- within Criminal Law topic(s)

- with readers working within the Banking & Credit industries

Overview

This article is the second of a series analysing the African Continental Free Trade Area (AfCFTA) and its implications for the Mauritian business community. The first article explored the Protocol on Trade in Goods, while this second article explores the Protocol on Trade in Services.

As highlighted in Part 11, the AfCFTA is a landmark trade agreement, constituting the largest free trade area in the world in terms of the number of participating countries. The Agreement, which brings together 54 African countries and eight regional economic blocs, represents a combined population of 1.3 billion and total GDP estimated at USD 3.4 trillion. The AfCFTA aims to eliminate tariffs and non-tariff barriers on almost all trade in goods and services.

46 Member States ratified the Agreement as of August 2023. The Agreement comprises the following protocols: Trade in Goods, Trade in Services, Dispute Settlement, Competition Policy, Investment, and Intellectual Property Rights. The Protocol on Digital Trade and the Protocol on Women and Youth in Trade are expected to be finalised later this year (end 2023).

UNCTAD's Economic Development in Africa Report 2022 shows that African services exports doubled between 2005 and 2019, amounting to USD 124 billion in 2019 and representing 17% of total exports on average for the same period. The services sector is also a crucial part of Mauritius' economy: according to the World Bank, trade in services (imports and exports) reached 36% of GDP in 2022. The AfCFTA aims to create a single liberalised market for trade in services through the Protocol on Trade in Services (hereafter referred to as the Protocol) which was signed in 2019. Article 1(p) of the Protocol defines Trade in Services as the supply of service in the four different modes of supply as follows:

| Mode 1: Cross-border trade | Service flows that move from the territory of one State party to the Agreement into the territory of another state party | Example: Banking or accounting services provided from a country A via digital tools to residents in country B |

| Mode 2: Consumption abroad | Service consumer moves into another State party's territory to obtain a service | Example: A tourist from country A traveling to country B to enjoy hospitality services |

| Mode 3: Commercial presence | Service supplier of one State party establishing territorial presence through ownership or lease of premises in another State party's territory to provide a service | Example: Service provided in country A by domestic subsidiary of foreign hotel chain headquartered in country B |

| Mode 4: Presence of natural persons | Consists of a person of one State party entering the territory of another State party to supply a service | Example: Accountants, doctors or teachers from a country A entering to a country B to supply their services. |

Source: Author's elaboration based on Protocol on Trade in Services

Article 3 of the Protocol details the objectives of the Agreement for trade in services. These include among others: 1. enhancing competitiveness of services through economies of scale, reduced business costs, enhanced continental market access, and an improved allocation of resources including the development of trade-related infrastructure; 2. progressively liberalising trade in services across the African continent on the basis of equity, balance and mutual benefit, by eliminating barriers to trade in services; 3. pursuing services trade liberalisation in line with Article V of the General Agreement on Trade in Services by expanding the depth and scope of liberalisation and increasing, improving and developing the export of services, while fully preserving the right to regulate and to introduce new regulations.

Article 4 of the Protocol sets out the Most-Favoured Nation (MFN) treatment obligation which ensures that each Member State accords to services and service suppliers of other Member States treatment no less favourable than that which they accord to services and service suppliers of any third country. For example, if Mauritius opens services trade in certain sectors to the European Union through the Economic Partnership Agreement, according to the MFN treatment obligation, the island must extend the same preference to all other AfCFTA Member States. Article 4(6) also provides for deviations from the MFN treatment obligation, provided that any measures inconsistent with the latter are listed in an agreed MFN exemption list. The MFN exemption list will undergo regular reviews to determine which exemptions can be eliminated.

Article 7 of the Protocol provides for special and differential treatment to ensure increased participation in trade in services by all Member States irrespective of their levels of economic development. In particular, it allows for the progressive liberalisation of services sectors commitments and modes of supply and provides for flexibilities such as transitional periods on a case-by-case basis to accommodate specific economic situations and development needs. For example, supposing Madagascar, a least-developed country, faces economic challenges if it liberalises trade in services in the personal travel subsector. A longer transitional period may be granted to Madagascar for completely opening the market in this subsector to all other AfCFTA Member States.

