- within Government, Public Sector, Energy and Natural Resources and Criminal Law topic(s)

- in Asia

- with readers working within the Law Firm and Construction & Engineering industries

IMPORTANT CASE LAWS

GOODS AND SERVICES TAX (GST)

- The Petitioner entered into an agreement with its overseas

customers for promoting their goods in India. In lieu of providing

such services, the Petitioner received commission from overseas

customers in convertible foreign exchange.

The Petitioner filed Writ Petition (WP) challenging the constitutional validity of intermediary services specified under Section 13(8)(b) of the Integrated Goods and Services Tax Act, 2017 (the IGST Act) before High Court. The Division Bench referred the matter to the Chief Justice.

It was contended by the Respondents that since the foreign exporter (overseas customers of Petitioner) sells its goods to the Indian importer and which is as a consequence of the services provided by the Petitioner to its overseas customers, the transaction of export of service changes its character as an intra-State transaction.

The Chief Justice, while referring to the validity of Section 13(8)(b) and Section 8(2) of IGST Act, did not discuss their vires on the touchstone of Article 14 and 19(1)(g) of the Constitution of India quoting that these provisions are well-settled by the previous judgments. The High Court held that the state cannot impose tax on the services rendered by intermediaries to recipient located outside India. It further held that the provision of intermediary is legal, valid and constitutional provided that such provisions are confined in operation to the provisions of the IGST Act only.

Takeaway: Intermediary Services provided under Section 8(2) of the IGST Act is constitutionally valid and amenable to IGST.

[Dharmendra M. Jani Vs. UOI, CGST, W.P. No. 2031/2018, Order dated April 18, 2023 (High Court, Bombay)]

- The Petitioner, an E-Commerce Operator (ECO), filed WP

challenging the constitutionality validity of clause (iii) and (iv)

of Notification No. 16/2021-CT(R) and clause 1(i) and 2(i) of

Notification No. 17/2021-CT (R), both dated November 18, 2021

(Impugned Notifications) withdrawing the exemption from payment of

GST on passenger transportation services by a non-air-conditioned

stage carriage when booked through an ECO as ultra vires

Article 14 of the Constitution of India and Section 9(5) and

Section 11 of the Central Goods and Services Tax Act, 2017 (the

CGST Act).

The High Court held that the statue itself recognizes and defines ECOs as independent and distinct class from the individual service providers and equality cannot be sought between unequals. Thus, the Impugned Notifications are not violative of Article 14 or contrary to Sections 9 and Section 11 of the CGST Act. It has been further held that Impugned Notifications do not create unreasonable classification on the basis of 'mode of booking'. The WP filed by the Petitioner was accordingly dismissed.

Takeaway: GST applicable on passenger transport services booked through e-commerce platforms.

[Uber India Systems Private Limited & Ors., Vs. UOI & Anr., W.P.(C) 14048/2021, Order dated April 12, 2023 (High Court, New Delhi)]

- The Petitioner is an Indian Branch Office of M/s Ernst &

Young Limited, UK (E&Y Limited). E&Y Limited, acting

through the Petitioner, entered into service agreements for

rendering professional consultancy services to various overseas

entities of Ernst & Young group (EY Entities) on arm's

length basis. The Petitioner applied for refund of input tax credit

(ITC) availed which was used for rendering professional services

for the period December 2017 to March 2020. The Department issued

show cause notice (SCN) and subsequently, rejected refund claimed

by the Petitioner on the ground that the services provided by the

Petitioner were rendered on behalf of its UK head office and is

accordingly acting as an Intermediary, and thus, does not qualify

as 'export of services'. On appeal, the Appellate Authority

upheld the refund rejection order. Subsequently, the Petitioner

filed WP challenging the orders rejecting the refund claimed.

