- within Tax topic(s)

- in Europe

- with readers working within the Business & Consumer Services industries

- within Insolvency/Bankruptcy/Re-Structuring, Family and Matrimonial and Real Estate and Construction topic(s)

- in Europe

Introduction

The oil and gas sector play a vital role in the Egyptian economy, contributing significantly to national income and attracting foreign investment. However, it remains one of the most regulated sectors, subject to complex tax obligations. Understanding the tax framework governing oil and gas activities in Egypt is essential for companies operating in this sector, as it involves various types of taxes and financial arrangements.

Egypt often utilizes Production Sharing Agreements (PSAs) to regulate the relationship between the state and international companies. Under these agreements, the international company assumes exploration risks and is entitled to a portion of the production upon achieving commercial discoveries. A part of the production is allocated for cost recovery, with the remainder shared between the company and the state according to the agreed terms.

- Oil Sector

Oil (petroleum) refers to crude oil in all its densities, asphalt, gas emitted from reservoirs, and all other hydrocarbons found, extracted, or obtained in any other manner from the area. It also includes all substances that may be derived from it, as well as the crude oil and hydrocarbons produced in a liquid state at the wellhead or gas separation points, or those extracted from gas or emitted from reservoirs at any facility, including distilled products and condensates.

Tax Obligations of the Oil Sector

Corporate Income Tax: Oil companies in Egypt are subject to corporate income tax on profits derived from exploration, production, refining, extraction, transportation, distribution, import, and export of petroleum and its derivatives, including motor oils, fuels, base oils, and additives. These profits are taxed at a special rate of 40.55%, higher than the general rate for other sectors, which stands at 22.5%. However, profits of the Egyptian General Petroleum Corporation (EGPC) are taxed at 40%.

Value-Added Tax (VAT): The oil sector enjoys several exemptions and incentives under Law No. 67 of 2016. Article 18 of the list of exempted goods and services provides direct exemptions, along with the following additional incentives:

1 - VAT Exemptions:

- Crude Oil: Refers to the natural raw material (not a final product and not subject to any industrial process). If any substance or industrial process is added that alters its original state, it becomes subject to the general VAT rate of 14%.

- Natural Materials, Including Products from Mines and Quarries in Their Natural State: For example, the exploration and extraction of phosphate ore.

2 - Law No. 11 of 1991: This law exempts agreements concluded between the Egyptian government and foreign countries, international or regional organizations, or petroleum or mining agreements.

3 - Egyptian General Petroleum Corporation (EGPC): EGPC and all companies owned by or under its supervision, engaged in the exploration, extraction, and production of petroleum, are exempt from VAT. Article 8 of Law No. 112 of 1985 stipulates that the General Petroleum Company is exempt from any taxes related to the extraction, production, export, or transportation of petroleum.

4 - Petroleum Concession Agreements: Petroleum concession agreements exempt many companies from VAT on purchases of local goods and services, provided these relate to petroleum exploration, development, extraction, production, export, or transportation within a specified area, with an exemption certificate issued in the name of the area. However, non-exempt items listed in the approved guideline by EGPC and the relevant authority are excluded.

The exemption is subject to the following conditions:

- The agreements must remain valid without any amendments affecting the exemption clauses.

- The granted exemption must not be used for purposes other than those for which it was provided.

- Exempt goods must not be disposed of within five years following the exemption.

- Suppliers of goods and services must be informed of the list.

5 - Revenues in Kind: Revenues can be collected in kind, for example, exchanging crude oil with other crude oil.

6 - Training and Healthcare Services for Others: Training and healthcare services provided to others are subject to specific tax provisions.

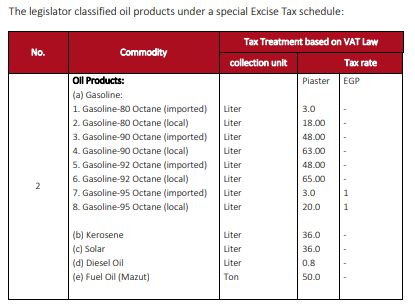

Schedule Tax:

The legislature has included petroleum products within the Schedule Tax list, subject to taxation only under this framework. Specific petroleum products and related services will follow the guidelines and rates outlined within the Schedule Tax.

Table Tax on Oil Products

Excise Tax Table

It is noteworthy that private sector companies (branches of foreign companies operating in Egypt) purchase these products from the Egyptian General Petroleum Corporation (EGPC), as it is the sole supplier of these products. The EGPC is responsible for reporting the schedule tax (excise tax) due on the products mentioned in the above table and remitting it to the Egyptian Tax Authority. Consequently, these companies (branches of foreign companies operating in Egypt) do not collect taxes on such items. This type of tax is predominantly reflected at fuel stations according to oil calibration standards and aircraft fueling processes.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.