- within Government, Public Sector, Criminal Law, Litigation and Mediation & Arbitration topic(s)

- with readers working within the Law Firm and Construction & Engineering industries

IMPORTANT CASE LAWS

GOODS AND SERVICES TAX (GST)

- The Petitioner applied for revocation of cancellation of

registration, cancelled due to failure in furnishing returns for

three periods consecutively. The Department rejected the

application of the Petitioner seeking revocation of cancellation of

registration. Being aggrieved by the Order of the Department, the

Petitioner filed appeal before the Appellate Authority which got

dismissed on ground of limitation. Subsequently, the Petitioner

filed Writ Petition (WP) against the order passed by the

Department.

The High Court held that the Petitioner was earning its livelihood through its business and requires registration under GST laws to run the business. The provisions of GST laws cannot be interpreted so as to deny the right to carry on trade and commerce to any citizen. Further, the state shall suffer loss of revenue in case GST registration of the Petitioner is not revived. Hence, the order of cancellation of GST registration was quashed.

Takeaway: Provisions of GST law cannot be interpreted so as to deny the right to carry on trade and commerce to any citizen.

[M/s Rohit Enterprises Vs. The Commissioner, WP No. 11833 of 2022, Order dated February 16, 2023 (High Court, Mumbai)]

- The Petitioner procures pre-paid payment instruments like gift

vouchers, cash back vouchers and e-vouchers from the issuers and

supplies them to its clients for specified face value. The

Petitioner filed an application for advance ruling to determine

taxability of such pre-paid instruments (vouchers). The Authority

for Advance Ruling (the AAR) held that supply of vouchers would be

taxable as goods. The Appellate Authority for Advance ruling (the

Appellate AAR) affirmed the order passed by the AAR. Subsequently,

the Petitioner filed WP challenging the order passed by the

Appellate AAR.

The High Court held that vouchers are mere instruments accepted as consideration for supply of goods or services and do not have any inherent value of their own. The transaction between the Petitioner and his clients is procurement of printed forms and their delivery. The issuance of vouchers is similar to pre-deposit and not supply of goods or services. Vouchers are mere instruments accepted as consideration for supply of goods or services, and hence, would be covered under definition of 'money' under Section 2(75) of the Central Goods and Services Tax Act, 2017 (the CGST Act) and excluded from definition of goods and service. Accordingly, vouchers, neither being goods nor services, would not be amenable to GST.

Takeaway: GST is not leviable on vouchers being in nature of instruments

[M/s Premier Sales Promotion (P) Limited Vs. UOI, WP No. 5569 of 2022, Order dated January 16, 2023 (High Court, Karnataka)]

- The Petitioner is engaged in business of providing goods

transportation agency (GTA) services. The Petitioner is registered

for such services, both under Reverse Charge Mechanism (RCM) and

under Forward Charge Mechanism (FCM) in the same state as some of

its customers were willing to discharge the liability under RCM and

others were not. While depositing balance in its electronic cash

ledger of FCM registration (from which it had to discharge tax

liability), the Petitioner inadvertently deposited the amount in

its RCM registration. Consequently, excess balance was left in the

electronic cash ledger of the RCM registration. Subsequently, the

Petitioner filed a refund application for claiming excess amount

deposited in the electronic cash ledger of RCM registration. The

Department issued a Show Cause Notice (SCN) and alleged that there

is a mismatch in the outward tax supplies in Form GSTR-3B compared

to Form GSTR-1 of RCM registration. The Department rejected the

refund and alleged that the Petitioner has obtained two

registrations in the same place of business and therefore it is not

eligible to claim refund. The Petitioner filed WP challenging the

order passed by the Department.

The High Court held that the order passed pursuant to the reply to the SCN has not deliberated with the content of reply, and rather, the Department has proceeded to pass an order rejecting the refund application on the grounds which were never part of SCN. It is settled principle of law that if an allegation or ground is not made at the time of issuance of SCN, the Department cannot go beyond the scope of SCN to create new ground at the later stage of adjudication. Also, the impugned proceedings are in gross violation of principles of natural justice as neither a proper SCN has been issued nor any opportunity of hearing was given to the Petitioner. Accordingly, the High Court set aside the impugned order passed by the Department as being bad in law, vague and cryptic in nature.