The High Court held that the Petitioner was not involved in arranging or facilitating goods/ services and has rather provided professional consultancy services to EY Entities on its own account. Accordingly, the supply made by the Petitioner cannot be termed as intermediary services. The Court further held that the place of supply of such services rendered by the Petitioner was that of service recipient, i.e., outside India, and hence, the services rendered by the Petitioner clearly qualify as 'export of services' as defined under Section 2(6) of the IGST Act. Accordingly, the Department was directed to process the refund application filed by the Petitioner.

Takeaway: Professional services provided by Indian Entity to foreign group companies qualifies as 'export of services'.

[M/s Ernst and Young Limited Vs. The Additional Commissioner, WP (C) No. 8600 of 2022, Order dated March 23, 2023 (High Court, Delhi)]

- The Petitioner is engaged in designing, developing, building

and deploying various types of advanced imaging and sensor systems

to sense, understand and control complex environments. The

Petitioner exported various unique products during the period May

2018 to March 2019. The Petitioner filed refund applications and

claimed refund of unutilized ITC under Section 54(3) of the CGST

Act read with Rule 89 of the Central Goods and Services Tax Rules,

2017 (the CGST Rules) for the period May 2018 to March 2019.

Subsequent to filing of the refund application, Rule 89(4)(c) of

the CGST Rules was amended w.e.f., 23.03.2020, by virtue of which

the definition of 'turnover of zero-rated supply of goods'

was amended. As per the amended definition, turnover of zero-rated

supply of goods means the value of zero-rated supply of goods made

during the relevant period without payment of tax under bond or

letter of undertaking or the value which is 1.5 times

the value of like goods domestically supplied by the same or,

similarly placed supplier, as declared by the

supplier, whichever is less, other than the turnover of supplies in

respect of which refund is claimed under sub-rules (4A) or (4B) or

both of Rule 89(4C) of the CGST Rules.

The Department rejected the refund application on the ground that the Petitioner did not furnish proof, of value of "like goods" domestically supplied by the "same or, similarly placed, supplier" as required under the amended Rule 89(4)(c) of the CGST Rules. The Petitioner argued that the refund claims were filed prior to the amended Rule, hence the same would not apply, and also challenged the validity of definition of 'turnover of zero-rated supply of goods' under the amended Rule 89(4)(c) of the CGST Rules.

While setting aside the amended portion of Rule 89(4)(c) of the CGST Rules as being ultra vires the provisions of the CGST Act and the IGST Act and also violative of Article 14 and Article 19 of the Constitution of India, the High Court held that Rule 89(4) of the CGST Rules bears no rational nexus with the objective sought by Section 16 of the IGST Act. It held that Section 16(3) of the IGST Act allows refund of ITC paid in the course of making a zero-rated supply, as the same covers exports as well as supplies to Special Economic Zones (SEZ). Section 16 of the IGST Act seeks to make exports tax-free by 'zero-rating' while amendment to Rule 89(4)(c) of the CGST Rules restricts the quantum of refund of tax available to the expended in making such exports. Consequently, inclusion of domestic turnover in the definition of 'zero rated supply' which is meant to cover only exports, is clearly arbitrary and unreasonable. Accordingly, it held that the amendment of definition of 'turnover of zero-rated supply of goods' is ultra vires the CGST Act and IGST Act and violative of the Constitution of India.

Takeaway: Rule 89(4)(c) of the CGST Rules as amended declared unconstitutional.

[M/s Tonbo Imaging India Private Limited Vs. UOI, WP No.13185/2020 (T-RES), Order dated February 16, 2023 (High Court, Karnataka)]

- The Appellant is engaged in the business of construction and

sale of residential apartments. The Appellant sought advance ruling

as to whether (i) other charges received by the Appellant such as

water connection charges, electric meter installation, deposit for

meter, development charges, and legal fees shall be treated as

consideration for construction services of the Appellant or

consideration for independent services of the respective head?;

(ii) What will be effective rate of GST applicable on services

underlying such other charges?

