- within Strategy, Privacy and Real Estate and Construction topic(s)

- with Inhouse Counsel

- with readers working within the Law Firm industries

On 19 April 2022, the International Financial Services Centre Authority (IFSCA) published the International Financial Services Centre Authority (Fund Management) Regulations, 2022 (FM Regulations), overhauling the fund regime in International Financial Services Centre (IFSC). In a stark contrast to its initial approach of benchmarking the IFSCA funds regime against the fund ecosystem created by the Securities and Exchange Board of India (SEBI), the IFSCA has now consolidated the existing fund framework into one unified regulation, which will regulate the fund managers, while prescribing operating guidelines for funds. The FM Regulations become effective on 19 May 2022 (Effective Date).

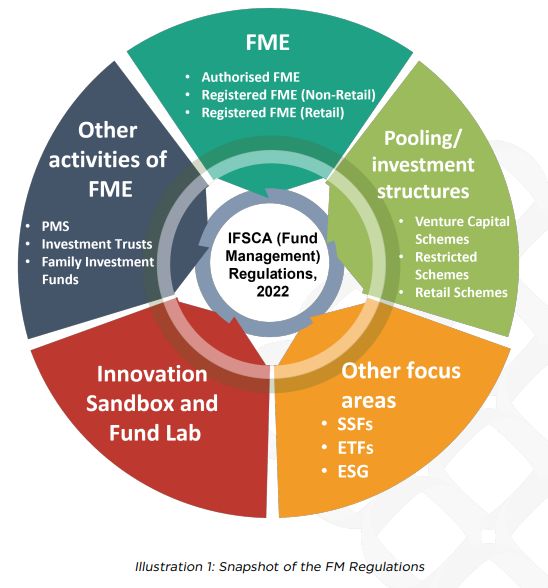

SNAPSHOT OF THE FM REGULATIONS

The FM Regulations seek to provide a comprehensive regulatory framework for all activities related to fund management in the IFSC, including management of managed accounts. The FM Regulations, inter alia, provide for governance of the following:

TRANSITION FOR EXISTING STAKEHOLDERS

Immediately, as on the Effective Date, the existing regime will cease to operate. All existing fund managers of an alternate investment funds (AIF) and portfolio management services (PMS) providers registered with the IFSCA shall be required to seek fresh registration within 6 months from the Effective Date under the FM Regulations.

| Comment: As the previous regulatory provisions are repealed and cease to operate from the Effective Date, clarity is awaited if the existing registered fund will continue to operate under the old regime or will be required to comply with the FM Regulations as well (and to what extent) in terms of minimum investment, investor commitment requirements, etc. |

CATEGORIES OF FUND MANAGEMENT ENTITY (FME)

All entities (including existing fund managers) that intend to undertake the business of fund management in the IFSCA are now required to register under the terms of the FM Regulations. As indicated in Illustration 1, the fund managers, based on their activities, are required to be registered as follows:

Authorised FME

- FMEs that intend to pool money from (i) accredited investors; or (ii) investors investing above a specified threshold (Eligible Investors), by way of venture capital scheme (VCS) and Family Investment Fund1 (Authorised FME).

Registered FME (Non-Retail)

- FMEs that intend to pool money from Eligible Investors through one or more Restricted Schemes2 (Registered FME (Non-Retail)).

- These FMEs are also allowed to undertake PMS activities (including to multi-family office), advisory services, and act as investment manager for private placement of real estate investment trusts (REITs) and infrastructure investment trusts (InvITs) (collectively Investment Trusts) and undertake all activities permitted to Authorised FME.

Registered FME (Retail)

- FMEs that intend to pool money from all investors or a section of the investors for investing through Retail Schemes3 or Restricted Schemes (Registered FME (Retail)).

- These FMEs are also allowed to act as investment manager for public offer of Investment Trusts, launch exchange traded funds (ETFs), and undertake all activities as permitted to Authorised FMEs and Registered FMEs (Non-Retail).

The FM Regulations also provide for eligibility, activities, investment conditions, responsibilities, etc. for each of these categories.