Takeaway: The Department cannot pass an order beyond the scope of SCN

[M/s CJ Darcl Logistics Limited Vs. UOI, WP(T) No. 215 of 2022, Order dated February 9, 2023 (High Court, Jharkhand)]

- The Petitioner supplied goods from Begusarai to Guwahati and

accordingly, paid Integrated Goods and Services Tax (IGST).

However, e-way bill generated by the Petitioner got expired as

carriage carrying goods suffered breakdown. In order to release the

vehicle, the Petitioner paid tax and penalty but preferred an

appeal before the Appellate Authority which also got dismissed.

Subsequently, the Petitioner filed WP challenging the order passed

by the Department imposing tax and penalty.

The High Court held that the Petitioner's consignment was found lying within the territory of the State for more than three days. The Petitioner had the opportunity to extend the validity of the E-Way bill when the goods vehicle had mechanical defect, however, the Petitioner did not take any step for extension of expired E-Way bill. Accordingly, the Department had lawfully imposed tax and penalty against the Petitioner.

Takeaway: Levy of Tax and penalty imposed for failure to extend validity of e-way bill

[M/s Ashok and Sons (HUF) Vs. Joint Commissioner, WPA No. 190 of 2023, Order dated February 6, 2023 (High Court, Calcutta)]

- The Petitioner challenged summons issued by the State GST

Department on ground that proceedings have already been initiated

by the Central GST Department on the same subject matter.

The High Court held that the State Department cannot prosecute the Petitioner in case Central Authority has already initiated action in respect of the same subject matter. Accordingly, the Petitioner was directed to appear for personal hearing before the State Department and state all its objections with regard to impugned summons issued by the State Department.

Takeaway: Parallel proceedings cannot be initiated by Central/State Tax Authorities on the same subject matter

[M/s Tvl Metal Trade Incorporation Vs. Commissioner of GST and Others, WPA No. 3033 of 2023, Order dated February 6, 2023 (High Court, Madras)]

- The Petitioner is a merchant exporter of mobile phones, who

purchased mobile phones through its sister concern, which

instructed the vendor to deliver the mobile phones to the airport

directly for export by the Petitioner. The vendor raised invoice in

name of sister concern of the Petitioner, but generated e-way bill

with delivery address mentioned as the airport. Its siter concern

raised an invoice upon the Petitioner for sale of mobile phones,

and the Petitioner files shipping bills and exported the goods

after due clearance from customs authorities. The Petitioner

claimed refund of IGST paid on export of mobile phones in

accordance with Rule 96 of the Central Goods and Services Tax

Rules, 2017 (the CGST Rules). Due to single movement of the goods

from the premise of the vendor to the airport, only one e-way bill

was generated by the vendor wherein the delivery address was

mentioned as the airport. During investigation proceedings, query

was raised regarding refund claimed by the petitioner on export and

the Department alleged that the e-way bill was not generated in

respect of purchases made by the Petitioner from its sister

concern, which was construed as deficiency of documents. The

Petitioner filed WP challenging the investigation initiated by the

GST Department.

The High Court held that the Customs Department has permitted the goods to be exported and the Petitioner has paid IGST on export. The process of refund of IGST after clearance of goods for export as has been provided under Rule 96 of the CGST Rules is very clear that shipping bill of the export would be treated as refund application. Since e-way bill once has been generated, export cannot be disputed and if there is any doubt as regards export of goods, it is for the Custom Department to take up the issue. Accordingly, the Court held that the Petitioner would be entitled to refund and the same would be paid along with interest.

Takeaway: The GST Department has no jurisdiction to initiate investigation in relation to refund of IGST claimed for export of goods

[M/s Mobile Shoppe Vs. UOI, R/Special Civil Application No. 10110 of 2020, Order dated January 20, 2023 (High Court, Gujarat)] - The Petitioner filed WP challenging the Department's order

for period July 2017 to March 2018 wherein GST demand of INR 10

Crores has been proposed against the Petitioner. The question was

whether the Petitioner can be denied opportunity of hearing merely

because he had chosen the option 'NA' against the column

description 'Date of personal hearing' in the reply to the

SCN submitted through online mode.

