- within Corporate/Commercial Law topic(s)

- in North America

- with readers working within the Automotive and Business & Consumer Services industries

- within Corporate/Commercial Law, Environment and Coronavirus (COVID-19) topic(s)

In September 2025, there were four Rule 2.7 announcements made across the UK public M&A market and seven further possible offers announced.

Firm Offers announced this month:

- Recommended cash offer by Harwood Private Equity LLP for Frenkel Topping Group plc – £64 million – unlisted securities alternative – public to private

- Return of capital by Petershill Partners plc – treated as an offer by Petershill Funds – £684.47 – public to private

- Cash offer by Bart Turtelboom for APQ Global Limited – £1.31 million

- Recommended cash offer by Exponent Private Equity LLP for Treatt plc – £156.6 million – public to private

Possible Offers announced this month:

- Formal sale process announced by Aferian plc

- Three possible offers by PCP International Finance Limited (withdrawn), Dr. Roger Kennedy, Wing-fai Ng and Firehawk Holldings Limited (withdrawn) and Earick Consortium for Tottenham Hotspur Limited

- Strategic review announced by Spire Healthcare Group plc

- Possible cash offer by Private equity funds managed by Warburg Pincus LLC for JTC plc

- Strategic review announced by IQE plc

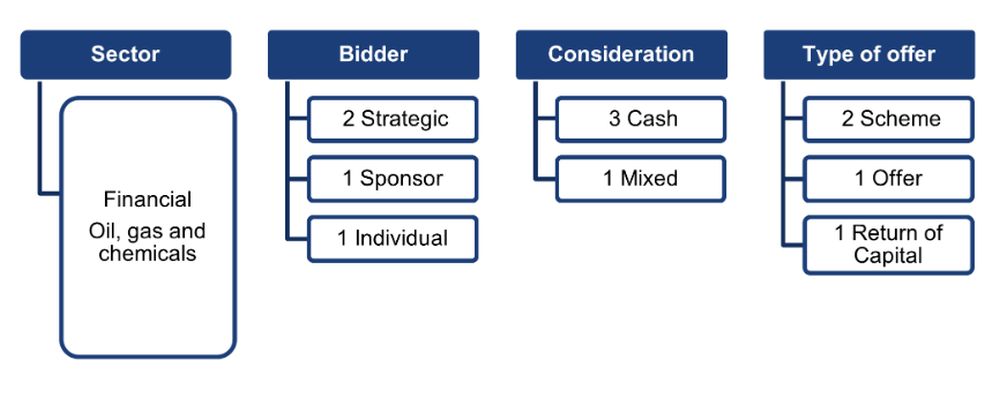

Firm Offers breakdown this month:

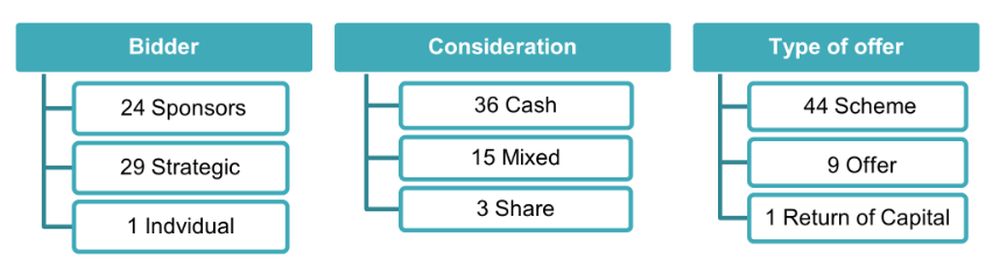

Year to date breakdown:

September 2025 Updates:

Takeover Panel Hearings Committee Chair rejects appeal against Panel Executive ruling in relation to Third Point Investors Limited

The chair of the Hearings Committee of the Takeover Panel has rejected an appeal (PS 2025/15) against a ruling by the Panel Executive which concluded that Third Point LLC was not required to make a mandatory offer for Third Point Investors Limited (TPIL) in light of a series of transactions which TPIL was undertaking.

TPIL was a Guernsey closed-ended investment company traded on the London Stock Exchange. Its share capital comprises:

- ordinary shares, which entitle the holders to one vote per share and are listed on the Main Market of the London Stock Exchange; and

- redeemable B shares, which also carry one vote per share except on "Listing Rule reserved matters" – that is where the UK Listing Rules (UKLRs) stipulate that approval of the holders of the listed shares (in this case, the ordinary shares) is required. The B shares are not listed or traded on any stock exchange or market.

The B shares have no economic rights and are held by VoteCo – a Guernsey-based voting company which is mandated to exercise the voting rights attaching to the B shares in the best interests of TPIL and its shareholders as a whole. VoteCo's purpose is to ensure that TPIL retains foreign private issuer status under US securities regulation.

Third Point is TPIL's investment manager and, together with its concert parties, held, prior to the transactions in question, 15% of the total voting rights, and 25% of the economic rights, of TPIL.

