- within Tax topic(s)

- with readers working within the Media & Information industries

- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Media & Information and Retail & Leisure industries

Not all Share Swaps are furniture company scams – some are smart, strategic, and tax neutral.

While some high-profile share swaps in the retail and lifestyle sector have left a bitter aftertaste, it is important to remember that not all corporate restructures are cautionary tales. Asset-for-share transactions, when properly structured, can be both strategic and necessary.

Section 42 of the Income Tax Act 58 of 1962 (the "ITA") provides essential tax relief for businesses and individuals seeking to restructure ownership of assets through what are known as asset-for-share transactions. These transactions are designed to be tax neutral, allowing qualifying parties to defer tax consequences that would ordinarily arise upon the disposal of assets. When structured correctly, section 42 facilitates business restructures, incorporations, and group reorganisations without triggering capital gains tax, income tax, or recoupment.

A section 42 asset-for-share transaction under the ITA in essence involves the transfer of an asset by a person, the transferor, to a resident company, the transferee, in exchange for the issue of equity shares in that company. The relief under this section applies only if specific statutory requirements are satisfied. The definition, found in section 42(1), is precise and must be applied strictly to avoid disqualification.

Practical Application and Reasons to Conclude an Asset-for-Share Transaction

1. Corporatisation of a Business or a Portion of a Business

Many entrepreneurs begin their journey as sole proprietors or in partnerships. As the business grows, formalising the structure into a company becomes essential for scalability, liability protection, and credibility.

Take the case of Mr. Y, who operates a successful furniture design and retail business. To prepare for future growth, Mr. Y transfers all his business assets, including inventory, equipment, and branding, to a newly formed company, CraftEdge (Pty) Ltd, in exchange for all its issued shares. This transaction qualifies under section 42, allowing Mr. Y to defer any tax that would otherwise arise on the transfer of assets.

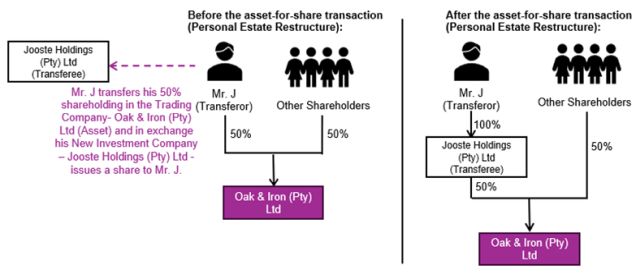

2. Estate Planning and Asset Protection Through a Holding Company

Section 42 is also a valuable tool for estate planning and creditor protection. By interposing a company between the individual and their assets, such as their primary home, one can achieve better control and succession planning.

For example, Mr. Jooste owns all the shares in Oak & Iron (Pty) Ltd (the trading company), a boutique furniture manufacturer. To enhance estate planning and protect the business from personal liabilities, Mr. Jooste transfers his shares in Oak & Iron to a new holding company, Jooste Holdings (Pty) Ltd, in exchange for shares in the holding company. This transaction qualifies for rollover relief under section 42, ensuring no immediate tax liability while achieving a more robust ownership structure.

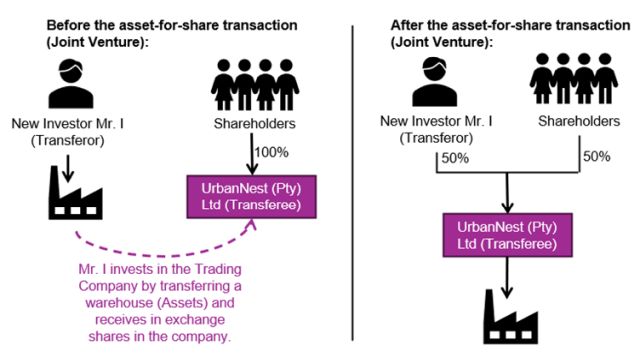

3. Creating a Joint Venture Through Asset Contribution

Joint ventures often require creative structuring, especially when one party contributes capital and the other contributes physical assets.

