In an important development for the fund industry, the International Financial Services Centre Authority (IFSCA) has notified the IFSCA (Fund Management) Regulations, 2022 (available here) (IFSCA Fund Regulations). The IFSCA Fund Regulations have been introduced to regulate the framework for investment funds in India's International Financial Services Centre (IFSC), in particular Gujarat International Finance Tec-City (GIFT City). The IFSCA Fund Regulations will come into force on the 30th (thirtieth) day from the date of its publication in the Official Gazette i.e. April 19, 2022.

As an immediate result of the introduction of the IFSCA Fund Regulations, various regulatory provisions and circulars issued by Securities and Exchange Board of India (SEBI) with respect to the funds in IFSC will cease to operate. Amongst others, the IFSCA Fund Regulations, in particular, repeal the applicability of SEBI (Alternative Investment Funds) Regulations, 2012; SEBI (Mutual Funds) Regulations, 1996; Chapter VI on Funds of SEBI (International Financial Services Centres) Guidelines, 2015, in IFSC. Further, all existing Fund Managers of Alternative Investment Fund (AIFs) registered by IFSCA will need to seek fresh registration from IFSCA under the IFSCA Fund Regulations within six (6) months from the effective date.

The IFSCA Fund Regulations in essence will govern, inter alia, an establishment of fund management entities (FMEs); schemes for fund management – venture capital schemes, restricted schemes (non-retail), retail schemes, special situation funds focusing on special situation assets, exchange traded funds; other fund management activities such as portfolio management, investment trust being Infrastructure Investment Trust (InvIT), Real Estate Investment Trust (REIT), family investment fund; environmental, social and governance (ESG) norms to be followed by FMEs; listing by the funds; general obligations and responsibilities; and advertisement by funds.

Certain key aspects of the IFSCA Fund Regulations have been discussed below under the following heads:

A. Mandatory certificate of registration from IFSCA as a Fund

Management Entity (FME)

B. Classification of FMEs

C. Eligibility conditions of applicants seeking certificate of

registration from the IFSCA

D. Constitution of the Fund / Scheme

E. Schemes for Fund Management | Restricted Schemes (Non-Retail

Schemes)

F. Schemes for Fund Management | Venture Capital Schemes (VCS) |

Green channel

G. Schemes for Fund Management | Retail Schemes

H. Schemes for Fund Management | Family Investment Funds

(FIFs)

I. Schemes for Fund Management | Special Situation Funds

(SSF)

J. Exchange Traded Funds (ETFs)

K. Focus on Environment Social Governance (ESG)

L. Other Fund Management Services

M. Listing of schemes/ units of FMEs

N. General Obligations and Responsibilities

A. Mandatory certificate of registration from IFSCA as a Fund Management Entity (FME)

1. Certificate of Registration: Any entity intending to undertake the business of fund management shall not commence operations in IFSC unless it has obtained a certificate of registration from the IFSCA as a Fund Management Entity (FME).

2. Validity of Certificate of Registration: The certificate of registration of FME shall be valid for such period as may be specified, unless it is suspended or cancelled by the IFSCA or surrendered by the FME and taken on record by the IFSCA.

B. Classification of FMEs

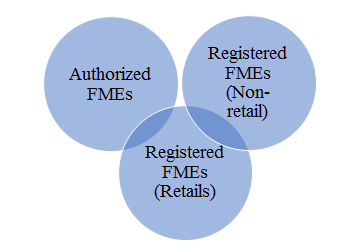

The FME shall seek registration under any of the following three categories, explained below:

1. Authorized FME: The FMEs that pool money from accredited investors or investors investing above the specified threshold by way of private placement and invest in start-ups or early-stage ventures through a Venture Capital Scheme. Family Investment Fund investing in securities, financial products and such other permitted asset classes shall also seek registration as an Authorised FME.

2. Registered FME (Non-Retail): The FMEs that pool money from accredited investors or investors investing above a specified threshold by way of private placement for investing in securities, financial products and such other permitted asset classes through one or more restricted schemes. Such FMEs shall also be able undertake Portfolio Management Services (including for multi-family office) and act as investment manager for private placement of Investment Trust (REITs and InvITs). Such FMEs shall also be able to undertake all activities as permitted to Authorised FMEs.

