- within Government, Public Sector, Criminal Law, Litigation and Mediation & Arbitration topic(s)

- with readers working within the Law Firm and Construction & Engineering industries

GOODS AND SERVICES TAX (GST)

a. The Petitioner purchased goods from Global Bitumen (the supplier), made payment from its bank account against the invoice raised and claimed input tax credit (ITC) for such purchases.

The adjudicating authority vide the impugned order refused to grant benefit of ITC on purchase from the supplier and also imposed penalty and interest on the ground that the supplier is fake and non-existing. The Department alleged that the Petitioner failed to verify genuineness and identity of the supplier before entering into the transaction, and that the registration of the supplier was cancelled with retrospective effect covering the period of transaction with the Petitioner. Aggrieved by the order, the Petitioner preferred appeal before Joint Commissioner, who upheld the adjudicating authority's order. Aggrieved by the order passed by the Joint Commissioner, the Petitioner preferred instant Writ Petition (WP).

The High Court while setting aside the impugned order held that at the time of transaction, the supplier was a registered taxable person with the Government record and the amount was paid through bank by the Petitioner. It has been held that without proper verification, it cannot be said that there was any failure of compliance of obligations by the Petitioner. The Department rejected the claim of the Petitioner merely due to cancellation of the supplier's registration. Accordingly, the Department was directed to consider the Petitioner's claim afresh.

Takeaway: ITC cannot be denied merely because of revocation of the supplier's registration

[M/s Gargo Traders Vs. The Joint Commissioner & Ors., WPA 1009 of 2022, Order dated June 12, 2023 (High Court, Calcutta)]

b. The Petitioner, a proprietorship firm, was subjected to survey wherein the place of business was not found as disclosed in the registration certificate and hence, was treated as bogus firm. Subsequently, registration of the Petitioner was cancelled and the application for revocation of registration was also rejected. Aggrieved by the rejection order, the Petitioner preferred an appeal, which was dismissed vide the impugned order. Subsequently, the Petitioner preferred instant WP.

The High Court, while relying upon the judgement of Apparent Marketing Private Limited Vs. State of U.P.1, quashed the impugned order on the basis that since the registration is granted by the Department, there exists a presumption that registration had been granted upon due verification of necessary facts. Moreover, consequences of cancellation of registration are serious as it takes away the fundamental right to engage in a lawful business activity from a citizen therefore, heavy burden lies on the Department to prove the facts that warrant cancellation of registration. Further, since the word "bogus" has not been used by the statute, registration cannot be cancelled by merely describing the assessee "bogus".

Takeaway: Registration of a firm cannot be cancelled merely by treating it as "bogus"

[M/s Star Metal Company Vs. Additional Commissioner, WT No. 397 of 2023, Order dated May 19, 2023 (High Court, Allahabad)]

c. The Petitioner operated as a payment aggregator platform under the name 'Onion-Pay', used by merchants and their customers to pay for goods and services. Payment by the customers for the transaction was received in escrow/nodal accounts and the Petitioner, who was entitled to transaction fee for processing the payment. The Petitioner retained only a part of the payment as transaction fee and paid the balance amount to the merchants and suppliers for the purchases made by their customers. The Petitioner's role was limited to payment processing and was not concerned with supplies made by any of its merchants using its online platform. The Petitioner charged GST on the transaction fee and duly discharged the same. The Petitioner's premises were searched, and its bank accounts were attached on the ground that it onboarded merchants that were not genuine. Further, the Department sought to create lien on the Petitioner's bank account for recovering the tax liability of the Petitioner's merchants, to whom it owed debt. Aggrieved by the attachment order, the Petitioner preferred instant WP.

The High Court while setting aside the impugned orders, held that bank accounts of only those taxable persons can be attached, who are liable for payment of any government revenue. In the instant case there was no issue regarding the GST liability of the Petitioner, therefore its bank account could not have been attached for any amount due and payable to the merchants using the Petitioner's platform. The High Court directed the Petitioners to clear the payments of its merchants in their respective bank accounts and held that Department can take effective steps as necessary in respect of various merchants, if it is so required, for protecting the government revenues.