The High Court, while relying upon the decision of M/s Bharat Mint & Allied Chemicals Vs. Commissioner Commercial Tax1, held that once it has been laid down by way of a principle of law that a person/assessee is not required to request for 'opportunity of personal hearing' and it remained mandatory upon the Assessing Authority to afford such opportunity before passing an adverse order, the fact that the petitioner may have signified 'No' in the column meant to mark the assessee's choice to avail personal hearing, would bear no legal consequence. It further held that such opportunity would ensure observance of rules of natural justice and also allow the authority to pass appropriate and reasoned order as may serve the interest of justice. Accordingly, the impugned order was set aside.

Takeaway: The opportunity of hearing cannot be denied merely because the Assessee has opted against personal hearing through online portal

[M/s Mohan Agencies Vs. State of UP, Writ Tax No. 58 of 2023, Order dated February 13, 2023 (High Court, Allahabad)]

- The Applicant is engaged in the business of providing

restaurant services, catering services and renting of banquet

services. The Applicant also sells alcoholic liquor for human

consumption to its customers on standalone basis.

The Applicant sought as to whether the Applicant is liable to reverse Input Tax Credit (ITC) used for the sale of alcoholic liquor for human consumption effected by it at its premises under Section 17(2) of the CGST Act read with Rule 42 of the CGST Rules?

The AAR held that the activities of selling of alcoholic liquor for human consumption by the Applicant qualifies as 'supply' under GST laws on which tax is not leviable and therefore, will be treated as 'non-taxable supply'. Further, 'exempt supply' includes 'non-taxable supply' under GST laws and therefore, it clearly denotes that the aforesaid supply shall also be treated as 'exempt supply' under the CGST Act. Hence, the Applicant is required to reverse ITC for supply of alcoholic liquor for human consumption under Section 17(2) of the CGST Act read with Rule 42 of the CGST Rules.

Takeaway: Reversal of ITC on account of supply of alcoholic liquor for human consumption

[M/s Karnani FNB Specialities LLP, Order No. 22/WBAAR/2022-23, Order dated February 9, 2023 (AAR, West Bengal)]

SERVICE TAX

- The Appellant downloaded software electronically from M/s. SSP

Sirius Ltd. UK (SSPSL) located outside India, for Core Insurance

Solution. Thereafter, a series of events/ activities were performed

for operationalizing the software, agreement was entered on May 27,

2008 and the invoice was raised on July 22, 2008. On being pointed

out during an audit objection, the Appellant deposited an amount of

Rs.58,63,413/-, along with interest. The Appellant subsequently

sought refund of the same as they were of the view that no tax was

payable even prior to the introduction of the service in the

Finance Act, 1994.

The information technology software was supplied to the Appellant electronically from abroad by SSPSL and downloaded in December 2007, i.e., prior to the introduction of said service in the Finance Act, 1994 (May 16, 2008). The Revenue contended that mere downloading of software does not make the service complete unless other incidental activities are completed and issued SCN and confirmed the demand.

The issue that arose was whether the point of taxation is the date of downloading of software; or the date of commissioning of such software. It was held that the actual right to use the software took place only after the agreement was signed and payment for the invoice was made, which happened after inclusion of such services under service tax net. Accordingly, the information technology software service was held to be leviable to service tax in the present case.

Takeaway: Actual right to use and not the date of downloading the software is the point of taxation for determining tax liability

[M/s Mobile Shoppe Vs. UOI, R/Special Civil Application No. 10110 of 2020, Order dated January 20, 2023 (High Court, Gujarat)]

- The Appellant is a hospital and has engaged doctors as

consultants for providing medical services to its patients. The

Invoice raised on the patients include doctor fees, hospital room

charges, medicines, other charges and out of the total fees

collected from the patients, 22% is retained by hospital and

remaining 78% is disbursed to doctors.

A SCN was issued wherein the Revenue contended that hospital is providing infrastructural support services which include secretarial support, consultation chamber, Operation Theatre and other facilities essential for providing medical care services and money retained by hospital is towards the consideration of such services and proposed to levy service tax under Business Support Services. Being aggrieved by the order, the Appellant preferred appeal before the Customs Excise and Service Tax Appellate Tribunal (the CESTAT).

The CESTAT held that the arrangement between hospital and doctors is a mutually beneficial revenue sharing model wherein doctors provide the skills and knowledge and hospital manages the patient and provide necessary support to the patient, which is nothing but health care services and not business support services. Hospitals are clinical establishments and provide health care services to patients which is exempt from service tax w.e.f. July 1, 2012. Prior to that, heath care services were only taxed for specified category of hospitals and for specified patients. Accordingly, the impugned order was set aside.