3. Registered FME (Retail): The FMEs that pool money from all investors or a section of the investors under one or more schemes for investing in securities, financial products and such other permitted asset classes through retail or restricted schemes. Registered FME (Retail) may act as investment manager for public offer of Investment Trusts (REITs and InvITs). Such FMEs shall also be able to launch ETFs. Further, such FMEs shall also be able to undertake all activities as permitted to Authorized FMEs and Registered FMEs (Non-retail).

4. No change in category: A FME which has been granted a certificate of registration under a particular category cannot change its category, except with the prior approval of the IFSCA.

C. Eligibility conditions of applicants seeking certificate of registration from the IFSCA

| Provision | Explanation | ||||||

| Legal form of the applicant |

(a) Applicant shall be present in an IFSC by forming a company or limited liability partnership (LLP) or branch thereof or any other form as may be permitted by the IFSCA, subject to certain conditions; (b) A Registered FME (Retail) shall not be permitted though LLP mode or its branch; (c) Branch structure is permitted only for a FME which is already registered and/or regulated by a financial sector regulator in India or a foreign jurisdiction for conducting similar activities; (d) Activity of fund management should be permitted by the memorandum of association in case of a company or the LLP agreement in case of LLP; (e) A Registered FME (Retail) shall have at least 4 directors with at least 50% of the directors to be independent directors and not associated with the FME. |

||||||

| Sound Track Record |

The applicant shall have a sound track record and general reputation of fairness and integrity in all its business transactions. "sound track record" shall mean: (a) In case of Registered FME (Retail): FME or its holding company shall not have less than 5 years of experience in managing Assets Under Management (AUM) of at least USD 200 million with more than 25,000 investors or at least 1 person in control of the FME holding more than 25% shareholding in the FME be carrying on business in financial services for a period of not less than 5 years. However, to facilitate new generation fintech companies with innovative ideas that may lead to further market development, any other criteria for sound track record may be considered by IFSCA. (b) In case of Registered FME (Non-Retail) and Authorized FME: FME shall employ such employees who shall have relevant experience as specified under the regulations. |

||||||

| Net Worth Requirements |

An entity seeking registration as a FME shall, at all times, comply with the net worth requirements:

An entity operating as a branch shall at all times comply with the minimum net worth requirements which may be maintained at the parent level. However, the parent entity shall ensure that adequate funds are available for branch for its day to day operations. Minimum contribution requirement with respect to FMEs, will be included while calculating the net-worth as stated above. |

||||||

| Other eligibility conditions |

(a) Appointment of Principal Officer: The applicant to designate a principal officer who shall be responsible for overall activities of the FME including but not limited to fund management, risk management and compliance. (b) Appointment of KMP: In case of Registered FME, in addition to the principal officer, one key managerial personnel(s) (KMP) to be designated as the compliance and risk manager. In case of Registered FME (Retail), in addition to above, an additional KMP to be appointed who shall be designated with the responsibility of fund management. (c) Change in principal officer and KMP: Any changes in the principal officer and/or the KMP to take place only with the prior approval of IFSCA. (d) Fit and Proper Persons: The applicant and its principal officer, directors/ partners/ designated partners, KMP and controlling shareholders shall be fit and proper persons, at all times, as prescribed. (e) Infrastructure: The entity to have necessary infrastructure commensurate to the size of its operations in IFSC. |

D. Constitution of the Fund/Scheme

1. A FME may launch various schemes and prior to the filing of a scheme document, it shall appoint the Board of Directors in case of Company, Designated Partners in case of LLP and Trustees (including the Board in case of a Trustee company) in case of a Trust. These will be referred to as fiduciaries.

2. A FME is also required to ensure that all the fiduciaries meet with the fit and proper requirements.

3. A FME intending to launch retail schemes shall take prior approval of the IFSCA for appointing any person as a fiduciary.