Takeaway: Bank account of any taxpayer cannot be attached for securing the Revenue of any other taxpayer

[Zhudao Infotech Pvt. Ltd. Vs. Principal Additional Director General & Anr., WP (C) 3428/2023, Order dated May 22, 2023 (High Court, New Delhi)]

d. Pursuant to implementation of GST, the Government introduced Budgetary Support Scheme (the Scheme) to remove the financial hardship faced by the industrial units due to recission of all areabased exemption notifications in the state of Jammu and Kashmir. The Petitioner, being an eligible unit filed its claim under the Scheme. The Department sanctioned the claim, however, due to nonavailability of requisite funds, the same could not be released in favour of the Petitioner. Aggrieved by the delay, the Petitioner filed WP seeking direction to the Respondents to disburse the sanctioned amount with interest in a time bound manner. The sanctioned amount was released in favour of the Petitioner during the pendency of the Petition, however, the Petitioner pursued the Petition in respect of its claim of interest.

The High Court while dismissing the WP held that exemption under the Scheme being in the nature of concession, could not be claimed as a matter of right. The delay in disbursement of amount was not deliberate, illegal, arbitrary or without any reason. Due to lack of any specific provision in the Scheme, the Petitioners cannot claim interest on delayed payment of sanctioned claim under the scheme.

Takeaway: Benefits envisaged in nature of concession/incentive extended by the Government cannot be claimed as a matter of right

[M/s VJ Jindal Cocoa Pvt. Ltd. Vs. UOI & Ors., WP (C) No. 1830/2020, Order dated May 26, 2023 (High Court, Jammu & Kashmir)]

e. The Appellant is engaged in purchase of Intel products from various distributors [who imported said products from "Intel inside US LLC" (IIUL)], and thereafter, its resale to various retailers. Further, the Appellant entered into an agreement with IIUL (the agreement) under Intel Authorized Components Supplier Program (IACSP), for a non-binding Plan of Record Target (POR Target), wherein the Appellant would receive incentives as percentage of performance to quarterly goal on eligible Intel products. The Appellant sought advance ruling as to (i) whether the incentive received from IIUL under IACSP could be considered as "Trade Discount"; (ii) if not, whether it is consideration for any supply; (iii) if considered as supply then whether it would qualify as export of service.

The Authority for Advance Ruling (the AAR) held that the incentive received from IIUL cannot be considered as Trade Discount as supply of goods in respect of which the incentives are purported to be given, are rendered by the distributors and not by IIUL. Since, there was no supply of goods between IIUL and the Appellant, the incentive received by the Appellant was consideration towards marketing services. Further, the impugned supply did not qualify as export of service as the place of supply was in India.

Aggrieved by the AAR order, the Appellant filed appeal before the Appellate Authority for Advance Ruling (the AAAR).

The AAAR while upholding the order of the AAR held that to qualify as a trade discount, the incentive must be known prior to removal of the goods and there should be change in the taxable value of the supply resulting in reversal of ITC. However, in the present case, the quantum of discount is not known at the time of removal of goods rather it is linked to the purchases done by the Appellant from the authorised dealers of IIUL. Further, the incentive is being directly received from IIUL and the agreement exists between the manufacturer (IIUL) and the supplier (Appellant) only, and not with the distributor. For incentives to qualify as trade discount, an agreement is required between the seller and purchasing party, which is missing here and so, the incentive received from manufacturer (IIUL) is separate from the transactions undertaken by the Appellant with distributors. Further, while relying upon the agreement between Appellant and IIUL, it is observed that the amount received by Appellant under the Scheme is to enhance Intel's sale in India, which is nothing but implied marketing services. In lieu of such services, the payout is being accrued to the Appellant, not in the form of trade discount as claimed by them, but as supply of marketing as well as technical support services. Therefore, as per Section 13(3)(a) of the Integrated Goods and Services Tax Act, 2017 (the IGST Act), the place of provision of service is in India. Accordingly, it has been held that the instant supply does not qualify as export of services. Thus, the AAR order was upheld and appeal dismissed.