The Authority for Advance Ruling (the AAR) held that other charges do not form part of composite supply, and hence, cannot be treated as a consideration for construction services but will qualify as consideration received against supply of independent services of the respective heads. It has been further held that other charges would be taxable as per the respective SAC codes prescribed under the Rate Notification. Being aggrieved by the order of AAR, the Appellant filed an appeal before the Appellate Authority for Advance Ruling (the Appellate AAR).

The Appellate AAR held that some services like water connection charges, electric meter installation and deposit of meter, development charges and legal fees, are inextricably linked to services by way of construction of residential apartment /dwelling, and are a part of bundled service, where principal service is that of construction of residential apartment /dwelling. Further, it has been held that the rate of tax applicable on such services shall be 12% as applicable to the construction service. However, other charges such as club house maintenance, share of municipal taxes, share money, entrance fees etc. do not pass the muster of indicators of a bundled service, hence, to be treated as a supply of independent services, taxable as per the respective SAC codes and rate of tax thereon.

Takeaway: Development charges, water connection charges, legal fees etc. are inextricably linked to services by way of construction of residential apartment /dwelling and hence taxable as part of bundled services.

[Puranik Builders Limited, Order No. MAH/AAAR/DS-RM/19/2022-23, Order dated March 30, 2023 (Appellate AAR, Maharashtra)]

- The Applicant is engaged in the business of manufacture, supply

and distribution of various pharmaceutical products. The Applicant

has provided canteen facility to its employees at the factory and

its corporate office.

The Applicant sought advance ruling as to whether subsidized deduction made by the Applicant from salary of the employees who are availing food in the factory/corporate office shall be considered as a 'supply' under Section 7 of the CGST Act? (ii) Whether the Applicant is eligible to claim ITC on GST charged by the canteen service provider?

The AAR held that Central Board of Indirect Taxes and Customs vide Circular No. 172/04/2022- GST dated July 6, 2022 has clarified that the subsidized deduction made by the Applicant from the employees who are availing food in the factory/corporate office would not be considered as a 'supply' under Section 7 of the CGST Act. Further, as regards availability of ITC, it has been held that under the present facts, it is obligatory for the Applicant to provide canteen facility to its direct employees under the Factories Act, 1948, and therefore, ITC would be available to the Applicant on GST charged by the canteen service provider.

Takeaway: GST not leviable on subsidized food to employees in factory/corporate office.

[Cadila Pharmaceuticals Limited, Advance Ruling No. GUJ/GAAR/R/2023/14, Order dated March 31, 2023 (AAR, Gujarat)]

SERVICE TAX

- The assessee provided 'corporate guarantees' to its

subsidiaries located within and outside India without any

consideration. The adjudicating authority issued SCN proposing

demand of service tax alleging that the assessee has provided

'banking or financial service' by issuing corporate

guarantees to its subsidiary and the same is a taxable service

under the Finance Act, 1994.

The assessee argued that no consideration either monetary or non-monetary had been received against the issuance of 'corporate guarantees' and hence, in absence of any consideration, such transaction does not fall within the purview of "service" defined Section 65B(44) of the Finance Act, 1994. Moreover, it was highlighted that the Department has made no attempt in the SCN to prove that the assessee has received any consideration or benefit from their subsidiary on account of issuance of corporate guarantees.

The Supreme Court held that the assessee has not received any consideration while providing corporate guarantee to its group companies. Thus, in the absence of any flow of consideration from subsidiary companies to the assessee, issuance of corporate guarantee cannot be held as supply of taxable service under the Finance Act, 1994.

Takeaway: Corporate guarantee provided to a group company without consideration is not leviable to service tax.

[CGST & CE Vs. Edelweiss Financial Services Ltd, Civil Appeal No. 5258/2023, dated March 17, 2023 (Supreme Court)]

- The assessee, engaged in the business of running Duty Free

Shops (DFS) at Arrival and Departure Terminals at the International

Airports, filed refund claim for refund of service tax paid on

input services utilized by it for making exports from DFS.

