be increasing its offer and so the auction was cancelled.

Blackstone's success in outbidding BBox shows one of the issues with offering share consideration in a competitive situation. In the weeks after BBox made its offer, its share price trended downwards, reducing the overall value of the bid. This meant that Blackstone was able to offer only a modest increase to its cash offer to make its bid more attractive.

Another auction procedure was announced in May 2025 after both Drax and Foresight Group made offers to acquire Harmony Energy Income Trust (HEIT). Instead of the default 5-day auction procedure set out in Appendix 8 of the Code, the bidders and the Takeover Panel agreed on an alternative procedure that would last just a single day. The auction was cancelled at the last minute, with Drax declaring their offer final the day before the auction was scheduled to take place.

More competitive situations mean more contractual offers, since an offer allows the bidder more flexibility than a scheme of arrangement. KKR's bid for Assura and Blackstone's bid for Warehouse both started off as schemes before changing structure once a rival offer came in. That being said, the successful bidders for HEIT and for Spectris earlier in the year both used schemes even once the situation became competitive.

UK Takeover Code and other legal and regulatory developments

Practice Statement on unlisted share alternatives

The Panel has published a new Practice Statement 36, on unlisted share alternatives or stub equity. It covers acceptable terms for an unlisted share alternative, the disclosure required, and the share rights that are permitted.

There has been an increase in offers where the bidder offers cash with an unlisted share alternative, with four in 2023, six in 2024 and three so far this year. They are usually seen on deals where there is a significant shareholder to whom the stub equity is attractive – by offering the stub equity, the bidder may be able to secure an irrevocable undertaking from that shareholder.

The focus of the Practice Statement is equal treatment of shareholders (General Principle 1 and Rule 16.1) and ensuring that shareholders have sufficient time and information to enable them to reach a properly informed decision (General Principle 2, Rule 23.1 and various other relevant Takeover Code provisions).

Key points to note in the Practice Statement include:

- Disclosure and consultation with the Panel – The Panel Executive expects bidders and their advisers to consult it early in respect of both the terms of any proposed alternative offer and the related disclosures. Bidders and their advisers should not rely on disclosures made in relation to previous unlisted share alternative offers as a substitute for consulting the Panel.

- Terms of the unlisted share alternative

– The Practice Statement says that bidders:

- can specify a maximum percentage of bidco share capital that will be available to target shareholders under the unlisted share alternative, and a minimum acceptance threshold (for example there being elections of at least 3%); but

- cannot however specify that the unlisted share alternative is only available to target shareholders who elect for the alternative offer in respect of at least an individual minimum threshold (for example, at least 100 shares or £1,000 worth of shares); and

- cannot use the share exchange ratio so as to exclude target shareholders who hold a smaller number of shares in the target.

- Rights attaching to unlisted shares – It may be acceptable for a bidder to grant governance rights (for example the right to appoint a director) to a shareholder who holds at least a specified percentage of the shares in bidco. The Panel will however look at the proposed rights and restrictions to ensure that a particular target shareholder is not in effect afforded a special deal, for example a preferential exit opportunity that is not available to all shareholders.

The Practice Statement also discusses:

- the disclosure required in the Rule 2.7 announcement and offer document in relation to the unlisted share alternative;

- Rules 20.1 and 20.2 and the requirements that apply when information is shared with the significant target shareholder;

- the requirement under Rule 24.11 that the offer document must contain an estimate of the value of the securities by an appropriate adviser, and the information an adviser is likely to have regard to in giving the estimated value; and

- the recommendation by the target board and the advice from the Rule 3 adviser in the context of an unlisted share alternative.

We discuss the Practice Statement in this episode of our UK public M&A podcast series.

Practice statement on profit forecasts, quantified financial benefits and investment research

The Takeover Panel has published a new Practice Statement 35 on profit forecasts and quantified financial benefits statements (QFBS).

The Practice Statement provides guidance on topics such as:

- the Executive's practice where a profit forecast is published by a target after the unequivocal rejection of an approach about a possible offer;

- when, on a possible offer, the Executive may consent to the publication of a QFBS without the contemporaneous publication of the reports required by Rule 28.1(a);

- when the Panel may grant a dispensation from the requirements of Rule 28 where the target privately provides a profit forecast to a bidder (for example, a bidder subject to US securities laws) for due diligence purposes and the bidder is subsequently required to include it in a document or announcement published by the bidder (for example in a proxy statement where the bidder is required to obtain shareholder approval for the transaction);

- the Executive's practice in relation to whether a forward-looking statement should be treated as an aspirational target to which Rule 28.1 does not apply; and

- when the Executive may be willing, following the announcement of a recommended firm offer where there is no competitive situation, to dispense with the requirement for investment research published by a connected firm to be pre-vetted.

