- in South America

- with readers working within the Banking & Credit, Media & Information and Retail & Leisure industries

- within Insurance, Corporate/Commercial Law and Immigration topic(s)

Introduction

Rising ocean levels, record-high temperature, rapid weather changes, rapid desertification and regular flooding have become the norm, globally, over the last few decades. While there have been many debates as to the remote causes of these challenging events, the primary cause has never been in doubt – climate change. The world as we know it is changing at an alarming rate largely due to the impact of human activities on the environment. This is why climate change has taken centre stage in discussions at both national and international scenes. According to the United Nations, the term "climate change" is used to refer to long-term shifts in temperatures and weather patterns. The World Bank refers to climate change, in its Climate Change Knowledge Portal, as being "...the significant variation of average weather conditions becoming, for example, warmer, wetter, or drier—over several decades or longer". In effect, climate change refers to long term changes in the environment that are likely to have adverse consequences on human existence. The World Bank projects that climate change could drive over 216 million people to migrate (in search of better climatic conditions) within their own countries by 2050.

Given the impact of climate change on economic development, there is an ongoing global shift towards developing a green economy that is less reliant on fossil fuels and other carbon-based sources of energy. However, while this global shift is ongoing, developing countries such as Nigeria are left in a tight spot because of the high cost of alternative sources of energy. This is because developing countries require support to achieve a green economy given that they will not be able to go through the phase of first growing their economies by focusing on carbon-based sources and then decarbonising later like many of the developed countries in the world today. As a response to the increasing effect of climate change on the Nigerian environment, and by extension the Nigerian economy, the Nigerian government has over the last few years shown its commitment to mitigating the impact of climate change by partaking in international discussions and agreements such as the Paris Agreement, Nationally Determined Contributions (NDCs), the Kyoto Protocol, and the United Nations Framework Convention on Climate Change (UNFCCC).

In that regard, in November 2021, the Nigerian President signed the Climate Change Act 2021 ("Climate Act") into law. The signing of the Climate Act into law followed President Buhari's commitment at the COP 26 in Glasgow, Scotland, that Nigeria will achieve net-zero carbon emissions by 2060. The Climate Act defines 'climate change' as "a change of climate, which is attributed directly or indirectly to human activity or natural climate variability that alters the composition of the global atmosphere and which is in addition to natural climate variability observed over comparable time periods", and provides a legal framework for mainstreaming climate change actions, carbon budgeting, mobilising of finance, and other resources required for achieving the goal of net-zero carbon emissions in Nigeria by 2050 - 2070.

Despite the seemingly gloomy economic and physical landscape as a result of the negative effects of climate change, one thing is certain - that is, transactions and financial dealings (both locally and internationally) will continue despite the effects of climate change. In view of this, we will in this article examine the impact of climate change on financing transactions in Nigeria and some of the impacts of the Climate Act on these transactions.

Effect of Climate Change on Financing Transactions in Nigeria

In discussing the impact of climate change on financing transactions in Nigeria, we will classify them into two broad sub-headings. We will first consider the physical impacts/effects and then focus on the non-physical impacts.

(a) Physical Impact

The principal effect of climate change is felt physically in the form of damage to physical assets such as land, goods and other properties. According to the National Emergency Management Agency (NEMA), during floodings experienced in 2012, over 400 people were killed while 1.3 million others were displaced. The flooding is estimated to have caused damages worth several billions of dollars. There have also been subsequent floodings which resulted in significant human and material losses.

In terms of the physical impact on financing transactions, the insurance angle is the most prominent given that the essence of insurance is to provide protection against losses on physical assets or properties. One issue that may come up during negotiations will be the costs associated with insuring any assets that form part of the security for a loan. For example, where one of the potential assets that can be used as security for a financing is equipment or land. As a result of climate change, there is an increased risk of flooding in the area where the equipment or land may be located. In order to ensure that the value of the secured asset is preserved, a lender may require the borrower to take out an additional insurance policy to protect against the specific risk of flooding. Given the high probability of flooding due to climate change, there will be an increased cost to the financing due to the premium payable for insuring the relevant asset annually. In addition, climate change can lead to a reduction in the value of assets that may be used as collateral for a financing. In effect, insurance cost to the borrower is likely to become more expensive and even unavailable in some high-risk areas due to their proclivity to the effects of climate change induced natural disasters.

