Rising economic uncertainty, coupled with stagnating consumer spending, could accelerate the dollar store channel's recent growth trajectory as cost-conscious shoppers flock to lower-cost alternatives. But dollar channel executives shouldn't expect mass retailers and grocers to cede share without a fight.

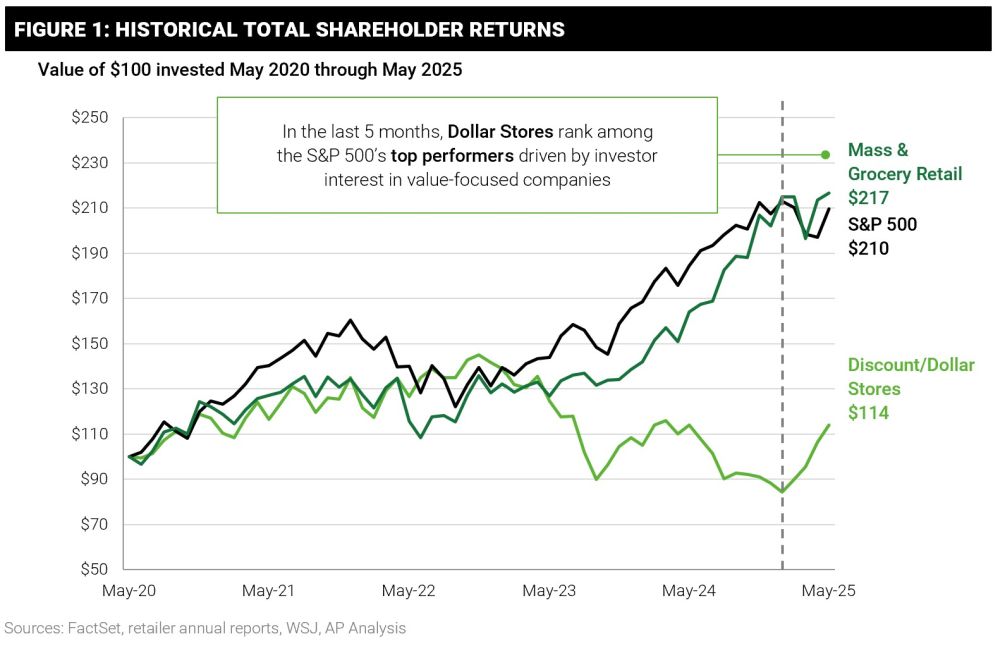

The proof points go beyond consumer behavior. Dollar channel stocks have recently outperformed many retail peers in the S&P500, demonstrating investor interest in value-focused companies. Having lagged in comparison to other retail segments over a five-year horizon, dollar store companies may be positioned to seize the momentum offered by the current market conditions to deliver value to customers and shareholders alike.

What's on the consumer's mind? Value first and foremost

A recent Associated Press-NORC poll indicated that most U.S. adults are at least somewhat concerned about the cost of groceries, with approximately half responding that grocery prices are a major source of stress. As families enter the annual back-to-school (BTS) season, similar anxieties are reflected in an ICSC poll where 91% of shoppers reported that higher prices will impact their shopping behavior.

As consumers grapple with inflation, stagnant wages, and financial uncertainty, they are trading down in many spending categories by chasing lower prices, delaying big-ticket purchases, and hunting for lower-cost alternatives as households seek to stretch their budgets.

Winner takes all?

Does the dollar store channel have what it takes to capitalize on the shift in trends and traffic that the headwinds are blowing in its direction? Can they retain new customers attracted to their value story once consumers feel better about the economy?

On the other hand, how can mass retailers and grocery chains protect their share and counter the dollar channel value play during uncertain times?

The competitive landscape...disrupted

Dollar stores excel in two areas: price and breadth of locations. A recent AlixPartners' consumer survey showed increased household penetration, shopping frequency, and basket size across core categories, including grocery, health and beauty, and home goods, underscoring the dollar channel's appeal during an economic downturn. Responses demonstrated widespread uncertainty about both macro and personal economic conditions, yet consumers indicated the dollar store channel is where they expect to reduce spending the least within retail.

