- with readers working within the Advertising & Public Relations industries

- within Law Department Performance topic(s)

The Goods and Services Tax Appellate Tribunal ("GSTAT") has become operational effective September 24, 2025, in accordance with the provisions of the Central Goods and Services Tax Act, 2017 ("CGST Act") read with the rules and notifications issued thereunder. The CGST Act provides for a multi-tier adjudication process for dealing with litigation under the goods and services tax laws. Sections 109 to 113 of the CGST Act provide for the constitution of the GSTAT and for filing appeals, respectively. The Goods and Services Tax Appellate Tribunal (Procedure) Rules, 20251 ("GSTAT Procedure Rules") have also been notified, outlining the detailed procedure for online filing of the appeals.

Framework of the GSTAT

1. The Principal Bench has been set up at New Delhi and the respective jurisdictional State Benches have been constituted in accordance with Section 109 of the CGST Act and notifications issued thereunder2. The jurisdiction of the GSTAT State Benches is enclosed as Annexure 1.

2. The following cases or class of cases, will be heard only by the Principal Bench of the GSTAT3:

a) issues concerning the determination of the place of supply; b) matters pertaining to anti-profiteering (Section 171 of the CGST Act) 4;

c) issues pending before 2 (two) or more State Benches where the President is satisfied that an identical question of law is involved;

d) issues arising under Sections 14 (special provision for payment of tax by a supplier of online information and database access or retrieval services) or Section 14A (special provision for specified actionable claims supplied by a person located outside taxable territory) of the Integrated Goods and Services Tax Act, 2017 ("IGST Act"); and

e) issues concerning Section 20 (manner of distribution of credit by Input Service Distributor) of the CGST Act.

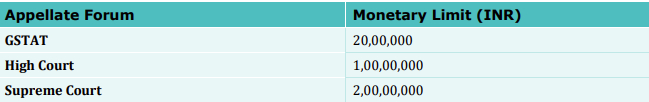

3. A specific monetary limit has also been provided for filing the appeal before GSTAT, High Court and Supreme Court, which is as below5:

4. The above monetary limit must be computed keeping in mind the following:

a) for a dispute involving a tax demand (with or without penalty and/or interest), only the aggregate amount of tax under dispute will be considered;

b) for a dispute involving a demand for interest (penalty or late fee) exclusively, only the respective amount of interest (penalty or late fee) will be considered;

c) for a dispute pertains to a demand for interest, penalty and/or late fee (without involving any disputed tax amount), the aggregate of amount of interest, penalty and late fee is to be considered;

d) for a dispute pertaining to an erroneous refund, the amount of refund under dispute will be considered; and

e) for a composite order which disposes more than 1 (one) appeal/demand notice, the monetary limits will be applicable on the total amount of tax, interest, penalty, or late fee, as applicable, and not to the amount involved in any individual appeal or demand notice.

5. The monetary thresholds will not apply in cases involving constitutional validity of provisions, vires of subordinate legislation, recurring interpretational issues such as valuation, classification, refunds or place of supply, or where adverse strictures are recorded against the authorities.

6. Appeals, even where the disputed amount exceeds the threshold, are to be filed only on the basis of merits. Further, non-filing of appeals on account of monetary limits is not to be treated as precedent by the authorities.

Time-limits for filing of appeals before GSTAT

1. Appeals against orders passed by the Appellate Authority under Section 107 or by the Revisional Authority under Section 108 of the CGST Act may be filed before the GSTAT within 3 (three) months6. For computing the period of limitation: (a) the day from which such period is to be computed; and (b) if the last day expires when the GSTAT remains closed, such day(s), are to be excluded7.

2. Appeals against orders communicated prior to April 1, 2026 may be filed before the GSTAT before June 30, 2026 and appeals against orders communicated on or after April 01, 2026 are to be filed within three (3) months from the date of such communication8.