The refund claim was rejected by the Department, against which relief was provided by the Customs Excise Service Tax Appellate Tribunal (the CESTAT). Aggrieved by the CESTAT's order, the Department filed the instant writ petition.

The assessee contended that it is an accepted legal fiction that DFS is located outside customs frontiers of India and transaction of DFS are said to take place outside India. Further, assessee submitted that the legal cell of Department has not filed any appeal in Higher Courts against the various rulings of High Courts and Supreme Court wherein the Courts have held that transactions of DFS is said to have taken place outside India.

The Supreme Court held that duty free shops, whether in the arrival or departure terminals, being outside the customs frontiers of India, cannot be saddled with any indirect tax burden and any such levy would be unconstitutional. Therefore, if any tax is levied, the same cannot be retained and the DFS would be entitled for refund of the same without raising any technical objection including that of limitation. Accordingly, the Court dismissed the Department's petition.

Takeaway: DFS can claim refund of service tax paid on input services.

[CGST & CE Vs. Flemingo Travel Retail Ltd, Civil Appeal No. 24336/2022, Order dated April 10, 2023 (Supreme Court)]

CENTRAL EXCISE

- The Appellant, a manufacturer, was paying excise duty as per

Section 4A of the Central Excise Act, 1944 (CEA) and sought

clarification from the Department regarding the applicable excise

duty. On receiving clarification, it changed its position and

started to pay excise duty as per Section 4 of CEA. Consequently,

it had paid an excess excise duty for which it filed a refund claim

before the Department. The Department rejected the refund claim on

the grounds of unjust enrichment. Consequently, the Appellant filed

an appeal before the CESTAT which was also rejected on the grounds

that issuance of a credit note will not enable the Appellant to get

refund as it is hit by unjust enrichment.

Aggrieved by this order, the Appellant approached the High Court and a direction was issued to the CESTAT to examine the case again. The Appellant submitted declarations evidencing that the burden of duty has not passed on to the wholesalers/distributors as they have returned the excess duty collected by cheque to their customer and hence unjust enrichment is not applicable. The Department contended that unjust enrichment does not apply where credit has been passed on to any person including the end customer. The credit note has been given to only wholesalers/distributors who are not the ultimate customers. Further, the declaration submitted does not convey that the duty burden has not been passed on to the end customers by the wholesalers/distributors.

The CESTAT, while dismissing the appeal, held that the Appellant has not been able to satisfy the condition to overcome the unjust enrichment clause that the receiver of goods has not taken the Cenvat Credit.

Takeaway: Refund not allowable where sufficient evidence not adduced to prove non applicability of unjust enrichment.

[Galaxy Medicare Ltd Vs. CCE & ST, Excise Appeal No. 298/2009, dated March 2, 2023 (CESTAT, Calcutta)]

- The assessee was engaged in rendering services which were used

for both types of goods i.e., dutiable as well as exempted. It did

not avail any Cenvat credit of the same. However, later on, the

assessee intimated jurisdictional authorities that the Company

intended claim proportionate Cenvat credit. In response, the

jurisdictionalSuperintendent directed the assessee to not avail

such Cenvat credit and that recovery along with penal actions would

be initiated if the assessee availed/ utilized the Cenvat

credit.

Aggrieved by such letter, the assessee filed an appeal before the Commissioner (Appeals), which was allowed. Consequently, the Department filed appeal against the Commissioner (Appeals) order based on the contention that letter of the Superintendent is not an order appealable.

The CESTAT held that Cenvat credit has been sought on dutiable goods, which is in accordance with the Cenvat Credit Rules, 2004. It further held that the Superintendent, in its letter has clearly mentioned while denying the Cenvat credit that in case of availment, penal action would be taken against the assessee, and thus is a clear decision given by proper officer. While rejecting the Department's appeal, the CESTAT held that if the Department's contention is accepted then the assessee will not be left with any remedy against denial of substantial benefit. Accordingly, Commissioner (Appeals) order was upheld as being legal and correct.

