- within Energy and Natural Resources topic(s)

- within Energy and Natural Resources topic(s)

- within Technology, Food, Drugs, Healthcare, Life Sciences and Antitrust/Competition Law topic(s)

General Overview of the Energy Market in Türkiye

Türkiye is an attractive and promising energy market, particularly due to its suitable geography and various natural resources. Its strategic location between the Middle East, Near East, and Continental Europe allows Türkiye to act as a natural "energy corridor", enabling it to carry and transfer energy resources between European countries and the major oil- and gas-producing countries around the Caspian Sea. The growing demand for energy in Türkiye—due to increasing population, urbanisation, market liberalisation, and increased licensing opportunities—is attracting private investors to the sector. Over the past two decades, major capacity additions in Türkiye have been made as a result of private-sector investments. The share of the private sector in electricity generation increased from 40% in 2002 to approximately 85% as of January 2025, while the share of Build-Operate ("BO") and BuildOperate-Transfer ("BOT") power plants decreased during the period.

As of April 2025, Türkiye's total installed electricity generation capacity exceeds 118 GW. The country's three largest renewable energy sources— hydroelectric (dam-based), solar, and wind— reached installed capacities of approximately 23,863 MW, 20,646 MW, and 13,044 MW, respectively. This growth aligns with the 2022 National Energy Plan,1 which aims to expand the installed capacity to 189.7 GW by 2035, with significant contributions from renewable energy sources. Although energy consumption in Türkiye is lower per capita than in Western European countries, the increase of the country's energy requirements has outpaced domestic production, making Türkiye a major energy importer. In this context, the 2022 National Energy Plan sets forth ambitious goals to increase domestic sources of energy, with renewable energy currently accounting for approximately 58% of the total installed electricity generation capacity, with a target to achieve 64.7% by 2035. Electricity consumption continues its upward trend and is projected to reach 380.2 TWh in 2025. To bolster supply security and reduce import dependence, Türkiye is prioritising the expansion of domestic and renewable energy sources and commissioning its first nuclear power plant—the 4,800 MW Akkuyu Nuclear Power Plant—by the end of 2025.

Current Mix of Energy Sources

Türkiye's main domestic energy resources are coal, lignite, solar energy, wind energy, natural gas, hydroelectric energy, and geothermal energy. Renewable energy sources rank as the secondlargest domestic energy resource after coal. Primary renewable energy sources in Türkiye are hydroelectric power, biomass, wind, biogas, geothermal, and solar power.

As Türkiye's energy consumption outpaces domestic production, the country has been dependent for a long time on energy imports, particularly oil and gas. Around 75% of Türkiye's crude oil is supplied from Saudi Arabia, Kazakhstan, Iran, Iraq, India, and Russia. Russia is also Türkiye's main supplier of natural gas, alongside Iran and Azerbaijan. Demand for natural gas in Türkiye is increasing rapidly, as it is the preferred fuel source for industrial use as well as for power generation and residential use.

Market Status of Renewable Energy

Demand for energy and natural resources in Türkiye has been increasing due to both economic and population growth. According to data from the Organisation for Economic Co-operation and Development ("OECD"), the growth in demand for energy in Türkiye is the highest among OECD members, and the projections of Türkiye's Ministry of Energy and Natural Resources ("MENR") confirm that this trend will continue for the medium and long term. Türkiye's economic growth is also reflected in the country's electricity generation infrastructure, given the dramatic rise in total installed capacity— from 31.8 GW in 2002 to 118,668 GW by the end of April 2025. To satisfy the increasing energy needs of the country, current capacity is expected to reach 189.7 GW by 2035 through further investments to be commissioned by the private sector, as underlined in the 2022 National Energy Plan.

Türkiye has significant potential to utilise and invest in its renewable energy resources. As at end-April 2025, renewable energy sources constitute a major portion of Türkiye's total installed electricity generation capacity: hydroelectric power accounts for 27.2%, wind for 11.2%, and solar for 18.7% of total capacity. These three sources together represent more than half of the national installed capacity. Aligned with global energy transition efforts, Türkiye has committed to achieving a net-zero emission economy by 2053. At the COP28 Summit held in Dubai in 2023, Türkiye joined 138 other countries in pledging to triple global renewable energy capacity by 2030. In line with this vision, the 2022 National Energy Plan aims to increase the country's installed electricity capacity to 189.7 GW by 2035, with 64.7% derived from renewable sources—35.1 GW from hydroelectric, 52.9 GW from solar, and 29.6 GW from wind.