While attractive prices and convenient locations will get shoppers in the door, do they have what it takes to keep them? Compared to mass retailers and grocers, the dollar channel misses the mark when it comes to breadth of categories, variety in a category, product availability, store cleanliness, and customer service. Specialty retailers, also limited in scope, outperform them in lower-importance but highly differentiating attributes such as experience and special occasion goods.

Can the dollar channel play the long game?

Dollar channel leaders face dual challenges: maintain the low-price value proposition while addressing gaps in the shopping experience that limit customer stickiness and share of wallet. However, if careful investment choices are made, these don't have to be opposing forces.

Here are five levers dollar channel executives can pull to build on the current momentum:

- Double-down on the core value message. Shoppers come to dollar stores for the lowest prices found in convenient locations. Don't lose sight of these central tenants as adjustments to the operating model are made.

- Implement self-help. Study areas of weakness and identify gaps that can most easily be addressed. Early wins could come from improved execution and customer service, as well as expanding offerings for occasions that can reach new customers.

- Restructure your cost base. Use this time to strategically analyze expenses and achieve a sustainable, value-driven cost structure designed to outlast current economic conditions and the inevitable return to normalcy. Instill a razor-sharp focus on lowest-cost execution enabled by planning, inventory, distribution, and store ops.

- Tell your story. Focus marketing efforts on the value story that resonates most with shoppers feeling the pinch. Let them know that you understand their needs during challenging times. Strengthen marketing around offerings and occasions that can reach customers (see white space potential below).

- Look for white space and strengthen the 'treasure hunt'. Bankruptcies impacting the specialty retailer segment offer growth opportunities for dollar stores. The shuttering of JoAnn Fabrics opened up the arts and crafts market. Similarly, Party City's demise means party and special occasion goods lack a category leader. Big Lots shoppers need a new place to hunt for bargains. Gaining share in any of these white space categories can boost the dollar channel's top line. It also requires players to act quickly to fill these niche markets and round out their product assortment before competitors move in. Finally, continue to drive the 'treasure hunt' experience with the right levels of newness, especially in critical seasonal categories.

Non-Dollar retail competitors can go the distance

Although current market turbulence offers the dollar channel an opportunity to gain ground, mass retailers and grocers still possess scale and structural advantages that will be challenging for dollar players to match. To sustain their edge, these retailers should double down on core operational fundamentals while selectively adopting proven strategies from the dollar channel's value-driven playbook.

- Pricing and promotion. The back-to-school season provides the perfect opportunity for mass retailers to flex their pricing and promotion power. Walmart's opening salvo includes reduced prices on 14 of the most popular school supply items, offering value and convenience during a critical shopping period.

- Dollar or value aisle. Evaluate the feasibility of adding a dollar section to directly compete with the dollar channel threat. Target's Bullseye Playground has long been a place where shoppers can expect to find essential and fun items at the $1, $3, and $5 price points, like the product assortment in dollar stores.

- Assortment and pack size reevaluation. Examine typical package sizes to determine how well they compete with the small pack sizes that dollar stores deliver at exceptional prices, or where differentiation can be made with bulk/family sizes. Determine key areas where breadth of categories and variety within categories is critical and invest to further drive differentiation from dollar stores.

- Differentiate with capabilities missing from the dollar channel toolkit. E-commerce and delivery capabilities may appeal to busy families who see price-competitive promotions for popular items with the added convenience of home delivery over in-person dollar store shopping.

Winning the value-driven shopper

Dollar stores need to upgrade assortment, environment & experience, and service while doubling down on price and quickly grabbing new category opportunities. Mass retailers and grocers should sharpen pricing, offer competitive pack sizes and value sections, and use scale and omnichannel reach to hold their ground. Disciplined operations and smart merchandising offerings will keep both sides ready for shifting market conditions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.