Increased levels of climate change induced natural disasters could also lead to a reduction in the level of access which businesses will have to financing from financial institutions. This is because in providing loans to prospective borrowers, lenders will typically consider the ability of the borrower to generate sufficient revenue for the repayment of the financing. The impact of climate change could significantly impact the cost of raw materials which will in turn affect the ability of the borrower to generate sufficient revenue.

(b) Non-Physical Impact

Access to funding is one of the principal issues faced by businesses in Nigeria and climate change poses a risk to the credit line of financial institutions to businesses. This could be in terms of the uncertainties that may arise from low-carbon socio-economic transitions and refusal to provide financing (based on policy changes needed to comply with climate change conditionalities) to businesses whose operations are heavily dependent on carbon emission. In recent times, financial institutions have been required to include climate risks in their risk management framework as well as their Internal Capital Adequacy Assessment Process (ICAAP). For example, the European Central Bank ("ECB") in November 2020 published the "Guide on climate-related and environmental risks" which sets out how the ECB expects financial institutions in Europe to consider climate-related and environmental risks in their financings. Various development finance institutions such as the International Finance Corporation and African Development Bank have adopted policies to reduce their financing projects that have negative effects on the environment contributing to climate change. These would significantly affect the provision of financing to businesses in Nigeria.

The Central Bank of Nigeria has not yet introduced any climate change specific prudential requirements for financial institutions in Nigeria. Given the increasing popularity of these sorts of prudential measures around the world, the non-physical impact of climate change may become more pronounced for financing in Nigeria in the coming years.

Impact of the Climate Act

The Climate Act has a number of objectives one of which includes reducing the level of carbon emissions, promoting inclusive green growth and sustainable economic development, facilitating the mobilisation of finance and other resources necessary to ensure effective action on climate change, and ensuring the close out of climate change actions and

incorporating it into Nigeria's national development priorities. Section 3 of the Climate Act establishes the National Council on Climate Change (Council) with powers to make policies and decisions on any matters regarding climate change in Nigeria and to generally administer the provisions of the Act.

Section 2 of the Climate Act requires all ministries, departments and agencies (MDAs) of government and public and private entities in Nigeria to comply with the provisions of the Climate Act. What this means is that the provisions of the Climate Act are applicable to all individuals and corporate entities carrying on business in Nigeria.

Under the Climate Act, MDAs are required to create a climate change desk where all compliance and planning activities are to be carried out. Failure of such MDAs to comply with carbon emission reduction targets would result in the imposition of sanctions on the principal officers, upon their being found liable, including imposition of fines as may be determined by the Council.

For public entities (that is, government owned institutions providing services to Nigerians), the Council is empowered to impose any climate change related obligations on any of such entities. The extent of this power is quite broad and the Climate Act does not provide clarity as to what criteria the Council will use in determining the kind of obligations to impose. What is clear, however, is that the Council can impose climate change related obligations on any public entity. This means that such obligations may be imposed on a specific public entity as opposed to being imposed on all public entities at the same time. This is a point to note as the Council becomes fully operational following the recent appointment of a Director-General for the Council and the holding of its inaugural meeting in February 2023.

In relation to private entities (that is, private and public companies and other entities incorporated under the Companies and Allied Matters Act 2020 (as amended)), the Climate Act contains detailed obligations which any financial institution providing financing to a private company must be aware of. For instance, the Climate Act requires that any private entity with 50 employees and above must:

- put in place measures to achieve the annual carbon emission reduction targets in line with the national action plan; and

- have a designated Climate Change Officer or an Environment Sustainability Officer who will be responsible for submitting an annual report on the efforts the company is making to meet its carbon emission reduction and climate adaptation plan.

The latter requirement is one that we have seen become more pronounced in loan agreements involving international development finance institutions over the last few years. It is advisable that Nigerian businesses hoping to seek financing should start taking steps to ensure compliance with this particular requirement ahead of seeking to obtain funding from financial institutions, particularly development finance institutions which are strict with this requirement. Although not expressly stated in the statute, it appears that private companies with less than 50 employees are not required to comply with any of the above requirements.