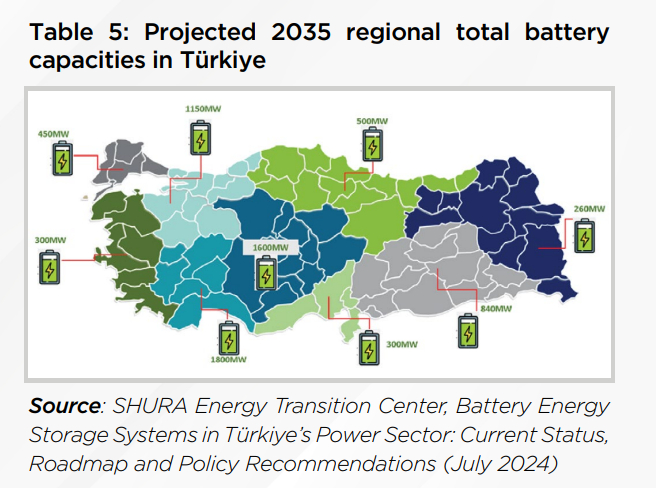

To support the integration of an increasing share of variable renewable energy, flexibility in the electricity system has become a national priority. Türkiye plans to reach 7.5 GW of battery energy storage and 5 GW of electrolyser capacity by 2035. While batteries play a key role in short-term (hourly) balancing, electrolysers will enable seasonal energy storage by converting surplus electricity—especially from solar and wind—into e-fuels. To promote battery storage investment, Türkiye has introduced a regulatory framework whereby investors who install energy storage systems are granted the right to build renewable energy plants with matching capacity. As of June 2024, Türkiye has granted prelicenses for 32 GW of integrated battery-renewable capacity, signalling strong momentum in the storage sector.

In order to create a favourable investment environment to strengthen the position of renewables in the market beyond the 2020s, various investment models have been introduced, such as unlicensed, licensed, and Renewable Energy Resource Area ("RERA") models, which address different types of investors and are encouraged by incentive instruments.

i. The Status of Wind Power in Türkiye

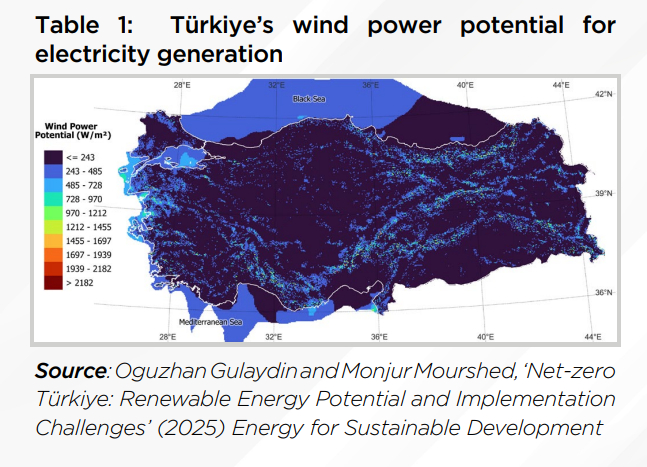

Türkiye's wind energy potential is estimated at approximately 79 GW. As of December 2024, the country had around 14 GW of installed wind power capacity. Of the total potential, Türkiye has an onshore wind potential of approximately 58 GW and a completely untapped offshore wind potential of approximately 21 GW. According to the 2022 National Energy Plan, the government aims to increase the level of installed wind energy power to 29.6 GW by 2035.

Türkiye's potential wind energy areas lie generally in the north-western, northern, and Aegean coastal regions. Other fields are in Türkiye's Middle Black Sea and East Mediterranean regions. Additionally, south-eastern parts of the country can produce wind energy.

Türkiye currently has a total of more than 365 wind power plants in operation. The projects with the largest generation capacity are listed below.

Table 2: Current operational wind power plants with the largest generation capacity in Türkiye

| Name of the Project | Installed Capacity (MWm) | Installed Capacity (MWm) | |

| 1 | Soma WWP | 288 | Manisa |

| 2 | Karaburun WPP | 268 | Izmir |

| 3 | İstanbul WWP | 200 | Istanbul |

| 4 | Albay Çiğiltepe WWP | 173 | Afyonkarahisar |

| 5 | Geycek WPP | 168 | Kırşehir |

ii. The Status of Solar Power in Türkiye

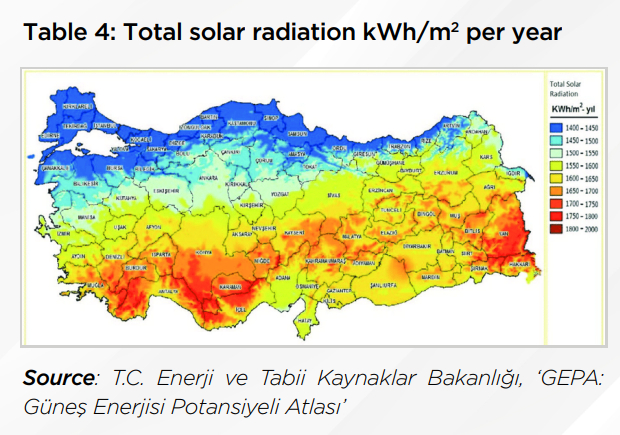

Türkiye is located at 36–42°N latitude, which is a highly beneficial geographical position for the utilisation of solar power.

According to the Solar Energy Map of Türkiye prepared by the General Directorate of Energy Affairs, the average annual amount of sunshine in Türkiye is 2,741 hours, which corresponds to 7.5 hours per day. The total solar energy derived per year is 1,527 kWh/m2 , which corresponds to 4.18 kWh/m2 per day—higher than most of Europe.