E. Schemes for Fund Management | Restricted Schemes (Non-Retail Schemes)

| Provision | Explanation | |||||||||

| Eligible Schemes (Category-I, II, III AIFs) |

Restricted Schemes are schemes that may be launched by Registered FMEs for various investment strategies for: (a) investing in start-up or early-stage ventures or social ventures or infrastructure or other sectors or areas which the government or regulators consider as socially or economically desirable and shall include venture capital funds, social venture funds, infrastructure funds, ESG Funds, Special Situation funds and such other Schemes/Funds as may be specified by the IFSCA. Schemes falling under this clause shall be a close ended scheme and filed before IFSCA as Category I AIF. (b) investment for undertaking diverse or complex trading strategies including investment in listed or unlisted derivatives and for permitted investments under longevity finance. The schemes under this clause shall be filed before IFSCA as Category III AIF and may be launched as open ended or close ended schemes. (c) investment which does not fall under the clause (a) and (b) above. The schemes under this clause shall be filed before IFSCA as Category II AIF and shall be launched as close ended schemes. |

|||||||||

| Filing of placement memorandum |

|

|||||||||

| Eligible Investors |

Restricted schemes shall have less than 1,000 investors or such number as may be specified by the IFSCA.

|

|||||||||

| Nature of scheme |

Restricted schemes may be launched as open ended or close ended schemes.

|

|||||||||

| Permissible investments (including physical assets such as real estate, art, bullion) |

A restricted scheme may invest the moneys collected under any of its schemes only in a specific list of instruments which inter alia include securities issued by unlisted entities, securities listed or to be listed or traded on stock exchanges in IFSC, India or foreign jurisdiction, money market instruments, debt securities, derivatives including commodity derivatives, units of mutual funds and AIFs in India and foreign jurisdiction, investment in LLPs, etc. Importantly, a close ended scheme may invest up to twenty percent (20%) of the corpus in other physical assets such as real estate, bullion, art or any other physical asset as may be specified by the IFSCA from time to time. |

|||||||||

| Investment Restriction |

In case of an open-ended scheme, maximum investment in securities of unlisted companies should not exceed 25% of the corpus of the schemes.

|

|||||||||

| Disclosure to investors |

The placement memorandum for such FMEs shall inter alia disclose the investment objective, the targeted investors, proposed corpus, investment style or strategy, investment methodology and proposed tenure, etc.

|

|||||||||

| Borrowing and Leveraging allowed |

A restricted scheme may borrow funds or engage in leveraging activities, subject to the following conditions: (a) The maximum leverage by the scheme, along with the methodology for calculation of leverage, shall be disclosed in the placement memorandum (b) The leverage shall be exercised in accordance with the disclosures in the placement memorandum and any deviation to be subject to consent of 2/3rd of the investors by value (c) The FME employing leverage shall have a comprehensive risk management framework appropriate to the size, complexity and risk profile of the fund |

|||||||||

| Valuation Norms |

FMEs to value its investments in accordance with certain overarching principles to ensure fair treatment to all investors including existing investors as well as investors seeking to invest. These principles inter alia include: (a) Principles of fair valuation (b) Identification of valuation methodologies (c) Consistent valuation of assets held by FME (d) Periodic review of the valuation policies and procedures. |

|||||||||

| Computation of NAV | FME to compute the NAV of each restricted scheme at least on a monthly basis and in case of a close ended restricted scheme the computation of NAV shall take place at least half-yearly. | |||||||||

| Skin in the game of FMEs – Relocation of offshore funds benefits | FME shall ensure that under a restricted scheme,

the FME or its associate shall invest:

Timeline for contribution: The said contribution in proportion to investor's investment in the scheme shall be made by the FME or its associate entity within forty-five (45) days (which may be extended subject to IFSCA's approval) and maintained on ongoing basis. The contribution, if brought in by FME, shall be included for the purpose of net worth requirements. Exemption from contribution: The said contribution shall be exempted in certain situations: (a) where at least 2/3rd of the investors in the scheme by value permits waiver of such contribution; (b) where at least 2/3rd of the investors in the scheme are accredited investors; (c) where scheme is a fund of fund scheme investing in a scheme which has similar such requirements; (d) in case of relocation of funds /schemes established or incorporated or registered outside India to IFSC. |

|||||||||

| Co-investment and leverage |

A restricted scheme may co-invest in permissible investments under these regulations through a SPV or through a segregated portfolio by issuing a separate class of units and shall ensure. The SPV may undertake leverage as disclosed in the placement memorandum.

|

F. Schemes for Fund Management | Venture Capital Schemes (VCS) | Green channel

1. Investments: VCS are schemes that can be launched by FMEs that invest primarily in unlisted securities of start-ups, emerging or early-stage venture capital undertakings mainly involved in new products, new services, technology or intellectual property right based activities or a new business model or other schemes which invest in such entities and shall also include an angel fund. Venture Capital Schemes shall be filed before IFSCA as "venture capital fund" under Category I AIF.