Article 9 on Domestic Regulation recognises that countries have the right to regulate the services sector provided that all measures affecting trade in services are administered in a reasonable, objective, transparent and impartial manner. For example, an AfCFTA Member State may want to regulate the financial services sector to protect its citizens from financial fraud and to comply with international norms. The Member State could do so by setting up a regulatory body that would be responsible for licensing financial institutions, setting standards for financial products and investigating financial crimes. The regulatory body should be impartial and treat domestic and AfCFTA Member States' companies equally (national treatment conditions – see Article 20 below). With regard to monopolies and exclusive service suppliers, in accordance with Article 11 of the Protocol, Member States have an obligation to ensure that any monopoly supplier of a service does not contravene their obligations and specific commitments under the Protocol on Trade in Services.

Article 10 on Mutual Recognition allows an AfCFTA Member State to recognise the education, experience obtained, requirements met, licenses or certifications granted in another AfCFTA Member State. For example, if a lawyer who is licensed in Mauritius wants to practice law in Ghana, under Article 10, Ghana should recognise the lawyer's Mauritian license subject to certain requirements such as completing a Ghanaian legal training course or passing a Ghanaian bar exam. Such recognition can be based on an agreement between the countries or can be given independently. If a country has an agreement with one country for recognizing qualifications, it should give other AfCFTA countries a fair chance to join that agreement or negotiate a similar one. If recognition is done independently, other countries should have a chance to obtain recognition for their qualifications.

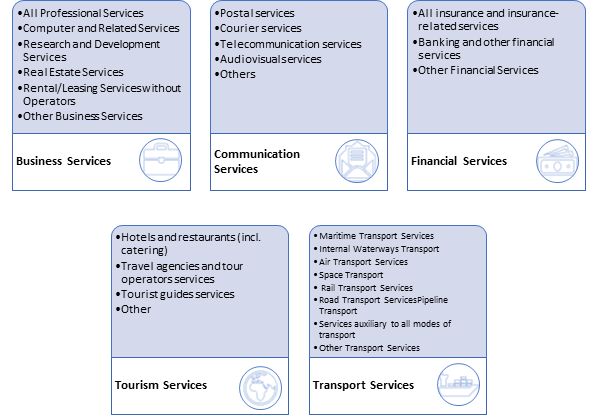

Article 18 on Progressive Liberalisation specifies that Member States will negotiate sector-specific obligations by developing regulatory frameworks for each sector, as necessary, taking into account best practices and acquis from the Regional Economic Communities (RECs) and the negotiated agreement on sectors for regulatory cooperation. It also stipulates that the liberalisation process will focus on the progressive elimination of the adverse effects of measures on trade in services to provide effective market access to boost intra-African trade in services. Article 18 includes a provision for a List of Priority Sectors to be annexed to the Protocol. The AfCFTA has prioritised five services sectors to be liberalised under the Agreement, namely business services; communications; financial services; transport; and tourism (see Figure 1). Other services sectors will be progressively liberalised over time.

Figure 1 Phase 1 of Trade in Services Liberalisation under the AfCFTA

Source: AfCTA Secretariat

Regarding market access, Article 19 stipulates that each Member State should accord services and service suppliers of other Member States treatment no less favourable than that provided for under the terms, limitations and conditions agreed and specified in its respective Schedule of Commitments. The Schedule of Specific Commitments lists the sectors and subsectors in which a Member State has made commitments to provide market access and national treatment to services and services suppliers from other Member States. When making a specific commitment, a Government binds the specified level of market access and national treatment. A specific commitment is also an undertaking not to impose new measures that would restrict entry into the market or operation of the service. The WTO website provides a comprehensive guide to reading services Schedules of Commitments and an example on how to read a schedule is provided below.

Article 19 also establishes a list of measures that a Member State is prohibited from maintaining or adopting in sectors where market access commitments have been undertaken, unless otherwise specified in the Member State's Schedule of Commitments. These measures include:

- Limitations on the number of service suppliers;

- Limitations on the total value of service transactions or assets;

- Limitations on the total number of service operations or on the total quantity of service output;

- Limitations on total number of natural persons that may be employed in a particular service sector or that a service supplier may employ;

- Measures which restrict or require specific types of legal entity or joint venture through which a service supplier may supply a service;

- Limitations on the participation of foreign capital.