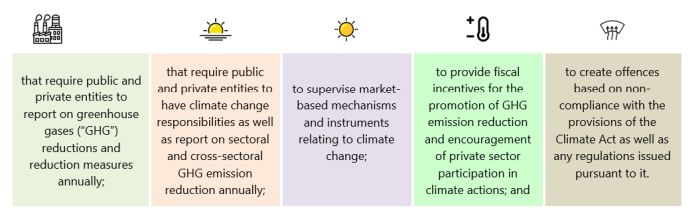

In addition to the above requirements, the Council is empowered to issue regulations:

It is important to note that the Council is yet to issue any regulations pursuant to the provisions of the Climate Act.

Introduction of a carbon tax

Another interesting aspect of the Climate Act is the introduction of a carbon tax into the Nigerian financial system. Section 4 (i) of the Climate Act states that one of the functions of the Council is to work with the Federal Inland Revenue Service, Nigeria's federal tax authority, to develop a mechanism for the payment and collection carbon tax. Carbon tax is a type of environmental tax that is levied on specific units of carbon derived from the production or use of fossil fuels such as coal, oil products and natural gas. The aim of this tax is to encourage a reduction in the amount of carbon emitted during the production and consumption of any goods and services. The introduction of carbon taxes will help the government generate more revenue while disincentivising businesses from relying on carbon-based energy sources.

On a global scale, there are currently over 25 countries with a carbon tax regime. Nigeria is, through the Climate Act, set to join the league of countries with a carbon tax regime. As of the time of writing this article, the mechanism for the payment of carbon tax in Nigeria has not been developed. There is, however, a legal basis for its operation when the government decides to commence the implementation of this new tax regime. Then, that would impose an additional burden on companies operating in Nigeria.

Climate Finance and the Climate Act

Climate finance refers to local, national and international funding that supports the actions required to address climate change. Climate finance is a fundamental part of the fight against climate change. While the lofty objective of having green economies where GHG emissions are cut down to the barest minimum is commendable, that is not realistic or feasible for most developing nations like Nigeria in near terms given their immediate need to sustain their economic growth. This is why some developing countries are pushing back on efforts to discourage the use of fossil fuels and demanding that, for them to be able to support the climate change agenda, they will require significant support (including financing) from developed countries.

In recognition of the challenges faced by developing countries, developed countries of the world have (as part of the Paris Agreement) agreed to provide financial support to developing countries to help them adapt to the effects of climate change while meeting their Nationally Determined Contributions (NDCs). It is in recognition of this fact that section 15 (1) of the Climate Act establishes the Climate Change Fund (Fund) which is to be maintained by the Council. One of the sources of income for the Fund is funding received from international organisations and funds due to Nigeria from meeting its prescribed NDCs. The Fund is to be applied towards a number of purposes including the funding of innovative climate change mitigation and adaptation projects across the country.

Conclusion

The world, as we used to know it, has changed and continues to change rapidly and, despite this, businesses must continue to grow through the use of fossil fuels. To have a sustainable environment, businesses must learn to finance transactions in the most environmentally efficient manner possible in light of the current efforts to mitigate the impact of climate change. While international cooperation among countries can help mitigate the effects of climate change, as the saying goes, "charity begins at home". On that basis, individual countries have the most important role to play in the collective fight against climate change. This is why the passage of the Climate Act is a welcome development as its implementation would provide Nigeria with a framework for financing the much needed infrastructural projects in a manner that takes into account its impact on the environment while also ensuring that Nigeria is on track to meet its goal of net-zero emissions by 2050 - 2070. Currently, the Climate Act is far from being fully operational as many of the measures required are yet to be put in place. The Nigerian government will need to take steps to ensure that the provisions of the Climate Act become fully operational in the coming months so as to put Nigeria on track to achieving its goals in the fight against the adverse effects of climate change. Companies should also start putting measures in place to meet the requirements of the Climate Act and also recognise that the implementation of the carbon tax may be commenced soon as an additional obligation.

Furthermore, the fight against climate change is a collective one and developing nations like Nigeria require significant support in order to meet their NDCs. It is vital that international organisations and developed countries continue to support Nigeria's efforts to combat climate change. Financial institutions should also put Nigeria's developmental needs into consideration in providing loans to businesses in the country as onerous obligations in respect of climate change could stifle the growth of such businesses.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.