- within Corporate/Commercial Law topic(s)

- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

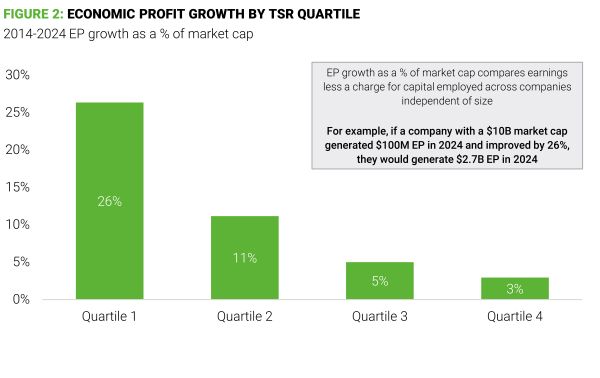

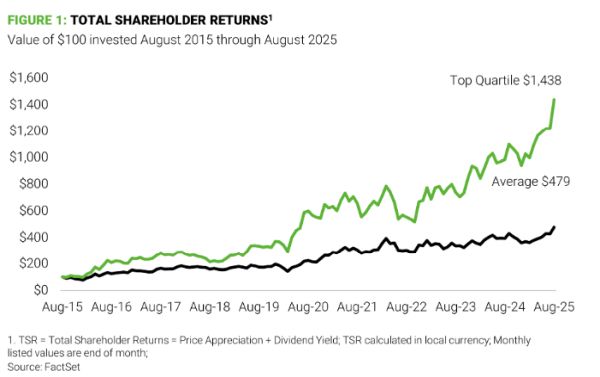

A new AlixPartners study, which reviewed 50 major publicly listed miners with market values above $5 billion, uncovered three reasons that focused operators routinely deliver Total Shareholder Returns (TSR) more than two-to-three times the industry average,: disciplined spending, commodity specialization, and targeted growth strategies sharply distinguish leaders from diversified, less agile rivals in a sector marked by volatile pricing and complex challenges.

Key takeaways:

- The most consistent indicator of top quartile TSR performance among miners is their ability to grow economic profit faster than peers, which requires strategically managing a portfolio based on market economics and individual competitive advantages, supported by disciplined capital spending and a rigorous focus on after-tax operating profit.

- Mining companies that are more commodity-focused consistently outperform their diversified and significantly larger peers on 10-year TSR, as focus fosters better operational discipline and sticking to attractive projects where a company can drive a competitive advantage, while larger, diversified companies often mask poor-performing assets or take on projects out of their depth and, in turn, underperform.

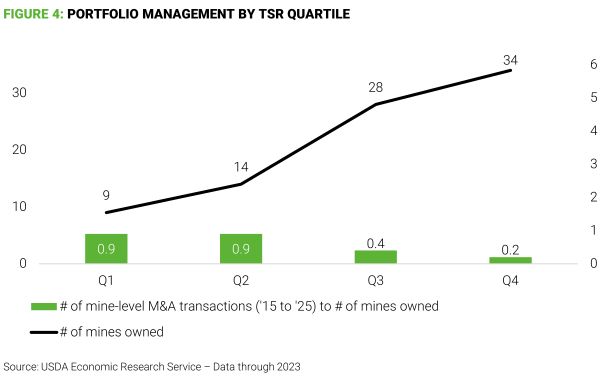

- Miners with top-quartile 10-year TSRs have typically maintained fewer assets while being more active in targeted mine-level acquisitions (i.e., are actively and strategically managing their portfolio), benefiting from faster integration and greater agility, while large-scale M&A tends to adversely impact TSR.

1. Operational and capital excellence is king:

We examined 20 separate performance indicators for mining companies, including metrics such as SG&A expenses, earnings per share, revenue growth, and increases in resource quantity. Among all drivers, the clearest predictor of achieving top-quartile total shareholder returns over a ten-year period was a company's ability to grow economic profit more quickly than its competitors. This means achieving after-tax operating profit (NOPAT) and having capital discipline.

This finding supports what we know from our work with investors and owners: they tend to reward "quality" over "quantity".

For the greater than 50 companies analyzed, companies with a top-tier 10-year TSR performance demonstrated capital rigor, whether it was brownfield/greenfield projects performing against their intended projections/budgets, or a capital deployment focus on the "precious few" projects that moved through the development stages in a disciplined fashion.

2. Being focused and mid-sized pays off:

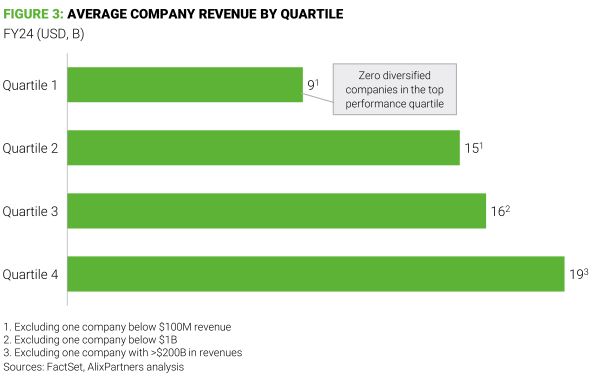

For the mining operators with more diverse commodity portfolios, none achieved a 10-year TSR that placed them in the top quartile of performance. And in general, diversified peers tend to deliver lower TSRs over time. While hindsight offers clarity, our experience confirms that strong, commodity-specific technical and managerial expertise drives performance across assets and companies. Diversified or not, successful operators must cultivate robust capabilities and disciplined practices tailored to the specific needs of each asset.

The diversified players were also significantly larger, with $52 billion in revenues (compared to $9 billion in the top quartile and $15 billion on average). Our analysis shows that larger companies tend to have a higher likelihood of having lower-performing assets, where poor financial performance is often "hidden" by higher-performing assets.

3. Having a leaner portfolio with a larger amount of asset-level acquisitions drives value:

Miners that have delivered top-quartile TSRs in the past 10 years have been more active in asset-level purchases, while having a lower number of assets held. Our analysis shows that faster integration and greater agility enable more effective portfolio management, maximizing competitive advantage and ultimately increasing shareholder value.

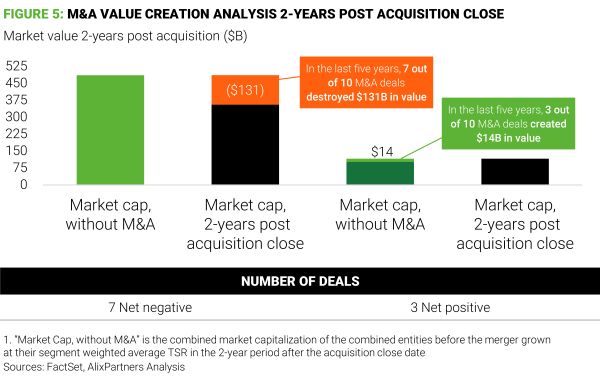

In contrast to asset-level acquisitions, large-scale M&A tends to destroy shareholder value. We looked at the largest 10 mega deals over the past decade, and found that 7 destroyed shareholder value (~$131 billion) after 2 years, while only 3 created value (~$14 billion).

The common factors amongst most unsuccessful large mergers were: high premium prices (>25%), overestimated synergies, underestimated jurisdiction risks/delays, and integration issues.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.