Takeaway: Hospitals do not render 'business support services' and revenue retained is pursuant to revenue sharing arrangement and is not infrastructure/ support service

[Maharaja Agrasen Hospital Charitable Trust Vs. CST - ST Appeal No. 52193/2016, Order dated February 22, 2023 (CESTAT, Delhi)]

CENTRAL EXCISE

- The Appellant availed Cenvat credit of various input services

procured by them for constructing residential quarters and civil

structures located at township away from the factory. Such credit

was denied by the Revenue on the ground that construction of

township is a welfare measure for employees and has no nexus with

the manufacture, storage and sale of final products.

The dispute that arose lies upon the nexus of the aforesaid activity with business of the Appellant and accordingly, qualifying within the inclusive leg of Rule 2(l) of the Cenvat Credit Rules, 2004 (the CCR).

It was observed that perception of 'nexus' with its unbounded meanings is not appropriate and conformity to the definition of 'input service' must be tested including the principal and inclusive leg. The principle of nexus of service should not restrict itself to direct use but should encompass indirect deployment and hence should be examined in relation to the definition. It was held that there is a lack in the finding and the appeal was accordingly, set aside and remanded back to determine nexus or lack thereof.

Takeaway: Complete definition of input and input services and its nexus with output service must be established to determine eligibility of credit

[Reliance Industries Ltd Vs. CCE & ST – Excise Appeal No. 1043/2012, Order dated January 20, 2023 (CESTAT, Mumbai)]

- The Appellant purchased certain inputs from a vendor and

availed Cenvat credit of the excise duty charged on such purchases.

The Revenue alleged that the vendor is not engaged in manufacturing

but has deposited excise duty. It was further alleged that tax

deposited is towards an amount paid under Section 11D of Central

Excise Act, 1944 which is in relation to deposition of excess tax

collected. SCN was issued denying the Cenvat credit on the ground

that credit of only duty of excise is allowed and demand was

confirmed.

It was observed that neither the Appellant nor the jurisdictional officer of the Appellant has the right to change the self-assessment made by the vendor. The Appellant cannot be expected to investigate the activities of each supplier and determine if activity undertook by vendor amounts to manufacture and thereafter avail credit of such duty. The order was accordingly, set aside and credit was allowed.

Takeaway: Credit can be availed based on invoice of vendor and recipient is not expected to determine correctness of tax charged by vendor.

[M/s RMC Switch Gears Ltd Vs. CCE, Excise Appeal No. 52817/2018, Order dated February 17, 2023 (CESTAT, Delhi)]

CUSTOMS

- M/s. Ashwin Gold Pvt. Ltd. (AGPL) imported gold in its export

unit in Special Economic Zone Cochin (SEZ) and moved the imported

gold for job work in Domestic Tariff Area (DTA). The Customs

Department conducted search and seizure of AGPL's DTA unit and

subsequently at its SEZ unit on the alleged clandestine movement of

gold. The question before the High Court was whether the Customs

Officers had jurisdiction for seizure or recovery of material in a

DTA area, which came from SEZ area.

The Revenue argued that since the breach originated in SEZ and travelled beyond it and the gold was seized from DTA, the Officers of Customs had jurisdiction for search and seizure in such SEZ area as well. AGPL argued that the gold has been moved from SEZ to DTA under the permission.

The High Court held that the SEZ authority has jurisdiction over establishment and continuance of a SEZ unit. However, for importing goods into DTA, the Customs Department have jurisdiction. In the present case, the search and seizure occasioned in DTA, therefore, the Customs Department would have the jurisdiction over illegal movement of gold out of SEZ.

Takeaway: Customs Officers had jurisdiction for seizure or recovery of material in a search carried out in DTA which led them to importer's unit in SEZ

[CC (Preventive), Kerala & Ors. Vs. Ashwin Gold Pvt. Ltd. & Ors., Cus Appeal No. 9/2022, Order dated December 22, 2022 (High Court, Kerala)]

INDIA REGULATORY & TRADE HIGHLIGHTS

FOREIGN TRADE

- Consequent to the inclusion of export items from Chapter 28

(products of Chemical or Allied Industries), 29 (Organic

chemicals), 30 (Pharmaceutical products) & 73 (articles of iron

or steel) under RoDTEP (vide Notification No. 47 dated December 07,

2022), Appendix 4R is aligned with First Schedule of the Customs

Tariff Act, 1975 for implementation with effect from February 15,

2023. [Notification No. 55/2015-2020 dated February 7, 2023].

