NEW YORK, October 23, 2025 – Proskauer today released its latest Private Credit Default Index (the "Index"), which tracks senior-secured and unitranche loans in the United States. The Index revealed a default rate of 1.84% for the period of July 1, 2025 – September 30, 2025. The rate is consistent with Q2 2025 (1.76%) and remains significantly below the default rates reported with respect to the broadly syndicated market.

This quarter's Index encompasses 705 loans representing $141.0 billion in original principal amount.

"While we're seeing some movement in default rates, particularly among larger borrowers, the overall picture remains one of strength and resilience. The market continues to mature, and this quarter's findings underscore the importance of proactive risk management and thoughtful structuring in navigating today's credit environment." said Stephen A. Boyko, partner and co-founder of Proskauer's Private Credit Group.

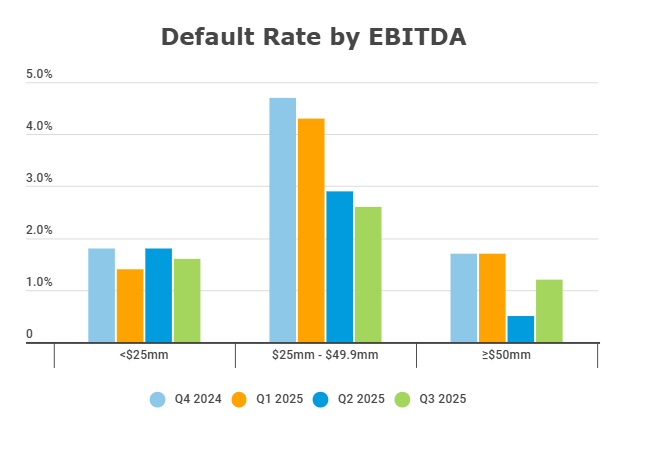

We saw both decreases and increases in the three EBITDA bands that the Index tracks. In companies with EBITDA of less than $25 million, defaults decreased from 1.8% in Q2 2025 to 1.6% in Q2 2025. For those with EBITDA of $25 million to $49.9 million, we observed a slight decrease in the default rate from 2.9% in Q2 2025 to 2.6% in Q3 2025. Companies with EBITDA equal to or greater than $50 million rose to 1.2% in Q3 2025 from 0.5% in Q2 2025.

The Proskauer Index includes a comparison to default rates published by the rating agencies, historical trends by industry and EBITDA bands, defaults by type, defaults in cov-lite loans and defaults by year of origination. The full report is available only to the Firm's direct lending clients.