- with Finance and Tax Executives

- with readers working within the Metals & Mining and Utilities industries

One question weighs heavily on retail CEOs' minds:

How do we grow like-for-like sales volumes when consumers are spending less, costs are rising, and competition is at an all-time high?

Retail's current reality: confidence is crushed, complexity is rising, and mature market growth is stagnant

Retailers can no longer depend on a rising tide to lift all boats. The old playbook won't deliver. Consumer confidence is on the floor, and inflation continues to squeeze already-tight margins. Retailers face intense competition across brands and channels, while rapid shifts – such as GenAI-enabled shopping, social selling, and blended digital experiences – are transforming how and where consumers shop. Footfall is flat or down, and years of tech underinvestment mean many retailers lack the tools or data to respond with speed or precision

Driving like-for-like volume growth now means taking share from competitors, requiring mastery of the basics alongside advanced goto-market tactics for clear differentiation. Sector distress means inorganic growth opportunities are coming to the fore, demanding bold moves as conventional expansion slows

Doing more with less is no longer an option. What's needed is a transformational approach: a creative, urgent reassessment of every activity and ambition. Only a true restructuring mindset will achieve the rapid action needed to compete and win.

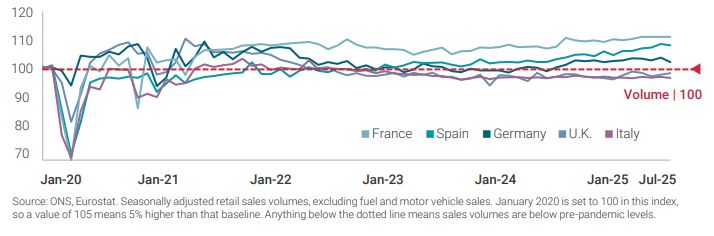

Across Europe's major retail economies, growth remains hard to achieve.

This challenge is particularly evident in the U.K. and Italy, where likefor-like volume growth has slowed significantly over the past five years.

Source: Retail Week/ONS/Eurostat, Trading Economics, Reuters

U.K. and Italy retail sales growth still tracks below pre-pandemic levels

Three strategic levers to drive like-for-like growth

We see a clear hierarchy of immediate action – a retail version of Maslow's hierarchy of needs – that retailers must execute simultaneously, not sequentially.

Fix the fundamentals:

the brilliant, non-negotiable basics

Getting the basics right has never been more critical. Too many retailers fail to deliver the right product, at the right price, in the right place, at the right time

Years of underinvestment in technology, assortment, and pricing capabilities have taken their toll, and constant market disruptions – from the pandemic to supply disruption – have weakened retailers' core trading muscle.

The remedy? Re-strengthen this muscle to trade better and more efficiently, creating headroom to invest. Leverage data and advanced analytics to unlock dynamic, localised decision-making.

Differentiate to drive demand:

smarter tactics for sharper results

To win share from competitors, retailers must take bold steps across their go-to-market proposition that set them apart. This means driving a compelling, differentiated proposition and delivering it with precision. Marketing budgets and tactics need fundamental rethinking to drive profitable improvements in footfall, conversion rates, and basket value.

AI has catalysed the potential for hyper-personalised campaigns at scale, better social engagement, and sharper targeting. Customer loyalty mechanics, promotional efficiency, and conversion techniques also need reimagining, including innovation in stores, e-commerce, social selling, and other emerging channels. Once a customer is through the door – physical or digital – every visit must count.

Be ready to make the big bets:

distress drives opportunity

Disruption and stress are opening new doors for inorganic growth, forcing businesses to consolidate or risk being consolidated. With M&A and restructuring already accelerating in retail, proactive strategies are essential. Key approaches include:

- M&A: Acquiring or merging with competitors and adjacent businesses to build scale and enhance market access

- Special purpose vehicles and partnerships: Deploying capital-light structures for targeted, flexible market moves

- Restructuring tools: Transforming balance sheets and business economics for greater speed and agility.

"To drive real enterprise value in this disruptive landscape, retailers must embrace creative, proactive approaches to inorganic growth. Fixing the basics is essential, but tackling advanced strategies at the same time is crucial – sequential steps are no longer enough."

– Matt Clark, Partner & Managing Director, EMEA Retail Lead

The bottom line:

like-for-like volume growth is today's barometer for sustainable success

Top-line growth must be driven by volume to be sustainable. In many categories, price increases are still masking sharp declines in volumes, this cannot continue. Consumers are cautious, saving for the rainy days they see ahead or shifting spending priorities towards experiences and essentials. That means growth must come from taking share, not waiting for a rising tide to lift all boats.

Retailers should not choose between operational excellence, disruptive tactics to take market share, or inorganic growth bets. All three must run in concert – now. No stone can be left unturned to turn fortunes around, and the response to such significant disruption demands an elevated level of constructive challenge to drive momentum and speed to results.

Today's retail environment is an archetypal "when it really matters" moment – where a restructuring mindset to challenge the status quo and rapid execution must align. We have honed these exact skills for more than 40 years at AlixPartners and are ready to discuss with you how you can reposition the retail challenges of today into the growth opportunities for tomorrow.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.