Article 20 on National Treatment establishes the obligation for Member States to provide services and service suppliers of other Member States party to the AfCFTA, a treatment no less favourable than it offers local services and service suppliers. National treatment can be subject to conditions and qualifications, which must be agreed between Member States concerned, and specified in the Member State's Schedule of Commitments. For example, if a Kenyan accounting company would like to open an office in Nigeria, under Article 20 (assuming that Nigeria has liberalised commercial presence for accounting services), Nigeria would be obligated to treat the Kenyan company just like a domestic company. Thus, the Kenyan company would be allowed to open an office, face the same administrative requirements, hire local employees and compete with other Nigerian firms.

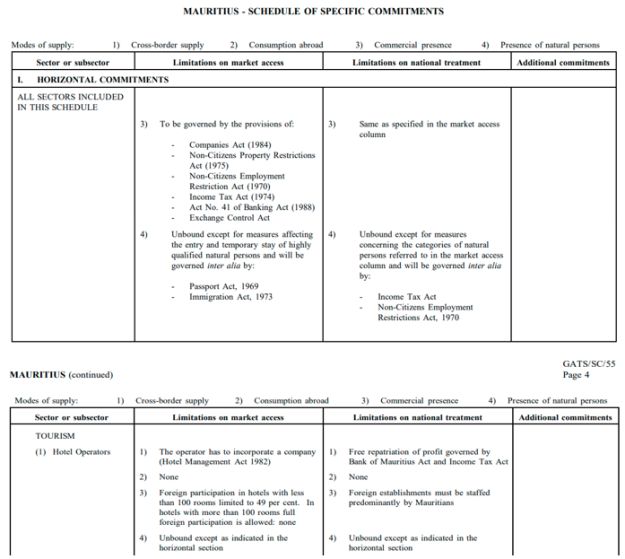

Figure 2 provides a snapshot of Mauritius' Schedule of Commitments in the General Agreement of Trade in Services (GATS). The Horizontal Commitments refer to the limitations that apply to all the sectors in the schedule. Horizontal commitment should be read together with specific commitments. For example, commercial presence for all services sectors is subject to the Non-Citizens Property Restriction Act. With regard to hotel operators, commercial presence requires foreign equity in hotels with less than 100 rooms to be limited to 49% whereas there are no restrictions on foreign equity in hotels with more than 100 rooms. The limitation on national treatment also requires that hotels be staffed predominantly by Mauritians.

Figure 2 Example of Mauritius' Commitments for Hotel Services in the GATS

Source: Mauritius Trade Easy Portal

As of August 2023, 41 countries, including Mauritius, had submitted their initial market access offers for Trade in Services. The negotiations to finalise the Schedules of Commitments are ongoing, and market access offers have not yet been made public. As such, trading under the Protocol on Trade in Services has not yet begun.

Once finalised, the AfCFTA will reduce barriers to trade in services providing a major opportunity for Mauritian companies to expand into the African continent. A clear understanding of the Schedules of Commitments and the regulatory frameworks is crucial for the Mauritian private sector to tap into the opportunities offered by the AfCFTA Protocol on Trade in Services. It is therefore imperative for Mauritian businesses to keep up to date with the negotiations and developments related to the implementation of the Protocol of Trade in Services.

International Economics Consulting Ltd (IEC) is an independent consultancy firm working with national and international development partners, governments, and the private sector to create value and promote sustainable growth and development. With extensive experience in trade policy, research, and negotiations, IEC can support governments and businesses deal with unfair trade practices and unforeseen consequences of free trade by providing analytical expertise and support.

References

1. AfCFTA Treaty – Consolidated Text, African Union Website, Available at: https://au.int/sites/default/files/treaties/36437-treaty-consolidated_text_on_cfta_-_en.pdf

2. Economic Development in Africa Report 2022 – Chapter 2, UNCTAD Website, Available at: https://unctad.org/system/files/official-document/aldcafrica2022_Ch2_en.pdf

3. General Agreement on Trade in Services – Article V, WTO Website, Available at: https://www.wto.org/english/res_e/publications_e/ai17_e/gats_art5_jur.pdf

4. Mauritius GATS Schedule, Mauritius Trade Easy Portal, Available at: https://www.mauritiustrade.mu/ressources/pdf/schedule-specific-commitments.pdf

5. Trade in Services in AfCFTA, African Union Website, Available at: https://au-afcfta.org/trade-areas/trade-in-services/

6. World Bank Open Data – Mauritius Trade in Services, World Bank Website, Available at: https://data.worldbank.org/indicator/BG.GSR.NFSV.GD.ZS?locations=MU

Footnote

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.