- within Corporate/Commercial Law topic(s)

- in Europe

- with readers working within the Media & Information industries

- with Senior Company Executives, HR and Finance and Tax Executives

- in Europe

- in Europe

- with readers working within the Accounting & Consultancy, Media & Information and Retail & Leisure industries

Section 45 – Because Not All Transfers within the Family (of Companies) Need to Be Taxing or Taboo

Section 45 of the Income Tax Act 58 of 1962 (the "ITA") provides a valuable tax deferral mechanism for corporate groups wishing to reorganise their internal structures without incurring immediate tax consequences. Referred to as intra-group transactions, these transactions allow companies within the same group to transfer assets between one another on a tax-neutral basis. When properly structured, section 45 facilitates operational asset redistribution without triggering capital gains tax, income tax, or recoupment. Much like the delicate optics of taking your brother's wife, intra-group transfers can be taxing, but when done within the bounds of the law and with proper structure, they're entirely legitimate and often strategically sound.

A section 45 intra-group transaction arises when a company (referred to as the transferor) disposes of an asset to another company (the transferee), provided that both companies are residents of South Africa and form part of the same group of companies at the end of the day on which the transaction takes place.

The provision contains two components:

- " Paragraph (a) applies to domestic intra-group transactions, and

- " Paragraph (b) applies to certain cross-border intra-group transactions involving controlled foreign companies.

This article focuses on domestic intra-group transactions under paragraph (a) of section 45(1) of the ITA.

Practical Application and Reasons to Conclude an Intra-Group Transactions

Before diving into the technical mechanics of section 45, it's helpful to first explore some of the commercial motivations behind corporate mergers, illustrated through practical, real-world examples.

1. Tax-Neutral Asset Transfers

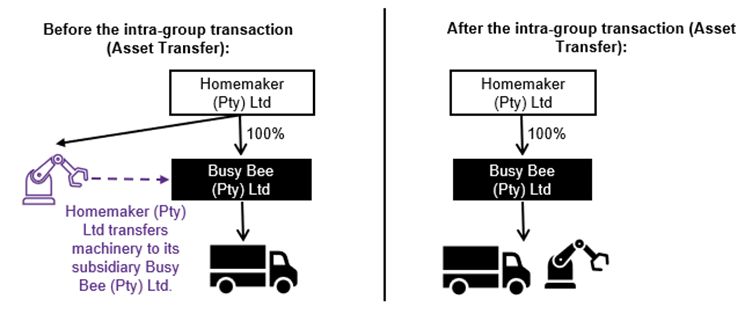

Section 45 allows companies within the same group to transfer assets without triggering immediate tax consequences such as capital gains tax, income tax, or recoupments. For example, Homemaker (Pty) Ltd, a manufacturing company transfers machinery to a logistics subsidiary, Busy Bee (Pty) Ltd, to centralise operations. The transfer qualifies for roll-over relief, preserving the tax base of the asset and avoiding immediate tax.

2. Debt Push-Down

Groups may use section 45 to shift debt to operating subsidiaries, aligning interest deductions with income-generating entities. A holding company transfers an asset to a subsidiary in exchange for a loan account. Section 45 ensures the asset transfer is tax-neutral, while anti-avoidance rules prevent abuse of the loan structure.

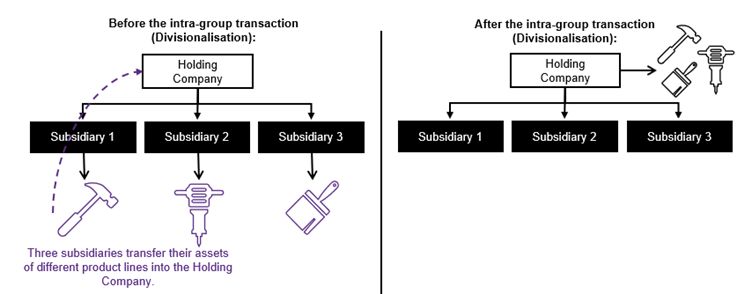

3. Divisionalisation into a Single Entity

Groups may consolidate multiple business units into one company to streamline operations, reduce administrative costs, or prepare for external investment. For example, three subsidiaries managing different product lines transfer their assets into a single operating company. Section 45 allows these transfers to occur without tax friction, provided the assets retain their character (e.g., capital asset or trading stock) and the companies remain in the same group.

