A green bond is a debt finance instrument used to raise funds specifically for a "green" purpose such as a renewable energy project, a conservation program or a climate change mitigation/adaptation measure.

As BVI and Cayman finance lawyers, we are keen to promote our jurisdictions for the issuance of green bonds but, as island-dwellers, green and sustainability-linked finance is even more important to us. This is not just because we have thriving tourism economies that depend upon clean beaches and clear turquoise waters; climate change actually goes to the very habitability of the islands we call home. For us, it's personal.

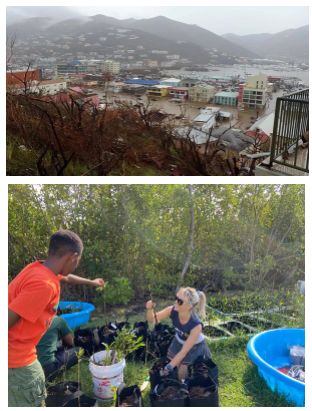

In 2017, Hurricane Irma ripped through the Eastern Caribbean and damaged or destroyed 4,000 homes. The economic cost of the disaster was estimated at over US$10 billion, but it would have been even worse had it not been for two lines of defence in the BVI. Just months earlier, a boulder structure had been engineered at Cane Garden Bay, based on a coastal dynamics study, to protect the coastal road from flooding. The revetment withstood the unprecedented storm surge of Category 5 Hurricane Irma and now serves as a regional model for coastal defence.

Equally, the BVI's red mangrove systems, which provide wildlife habitat, prevent erosion, and protect people from storm surge and swell, provided a natural buffering from Irma, which sadly took out some 90 percent of the island's mature mangroves. Volunteers continue to work with the Community College and the mangrove nurseries in restoring this natural defence.

Last year's Tropical Storm Grace pummelled Grand Cayman, destroying homes and bringing back painful memories for many residents who experienced Category 5 Hurricane Ivan in 2004. Ivan brought a storm surge of 8 to 10 feet, with wave heights of 20 to 30 feet, submerging much of the low-lying island for days afterwards and inflicting an estimated US$2.86 billion of damage to the Cayman Islands. As sea levels continue to rise, the likelihood of flooding and tsunamis increases for us and many of our small island neighbours.

Global investors who are increasingly keen to de-carbonise the economy will be well familiar with the myriad reasons to use a BVI or Cayman entity as a bond issuing vehicle: ease and efficiency of incorporation; modern, flexible corporate laws; light but effective regulation; tax and political neutrality; and the ability to structure an insolvency remote issuer by, inter alia, use of a restricted purpose company or inclusion of judicially-upheld limited recourse and non-petition wording.

What will be less well known are our efforts to protect the turtle-breeding grounds, to restore our mangrove board walks and to move towards solar and sustainable energy resources. Trust us, from where we're standing, we really see the value of the "green" in green bonds and finance.

Some of damage caused by Hurrricane Irma and Ellie assisting with replanting mangroves.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.