- within Consumer Protection topic(s)

- within Consumer Protection, Finance and Banking and Energy and Natural Resources topic(s)

- with readers working within the Chemicals industries

Intra-African trade (especially in manufactured products) has been touted as a major driver of economic development in Africa as it promotes the scaling of African industries. Though this concept of intra-African trade is not new to African economies, it was significantly impaired by colonialization and has since been a struggle for many African economies to effectively trade among themselves, especially in manufactured products. The extroverted pattern of trade towards the West and now Asia has undermined regional integration and exposed many African countries to external shocks. Notwithstanding, this pattern seems to be increasingly shifting among West African economies, especially for less endowed countries like Burkina Faso and Togo where ECOWAS trade represents about 60% – 70% of their total global trade.

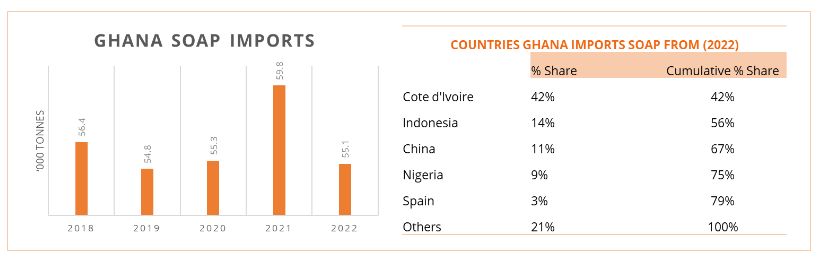

Trade in soap is such a promising indicator of improving regional trade of manufactured goods within West Africa. A country like Ghana now imports over 50% of manufactured soap from neighboring Cote d'Ivoire and Nigeria, while over 90% of her exports of manufactured soaps go to other West African markets in Cote d'Ivoire, Burkina Faso, Senegal, and Togo as domestic production in-country scales. In 2022, Ghana was a net exporter of soaps exporting over 66,000 tonnes of manufactured soaps.

Soap Manufacturing in Ghana; From Net Importer to Net Exporter

Although Ghana, like many African countries, had for a very long time been a net importer of several manufactured products, the tide appears to be changing especially among Fast Moving Consumer Goods (FMCGs) such as soap. Generally, import volumes of soaps have declined significantly as domestic production improves. Between 2012 and 2015, Ghana imported an average of 76,000 tonnes of manufactured soap annually but has since 2016 been importing just between 50,000 to 55,000 tonnes of manufactured soaps annually. Though imported soaps still hold a significant share of the soap market, the perception of quality it enjoys is no longer exclusive to them. Many local brands are now considered to be of good quality and widely accepted in the market. Nevertheless, there are still some segments of the soap market such as liquid bath soaps that are heavily import-dominated. Popular imported brands include Nivea, Dove, Dettol, Olay, Irish Spring, and Palmolive. These brands are perceived to offer high-quality and advanced formulations, which appeal to middle and upper-income consumers. There has also been a trend of local traders traveling to China to toll-manufacture their own liquid bath soap brands.

Source: Firmus Research and Customs Data

Presently there are over 10 major producers of soaps in Ghana with new entrants joining each year. There are also small-scale producers and home-based producers in the market catering to different segments of the market. The significant growth in domestic production has been facilitated by increasing consumer preference for locally made products, rising population and income levels as well as growing consumer preference for organic and natural soaps, produced with local raw materials. Numerous Small and Medium Enterprises produce handmade, organic, and herbal soaps. Brands like Alata Samina (African Black Soap) and Pure Honey Soap cater to niche markets focused on natural and organic skincare solutions. These products are often marketed through local markets, pop-up shops, and online platforms, gaining popularity for their natural ingredients and traditional production methods.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.