- within Accounting and Audit, International Law and Law Department Performance topic(s)

The Financial Services Conduct Authority ("FSCA") has recently introduced new and extensive regulation in respect of advertising by financial services providers ("FSPs") and banks. These are contained in:

- the amendments to the General Code of Conduct for authorised financial service providers and representatives, 2003 ("General Code") published under the Financial Advisory and Intermediary Services Act, 2002 ("FAIS") ("Amended COC"); and

- Conduct Standard 3 of 2020 (Banks) under the Financial Sector Regulation Act, 2017 ("FSRA").

The Amended COC and the Conduct Standard were published with the aim of promoting the principles of Treating Customers Fairly, closing the gap in conduct regulation identified by the FSCA in relation to banks, and in furtherance of the principles to be ushered in by the draft Conduct of Financial Institutions Bill, 2018 ("COFI Bill") when enacted.

Advertising is a key focus for the FSCA in ensuring the fair treatment of customers. Importantly, the Conduct Standard defines a "potential financial customer" as a person who "...has been solicited by the bank to become a retail financial customer, or has received advertising material in relation to the bank's financial products or financial services". This follows the same definition proposed in the first draft of the COFI Bill. The COFI Bill, if enacted in its current form, will enable potential financial customers to lodge complaints in respect of advertising and will require a financial institution to render services consistent with the reasonable expectation of a financial customer created through the representations of the financial institution, including advertising. Once the COFI Bill is enacted, these provisions (unless amended) will apply to all financial institutions, not just banks.

The regulation of advertising and marketing by financial institutions is not new:

- the General Code of Conduct has always regulated advertising and direct marketing. Although the definition of "advertisement" was relatively broad, the applicable provisions were generalised in nature. Advertisements were prohibited from containing fraudulent, untrue or misleading statements. Further disclosures were required to be made depending on the type of data being advertised, such as the source and date of such data, and/or warning statements. Only advertisements and direct marketing via telephone and advertisements via public radio necessitated additional requirements;

- advertising has been closely monitored in respect of collective investment schemes ("CIS") since the promulgation of Board Notice 92 of 2014 ("BN 92") under the Collective Investment Scheme Control Act, 2002 ("CISCA") on 15 May 2015. The CIS industry has been required to conform to the inclusion of mandatory disclosures and the filing of advertisements in terms of BN 92. Luckily for FSPs and banks, there is no obligation in the newly proposed regulations that would require filing of advertisements with the registrar; and

- banks are and have always been guided in terms of the advertising and marketing principles and standards set out in the Code of Banking Practice published by the Banking Association of South Africa. However, such standards simply require that advertising and promotional materials are clear, fair, reasonable and not misleading. While this is echoed in the Conduct Standard, more onerous provisions have now been included.

What is an advertisement?

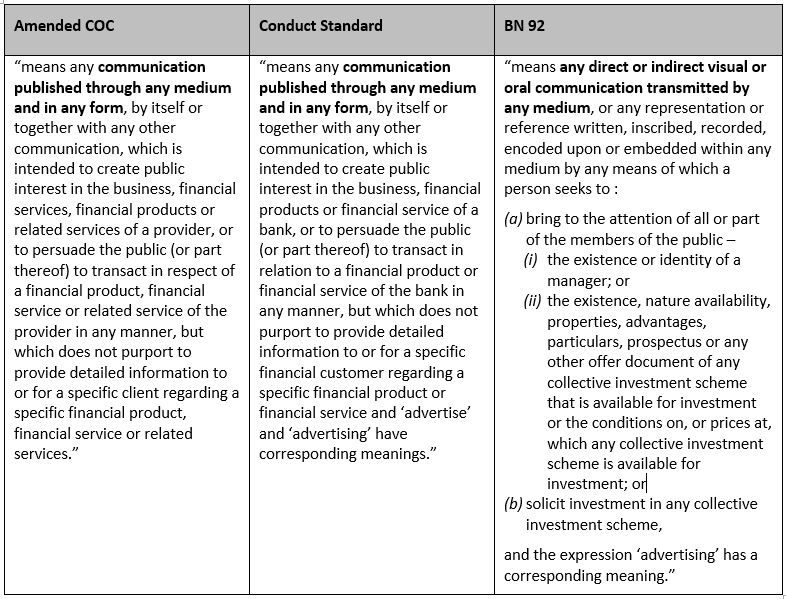

The term "advertising" is largely aligned in the Amended COC and the Conduct Standard, including both direct and other marketing, and is even more widely stated for purposes of BN 92.

What is required in terms of the new advertising provisions?

In its consultation report in respect of the Amended COC, the FSCA indicated that "advertising" is intended to include "brand awareness" advertising, provided that advertising will only fall within the definition where reference is made to a financial product, financial service or related service of the provider. While this comment was not similarly made in respect of the definition used in the Conduct Standard, as the wording is materially similar, the same principle must apply.