Takeaway: Written communication by proper officer stating its decision is an appealable order.

[CE & ST Vs. Sanofi India Ltd, Excise Appeal No. 10631/2013-DB, Order dated April 11, 2023 (CESTAT, Ahmedabad)]

CUSTOMS

- The Appellant imported canned pineapple slices and the same

were cleared for home consumption on the basis of self-assessed

Bill of Entry (BOE). Thereafter, the Appellant requested the Deputy

Commissioner (DC) to re-assess the BOE classifying the imported

goods under different tariff heading. The DC accepted the

Appellant's request and passed the re-assessment order. The

Department filed an appeal before the Commissioner (Appeals)

against the Re-assessment Order. The Commissioner (Appeals) held

that self-assessment could be altered only through appeal

proceedings and not through re-assessment and accordingly the

Re-assessment Order was set aside as not being legal since goods

were already given out of charge by the Officer. Aggrieved by such

order, the Appellant filed the appeal before the CESTAT.

The CESTAT, while rejecting the Appeal, held that there can be no re-assessment after an order permitting clearance of goods for home consumption is issued. It further held that once the goods are cleared for home consumption, the same cease to be imported goods. Even the Indian Customs Electronic Data Interchange System (ICES) does not permit re-assessment of BOE once an order permitting clearance of goods is given for the bill of entry. The CESTAT upheld order of the Commissioner (Appeals) that order of self-assessment can only be challenged by way of an appeal before the Commissioner (Appeals).

Takeaway: Re-assessment of goods not permitted once goods are cleared for home consumption.

[M/s Holy Land Marketing Private Limited Vs. CC, CA No. 51055 of 2020, Order dated January 31, 2023 (CESTAT, New Delhi)]

- The Petitioner, a Telecommunications Solutions provider and

manufacturer of telecom equipment, imports hardware for rendering

services. The Department of Revenue Intelligence (DRI) initiated an

investigation challenging the classification of the imported goods

and the Petitioner's BOEs were provisionally assessed in the

ICES. No document representing the assessment was provided to the

Petitioner and only a letter (the impugned letter) referring to the

provisional assessment on the BOEs and the alleged

misclassification was issued, wherein demand of differential duty

and interest was raised upon the Petitioner.

The Petitioner filed a writ petition and contested that since the demand is not preceded by either a show cause notice or an order revising the BOEs, the same has no legal basis and is liable to be set aside. The Petitioner further highlighted that the impugned letter has been issued without the Document Identification Number (DIN) and hence, stands invalid.

The High Court held that since the demand was not preceded by either a show cause notice or order revising the bills of entry (self-assessments), it has no basis and is liable to be set aside. Further, the impugned letter does not contain DIN, and it is contrary to the Circular no. 37/2019 dated November 5, 20219 and Circular no. 43/2019-cus dated December 23, 2019 which imposes responsibilities on the departmental officers to generate DIN for all the official communications. Accordingly, the demand raised by the impugned letter was dropped.

Takeaway: Generation of DIN is mandatory for all official communications

[M/s Ericsson India Private Limited Vs. Dy. Commissioner of Customs, W.P.No.14776 of 2020, Order dated March 16, 2023 (High Court, Madras)]

INDIA REGULATORY & TRADE HIGHLIGHTS

FOREIGN TRADE

- The Respondent filed WP against the Notification No.

79/2017-Cus. dated October 13, 2017 (the Notification), which

inserted "pre-import conditions" in order to avail

exemption of Integrated Goods and Services Tax (IGST) and

Compensation Cess for exports made under Advance Authorizations

(AAs). Subsequently, pre-import conditions were removed with effect

from January 10, 2019. The Respondent filed WP against the validity

of the pre-import conditions from October 13, 2017 till January 10,

2019 (the disputed period).