Consider Mr. I, who owns a large, underutilised warehouse. He partners with UrbanNest (Pty) Ltd, a fast-growing furniture retailer that has secured several large contracts but lacks the production space to fulfil them. Instead of injecting cash, Mr. I transfers his warehouse to UrbanNest in exchange for shares equal to the warehouse's market value. This asset-for-share transaction qualifies under section 42, allowing Mr. I to become a shareholder without triggering capital gains tax on the warehouse transfer.

4. Acquisition of a New Business Using Shares

Section 42 also facilitates business acquisitions where the acquiring company issues shares instead of paying cash.

For example, Neo Furniture Ltd, a listed company, seeks to acquire TT (Pty) Ltd, a footwear retailer owned by Mr Tekkies. Rather than paying cash, Neo Furniture issues shares to Mr Tekkies in exchange for his shares in TT (Pty) Ltd. Because Neo Furniture is a listed company and Mr. Tekkies receives equity shares in return, the transaction qualifies under section 42. Mr. Tekkies defers any capital gains tax, and Neo Furniture expands its product line and market reach in a tax-efficient manner.

A similar scenario occurred in the infamous acquisition by Steinhoff International Holdings N.V in 2016 of 100% of the ordinary shares in Tekkie Town (Pty) Ltd. As consideration for the shares in Tekkie Town Steinhoff primarily used its own shares.

Section 42 Compliance Requirements

Section 42 of the ITA offers automatic tax relief when its statutory requirements are met, making it a powerful tool for corporate restructures and reorganisations. To fully benefit from this relief, it is important to ensure that all formalities are strictly adhered to and that the transaction is thoroughly documented.

SARS recognises and upholds roll-over relief where transactions are implemented in good faith and in accordance with the legislative requirements. Relief will apply where:

- The value of the shares issued corresponds accurately to the value of the asset transferred;

- The company involved is a South African tax resident;

- The transaction satisfies the qualifying interest or employment requirements; and

- The intention regarding asset use is aligned between the parties.

Alignment of Purpose and Intention

The last-mentioned important condition for achieving tax neutral treatment refers to the alignment of how the asset was used by the transferor and how it will be used by the transferee. For example, a capital asset transferred must be held by the transferee as a capital asset to qualify. There are certain exceptions, such as where the parties are not part of the same group or where the assets are listed shares or collective investment scheme interests, which make these rules more practical in real-world transactions involving many shareholders.

| In the hands of the transferor | In the hands of the transferee | |

| Trading stock | Trading stock | Yes |

| Capital asset | Capital asset | Yes |

| Capital asset | Trading stock | Only if not in the same group |

Tax Implications for the Transferor

Where a transaction qualifies under section 42 of the ITA, the person transferring the asset does not incur a capital gain, trading profit, or recoupment. Instead, the shares received are deemed to have been acquired at the same tax cost and on the same date as the original asset. This effectively rolls over the tax history from the asset to the shares, allowing the transaction to be tax neutral.

This roll-over is particularly valuable when calculating future capital gains or determining whether shares have been held long enough to qualify as capital under section 9C of the ITA.

Tax Implications for the Transferee

The receiving company, the transferee, inherits the tax cost and character of the asset as held by the transferor. This includes whether the asset is classified as capital or trading stock. This transfer of tax attributes ensures continuity and prevents a deemed disposal or acquisition from affecting the tax base.

Conclusion

Section 42 of the ITA provides a crucial mechanism for taxneutral restructuring through asset-for-share transactions. When all statutory conditions are met, including asset type, share issue, qualifying interest or full-time employment, and purpose alignment no immediate tax is payable by either the transferor or the recipient company, the transferee.

This roll-over relief is instrumental in enabling corporate flexibility and economic efficiency, provided it is used in good faith and within the boundaries of the legislation. Legal and tax advisory support is strongly recommended to ensure the transaction qualifies and to avoid unintended tax exposure.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.