2. Green channel: The filing of scheme documents for such VCS shall be under a green channel i.e. the schemes filed can be open for subscription by investors immediately upon filing with the IFSCA. The validity of the placement memorandum for launch of the venture capital scheme shall be six (6) months from the date of filing with the IFSCA.

3. Eligible Investors: (a) VCS to have less than 50 investors; (b) Accredited Investors or investors investing above USD 250,000 shall be permitted to invest in such schemes.

4. Permissible Investments: A VCS may invest moneys collected under any of its schemes only in specified avenues, such as securities issued by unlisted entities; securities listed or to be listed or traded on stock exchanges in IFSC, India or foreign jurisdiction; debt securities; securitized debt instruments; other VCS set up in the IFSC, India and foreign jurisdiction; units of mutual funds and AIFs in India, IFSC or foreign jurisdiction; limited liability partnerships; other securities or financial products/ assets or instruments as specified by the IFSCA.

5. Nature of scheme: Only close ended schemes with a minimum tenure of 3 years. Tenure can be extended subject to fulfilment with certain conditions. VCS shall be constituted in IFSC as Company or LLP or Trust under the applicable laws of India.

6. Corpus of scheme and investment Restrictions: Minimum size of the corpus to be USD 5 million, and total corpus shall not exceed USD 200 million. Further, VCS shall invest at least 80% of the AUM in investee companies incorporated for less than 10 years or other VCS.

7. Borrowing: A VCS may borrow funds or engage in leveraging activities, subject to the certain conditions including disclosure of maximum leverage by the scheme in the placement memorandum.

8. Computation of NAV: To be done at least on an annual basis.

9. Skin in the game of FME: The FME shall ensure that under a venture capital scheme, the FME or its associate shall invest:

- at least 2.5% of the targeted corpus and not exceeding 10% of the targeted corpus in a scheme with targeted corpus of less than USD 30 million;

- at least USD 750,000 and not exceeding 10% of the targeted corpus in a scheme with targeted corpus of more than USD 30 million.

10. Timeline for contribution by FME: The said contribution in proportion to investor's investment in the scheme shall be made by the FME or its associate entity within forty-five (45) days (which may be extended subject to IFSCA's approval) and maintained on ongoing basis. The contribution, if brought in by FME, shall be included for the purpose of net worth requirements.

11. Exemption from contribution: The said contribution shall be exempted in certain situations:

(a) where at least 2/3rd of the investors in the scheme by value permits waiver of such contribution;

(b) where at least 2/3rd of the investors in the scheme are accredited investors;

(c) where scheme is a fund of fund scheme investing in a scheme which has similar such requirements;

(d) in case of relocation of funds /schemes established or incorporated or registered outside India to IFSC.

12. Co-investment and leverage: Co-investment in permissible investment through a SPV under a framework specified by the IFSCA or through a segregated portfolio by issuing a separate class of units. Such SPV may undertake leverage as disclosed in the placement memorandum.

G. Schemes for Fund Management | Retail Schemes

1. Type of FME: Retail Schemes are schemes that shall be launched by Registered FMEs (Retail) for pooling money from all investors or a section of investors through an offer document for investment as per its stated investment objective in various permissible investments.

2. Nature of scheme: Retail schemes may be open ended or close ended.

3. Eligible Investors: Retail schemes shall have at least 20 investors with no single investor investing more than 25% in a scheme.

