- within International Law topic(s)

- in United States

- with readers working within the Media & Information industries

- within International Law topic(s)

- in United States

- with readers working within the Media & Information and Oil & Gas industries

- within International Law, Tax, Media, Telecoms, IT and Entertainment topic(s)

Introduction

The exemption regime for certain goods delivered through mail or expedited shipments ("Low-Value Channel" or "LVC") was initially designed for personal imports and exports. It aimed to streamline customs monitoring and reduce compliance burdens for non-commercial shipments. However, with the rapid expansion of global e-commerce, customs regulations have evolved to address new challenges arising from cross-border transactions.

In response to increasing e-commerce volumes and protectionist trade policies, Türkiye has recently tightened its customs regulations. The country has reduced the exemption threshold for expedited shipments from 150 Euros to 30 Euros and significantly increased duty rates1. These changes mark a major shift in how Türkiye taxes and regulates personal imports, particularly those made via online platforms.

This article examines the recent changes in personal imports and their implications for both consumers and businesses importing goods into Türkiye. Previously, low-value imports bypassed many compliance requirements applicable to commercial imports, such as product compliance certificates and the involvement of customs brokers. However, the new legislation emphasizes stricter trade compliance while aiming to protect local industries and improve tax collection. Additionally, customs authorities retain considerable discretion in classifying imports and processing transactions.

Low Value Channel Overview

The legal foundation for customs procedures related to LVC is established in the Turkish Customs Act2 and its regulations. The primary regulation governing LVC procedures is the Application of Certain Articles of the Customs Act, supplemented by communiqués from the Ministry of Trade.

Authorized entities, including Turkish postal service ("PTT") and certain express cargo operators, handle the clearance of LCV. The following categories of goods are eligible for LVC procedures3:

- Documents,

- Samples, models and goods for research, analysis or testing,

- Books and printed publications brought by public institutions, libraries and museums,

- Passenger goods (if brought one month before or three months after the arrival of the passenger)

- Books and printed publications brought by real persons worth up to 1.500 euro,

- Import goods of a non-commercial nature worth up to EUR 22, (If the buyer is a legal entity)

- Import goods of a non-commercial nature worth up to EUR 30, weight up to 30 kg (If the buyer is a real person)

- Export goods worth up to EUR 15.000, weight up to 300 kg.

Certain goods, including cosmetics, mobile phones, alcohol, tobacco products, animal products, and medicines, are prohibited from being delivered via mail or expedited shipping.

Turkish customs law distinguishes between personal and commercial imports, with the latter being subject to stricter requirements. LVC imports under 30 Euros benefit from simplified tax and customs procedures, but customs authorities retain the discretion to determine whether an import is commercial or personal.

Key Simplifications in the LVC Regime

- Authorized carriers can complete customs procedures for shipments under 30 Euros.

- Simplified customs declarations streamline import processing.

- Simplified duty rates replace complex commercial duty calculations.

Detailed Breakdown of LVC Procedures

Authorized Carriers & Customs Procedures

Express cargo operators can be authorized to handle customs procedures for LVC shipments under 30 Euros. The Ministry of Trade sets the conditions that these carriers must meet. Authorized carriers act as indirect representatives and must employ customs brokers to process shipments.

Simplified Customs Declaration

A Simplified Customs Declaration ("SCD") is an electronic form with a reduced data set for LVC shipments. The declaration must include:

- Customs classification (determining applicable duty rates)

- Customs value (determining duties owed)

- Country of origin (COO) (indicating where the product was manufactured)

Additionally, the quantity limit for simplified declarations has been reduced from 2,000 units to 500 units per import transaction.

Valuation of the LVC Threshold:

- The valuation of goods will be based on the invoice, sales receipt, or proof of payment. If these documents are not provided or the declared value is deemed low, the customs administration will determine the value.

- For goods arriving via LVC, transportation costs made until the entry point in Turkey will be added to the value of the goods.

- In cases where freight costs are included in the delivery terms, these must be shown separately on the invoice or receipt. If not, a standard freight cost of 3 Euros will be added to the price paid/to be paid.

- In deliveries where freight costs are not included, if a freight receipt cannot be provided or cannot be accepted, a standard freight cost of 3 Euros will be added to the price paid/to be paid.

- The simplified customs declaration must separately declare the value of goods and freight costs in the relevant sections of the transport document.