- Gemological Science International (GSI) Pvt. Ltd., Mumbai,

Maharashtra, India is added as an agency permitted to import

diamonds for certification/ grading & re-export. [Notification

No. 56/2015-2020 dated February 07, 2023].

- The procedure for allocation of quota for import of (i)

Calcined Pet Coke for use in Aluminum Industry; and (ii) Raw Pet

Coke for Calcined Pet Coke manufacturing industry for the year

2023- 24 is notified. [Public Notice No. 57/2015-20 dated February

14, 2023].

- One time relaxation is granted in submission of additional fee

to cover excess duty utilized in Export Promotion Capital Goods

authorizations issued under Foreign Trade Policy (2009-14)

(extended up to March 31, 2015). [Public Notice No. 58/2015-2020

dated February 24, 2023].

- Para 4.42 of the Handbook of Procedures 2015-2020 is amended to

integrate a uniform and transparent system for implementation of

all Policy Relaxation Committee decisions for levy of Composition

Fee for allowing extension of Export Obligation period and/or

regularization of exports already made under Advance Authorization

Scheme. [Public Notice No. 59/2015-2020 dated February 28,

2023].

THE DIRECTORATE GENERAL OF TRADE REMEDIES, MINISTRY OF COMMERCE & INDUSTRY

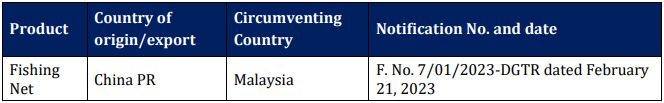

- Initiation of Anti-Circumvention Investigation of

Anti-Dumping Duty imposed on import of:

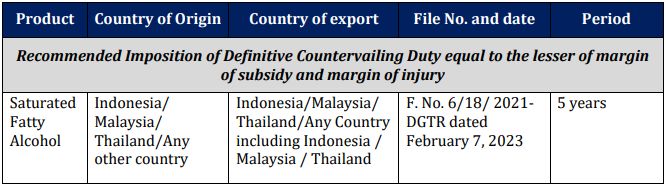

- Final Findings regarding Anti-Subsidy Investigation on

import of:

- Final Findings regarding Sunset Review Anti-Dumping

Duty Investigation on import of:

INDIAN CUSTOMS HIGHLIGHTS

- Devices affixed on durable containers exempted from

basic customs duty (BCD) and IGST

Containers of durable nature were exempted from BCD as well as additional duty subject to specified conditions. The Notification exempts device such as tag, tracking device or data logger already affixed on the container at the time of import from BCD and IGST.

[Notification No. 14/2023-Cus dated February 28, 2023] - Details of ex-bond bill of entry no./shipping bill no.

And date to be provided by warehouse license holder

Form A provided in Circular 25-2016-Cus dated June 8, 2016, that is to be maintained by the warehouse licensee has been amended to include following additional details in cases of removal of goods from warehouse for home consumption or export:

- Ex-Bond Bill of Entry No.

- Date/Shipping Bill No. and date

[Circular No. 04/2023-Cus dated February 21, 2023]

- Ex-Bond Bill of Entry No.

- Time limit of 45 days has been provided for antecedent

verification of application for warehouse licence

Due to lack of prescribed time limit, antecedent verification of application for a warehouse licence has been facing unreasonable delays. To get rid of such delay, time limit of 45 days from receipt of the application has been provided vide this circular.

[Circular No. 05/2023-Cus dated February 21, 2023]

INDIA GST HIGHLIGHTS

- Activities carried on by any authority, board or a body set up

by the Central Government or State Government including National

Testing Agency for conduct of entrance examination for admission to

educational institutions shall be treated as educational

institution for the limited purpose of providing services by way of

conduct of entrance examination for admission to educational

institutions w.e.f., March 1, 2023.

[Notification No. 1/2023- CT(R), IT(R) & UT(R) dated February 28, 2023]

- GST under reverse charge mechanism (RCM) to be applicable on

services supplied by Courts and Tribunals to business entities.

Also, registered person is liable to pay GST under RCM in case

renting of immovable property services received from Courts and

Tribunals w.e.f., March 1, 2023.