The High Court held that such impositions of the pre-import conditions do not meet with the test of reasonableness and are not in consonance with the intent of allowing duty-free import under AAs, and accordingly, the same were held to be ultra vires the Advance Authorization Scheme as contained in the Foreign Trade Policy, 2015-2020 (the FTP). Aggrieved by such order, the Department filed appeal before the Hon'ble Supreme Court.

The Supreme Court, while upholding the Notification, set aside the High Court's order and held that the FTP empowers the Director General of Foreign Trade (DGFT) to impose pre-import conditions in relation to any goods in addition to those specified in Appendix-4J of the Handbook of Procedures (the HBP), which has not been discussed by the High Court in its order. It has been further held that the exporter's argument that there is no rationale for differential treatment of BCD and IGST under AA Scheme is without merits as BCD is a custom duty levied at the point of import with no credit, whereas IGST is levied at multiple points and input tax credit gets into the stream till the point of end user.

Takeaway: Pre-import condition required to be fulfilled by exporters to claim exemption of IGST and Compensation cess on imports made under Advance Authorisation during disputed period.

[UOI Vs. M/s Cosmo Films Limited Civil Appeal No. 290 of 2023, Order dated April 28, 2023 (Supreme Court of India)] - The Petitioner is engaged in manufacturing and exporting

refined white sugar and claiming benefit under the Remission of

Duties and Taxes on Exported Products (the RoDTEP) scheme on such

exports. DGFT issued Notification dated May 24, 2022 limiting the

quota of export of sugar. Basis the mentioned Notification, the

revenue authorities disputed that the RoDTEP benefits claimed by

the Petitioner post June 01, 2022 and alleged that export of sugar

made post June 01, 2022 would be treated as restricted goods and

that the RoDTEP benefit is admissible to the goods where the export

was restricted under the Foreign Trade Policy.

The High court held that the Petitioner is entitled to the export benefits under the RoDTEP scheme in respect of export of white refined sugar at the rate permissible. Further, even if such benefits are not claimed or mentioned in the shipping bills, the Petitioner is allowed to make necessary application seeking such benefits and time lag in filing such application would not make such claims as time-barred. Moreover, such non-mentioning of the benefits in the shipping bills by the Petitioner will not be treated as waiver of the benefit.

Takeaway: Non-mentioning of RoDTEP benefits in shipping bills does not tantamount to waiver of right and separate application filed to claim such benefit would not render the claim time-barred.

[M/s Shree Renuka Sugars Ltd Vs. UOI, R/Special Civil Application No. 2186 of 2023, Order dated April 13, 2023 (High Court, Gujarat)]

1.1. Foreign Trade Policy Notifications

- The HBP, 2023 notified w.e.f., April 1, 2023. [Public Notice No. 1/2023 dated April 1, 2023].

- Amnesty scheme introduced for one-time settlement of default in export obligation by Advance and Export Promotion Capital Goods (EPCG) authorization holders. [Public Notice No. 2/2023 dated April 1, 2023].

- Procedure notified for applying for Amnesty scheme for one-time settlement of default in export obligation by Advance and EPCG authorization holders. [Policy Circular No. 1/2023 dated April 17, 2023].

- Interest liability capped at 100% of exempted duties for one time settlement of default in export obligation by Advance and EPCG authorization holders under the Amnesty scheme. [Public Notice No. 7/2023 dated April 18, 2023].

- Procedure specified for filing application/issuance of Registration Certificate for import of Isopropyl Alcohol falling under ITC (HS) Code 29051220, subject to Country-wise Quantitative Restrictions, for the year 2023-24. [Public Notice No. 4/2023 dated April 11, 2023].

- Aayat Niryat Forms (ANFs) and Appendices notified under the FTP (2015-20) extended till May 31, 2023 or till the date on which new ANFs and Appendices are notified under the FTP 2023, whichever is earlier, insofar as they are not inconsistent with the provisions of the FTP, 2023 and the HBP. [Public Notice No. 5/2023 dated April 11, 2023].