Simplified Duty Rates

Unlike the complex and varying duty rates applicable in the commercial import channel based on the HS code and country of origin; duty rates applicable in the LVC are simple and straightforward. Turkish Customs laws prohibit or restrict several personal imports in the LVC based on the value and/or type of the products. These restrictions will depend on two following determinants:

- whether the goods are dispatched from an EU or non-EU country,

- product type:

- books,

- excise-scoped products, and

- all others.

These goods are exempt from all customs duties as well as V.A.T4:

- Documents,

- Samples, models and goods for research, analysis, or testing,

- Books and printed publications brought by public institutions, libraries, and museums,

- Passenger goods, (brought one month before or three months after the arrival of the passenger)

- Books and printed publications brought by real persons worth up to 1.500 euro.

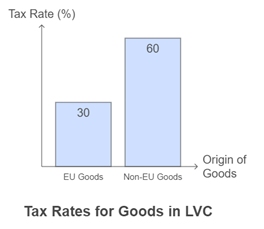

In LVC, for the goods not exceeding EUR 30 and below 30 kg, the single tax rate that will be applied for the goods arriving directly from EU countries is 30% and the rate is 60% for the goods arriving from non-EU countries. Previously, the threshold was EUR 150, and the rates were %20 and %30, respectively. In other words, with the Decree, de minimis threshold for LVC exemptions were lowered and consequently, the scope of the exemptions was narrowed.

For books and other similar print publications, there is a separate and specific arrangement. The threshold for importing such goods for personal use for natural persons is EUR1500. Furthermore, the duty rate for such books and other similar print publications is %0. In other words, books and similar print publications imported for personal use by natural persons are exempted from duties. This provision was not changed with the recent Decree.

The Effects of Changing customs policies on LVC

There are several major implications of the recent custom policies. First, fewer goods are eligible for the simplified customs declaration due to the lower threshold, which would affect a large number of small-scale, private imports. Pursuant to the Decree, only goods valued below EUR 30 benefit from simplified procedures, such as omitting certain documents and reduced information requirements on customs forms. Due to this change, more packages entering Türkiye are probably going to need thorough paperwork and standard customs processing. This might lead to longer clearance times for imports that were previously handled through simplified processes. Secondly, the new duty rates reflect a major shift, affecting especially the goods imported from non-EU countries. As the increased rates make importing certain low-value items less economically viable, the volume of low-cost imports into Türkiye may fall. Consumers would probably find imported goods, especially non-EU ones, less affordable. Consequently, there might be a shift towards domestic alternatives and benefiting local producers. Thirdly, the decree may deter some individuals and small businesses from sourcing cheaper goods abroad, particularly from non-EU regions, by increasing duties on low-value goods and restricting exemptions. Both Turkish online shoppers and international vendors who ship to Türkiye may be impacted by these changes. To illustrate, because of the recent changes custom policies, Nike stopped operating its online platform stating the reason behind as "the recent changes in the Turkish customs legislation".5

As a result of the impact on consumers and vendors, the amount of cross-border e-commerce in low-value goods may decrease. Additionally, since fewer items would qualify for simplified customs, the role of authorized carriers, acting as indirect representatives for importers, becomes more critical, potentially increasing the demand for customs brokerage services.

Conclusion

Türkiye's revised LVC regulations mark a significant shift in its approach to low-value imports. By lowering the exemption threshold from 150 Euros to 30 Euros and increasing duty rates, the government aims to tighten control over cross-border shopping, encourage domestic production, and improve tax collection.

For consumers, this means higher costs for imported goods, particularly from non-EU countries. As a result, domestic alternatives may become more attractive. Stricter regulations could also discourage international retailers from selling low-value goods to Türkiye, reshaping the cross-border e-commerce landscape. Additionally, more parcels will require full customs declarations, increasing the importance of authorized carriers and customs brokers.

Ultimately, while these changes support local industries and enhance customs control, they also introduce new costs and compliance burdens for both consumers and businesses involved in low-value imports. We should add that the Ministry of Trade is closely monitoring the LVC thresholds and it is very likely that new adjustments will be made if necessary!

Footnotes

1. From 20% to 30% for EU products; from 30% to 60% for non-EU products.

2. Aka. No: 4458 Decision

3. The list is from the FAQ section of Ministry of Trade https://ticaret.gov.tr/gumruk-islemleri/sikca-sorulan-sorular/english/expedited-shipments

4. The list is from the FAQ section of Ministry of Trade https://ticaret.gov.tr/gumruk-islemleri/sikca-sorulan-sorular/english/expedited-shipments

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.