We discuss the Practice Statement in this episode of our UK public M&A podcast series.

Consultation paper on dual class share structures, IPOs and share buybacks

The Panel has published a consultation paper PCP2025/1 on dual class share structures, IPOs, and share buybacks.

A company with a dual class share structure (DCSS) is typically one which has, in addition to voting ordinary shares, a class of shares with an enhanced level of voting rights or control as compared to the ordinary shares, held for example by a founder of the company. In light of the new UK Listing Rules that came into force in 2024, which allow DCSS companies to list in the equity shares (commercial companies) category, the Takeover Panel is consulting on amendments to the Takeover Code relating to DCSS companies.

Key proposals in the consultation paper include:

- Companies with a DCSS – The Panel is

consulting on a framework for the application of the Takeover Code

to a DCSS company, which will primarily be applicable to a

structure where the 'founder' shares carry multiple votes

per share from the point of issue, and are extinguished or

converted to ordinary shares on particular trigger events, such as

a "time sunset" a specified number of years after the

company's IPO, or the retirement or resignation of the founder

shareholder. The Panel is also proposing provisions to:

- clarify the application of the mandatory offer requirement to a DCSS company where a shareholder's percentage of voting rights is increased as a consequence of a trigger event (and the resultant conversion or extinction of the founder shares), and when a dispensation from the requirement to make a mandatory offer will normally be granted; and

- make an acceptance condition on a contractual offer for a DCSS company subject to two tests (both of which must be satisfied in order for the offer to become unconditional), referenced to the voting rights position: (i) immediately before; and (ii) immediately after the relevant founder shares convert or are extinguished.

- IPOs – There will be new provisions

requiring a company to make disclosures in respect of the Takeover

Code and any controlling shareholders (and their concert parties)

on an IPO. The ability of the Panel to grant a "Rule 9

dispensation by disclosure" will also be codified –

meaning that the Panel will be able to grant a dispensation from

the obligation to make a mandatory offer upon the occurrence of a

time sunset (or other trigger event), provided that:

- the IPO admission document sets out appropriate disclosure of the maximum percentage of voting rights that the shareholder would hold following the time sunset (or other trigger event), based on the share capital of the company as at the point of IPO; and

- except with the consent of the Panel, there have been no additional acquisitions of interests in shares by the shareholder, or any person acting in concert with it, between the admission to trading of the company's securities and the time sunset (or other trigger event).

- Share buybacks – The rules around share

buybacks will be made clearer and more concise. In addition, the

Panel is proposing to:

- amend the provisions on disqualifying transactions where a company buys back shares under an annual shareholder authority. When shares are bought back, the percentage of voting rights held by each of the remaining shareholder will increase. If a person's interests go through 30% as a result of a buyback, the Panel will normally waive the requirement to make a mandatory bid, unless they are a director of the company or a related person. However, the Panel will not grant a waiver where there has been a "disqualifying transaction", for example if the shareholder in question bought shares at a time when they had reason to believe that the company intended to seek authority from shareholders to purchase its own shares. Under the rule changes, a purchase when the shareholder was aware that the company had obtained, or intended to obtain, a general shareholder authority to buy back shares will not be a disqualifying transaction; and

- codify the practice that the Panel may treat as an "offer" a share buyback which could result in all or substantially all of the company's shares being held by one person or a group of persons acting in concert.

The consultation closed on 26 September 2025, and the Panel expects to publish the final rules by the end of the year, with the amendments coming into effect in the first quarter of 2026.

Takeover Panel Hearings Committee Chair rejects appeal against Panel Executive ruling in relation to Third Point Investors Limited

The chair of the Hearings Committee of the Takeover Panel rejected an appeal ( PS 2025/15) against a ruling by the Panel Executive which concluded that Third Point LLC was not required to make a mandatory offer for Third Point Investors Limited (TPIL) in light of a series of transactions which TPIL was undertaking.

TPIL and its share capital

TPIL was a Guernsey closed-ended investment company traded on the London Stock Exchange. Its share capital comprises:

- ordinary shares, which entitle the holders to one vote per share and are listed on the Main Market of the London Stock Exchange; and

- redeemable B shares, which also carry one vote per share except on "Listing Rule reserved matters" – that is where the UK Listing Rules (UKLRs) stipulate that approval of the holders of the listed shares (in this case, the ordinary shares) is required. The B shares are not listed or traded on any stock exchange or market. Under TPIL's articles, the number of B shares in issue must, at all times, represent at least 40% of the aggregate issued number of ordinary shares and B shares. The B shares, which have no economic rights, are held by VoteCo – a Guernsey-based voting company which is mandated to exercise the voting rights attaching to the B shares in the best interests of TPIL and its shareholders as a whole. VoteCo's purpose is to ensure that TPIL retains foreign private issuer status under US securities regulation.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]