- within Employment and HR, Family and Matrimonial, Media, Telecoms, IT and Entertainment topic(s)

Major tax relief for households and MSMEs, faster refunds for exporters, and stricter rules for tobacco and luxury items mark a decisive shift in India's indirect tax regime

The 56th GST Council meeting held on 3 September 2025 has delivered the most comprehensive tax restructuring since GST implementation, touching almost every sector of the economy. Under Finance Minister Nirmala Sitharaman's leadership, the Council approved sweeping changes that seem to prioritize affordability for essential goods while supposedly overloading luxury/sin goods to maintain revenue streams.

The changes will be implemented in phases, with most goods and all services seeing new rates from 22 September 2025. However, tobacco products will continue at existing rates until the government's compensation cess obligations are fully discharged. Let's have a look at the proposed changes:

Food Processing & Agriculture: Maximum Relief Package

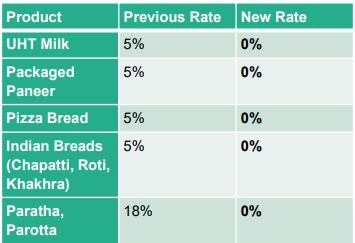

The food processing sector emerges as the biggest beneficiary of the GST restructuring, with the Council demonstrating clear intent to reduce food inflation and support agricultural value chains. Several everyday food items have been completely exempted from GST:

Other Significant Reductions (12% to 5%)

The Council has substantially reduced rates on protein-rich and processed foods:

- Dairy Products: Butter, ghee, cheese, and condensed milk

- Nuts and Dried Fruits: All varieties including almonds, dates, and cashews

- Meat and Seafood: All prepared and preserved meat, fish, and seafood products

- Beverages: Fruit juices, tender coconut water, and soya milk drinks

- Ice Creams

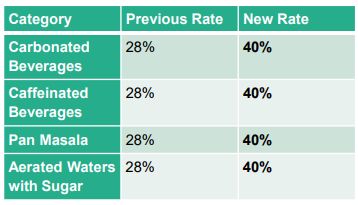

This is expected to invigorate sales during peak seasons and help maintain affordability for millions of consumers. However, balancing the relief provided above, certain premium beverages and snacks see rate increases. These goods mostly belong to the category of 'sin' goods. The same is summarized as under.

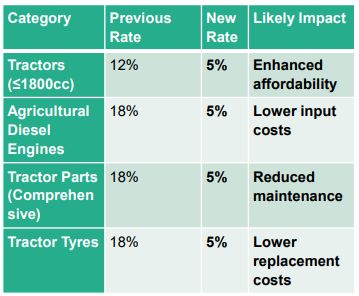

Agricultural Equipment: Comprehensive Support System

The agriculture sector receives unprecedented support through substantial tax reductions across the entire mechanization value chain.

Tractors and Components (Multiple Rate Reductions)

The reduction covers over 15 categories of tractor components including gearboxes, hydraulic systems, brake assemblies, steering components, and body parts. If there is any short reversal, ITC should be reversed through Form GSTR-3B or discharged through Form DRC-03 before September 2025 along with interest to computed from 1 April 2025.

Similarly, Farm Equipment and Inputs also receive substantial rate reduction summarized as follows:

- Irrigation Equipment: GST on Drip systems, sprinklers, and nozzles reduced to 5%

- Harvesting Machinery: All types of such machinery would now attract at 5% GST

- Processing Equipment: Composting machines benefit from rate reduction

- Fertilizer Inputs: GST on key chemicals like sulphuric acid, nitric acid reduced from 18% to 5%

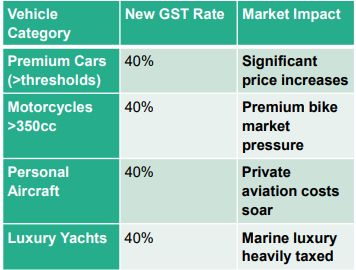

Automotive Sector: Tale of Two Markets

The automotive sector sees the most polarized treatment, with clear differentiation between mass market vehicles and luxury segments. The Council creates a clear distinction between affordable mobility and premium consumption, with mass market segments receiving tax relief and luxury categories subject to higher rates.