Net worth: The FM Regulations provide for minimum capital norms depending on entity classification. The net worth requirement is to be met for each regulated activity proposed to be conducted. The net worth requirement for Authorised FME is USD 75,000, for Registered FME (Non-Retail) is USD 5,00,000 and Registered FME (Retail) is USD 1 million.

The net worth includes any minimum contribution made by the FME under the schemes and for 'branches' operating as FME, it can be maintained at the parent level.

People: The FM Regulations provide for requirement of designating a principal officer (for all FMEs), a compliance and risk manager (for Registered FMEs), and additional requirements of 50% independent directors and 1 additional key managerial personnel (KMP) for Registered FME (Retail).

Legal form: In line with the establishment of unit under the Special Economic Zones Act, 2005, an FME is permitted to operate by forming a company, a limited liability partnership or a branch (if already registered or regulated) thereof. However, a Registered FME (Retail) is permitted to operate as a company only.

|

Comment:

|

TYPE OF SCHEMES

The categories of FME outlined above, may float the following three types of schemes, structured as a company, trust or a limited liability partnership, each having a minimum of corpus of at least USD 5 million.

- Venture Capital Scheme

This scheme can be offered by any registered FME to less than 50 Eligible Investors and certain specified stakeholders of the FME, with a minimum tenure of 3 years and having a maximum corpus of USD 200 million. A VCS needs to invest at least 80% of its assets under management (AUM) in companies incorporated for less than 10 years. Permissible investments by VCS include:

- securities of unlisted and listed (or to be listed) entities;

- money market instruments;

- debt securities;

- securitised debt instruments;

- other venture capital schemes;

- units of mutual funds and AIFs; and

- investment in limited liability partnerships.

Restricted Schemes

This scheme can be offered by any registered FME to less than 1000 Eligible Investors and certain specified stakeholders of the FME as either close ended (having minimum tenure of 1 year) or open ended.

Permissible investments by Restricted Schemes include investments permitted under VCS, as well as other investment schemes set up in the IFSC, India and foreign jurisdiction and derivatives including commodity derivatives; provided that a maximum of 25% of the corpus can be invested in unlisted companies (in case of open ended schemes). Additionally, a close ended scheme may also invest up to 20% of its corpus in physical assets such as real estate, art, bullion, etc.

Retail Schemes

This scheme is open for subscription to all sections of retail investors. It shall have at least 20 investors with no single investor investing more than 25% in a scheme and can be either close ended (This scheme is open for subscription to all sections of retail investors. It shall have at least 20 investors with no single investor investing more than 25% in a scheme and can be either close ended (having minimum tenure of 3 years) or open ended. having minimum tenure of 3 years) or open ended.

The permissible investments are similar to a Restricted Scheme, however, (i) investment in limited liability partnerships; (ii) derivatives (for purposes other than hedging) and (iii) physical assets, are not permitted.

The Retail Scheme has the following additional restrictions:

- maximum investment of a close ended scheme in unlisted companies to be 50% of its AUM;

- minimum investment of an investor in a close ended scheme investing more than 15% in unlisted securities to be USD 10,000;

- maximum investment in a single company to be 15% of its AUM with prior approval by fiduciaries of the scheme (a maximum of 10% without approval); and

- maximum investment in a single sector to be 25% of its AUM (a maximum of 50% is allowed in financial services sector). However, this restriction pertaining to sectoral limit does not apply to thematic, or sector focused or index scheme.

|

Comment:

|

OTHER ACTIVITIES OF THE FME

PMS, Investment Advisory, Investment Trusts

The IFSCA had previously prescribed regulatory provisions for the PMS, Investment Trusts and investment advisories. The FM Regulations has now consolidated the framework for registration of PMS, Investment Trusts and norms on investment advisory.

Family offices

Family offices have been categorised into two broad segments:

- Single family office: A self-managed fund pooling money only from a single family and set up in accordance with the terms of the FM Regulations and registered as Authorised FME. Net worth requirements are not applicable to a Family Investment Fund.

- Multiple family office: An FME may also provide services to multi-family office under a portfolio management agreement, to be governed by additional guidelines as may be prescribed by the IFSCA.