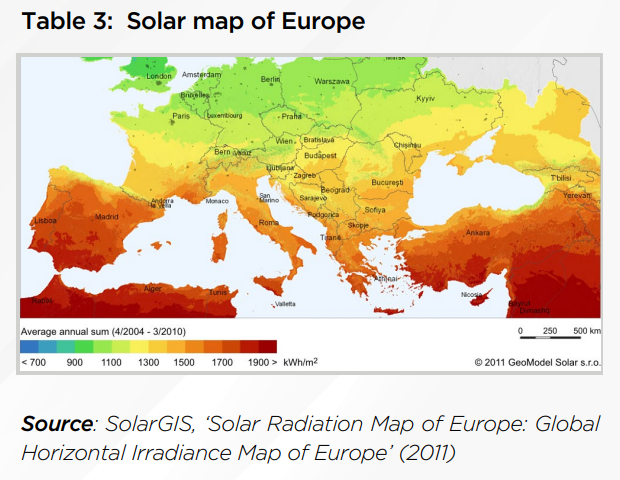

The sunshine that Türkiye receives is similar to that of Spain, as shown in the solar map of Europe below.

Türkiye's yearly total sunshine intensity is 1,311 kWh/ m2 , which is equal to a total of 3.6 kWh/m2 per day. As can be seen in the map above, the irradiation values in Türkiye are higher than in most European countries.

Türkiye has benefited from the solar energy sector since the 1970s, primarily through the widespread use of solar collectors for water heating. According to the International Energy Agency Solar Heat Worldwide 2024 report, Türkiye ranks as the world's second-largest user of solar thermal collectors after China and is also among the top global manufacturers of solar thermal collectors. The country's market is dominated by flat-plate collectors, although the use of evacuated-tube collectors is increasing.

In Türkiye, solar energy is currently used not only for producing water vapour, heating and cooling buildings, and producing salt and ice, but more significantly for electricity generation. Over the last two and a half years, Türkiye's installed solar capacity has doubled, reaching 19.6 GW by the end of 2024, surpassing its 2025 target well ahead of schedule.

This growth has notable economic and strategic impacts. Between 2022 and 2024, solar and wind energy combined helped reduce natural gas imports, contributing directly to energy independence. In the same period, solar energy alone generated 52 TWh of electricity, meeting 6% of the country's total electricity demand and replacing approximately USD 5.4 billion in natural gas imports.

Türkiye's 2022 National Energy Plan initially set a target of 53 GW of installed solar capacity by 2035. However, during COP29 in November 2024, the Ministry of Environment, Urbanisation, and Climate Change announced an updated LongTerm Climate Strategy, raising the 2035 target to 77 GW— a 45% increase over the 2022 National Energy Plan figure. Türkiye has demonstrated significant progress in meeting short-term goals: as of August 2024, the country had already reached the 2025 year-end target of 18 GW set in the 2022 National Energy Plan, achieving this milestone one and half years ahead of schedule. This reflects Türkiye's strengthened climate ambitions and its commitment to accelerating the transition to clean energy.

iii. The Status of Battery Energy Storage in Türkiye

Recent policy reforms, regulatory advancements, and targeted investment incentives have positioned Türkiye's battery energy storage systems ("BESS") market as a high-potential sector within the broader energy transition framework. The government's commitment to integrating renewable energy sources and modernising the grid has accelerated interest in BESS as a critical infrastructure component. Notably, the steady increase in renewable capacity, the significant rise in BESS license applications and approvals, and the scaling of domestic manufacturing capabilities are viewed by industry experts as strong indicators of sustained growth in the Turkish BESS market.

The 2022 National Energy Plan sets a target of achieving installed BESS capacity (with a discharge duration of two hours) of 2.1 GW by 2030 and 7.5 GW by 2035. Within the framework of this plan, wind and solar energy are expected to account for more than 90% of the installed capacity of non-hydro renewable energy sources. This is anticipated to positively influence demand for the BESS industry, as the integration of large shares of variable renewable energy sources will increase the need for energy storage solutions.

As of December 2023, Türkiye's Energy Market Regulatory Authority ("EMRA") received 5,968 applications for BESS projects, totalling approximately 260 GW of capacity. By September 2024, 658 of these applications had been granted preliminary licenses, representing a combined capacity of 34 GWh. The first of these licensed BESS installations are anticipated to become operational by the last quarter of 2025.

To reduce dependency on imports and foster local industry, Turkish manufacturers have announced plans to establish BESS production facilities exceeding 1 GWh in capacity, particularly in regions like Ankara, Istanbul, Antalya, and Kocaeli. Many of these initiatives involve collaborations with international firms, aiming to enhance technological expertise and production efficiency. Additionally, since January 2024, Türkiye has imposed a 30% customs duty on imported prismatic LFP batteries from Far Eastern countries to protect and encourage domestic manufacturing.

Footnote

1 The 2022 National Energy Plan is Türkiye's comprehensive strategy to guide energy investments and sectoral transformation through 2035, focusing on increasing renewable energy, enhancing supply security, and supporting the country's 2053 net-zero emission target.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.