- within Corporate/Commercial Law topic(s)

- in Asia

- within Corporate/Commercial Law topic(s)

- in Asia

- within Antitrust/Competition Law, Real Estate and Construction and Intellectual Property topic(s)

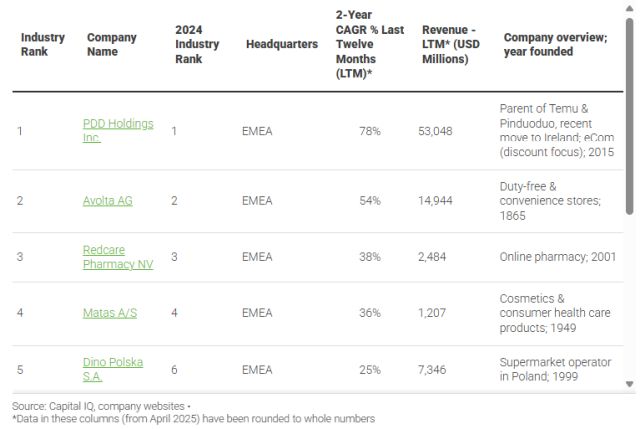

On the surface, the retail growth story looks familiar. Eight out of ten of the 2024 Retail Supergrowers are back in 2025, with very little movement in the ranks. But that may change as the industry faces major global disruption in 2025. Companies have doubled down on winning formulas to hold their position, but will that strategy continue to work?

Large Chinese discounters maintain prominence based on structural cost advantages that may soon be disappearing. PDD Holdings (parent of Temu and Pinduoduo) held the number one spot once again this year, but the outlook for a three-peat in 2026 is uncertain. Increased costs from the new tariffs on Chinese imports may end U.S. shoppers' obsession with the ultra-low-cost goods sold by Temu, Shein, and competitors; at the very least, high tariffs and uncertainty threaten their business model.

At the same time, traditional discount retailers may see new challenges or opportunities if economic growth lags in the months ahead. A downturn could slow the growth of value-focused retailers, such as European discounter Action. A privately held firm omitted from this list of public companies, Action has been expanding like Walmart did and now has close to 3000 stores that feature a limited category selection and frequently refreshed product assortment to entice repeat buyers and emphasize strong revenue drivers.

A booming travel industry in 2024 led to growth for retailers such as Avolta and WH Smith serving that sub-segment of the industry—but this, too, could be a casualty of consumer financial fears or geopolitical quarrels. While challenges remain in many categories of fashion retail, Aritzia and Abercrombie & Fitch found a path to growth that included a focus on strengthening their brands as well as geographic expansion.

Despite differences in market conditions across retail segments, many of the fastest-growing retailers are using similar strategies to win the battle for market and mindshare in highly competitive markets.

Finding the most efficient and profitable ways to inexpensively and quickly get goods onto their shelves or directly into the hands of consumers continues to be a top priority for many retailers focusing on creating agile supply chains—an area that will continue to be of increasing importance in the year ahead. This capability pairs well with another strategy used by many of the retail super growers: geographic expansion into new markets.

Serving the right products to the right customers is another common theme among retail supergrowers. In some cases, this has led to increased focus on private label offerings. Other strategies include building sophisticated customer profiles for precision targeting or creating barriers to entry by expanding into markets like airports, where competitors find it difficult to follow.

Retail

Low-cost Chinese retailers continue to have an outsized impact on the retail landscape. Temu, the company that pioneered the social-commerce model, saw benefits to delivery times and reduced reliance on duty-free shipments through expansion into North America and Europe over the last year, but this is unlikely to protect the company in 2025 as the U.S. and China tariff war plays out. Temu's cost structure had been greatly advantaged by the de minimus loophole, which allowed packages valued under $800 to enter the U.S. duty-free. Now, strong personalization techniques that include product recommendations based on past purchases, targeted ads, and special-offer emails remain in Temu's plus column, along with gamification to encourage repeat visits and purchases. On the home front, the company's expansion into agritech and rural commerce in China has been a source of new revenue, along with an aggressive focus on promotions to add customers through discounts and subsidy offers. Shein (not on this list due to private ownership) has been weighing an IPO off the back of several successful years, although those plans may be on hold due to changing business conditions.

Continued growth in the travel industry kept Avolta, an operator of duty-free and convenience stores, at number two in 2025 and WH Smith at number eight. Innovations at Avolta include a focus on luxury and higher-margin products and increased use of AI to tailor touchpoints to customer preferences to drive deeper connections and conversions. The company is also using AI to create efficient, frictionless shopping experiences, particularly in busy areas like airports.

WH Smith, founded in the late 18th century, continues to look to growth in travel as the key trend driving it forward in the 21st century. The company recently announced the sale of its UK High Street business so as to become a pure-play global travel retailer. As part of this plan, the company aims to open 500 shops in North American airports and other travel hubs by 2028, while also opening 15-20 new stores per year in UK airports, hospitals, and rail stations. The goal is to capture an increasing share of travelers' spending by expanding its product line as well as its footprint, adding trendy items such as vinyl records and Toys R Us merchandise to the mix of products on its shelves.

Moving to the world of fashion, Canada-based Aritzia entered the retail supergrower list, propelled by significant growth in the U.S. market that contributed to a 72% surge in profits. The company's focus on quality and style resonates across a broad range of customers, particularly with Gen Z, thanks to its celebrity and influencer-driven social media presence. Look for more flagship locations to open in major U.S. cities in the year ahead and continued growth in e-commerce revenues as the company focuses on website user experience upgrades to ensure frictionless navigation on the front end and better inventory management on the back end.

While Abercrombie & Fitch (AF) may not be as old as WH Smith, the fashion retailer has seen many changes since it was founded in the late 19th century. Its most recent transition, occurring over the last several years, has seen the brand evolve to attract a broader and more inclusive customer base. In the Young Adult fashion segment, Abercrombie is second only to American Eagle but ranks first with shoppers when it comes to experience, according to the 2024 AlixPartners Consumer Sentiment Index. The redesigned stores are more open and inviting to in-person shoppers who are greeted by versatile styles meant to appeal to today's twenty-somethings. With a strong loyalty program and a focus on a seamless shopping experience that integrates online and offline channels, customers are finding lots of reasons to keep coming back.

The retail growth story underscores just how quickly dominance can shift in an industry shaped by global forces, evolving consumer behavior, and economic uncertainty. While many top performers rely on proven strategies, the true winners may be those most prepared to adapt—whether that means redefining value, rethinking logistics, or reshaping the customer experience. In today's volatile retail landscape, agility may matter more than momentum.

Return to the Supergrowers homepage to view the full list, or learn more about our methodology

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.