4. Internal Restructuring and Simplification

Section 45 supports reorganisations aimed at simplifying group structures, aligning business functions, or preparing for mergers, acquisitions, or divestitures. An example of such a scenario is where a group restructures its property holdings by transferring real estate from multiple subsidiaries into a central property company. This improves oversight and facilitates future financing or sale of the property portfolio.

Section 45 Compliance Requirements

To benefit from the automatic roll-over relief provided by section 45 of the ITA, companies must ensure that all statutory conditions are strictly adhered to. The following positive requirements must be met:

- Both the transferor and transferee companies must be South African tax residents.

- The companies must form part of the same 'group of companies' as defined in section 41(1) at the end of the day on which the transaction takes place.

- The asset must retain its character in the hands of the transferee.

- The consideration for the asset must be appropriate and commercially justifiable.

- All transactions should be properly documented and substantiated.

By proactively ensuring these conditions are satisfied, companies can confidently implement intra-group transactions without incurring immediate tax consequences. Proper structuring and diligent compliance will also help safeguard the relief against scrutiny by SARS.

Alignment of Purpose and Intention

Another important condition for achieving tax neutral treatment is the alignment of how the asset was used by the transferor and how it will be used by the transferee company.

| In the hands of the transferor | In the hands of the transferee | Relief available |

| Capital asset | Capital asset | Yes |

| Trading stock | Trading stock | Yes |

Any deviation from this alignment, such as a capital asset becoming trading stock in the hands of the transferee, may disqualify the transaction from rollover treatment.

Tax Implications for the Transferor Company

When a transaction qualifies under section 45 of the ITA, the transferor company is not subject to tax on the disposal of the asset. This includes the following:

- No capital gain or loss where a capital asset is disposed of,

- No trading profit or loss in respect of trading stock, and

- No recoupment in relation to any allowance asset transferred.

Instead, the transaction is deemed to occur on a tax-neutral basis. The asset retains its tax history, and the transferor is effectively deemed not to have disposed of the asset for tax purposes. This roll-over relief applies automatically under section 45(2) and 45(3) of the ITA, assuming all statutory requirements are satisfied.

It is worth noting that, although this article focuses on domestic transactions, in the case of cross-border transactions involving controlled foreign companies, this relief only applies if the asset's market value is at least equal to its tax cost, to prevent the artificial importation of tax losses into the South African tax system.

Tax Implications for the Transferee Company

The transferee company acquires the asset with the same tax cost and characteristics as in the hands of the transferor company. This ensures continuity for tax purposes and prevents any artificial creation or loss of value for tax calculations.

Key roll-over effects for the transferee include:

- The tax cost of the asset is deemed to be the same as it was for the transferor.

- The nature of the asset, whether capital or trading stock, remains unchanged.

- The original acquisition date and holding period carry over, which is particularly relevant for capital gains tax and section 9C assessments.

Conclusion

Section 45 of the ITA offers a robust and essential tool for domestic group restructuring. When assets are transferred between resident companies within the same group, and the statutory requirements are satisfied, no immediate tax is triggered. Both the transferor and transferee benefit from roll-over relief, preserving the tax cost and character of the asset across the transaction.

This provision supports internal reorganisations and promotes long-term corporate efficiency. However, strict compliance is required, and professional tax and legal advice is recommended to ensure qualification and to avoid the risk of SARS denying relief based on technical non-compliance or anti-avoidance concerns.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.