Takeaway: Target based incentive without sale agreement including provision for discount between supplier and recipient cannot be considered as trade discount

[M/s MEK Peripherals India Pvt. Ltd., Appeal No. MAH/GST-AAAR/05/2022-23, Order dated June 13, 2023 (AAAR, Maharashtra)]

SERVICE TAX

a. The Appellant is engaged in providing construction of residential complex. Two customers booked a flat and deposited advance along with service tax on the same. Later on, the bookings were cancelled by the customers and entire amount was refunded by the Appellant to the customer. The Appellant filed refund claim of service tax paid on such bookings. Show Cause Notice (SCN) was issued by the adjudicating authority proposing to reject the refund claim as time-barred under Section 11B of the Central Excise Act, 1944 (the Central Excise Act) and subsequently rejected the refund claims. An appeal was filed by the Appellant before the Commissioner (Appeals), which was also rejected. Being aggrieved, the Appellant preferred appeal before the Customs, Excise & Service Tax Appellate Tribunal (the CESTAT).

The CESTAT held that the Appellant cannot be saddled with any liability when no service has been provided to the Appellant. Tax is to be paid only on the services which are taxable and for that purpose there has to be some 'service'. Since the buyer cancelled the booking and the consideration for service was returned, the service contract got terminated and hence, no service was provided. Accordingly, the amount paid cannot partake the character of tax, and so, the applicability of limitation period prescribed under Section 11B of the Central Excise Act, will not arise as the same pertains to refund of tax and interest.

Takeaway: Limitation period prescribed under Section 11B of the Central Excise Act for filing refund claim is not applicable where a contract is terminated, and no service is provided

[Guardian Landmarks LLP Vs. CCE & ST., STA No. 88085 of 2019, Order dated June 6, 2023 (CESTAT, Mumbai)]

b. The Appellant short paid service tax in the months of April, August and September and excess paid service tax in the months of May, June and July. Such short-paid tax was adjusted with excess paid tax and mistakenly shown in service tax return as adjustment in terms of Rule 6(3) of Service Tax Rules, 1994 (the Service Tax Rules) instead of Rule 6(4A) thereof.

A SCN proposing a demand for short payment of tax was issued wherein it was alleged that adjustment under Rule 6(3) of the Service Tax Rules is permissible only where the Appellant paid service tax for a taxable service that was not provided, or where the Appellant refunds the consideration received before making adjustment of excess paid service tax, and subsequently demand was confirmed for allegedly wrong adjustment done by the Appellant. Aggrieved by such order, the Appellant filed an appeal before the Commissioner (Appeals) which was rejected. Consequently, an appeal was filed before the CESTAT.

The Appellant contended that instead of adjusting the service tax paid in terms of Rule 6(4A) of the Service Tax Rules, the details of excess payment of tax was mistakenly mentioned in the service tax return column as per Rule 6(3) of the Service Tax Rules; and that service tax cannot be demanded simply because of a wrong entry in the return column.

The CESTAT, while setting aside the impugned order, held that the adjudicating authority did not discuss the submissions made by the Appellant, and did not produce even a single piece of evidence to show that the Appellant violated the provisions of Rule 6(3) of the Service Tax Rules.

Takeaway: Tax adjustment cannot be disallowed if sufficient evidence for violation of Service tax Rules has not been produced by the Department

[B.L. Kashyap & Sons Ltd Vs. CST., STA No. 54315 of 2014, Order dated May 30, 2023 (CESTAT, Delhi)]

CENTRAL EXCISE

a. The Appellant manufactures plastic furniture and sells the entire production to a furniture company (buyer) at their factory gate. The Appellant procures raw material as per specification of the buyer and uses the mould supplied by the buyer. SCN was issued alleging that the Appellant were job-workers for the buyer and required to pay excise duty on the sale price of buyer at their depots. The adjudicating authority confirmed the demand.