- The updated Appendices and ANFs of Foreign Trade Policy 2023 notified with immediate effect. [Public Notice No. 10/2023 dated April 26, 2023].

- The validity of ad-hoc norms for authorizations where Standard Input Output Norms (SION) do not exist, extended up to March 31, 2026, for ease of doing business and reduction of transaction cost. [Public Notice No. 09/2023 dated April 25, 2023].

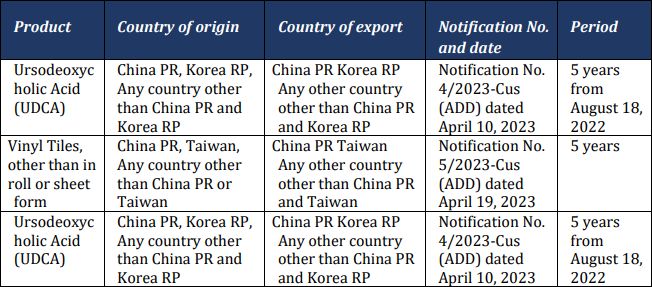

THE DIRECTORATE GENERAL OF TRADE REMEDIES, MINISTRY OF COMMERCE & INDUSTRY

- Final Findings regarding Sunset Review Anti-Dumping Duty Investigation on import of:

MINISTRY OF FINANCE

- Final Findings regarding Sunset Review Anti-Dumping Duty Investigation on import of:

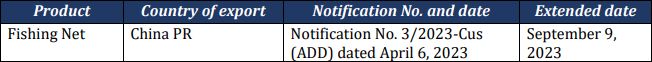

- Extension of Levy of Anti-Dumping Duty on import of:

INDIAN GST HIGHLIGHTS

INDIA GST HIGHLIGHTS

- Advisory issued on restriction on reporting e-invoices

on Invoice Registration Portal (IRP) portal

- Taxpayers having Annual Aggregate Turnover (AATO) more than INR 100 Crores required to generate all documents types for which Invoice Reference Number (IRN) is generated, i.e., invoices, credit notes and debit notes, within 7 days from the date of such document, w.e.f. May 1, 2023 onwards.

[GST portal update dated April 13, 2023]

- Advisory issued on bank account

validation

- To ensure that a Tax Payer provides correct bank account number, functionality for bank account validation has been integrated with the GST System. The bank account status detail will be sent to the Tax Payer on registered e-mail and mobile number after validation.

[GST portal update dated April 24, 2023]

- New facility to verify document Reference Number (RFN)

mentioned on offline communications issued by State GST

authorities

- Facility of RFN generation for physically generated correspondence sent by state GST officer to taxpayer has been provided. Taxpayer can verify RFN on the GST portal to check the authenticity of non-system generated communication.

[GST portal update dated April 28, 2023]

SCOPE OF INTERMEDIARY SERVICES AN UNADDRESSED ISSUE KNOCKING THE DOOR AGAIN!

Scope of Intermediary Services – an unaddressed issue knocking the door again!

The classification of 'marketing and promotional support services' provided by foreign education consultants as 'intermediary services' has been an issue of discord under the Indirect tax laws since time immemorial. Contradictory advance rulings pronounced under the erstwhile regime and the GST regime despite having similar provisions has further added fuel to this continued conflict. Recent notices and summons issued by the Directorate General of GST Intelligence (the DGGI) to dozens of education consultants, have again ignited the debate over scope of intermediary services under GST laws.