A Family Investment Fund can be set-up as a company, LLP or a contributory trust with minimum corpus of USD 10 million, with similar permissible investments as Restricted Schemes (without caps and restrictions). The nature of such funds can be open ended or close ended, as per the requirements of the family with all activities related to managing family investment fund being permitted.

|

Comment: This is the first of its kind framework for family offices in India. An FME registered as a family office can undertake a wide range of activities and investments. It is a welcome move to permit Family Investment Funds to raise debt / loans, however, it is pertinent to note that such borrowing shall be as per the risk management policy of the Family Investment Fund. |

OTHER FUND MANAGEMENT ACTIVITIES

Special Situation Funds (SSF)

A Registered FME may launch an SSF as a closed ended scheme of at least 3 years to invest in special situation assets (as specified under the FM Regulations). SSFs target stressed loans/assets, security receipts by asset reconstruction companies, etc. While the governance is similar to a close ended restricted scheme, we expect the IFSCA to provide further clarification on corpus, eligible investors, etc. separately.

Exchange Traded Funds (ETF)

Registered FMEs (Retail) may launch an ETF. ETFs shall be mandatorily listed and traded on a recognized stock exchange and shall include:

- Equity index-based ETFs

- Debt index-based ETFs

- Commodity based ETFs

- Gold ETFs

- Silver ETFs

- Hybrid ETFs (investing in 2 or more asset class)

- Actively managed ETF

- Any other ETFs subject to approval of the concerned recognised stock exchange and the authority

The FM Regulations provide for further detailed guidelines on each of the above.

Environmental, Social and Governance (ESG)

A FME managing AUM above USD 3 billion as at the close of a financial year or as may be specified by the IFSCA, is now required to: (i) establish policy on governance around material sustainability-related risks and opportunities; and (ii) disclose in its annual report how the FME identifies, assesses and manages material sustainability-related risks and the process of factoring sustainability-related risks and opportunities into fund manager's investment strategies and processes.

Regulatory and innovation sandbox

Fund lab

The IFSCA may provide exemption from the operation of all or any of the provisions of the FM Regulations for up to 18 months, for furthering innovation in aspects relating to testing new products, strategies, processes, services, business models, use of technology, etc. in live environment of regulatory or innovation sandbox in the financial markets. Such funds cannot solicit money from public and shall be governed by a framework to be specified by the IFSCA. Exemption is subject to conditions as may be specified by the IFSCA including conditions to be complied with on a continuous basis.

Special purpose vehicle (SPV) as a coinvestment structure

The FM Regulations have introduced a new coinvestment structure, enabling a VCS and / or a Restricted Scheme to co-invest through a SPV under a framework specified by the IFSCA. Previously this was limited to co-investment through a segregated portfolio by issuing a separate class of units.

CONCLUSION

The IFSCA has endeavoured to develop a comprehensive and consistent regulatory framework for investment funds based on global best practices with a special focus on ease of doing business.

The provisions of the FM Regulations provide for regulating the 'fund manager' as against the 'funds', a single point registration process for an FME intending to undertake a host of activities, and an overlay of specific requirements for certain funds to enable smoother fund launch process and fund raising. By prescribing requirements for Family Investment Funds, the IFSC can also emerge as a perfect solution to facilitate growth of Indian and global family offices which are looking at diversifying and to encourage domiciling of family offices promoted by Indians or persons of Indian origin residing abroad.

The FM Regulations have, to a large extent, addressed the concerns of the industry related to the regulatory landscape for investment funds and fund managers within the IFSC and providing the best-in-class platform to support the growing aspirations of the financial services industry.

Footnotes

1. Family Investment Fund under the FM Regulations refers to a "means a self-managed fund pooling money only from a single family and has been set up in terms of these regulations"

2. Restricted Scheme under the FM Regulations refers to a "scheme under a private placement offer to only "accredited investors" or investors investing above USD 1,50,000 and it shall not have more than 1000 investors or such other number as may be specified by the Authority".

3. Restricted Scheme under the FM Regulations refers to a "scheme offered to all investors or a section of the investors for subscription with no ceiling as to number of investors in the scheme".

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com