Relief to Mass Market vehicles (28% to 18%)

Passenger Vehicles:

- Small petrol cars (≤1200cc, ≤4000mm length)

- Small diesel cars (≤1500cc, ≤4000mm length)

- Small hybrid vehicles meeting size criteria

- Three-wheelers and ambulances

Two-Wheelers: All motorcycles and scooters ≤350cc

Commercial Vehicles: All goods vehicles, buses, and commercial chassis

Luxury Segment Taxation (28% to 40%)

The proposed changes by the Council has created one of the world's highest GST rates on luxury auto segment:

Pharma and Healthcare: Universal Access Focus

Over the past year, GST on life and medical insurance premia was one of the most highly debated topics. The Council seems to have read into the displeasure of the taxpayers and have had thorough re-look on the GST rates applicable in this sector:

Insurance Becomes Tax-Free

The council proposes to exempt GST on life and medical insurance premia completely. Currently the same is chargeable to GST at 18%, thus marking a significant reduction.

Life-Saving Medicines (12% to 0%)

33 critical drugs including cancer treatments, enzyme replacements, and rare disease medications are now exempt from GST. Medical Equipment and Supplies (12% to 5%)

- Medical oxygen and anesthetics

- Diagnostic equipment and test strips

- Surgical instruments and appliances

- Spectacles and contact lenses

- Thermometers and medical devices

Impact on Industry and Patients

- Pharma companies will need to adjust pricing strategies promptly to ensure compliance with anti-profiteering norms, passing tax savings directly to patients and hospitals. This will be crucial to prevent exploitative pricing, especially in life-critical drugs and devices.

- Lower GST on medical consumables will also incentivize domestic manufacturing, aligning with the government's "Make in India" initiative for pharma self-reliance.

- The move to reduce GST on advanced medicines such as gene therapies, cancer drugs, and biologics from 12% to 5%, and essential drugs and vaccines to nil or 5%, coupled with a cut on diagnostic and medical equipment (including glucometers, occlusion devices, surgical gloves) from 18% to 5%, is expected to ease treatment costs, strengthen domestic manufacturing, and improve accessibility especially in Tier-II and rural markets.

Education Sector: Student-Friendly Measures

Educational supplies receive comprehensive tax relief:

Complete Exemptions (12% to 0%)

- Exercise books and notebooks

- Pencils, crayons, and drawing materials

- Pencil sharpeners

- Maps and educational atlases

Reduced Rates

- Mathematical and geometry boxes: 12% to 5%

Construction and Infrastructure

One of the most consequential moves for India's housing and infrastructure sectors is the reduction of GST on cement from 18% to 12%. Cement is a foundational material in construction and infrastructure projects, contributing significantly to housing costs.

What this means for consumers and the housing sector

- The GST cut on cement will translate into lower construction costs for developers and contractors. These savings can percolate down to reduced home prices or improved housing project viability, thereby addressing India's persistent challenge of affordable housing.

- The reforms are well-aligned with government housing initiatives like Pradhan Mantri Awas Yojana (PMAY), further supporting inclusive urban development.

- The move is also expected to revive stalled real estate projects, particularly in low- and mid-income housing segments, by improving cost viability.

- Public infrastructure and urban development agencies will benefit from reduced input costs, potentially leading to increased allocation for housing, sanitation, and civic projects.

- Overall, the cement GST cut serves as a demand-side and supply-side intervention, lowering acquisition cost for buyers while improving margins for developers.

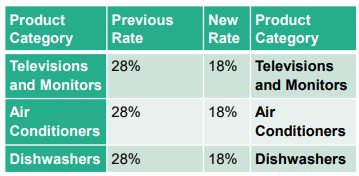

Consumer Electronics

Consumer is the winner here when it comes to electronics:

- This reduction directly impacts affordability, enabling the common man's aspiration to own modern household appliances and durable goods to be more easily achievable. With sustained inflationary pressures on durable goods, these tax cuts are expected to stimulate demand and invigorate domestic manufacturing and retail sectors

Services Sector Restructuring

Goods Transport Agency (GTA) Services: Streamlining Logistics

GST 2.0 preserves the 5% GST rate on GTA services but introduces clarity and simplifications to ease compliance:

- Special provisions for small transport operators and intermediaries aim to reduce regulatory burden.

- Simplified input tax credit rules and clearer guidelines will facilitate easier credit claims for logistics service providers.