On appeal, the Appellant submitted that contract and relationship between the Appellant and buyer is that of principal-to-principal basis. Further, the Appellant has not manufactured goods on the raw material provided by the buyer which is the main requirement under Rule 10A of the Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000 pertaining to job work.

The CESTAT, while allowing the appeal, held that a job worker is the one who works upon the inputs or goods supplied directly or indirectly by the principal manufacturer from which final goods are manufactured. Such inputs or goods includes only raw material, component, semifinished goods etc. and does not include moulds. In the instant case since the goods are not supplied by the buyer, Appellant does not qualify as a 'job-worker'. Accordingly, demand of excise duty was dropped and appeal allowed.

Takeaway: A job worker works upon the inputs or goods supplied directly or indirectly by the principal manufacturer from which final goods are manufactured

[Punjab Telenet Cables Limited Vs. CCE, EA No. 1860-61 of 2012, Order dated May 12, 2023 (CESTAT, Chandigarh)]

b. The Appellant manufactured ice cream and cleared the same by classifying it as "frozen dessert" under Chapter Heading 2105 of the Central Excise Tariff Act, 1985 since vegetable oil is added to the mix and not milk fat. Department issued SCN proposing to classify the same under chapter heading 2106 under residual category on the basis of definition contained in the Prevention of Food Adulteration Act, 1954 (the PFA), in terms of which products with less than 10% milk fat cannot be treated as ice cream. Department confirmed the tax demand in the SCN and passed the impugned order. Aggrieved against the impugned order, the Appellant preferred instant appeal. The Appellant placed reliance upon the decision of Supreme Court in the matter of Connaught Plaza Restaurant2.

The CESTAT, applying the Rule of Estoppel, relied upon its decision for previous period on the same issue wherein, it held that goods manufactured by the Appellant namely, frozen dessert using vegetable oil is correctly classifiable under Chapter 2105. Accordingly, it set aside the impugned orders.

Takeaway: Rule of Estoppel prevents Department from taking contrary stand

[Dinshaws Dairy Foods Ltd Vs. CCE, EA No. 88342 of 2018, Order dated March 15, 2023 (CESTAT, Mumbai)]

CUSTOMS

a. The Respondent imported EG Defective/Secondary Sheets (the goods) and filed bills of entry (the BOE) for clearance under self-assessment. The Department rejected the declared value on the basis of higher values of contemporaneous import of 'similar goods' available in the National Import Database (the NIDB)/ the Directorate General of Valuation Board of Excise & Customs (the DGOV) data. The importer cleared the goods on payment of enhanced Customs Duty to avoid demurrage charges. On receipt of an assessment order, the Respondent filed an appeal before the Commissioner (Appeals) challenging the enhanced values. The Commissioner (Appeals) set aside the enhancement of values and assessed the BOE at declared value.

Aggrieved by the order passed by the Commissioner (Appeals), Department preferred instant appeal before the High Court on the ground that the Respondent had agreed to the enhanced value and thereafter cleared the goods, and hence the Respondent cannot file an appeal against such assessment order.

The CESTAT, while rejecting the Department's appeal, held that just because the Respondent agreed upon the enhanced value does not mean that they have forgone their statutory right to file an appeal. With respect to valuation, the CESTAT held that the Department has failed to bring in any evidence to reject the invoice value declared by the Respondent. The valuation of similar goods depends on factors such as characteristics, composition & like component material. The NIDB data is not exhaustive as it only depicts the value at which goods are assessed but not whether the assessed value is proposed by the importer or enhanced by Department. Thus, the value available in the NIDB/the DGOV data on similar defective goods are not comparable with the goods imported by the Respondent.

Takeaway: Declared value of imported goods cannot be rejected without any evidence by merely relying on the NIDB/the DGOV data

[Commr. of Customs (Port) Vs. M/s R V Udyog Pvt. Ltd., CA No. 76556 of 2018, Order dated June 1, 2023 (CESTAT, Kolkata)]

b. The Appellant filed shipping bills for export of garments under duty drawback. The goods were detained by the Special Investigation and Intelligence Branch (the SIIB) and on suspicion that the cargo was overvalued, samples were drawn for testing and sent to the Valuation Committee. Drawback was withheld till finalization of the valuation issue. The Valuation Committee fixed the price of the samples and accordingly, the Freight on Board (FOB) value of exports was determined at INR 4.68 lakhs as against INR 8.26 lakhs (as claimed by Appellant).