TPIL announced it would be undertaking a series of transactions, including the acquisition of a company Malibu Life Reinsurance, for share consideration. Malibu was, prior to the transaction, owned by Third Point affiliates and so Third Point's stake in TPIL increased as a result of the acquisition, and a separate share redemption offer and subscription. Following completion of the transactions, the Third Point concert party was expected to be interested in ordinary shares comprising approximately 26.2% of the total voting rights of TPIL and approximately 43.7% of the economic rights of TPIL (due to the B share structure).

TPIL also announced it was redomiciling from Guernsey to the Cayman Islands, with the migration taking place at least two business days before completion of the acquisition of Malibu.

An investor group including Asset Value Investors made submissions to the Panel Executive arguing that:

- Third Point (and, in turn, the Third Point concert party) was acquiring control of TPIL for the purposes of Rule 9 of the Takeover Code as a consequence of the transactions – on the basis that the B shares should not be considered voting securities for the purposes of Rule 9 – and Third Point should therefore be required to make a mandatory offer pursuant to Rule 9; and

- whilst the transaction would complete following migration of TPIL from Guernsey (where it was subject to the jurisdiction of the Takeover Code) to the Cayman Islands (where the Takeover Code does not apply), because at the time the transactions were proposed to TPIL shareholders the Executive had jurisdiction in respect of TPIL, the Takeover Panel should be able to require that a mandatory offer be made, or that a waiver of the obligation to make a mandatory offer pursuant to Rule 9 be sought.

The Panel Executive ruled that

- no mandatory offer was required as there was no reason to treat the B shares as not having voting rights, and so even after completion of the proposals, the Third Point concert party would not have acquired an interest in shares carrying 30% of the voting rights in TPIL; and

- even if that were not the case, the relevant time at which to consider whether a particular transaction is one governed by the Code is the point at which that transaction is carried out, and not at some earlier point where it is simply being proposed. While TPIL was a company to which the Code applied at the time it announced the proposed transactions, a consequence of its migration was that at the time of the acquisition, and so at the point at which the Third Point concert party acquired the additional shares, TPIL's domicile and registered office was in the Cayman Islands. TPIL would not then be a company to which the Code applies.

The investor group sought to appeal the Panel Executive ruling but the chair of the Hearings Committee concluded that the Executive's Ruling was plainly correct and that any appeal against it lacked any reasonable prospect of success. He therefore refused to convene the Hearings Committee to hear an appeal.

UK Public M&A Consolidated Update

Our consolidated public M&A update gives a brief overview of developments in recent months in UK public M&A.

In it we discuss:

- recent market activity, including the bidders driving the increase in activity and competitive situations;

- legal and regulatory developments, including two new Practice Statements from the Takeover Panel and its consultation paper on dual class share structures; and

- our publications and resources, including our video series on top tips for navigating public M&A in the UK and our latest podcasts.

Please click here to see the full briefing.

September 2025 Insights:

September has seen activity that is fairly consistent with the same period across the previous five years. Overall, the number of firm offers match the number of firm offers seen in September 2024 and 2023. There has been a slight uptick in the number of possible offers, up from five to seven. In terms of industry sector, September was a very active month for the finance sector, with three firm offers and one possible offer.

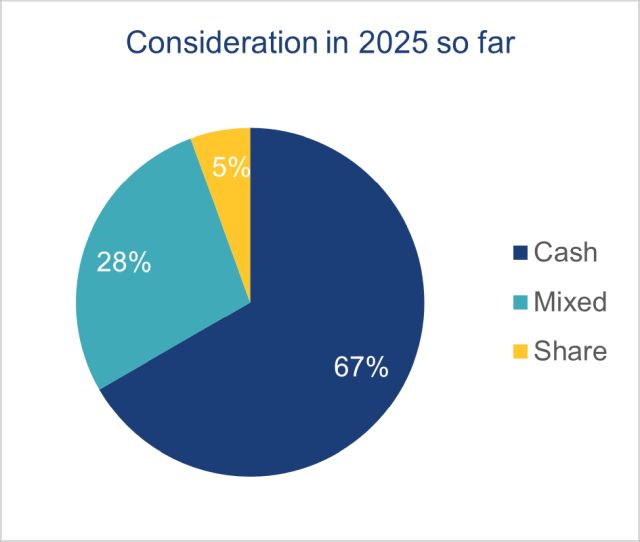

Cash has been king so far in 2025, accounting for the consideration on 67% of firm offers so far. While there was an initial uptick in mixed consideration (where the consideration comprises a combination of, for example, cash and shares, or cash and unlisted securities) in early 2025 this has since settled at 28%, indicating a more modest increase compared to the 22% recorded across the whole of 2024.. Share consideration, which also showed early momentum has not maintained the same pace. September saw a dominance of cash-based transactions, with three deals involving cash consideration and only one structured as a mixed consideration deal.

Useful links

- Herbert Smith Freehills Takeovers Portal.

- Herbert Smith Freehills Public M&A Podcast Series.

- The Takeover Code.

- The Takeover Panel's Disclosure Table (detailing offeree companies and offerors currently in an offer period).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.