This will reduce operating costs across the supply chain, indirectly benefiting manufacturers, retailers, and consumers through improved logistics efficiency

Hospitality Sector: Boost to Domestic Tourism

The Council has reduced GST on hotel stays from 12% to 5% for tariffs up to INR 7,500 per night, significantly improving affordability for domestic travelers

Families and mid-income groups will benefit from lower accommodation costs during travel, leisure, and pilgrimage trips.

Hospitality businesses, especially in tourismdriven regions, are expected to see higher footfalls and increased occupancy.

The measure supports state tourism and the informal economy, including small hoteliers, guesthouses, and homestays.

Gold and Jewelry Sector: Stability Retained

The Council has retained the 3% GST rate on gold, preserving rate stability in a sentimentdriven sector.

This move avoids price shocks during festive and wedding seasons, ensuring consumer confidence and predictable demand.

Jewelry retailers and manufacturers gain clarity for pricing and inventory planning.

The status quo also discourages informal trade and supports the organized sector's role in gold monetization and traceability efforts.

Refunds Reimagined: Risk-Based Provisional Payouts to Ease MSME Cash Flows

Refund delays have been a persistent pain point, especially for exporters and MSMEs operating under zero-rated supplies or inverted duty structures. Recognizing this, the Council has introduced a transformative risk-based refund mechanism designed to significantly ease working capital constraints for small and medium enterprises.

Key features of the reimagined refund process include

- Provisional payouts of up to 90% of the refund claims will be disbursed upfront, enabling immediate liquidity support to exporters and MSMEs.

- The balance amount will be subject to postfacto scrutiny and audit, ensuring compliance without stalling cash flow.

- Threshold limits on refunds for small exporters and e-commerce sellers have been removed, broadening the scheme's reach and inclusivity.

- A pilot refund automation portal will be launched on 1 November 2025, with full system rollout by June 2026, leveraging data analytics and risk assessment algorithms to fast-track approvals.

- Simplified documentation requirements and enhanced transparency will reduce disputes and enable smoother processing.

- Fraud detection and monitoring mechanisms will be strengthened to protect the exchequer while facilitating speedier disbursal.

Impact for Businesses

- The new system is expected to unlock billions in working capital, allowing MSMEs and exporters to meet operational expenses, invest in capacity expansion, and improve competitiveness in global markets.

- Faster refund cycles will especially benefit sectors with long cash conversion cycles, such as textiles, handicrafts, and e-commerce.

- By minimizing procedural bottlenecks, the government signals its commitment to a business-friendly environment and enhanced ease of doing business.

GST Appellate Tribunal (GSTAT): A GameChanger for Tax Dispute Resolution

The operationalization of the GST Appellate Tribunal marks a critical step in reducing litigation and enhancing tax certainty:

- GSTAT will begin accepting appeals on 30 September 2025.

- Hearings will commence from December 2025.

- All pending appeals must be filed by 30 June 2026.

- The Principal Bench of GSTAT will function as a national appellate authority, harmonizing rulings and mitigating jurisdictional inconsistencies.

Significance

This institutional reform will shorten dispute resolution timelines drastically, saving costs for businesses and improving ease of doing business. The timely disposal deadline sends a strong message on government commitment to dispute finality.

Intermediaries: Major Relief for Intermediaries in Landmark Reform

Current Challenge for Intermediaries

Under the existing GST framework, intermediary services, defined as facilitation or arrangement of supply between parties, are taxed at 18%, even when the recipient is located outside India. This is due to Section 13(8)(b) of the Integrated Goods and Services Tax (IGST) Act, which deems the place of supply for such services to be India. Consequently, Indian intermediaries face a tax disadvantage compared to their global peers, leading to higher costs and reduced competitiveness.

Proposed Amendment and Its Implications

The GST Council has recommended deleting Section 13(8)(b) from the IGST Act. This change will shift the place of supply determination to Section 13(2), which considers the recipient's location, effectively classifying intermediary services provided to foreign clients as exports. Such services would become zero-rated under Section 16 of the IGST Act, allowing intermediaries to claim input tax credit refunds and easing cash flow.

Post-Sale Discounts and ITC Reversal: Legislative Amendments

To reduce litigation and clarify business practices, the Council has:

- Recommended omission of Section 15(3)(b)(i) of CGST Act, which restricted post-sale discounts unless pre-agreed.

- Allowed credit notes to account for discounts even if not linked to specific invoices.

- Mandated proportionate ITC reversal by the recipient to the extent of the discount received.