On adjudication, the declared value was rejected, and the adjudicating authority re-determined the value as fixed by the Valuation Committee, imposed fine and penalty upon the Appellant and held that the goods are liable for confiscation. Aggrieved by the order, the Appellant preferred appeal before the Appellate Authority, who upheld the adjudication order. Aggrieved, Appellant preferred appeal to the CESTAT on grounds that firstly, the Adjudicating Authority should have resorted to Rule 5 of the Customs Valuation (Determination of Value of Export Goods) Rules, 2007 (the Valuation Rules) for valuation since the cost of goods matched with the declared value; and secondly, the report of the Valuation Committee was not provided to the Appellant, who could not rebut the same, which is against the principles of natural justice.

The question before the CESTAT was whether the exported goods are overvalued or not and whether the confiscation of the goods and imposition of penalty is justified.

The CESTAT, while partly allowing the Appeal, held that the Department did not follow the valuation methods sequentially as provided in the Valuation Rules and directly resorted to the residual method of Rule 6 of the Valuation Rules. Further, it has been held that no opportunity for rebuttal of the value adopted by the Valuation Committee was provided to the Appellant, which violates the principles of natural justice. However, the CESTAT further held that there was misdeclaration of the value of export goods, which is in contravention of the Customs Act, 1962 and the Valuation Rules. Accordingly, the appeal was partly allowed setting aside the adjudicating order with consequential relief and reduced the redemption fine and penalty.

Takeaway: Method of valuation under the Valuation Rules must be followed sequentially

[M/s Kalima Exim Vs. The Commissioner of Customs, CA Nos. 41172 & 41173 of 2013, Order dated June 12, 2023 (CESTAT, Chennai)]

FOREIGN TRADE POLICY NOTIFICATIONS

a. Schedule I of ITC (HS) 2022 amended to allow the import of Needle Pet Coke for making graphite anode material for Li-Ion battery as feedstock/ raw material, Low Sulphur Pet Coke by integrated steel plants only for blending with the coking coal in recovery type coke ovens equipped with desulphurization plant, subject to terms and conditions set out by the Ministry of Environment, Forest and Climate Change. [Notification No. 10/2023 dated June 02, 2023].

b. The Category 5B of the Appendix 3 (the SCOMET List) of Schedule 2 of the ITC HS classification of Import and Export Items that controlled the export of all kinds/types of Drones/UAVs amended to simplify and liberalize the SCOMET policy for export of Drones/UAVs. Consequently, Drone Manufacturers/ Exporters with General Licensing procedures under General Authorization for Export of Drones (GAED) Authorization are exempt from applying for SCOMET license for every similar export shipment, within the validity period subject to post reporting and other documentary requirements. [Notification No. 14/2023 dated June 23, 2023].

c. The procedure for grant of GAED for export of Drones/UAVs under Category 5B, along with the new Aayat Niryat Form (ANF) 10G notified for applying under GAED. [Public Notice No. 19/2023 dated June 23, 2023].

THE DIRECTORATE GENERAL OF TRADE REMEDIES, MINISTRY OF COMMERCE & INDUSTRY

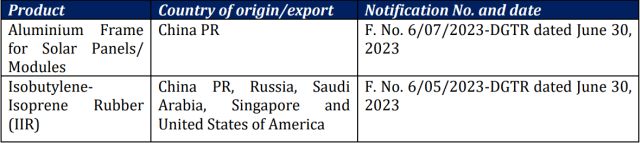

a. Initiation of Anti-Dumping Duty Investigation on import of:

b. Initiation of Sunset Review Investigation of Anti-Dumping Duty imposed on import of:

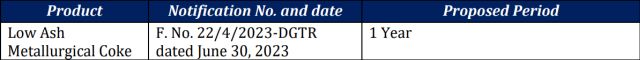

c. Final Findings regarding Sunset review investigation of the Anti-Dumping Duty imposed on import of:

d. Initiation of Safeguard Measure Investigation on import of:

INDIAN CUSTOMS HIGHLIGHTS

a. Customs procedure for import and re-export of goods under Electronic Repairs Services Outsourcing (ERSO) initiative clarified

- ERSO is a Government of India initiative that involves import of defective/damaged electronic goods for repair by designated repair service entities in India and thereafter reexport of the repaired goods.

- Bills of entry or shipping bills to be filed in advance to minimize clearance time and amendments.

- All the necessary documents in legible form to be uploaded on e-Sanchit.

- Appropriate continuity/running re-export Bond (without bank guarantee) registered with ACC, Bengaluru to be used by importer. Electronic Data Interchange system would debit amount involved against each import and one re-export is made, the bond would be recredited by the officer at ACC, Bengaluru. Importer would have an option to check balance of bond amount on ICEGATE system.

- Importers should opt for first check examination to check the nature of goods re-exported with the goods which were imported.

[Circular No. 14/2023- Cus dated June 3, 2023]

INDIA GST HIGHLIGHTS

Portal Update

a. Advisory on Features, Benefits and uses of e-Invoice Verifier App (the App) issued

- Accuracy and authenticity of an e-invoice can be identified by scanning the QR code on it.

- Verification of e-Invoices reported across all six IRPs is supported by the App.

- The App does not require users to log in.

[GST Portal Update dated June 8, 2023]

b. Functionality to enable the taxpayer to explain the difference in GSTR-1 & 3B return online notified

- GST Portal's feature to explain the difference in GSTR-1 & 3B return online, as directed by the GST Council, now live.

- Liability declared in GSTR-1/IFF gets compared with the liability paid in GSTR-3B/3BQ and if the declared liability exceeds the paid liability, taxpayer will receive an intimation in the form of DRC-01B.

- Upon receiving an intimation, taxpayer must provide clarification by filing a reply in Form DRC-01B Part B.

- A detailed manual containing the navigation details is available on the GST portal.

[GST Portal Update dated June 29, 2023]

TAXABILITY OF ANCILLARY SERVICES UNDER CONSTRUCTION SECTOR

Since the inception of the indirect tax laws, real estate sector has been 'a goose that lays the golden eggs' for the tax authorities. Be it the ever-evolving multifaceted transactions or ever-changing taxation laws, construction industry stands on the losing end because of its dynamics and tax ambiguities. Amongst the several existing issues, taxability of ancillary services such as Preferential Location Charges (PLC), car parking charges, common area charges etc., provided along with construction services, has been stemmed along since time immemorial.

Under both, the Service Tax as well as GST regime, supply of construction service has been taxable at an abated rate, after giving deduction for the value of land. Now, apart from construction services, real estate developers also provide ancillary services related to car parking, PLC, etc. Such ancillary services are clubbed along with construction services, and charged to tax as 'bundled services', where construction service is the principal supply and accordingly, tax is charged at an abated rate on the entire value of all services combined, including the ancillary services. On the other hand, the tax authorities seek to levy full rate and not abated rate of tax on ancillary services alleging that ancillary services are independent supplies not forming part of construction services, and hence, cannot be taxed as composite supplies. The dispute that initiated under the Service Tax regime continue till date under the GST regime as well, on account of similar provisions and lack of any clear instructions from the Government.

Surprisingly, we have witnessed contrary judgments under the Service Tax and GST regime though the legal provisions pertaining to construction services under both legislations are similar. Under the Service Tax regime, the CESTAT in its various decisions3 has held that the additional recoveries made by the real estate developers under different heads i.e., PLC, car parking, common area charges etc., are part and parcel of the main service i.e., construction service. Accordingly, ancillary services provided along with the supply of construction services were held to be 'composite supply' and abated rate of tax was made applicable. The Delhi High Court in the case of Suresh Kumar Bansal4, held that PLC cannot be directly traced to the value of any goods or value of land but are as a result of development of complex as a whole and thus, being a separate service, Service Tax shall be levied on the same. However, inspite of the decision in the Suresh Kumar Bansal case, there are few CESTAT rulings5 which again pronounced that ancillary services provided along with construction services are naturally bundled and forms part of composite supply.