The issue arises because of the wide interpretation of the term 'intermediary' adopted by the revenue authorities to even classify 'marketing and promotional support services' under the ambit of intermediary services. Foreign education consultants have also been the victim of such interpretational ambiguity. It becomes pertinent to note that in many instances the revenue is inclined towards classifying 'education consultants' services under 'intermediary' considering them as recruitment agent, who are facilitating the recruitment or enrolment of students to foreign universities. On the other hand, education consultants argue that they are engaged in the provision of 'marketing and promotion services' on their own account. This tug of war between revenue authorities and education consultants has been a controversy since service tax regime and has continued into the GST realm also due to similar provisions related to 'intermediary services' under both the regimes.

One such classic example of this dispute is the case of Sunrise Immigration Consultants1 wherein it has been held that since the appellant did not arrange or facilitate main service, i.e., education rendered by colleges, but was engaged in provision of auxiliary services, it could not be classified as an 'intermediary'. However, under the GST regime, on similar facts, the Appellate AAR2 in the case of Global Reach Education3 has ruled a complete contrary ruling and held that the definition of 'intermediary' under the GST law is different from the erstwhile regime as under GST, an 'intermediary' is an entity who arranges/facilitates the supply of services of another entity, which may include ancillary services. Whereas, under the erstwhile regime, an intermediary arranges/facilitates provision of services of the main service provider. Accordingly, the appellant engaged in promoting courses of the foreign universities, would be considered as 'intermediary' under the GST Law. These contrary rulings under the erstwhile regime and GST law have only added to the existing perplexity on the scope of intermediary services.

An important aspect that courts have referred while deciding the scope of intermediary services are terms of the contract entered between the parties. For instance, in the case of Asahi Kasei4, the AAR gave due weightage to the contractual terms and held that the applicant is not involved in the conclusion of contracts, acceptance of sale orders, invoicing, determination of sales price, hence, the marketing services provided by the applicant could not be classified as intermediary services. Another such ruling in the case of IDP Education5, wherein basis the contract terms, it was held that the appellant is providing marketing and promotional services as a part of its subcontract, on its own account and the same could not be classified as 'intermediary services'.

On the basis of the above judicial precedents, it is evident that contractual terms are of paramount importance while deciphering the nature of services rendered by a service provider, and in determining its taxability. Now, foreign education consultants are engaged in the provision of services related to promotion of foreign universities' courses in India, and do not have any role in the final placement of students with the Universities. Further, post placement by the university, students directly make payment to the University. The consultants generally enter into contract with the students limiting their liability to education counselling only. Thus, if the agreement terms with the foreign universities clearly carve out the relationship and responsibilities between the parties being more akin to the marketing and business promotion services, there are chances that such services provided might not classify as 'intermediary services'.

Given the ongoing disputes regarding the scope of Intermediary Services, the Government vide the Circular6 has clarified regarding the parameters to be checked before classifying any activity under such category. In terms of the Circular, an indicative reference has been made that the authorities shall analyze the facts and terms of contract while applying the parameters on a transaction to decipher whether it qualifies as Intermediary services or not.

Accordingly, it is crucial that before classifying any activity as that of an intermediary, revenue authorities should not turn a blind eye to the contractual terms of the parties involved. At the same time, it is of equal importance for taxpayers to carve out their relationship with the contractor unambiguously in the agreement to avoid unnecessary litigation.

Footnotes

1. M/s Sunrise Immigration Consultants Pvt Ltd Vs Commissioner of Central Excise and Service Tax, Chandigarh, Appeal No. ST/52205/2015, order dated March 16, 2018

2. Appellate Authority for Advance Ruling

3. West Bengal AAAR in the case of M/s Global Reach Education Services Private Limited, Appeal Case No. 01/WBAAAR/Appeal/2018 dated April 26, 2018

4. Maharashtra Authority for Advance Ruling in the case of Asahi Kasei India Private Limited, Maha-GST-ARA-35-B-108 dated September 5, 2018

5. M/s IDP Education India Private Limited Vs Additional Director General of Central Excise Intelligence, CESTAT, New Delhi, Final Order No. 51901/2021 dated October 28, 2021

6. Circular No. 159/15/2021-GST dated September 20, 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.