FSPs will need to consider the advertising provisions applicable to them and banks who are also FSPs will need to be cognisant of both the advertising provisions in both the Amended COC and the Conduct Standard.

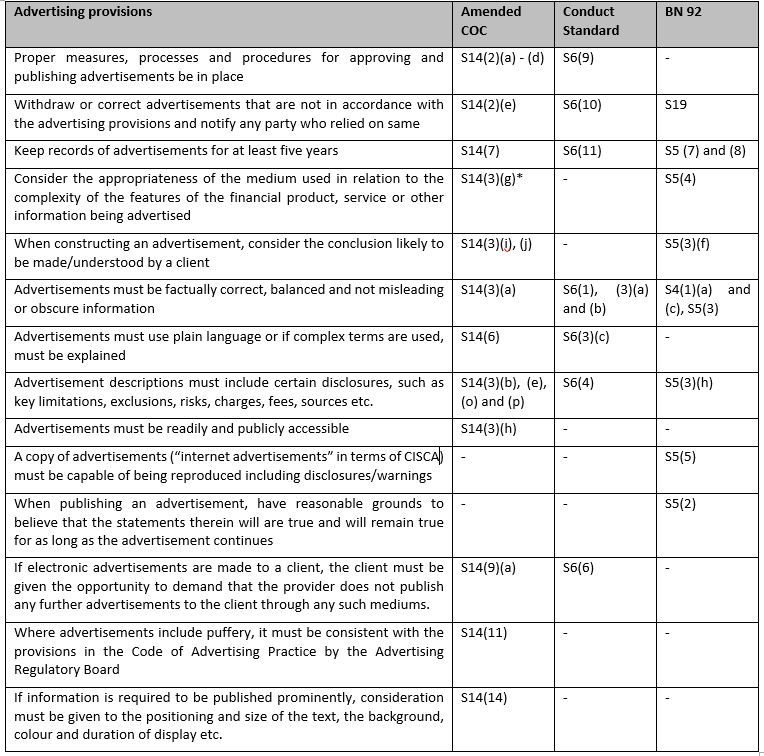

We have summarised some of the key advertising provisions below. While these generally align, they are not identical and a financial institution, especially one acting in more than one capacity and therefore subject to more than one set of legislation, should take care to ensure compliance:

* Note that section 14(3)(g) of the Amended COC states that if a provider can demonstrate that due to the nature of the medium used for the advertisement it is not reasonably practical for the information required in section 14(3)(e) to be fully included (ie, certain key limitations, exclusions, risks and charges) in the advertisement itself, then the advertisement must indicate that such missing information is available and how and where it can be accessed.

What does this mean for advertising financial services through social media?

While the above advertising provisions impact FSPs' and banks' advertising generally, it is perhaps most interesting to consider the impact on the use of social media as a platform to publish advertisements.

Most social media posts would, in our view, generally fall within the various definitions of "advertisement" given that they are inherently created to raise public interest in a particular financial service or business and influence consumers seeking financial services. While there is no explicit reference to social media in the Amended COC, the Conduct Standard or BN 92, the FSCA has indicated its view that advertising through this medium falls within the ambit of "advertisement" for purposes of regulation.

The effect of applying the advertising principles to social media means that, for example:

- the institution's mandatory policies and procedures, which require approval before publishing an "advertisement", must be followed before a post or tweet may be uploaded. This may slow or frustrate a businesses' social media presence, given that this medium, by its nature requires immediacy and spontaneous reaction.

- word or character-count may limit the possibility of accurately communicating correct and balanced information and this must be taken into account and addressed in some other way. Section 14(3)(g) of the Amended COC expressly provides, for example, for these to be included by way of a link to, or other incorporation of, another document;

- providers must be mindful of past posts that remain on social media platforms, especially since FSPs and banks are obligated to correct or withdraw posts that do not meet the requirements of the respective advertising provisions. Furthermore, FSPs should keep in mind that the advertising provisions of the Amended COC apply to any advertisement published on or after its effective date "regardless of whether such advertisements were also previously published prior to the section taking effect", as set out in section 14 (1)(c) of the Amended COC. Accordingly, all advertisements published in the past and still in circulation or to be published in the future by FSPs must, in terms of the Amended COC, comply with the advertising provisions;

- records of every post published must be retained. Given the nature of social media, this may become a burdensome task; and

- institutions should have a well-constructed social media policy. Such policy should address issues such as: which employees are authorised to participate on social media on behalf of the institution, what is considered inappropriate use of social media and the use of social media for marketing and business communications.

We will be unpacking the provisions of the Conduct Standard in greater detail at an upcoming webinar on TUE 21 JUL 2020 at 11am and will be exploring the impact of the Conduct Standard on Advertising by banks in particular. Other themes include, liability for distribution networks, product design, customer complaints and the termination or switching of financial products.

Please click here to RSVP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]