Rescinded Circular:

- Circular No. 212/6/2024-GST (dated 26 June 2024) will be rescinded.

- A new clarificatory circular will be issued to ensure consistent application.

Advice for Businesses

- Review dealer incentives, promotional schemes, and discount mechanisms.

- Update ERP/accounting systems to comply with new ITC norms.

- Align documentation to avoid mismatch in GSTR-1 and GSTR-3B filings.

Anti-Profiteering: Ensuring Tax Benefits Reach Consumers

- In line with the Council's consumer-first approach, the government will maintain close vigilance to ensure that GST rate reductions and other benefits are passed on to end consumers, either directly or indirectly.

- Though the existing anti-profiteering framework under the National AntiProfiteering Authority (NAA) was sunset and responsibilities transferred to the Competition Commission of India (CCI), there is serious consideration underway to revive and strengthen dedicated anti-profiteering provisions for GST.

- Businesses are therefore advised to adopt transparent pricing policies, maintain robust documentation of cost and pricing decisions, and promptly pass on tax benefits. Failure to comply may attract stringent regulatory action, including penalties.

Consumer Benefits: Immediate and LongTerm Gains

The reforms create a win-win scenario for consumers and businesses alike:

- Households will experience tangible monthly savings, ranging from INR 200 to INR 400 or more, on essentials, consumer durables, healthcare, and education.

- First-time homebuyers and middle-income families stand to benefit from lower housing costs driven by reduced GST on cement and related construction materials.

- Access to affordable healthcare and education materials is expanded, especially benefiting rural and semi-urban populations.

- Lower GST on personal care and FMCG products will ease the burden on daily budgets, supporting improved standards of living.

- Reduced hotel tariffs will make domestic tourism more accessible for families, senior citizens, and group travelers.

- Stable gold taxation assures middle-class buyers during festive and wedding seasons, keeping discretionary purchases within reach.

Business Cash Flow and Supply Chain Realignment: The Bigger Picture

The GST 2.0 reforms extend beyond immediate tax cuts and refunds, they fundamentally improve cash flow dynamics and compel re-alignment of supply chain and pricing policies:

- The 90% upfront refund mechanism will release blocked capital for MSMEs and exporters, enabling reinvestment, expansion, and debt servicing.

- Simplified ITC rules and clarified discount treatments reduce compliance costs and disputes, creating a more predictable tax environment.

- Businesses will need to revise supply chain contracts, pricing agreements, and ERP systems to align with new tax rates and credit rules.

- Manufacturers and retailers must work collaboratively to update shelf prices, promotional strategies, and billing systems to reflect tax savings and comply with antiprofiteering mandates.

- Logistic providers and Goods Transport Agencies (GTAs) will see smoother compliance, reducing supply chain bottlenecks and enhancing distribution efficiency.

Together, these changes encourage a more formalized, transparent, and efficient tax ecosystem, benefiting the entire economy.

The True GST 2.0

While 1 July 2017 created an epoch in India's Indirect taxation timeline, the 56th GST Council meeting represents the birth of GST 2.0. With significant tax relief on essentials, expedited refunds, a functioning appellate mechanism, clarified ITC rules, and rigorous antiprofiteering enforcement, GST 2.0 represents a balanced and forwardlooking reform.

These comprehensive reforms come at a critical juncture as global trade dynamics shift dramatically. With the US intensifying tariff pressures on various countries and trade wars reshaping international commerce, India's domestic GST restructuring positions the economy strategically for both internal resilience and external competitiveness. The reduction in manufacturing input costs, from agricultural equipment to automotive components, strengthens India's export capabilities precisely when global supply chains are being reconfigured.

The Council's emphasis on making essential goods affordable while taxing luxury consumption reflects a deliberate strategy to build domestic demand resilience and consequently inoculating the economy against global trade shocks. As external trade becomes increasingly uncertain, a robust domestic market supported by affordable food, healthcare, and transportation becomes India's economic anchor. The agricultural mechanization support and food processing relief create the foundation for food security and rural prosperity that insulates the economy from global volatility

As businesses adapt to these changes over the coming months, the true measure of success will be whether the restructuring achieves its intended goals: making essential goods more affordable, strengthening domestic manufacturing competitiveness, and maintaining the fiscal resources necessary for national development, all while positioning India as a stable, self-reliant economy capable of thriving regardless of global trade uncertainties.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.