Under the GST regime, the AAR and the AAAR have pronounced complete contradictory rulings with absolutely different reasoning on this issue. In the case of M/s Bengal Peerless Housing Development Company6, the AAR HAS held that ancillary services such as PLC, right to use car parking space, enjoyment of common areas, club, swimming pool etc., are naturally bundled and offered in conjunction with one another in the ordinary course of business where construction service is the main supply. However, the AAAR held that PLC and car parking services are separate services from the construction and highlighted that the abatement, which is allowed on the value of construction services, on account of value of land involved, cannot be deemed to be applicable in respect of PLC, which is altogether a separate service having no association with land. Accordingly, it held that tax shall be separately recovered on PLC and car parking services not considering the same as part of composite supply of construction service. While the primary question in this case was whether ancillary services falls under the definition of composite supply or not, the said ruling was pronounced on the sole ground that abatement pertains to value of land and such abatement cannot be made available to other ancillary services having no nexus with land. No substantive discussion was made in the AAAR to the moot point.

Further, in yet another ruling pronounced by the AAAR in the case M/s Eden Real Estate7, it has been held that sale/right to use car parking is an optional service provided along with the construction services, which is a separate service not dependent on construction service, and so, the service of sale/right to use car parking was held not to be naturally bundled with the construction services.

These contradictory rulings under the erstwhile regime and GST law only adds to confusion, lack of clarity and the ever-increasing list of litigious issues existing under construction sector.

In an effort to settle the dispute around taxability of PLC, the government vide the Circular dated August 3, 20228 clarified that PLC paid upfront in addition to the long-term lease premium of land, is naturally bundled with long-term lease services. However, the clarification only discusses the PLC collected with long-term lease premium; no discussion/clarification related to PLC collected with the construction services has been provided. Nonetheless, taking cue from the Circular, an argument can be taken that since the nature of PLC services remains the same, be it under long-term lease or construction services, accordingly, PLC services should qualify as being naturally bundled with construction services as well. However, there are chances that revenue authorities might argue that the clarification did not discuss about the construction services explicitly, and hence, this clarification is not applicable on ancillary services supplied along with the construction services.

In absence of any specific clarification from the government, taxability of ancillary services continue to be a bone of contention under construction sector, which ought to be addressed soon.

Footnotes

1. Writ Tax No. 348/2021 decided March 5, 2022

2. C.C.E. Vs. Connaught Plaza Restaurant, Civil Appeal No's. 5307-5308 of 2003.

3. Logix Infrastructure Pvt Ltd vs. Commissioner of C. Ex. & S.T., Noida (Final Order Nos. 7237/2018, dated September 20, 2018, CESTAT, Allahabad; SPJ Infracon Limited Vs The Commissioner of Central Excise & Services Tax, Noida ( Final Order No. 72649/2018 dated November 19, 2018; and Sunworld Developers Pvt Ltd V. Noida (Appeal Nos. ST/70272 & 70273/2018-CU).

4. Suresh Kumar Bansal vs Union of India, Delhi High Court W.P. (C) 2235/2011 dated June 3, 2016.

5. Shreno Ltd vs Commissioner of Central Excise and Service Tax, CESTAT Ahmedabad, service tax appeal no. 10197 of 2017, order dated May 25, 2021.

6. Bengal Peerless Housing Development Company Limited, AAR, 01/WBAAR/2019-20 dated May 2, 2019.

7. M/s Eden Real Estate Private Limited, West Bengal AAAR, 01/WBAAAR/APPEAL/2023 dated April 20, 2023.

8. Circular No. 177/09/2022-TRU dated August 3, 2022.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.