[Notification No. 02/2023-CT(R), IT(R) & UT(R) dated February 28, 2023]

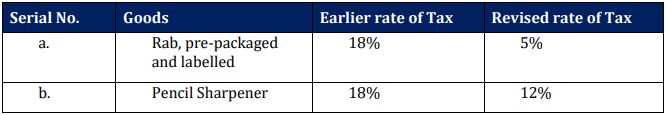

- Rate of GST revised on supply of specified goods

w.e.f., March 1, 2023

[Notification No. 03/2023-CT(R), IT(R) & UT(R) dated February 28, 2023]

- Exemption from payment of GST on supply of Rab, other than

pre-packaged and labelled w.e.f., March 1, 2023.

[Notification No. 04/2023-CT(R), IT(R) & UT(R) dated February 28, 2023]

- Exemption from payment of Compensation Cess on supply of coal

rejects to and by a coal washery, arising out of coal on which Cess

has been paid and no ITC thereof has been availed by any person

w.e.f., March 1, 2023.

[Notification No. 01/2023-Compensation Cess (R) dated February 28, 2023]

TREATMENT OF SALE OF ALCOHOLIC LIQUOR FOR HUMAN CONSUMPTION UNDER GST

Article 366(12A) of the Constitution of India, the very fountainhead of GST in India, defines GST as any tax on supply of goods, or services or both, except for taxes on the supply of the alcoholic liquor for human consumption. By virtue of Article 366 (12A) of the Constitution of India, the scope of GST has been restricted to specifically exclude the supply of alcoholic liquor for human consumption.

Taking genesis from the Constitution of India, the Legislators have framed GST laws in India. The charging section of the CGST Act2 provides that GST shall be leviable on all intra-state supply of goods/services except on supply of alcoholic liquor for human consumption3. The term 'supply' includes all forms of supply of goods or services or both such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in course of furtherance of business4. Further, non-taxable supply means supply of goods or services or both which is not leviable to tax5. Now, on a bare reading of definition of term 'supply' and 'non-taxable supply', it appears that sale of any goods would fall under the ambit of 'supply'. Accordingly, sale of liquor for human consumption might also fall under the ambit of 'supply' under GST laws but would remain out of the tax net basis the charging section. Further, supply of alcoholic liquor for human consumption being not leviable to tax, appears to be categorised as 'non-taxable supply'. However, reaching to this conclusion does not appear to be in sync with the Constitution of India since the basic definition of GST defines it as any tax on supply of goods, or services or both, except for taxes on the supply of the alcoholic liquor for human consumption. Moreover, in case supply of alcoholic liquor for human consumption is classified as being non-taxable supply, there would be implications of reversal of input tax credit6. Hence, the determination of applicability of GST laws on supply of liquor need consideration.

Recently, the West Bengal Authority for Advance Ruling in case of M/s Karnani FNB Specialities LLP held that sale of alcoholic liquor for human consumption qualifies as 'supply' under GST laws on which tax is not leviable and is accordingly, to be treated as 'non-taxable supply'. It has been further held that 'exempt supply' includes 'non-taxable supply' under GST laws and therefore, supply of alcoholic liquor for human consumption by the Applicant shall also be treated as 'exempt supply' under the CGST Act. Accordingly, the Applicant would be required to reverse ITC for supply of alcoholic liquor for human consumption under Section 17(2) of the CGST Act.

CONCLUSION

On perusal of the AAR order, it can be seen that the supply of alcoholic liquor for human consumption has been treated as 'non-taxable supply'. However, it cannot be ignored that legislative intent was nowhere to bring alcoholic liquor into the ambit of GST. The Constitution of India empowers the State Government to levy excise duty and VAT on alcoholic liquor for human consumption and it does not form the subject matter of GST to be levied either by the State or the Central Government. However, by including the supply of alcoholic liquor for human consumption under the ambit of 'non-taxable' and hence, 'exempt supply', the authorities have tried to cast an unnecessary burden upon the assessee by requiring it to include the revenue earned out of sale of alcohol for the purpose of reversal of ITC under GST laws.

Footnotes

1. 2022-VIL-189-ALH

2. The Central Goods and Services Tax Act, 2017

3. Section 9 of CGST Act

4. Section 7(1) of CGST Act

5. Section 2(78) of CGST Act

6. Section 17(2) of CGST Act

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]