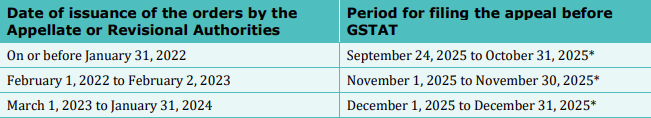

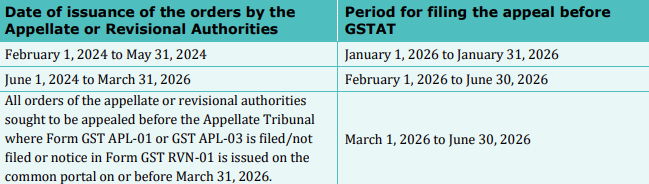

3. The GSTAT has prescribed9 the following guidelines for staggered filing of appeals before GSTAT to manage portal capacity and ensure smooth processing:

* The outer limit for filing the appeal will be June 30, 2026

Procedure for filing of appeals before GSTAT and its processing 1. The GSTAT Procedure Rules outlines the procedure with respect to appeals filed before the GSTAT, which includes:

a) Electronic filing of appeals: All appeals before the GSTAT must be filed electronically in FORM GST APL-05 with supporting documents and prescribed fees; and cross-objections must be filed in FORM GST APL-0610.

b) Provisional acknowledgement of appeal filing: A provisional acknowledgement is issued on filing, and a final acknowledgement with appeal number is issued upon removal of defects, which determines the filing date.

c) Documents required to accompany form of appeal: Rule 21 of the GSTAT Procedure Rules requires (online) submission of all relevant documents including the certified copy of the decision or order appealed against along with prescribed fees.

d) Interlocutory applications: Rule 29 of the GSTAT Procedure Rules provides for filing of interlocutory applications such as application for stay of demand, condonation of delay, amendment of pleadings or any other interim relief in prescribed manner.

e) Rejection or amendment of form of appeal: Rule 32 of the GSTAT Procedure Rules empowers the registrar to: (a) allow necessary amendments to the form of appeal and seek additional documents; and (b) reject the form of appeal if such amendment is not made or documents are not submitted within the prescribed time.

f) Who may be joined as respondents: As per Rule 33 of the GSTAT Procedure Rules, the Commissioner will be made the respondent to the appeal or application in case an appeal is filed against the authorities.

g) Appeal referred to larger bench: Under Rule 50 of the GSTAT Procedure Rules, an appeal may be referred to a larger bench by the President, in case of difference of opinion between members of the bench while hearing an appeal.

h) Electronic filing and processing of appeals and applications: Under Rule 115 of the GSTAT Procedure Rules, all filings, communications, proceedings, and orders before the GSTAT must be mandatorily conducted, processed, and recorded electronically on the GSTAT portal, with hearings permitted in physical or electronic mode as directed.

i) Pronouncement of order: As per Rule 103 of the GSTAT Procedure Rules, GSTAT is required to pronounce the order within 30 (thirty) days from the date of final hearing.

2. The prescribed fee for filing appeal is INR 1,000 (Indian Rupees one thousand) per INR 1,00,000 (Indian Rupees one lakh) of tax, input tax credit, fine, fee, or penalty involved, subject to a minimum of INR 5,000 (Indian Rupees five thousand) and a maximum of INR 25,000 (Indian Rupees twenty-five thousand). Further, no fee is payable for rectification applications under Section 112(10) of the CGST Act.

3. Further, Section 112(8) of the CGST Act requires an appeal to be filed before the GSTAT to be accompanied with a pre-deposit of 10% (in addition to the pre-deposit made before the Appellate Authority) of the tax demand (subject to maximum of INR 20,00,00,000 (Indian Rupees twenty crore) will have to be deposited.

Appeals against orders passed by GSTAT

The orders issued by the GSTAT State Benches can be challenged before the High Court, only on substantial questions of law and are to be filed within 180 (one hundred and eighty) days (extendable on sufficient cause) from the communication of the order. However, the appeals challenging the order passed by the Principal Bench of the GSTAT will lie directly before the Supreme Court.

To view the full article clickhere

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.