4. Permissible investments: A retail scheme may invest moneys collected under any of its schemes only in securities listed or to be listed or traded on stock exchanges in IFSC, India or foreign jurisdictions; securities issued by unlisted entities; money market instruments; debt securities; securitized debt instruments, which are either asset backed or mortgage-backed securities; other investment schemes set up in the IFSC, India and foreign jurisdiction subject to appropriate disclosure in the offer documents; derivatives including commodity derivatives only for the purpose of hedging subject to suitable disclosures in the offer document; units of mutual funds and alternative investment funds in India and foreign jurisdiction; or such other securities or financial products/assets or instruments as specified by IFSC.

5. Investment Restrictions inter alia include:

(a) Open ended schemes: Maximum investment in unlisted securities should not exceed 15% of the total AUM of the schemes.

(b) Close ended schemes investing more than 15% in unlisted securities: Minimum amount of investment by an investor shall be USD 10,000.

(c) Retail schemes shall not invest more than 10% of its AUM in securities of a single company.

(d) The minimum size of the retail schemes shall be USD 5 Million.

6. Skin in the game: The FME shall ensure that under a retail scheme, the FME or its associate shall invest, lower of 1% of the AUM of the scheme or USD 200,000.

H. Schemes for Fund Management | Family Investment Funds (FIFs)

| Provision | Explanation |

| Legal form | Family Investment Fund could be set up in the IFSC as a Company, Trust (Contributory Trust only) or LLP or any other form as may be permitted by the IFSCA from time to time. |

| low body | A FIF in IFSC should have and maintain a minimum corpus of USD 10 million within a period of 3 years from the date of obtaining certificate of registration. |

| Nature of fund | Open-ended or close-ended, depending upon the requirements of the family. |

| Permissible activities | FIF may undertake all activities related to managing family investment fund and as may be specified by the IFSCA. |

| Permissible investments | FIF may invest money in a specific set of instruments which inter alia include securities issued by unlisted entities, securities listed or to be listed or traded on stock exchanges in IFSC, India or foreign jurisdiction, money market instruments, debt securities, derivatives including commodity derivatives, investment in LLPs, units of mutual funds and AIF in India and foreign jurisdiction, and physical assets such as real estate, bullion, art, etc. |

| Borrowing | FIF may borrow funds or engage in leveraging activities as per their risk management policy. |

I. Schemes for Fund Management | Special Situation Funds (SSF)

1. What is a SSF: A scheme that invests in special situation assets in accordance with its investment objectives and may act as a resolution applicant under the Insolvency and Bankruptcy Code, 2016 (Insolvency Code).

2. Permissible Investment: SSFs can invest in special situation assets which inter alia include:

(a) stressed loan available for acquisition in terms of Clause

58 of Master Direction – Reserve Bank of India (Transfer of

Loan Exposures) Directions, 2021 (RBI Master

Direction), a resolution plan approved under the

Insolvency and Bankruptcy Code, 2016 (IBC) or in

terms of any other policy of Reserve Bank of India

(RBI) or IFSCA or Government of India issued in

this regard from time to time;

(b) security receipts issued by an Asset Reconstruction Company

(ARC) registered with RBI;

(c) securities of investee companies:

-whose stressed loans are available for acquisition in terms of

Clause 58 of the RBI Master Direction, a resolution plan approved

under the IBC or in terms of any other policy of the RBI or IFSCA

or Government of India issued in this regard from time to

time;

-against whose borrowings, security receipts have been issued by an

ARC registered with the RBI;

-whose borrowings are subject to corporate insolvency resolution

process under Chapter II of the IBC;

-who have disclosed all the defaults relating to the payment of

interest or repayment of principal amount on loans from banks /

financial institutions/ systemically important non-deposit taking

Non-Banking Financial Companies (NBFC)/ deposit

taking NBFC and /or listed or unlisted debt securities and such

payment default is continuing for a period of at least 90 calendar

days after the occurrence of such default; and

(d) any other asset as may be specified by IFSCA from time to

time.

3. Nature of Scheme: A SSF to be close ended with a minimum tenure of 3 years. Tenure can be extended subject to fulfilment of certain conditions. A SDF shall be constituted in IFSC as a company or LLP or Trust under the applicable laws of India.

4. Borrowing: An SSF shall not borrow or engage in any leveraging activities other than to meet day-to-day operational requirements.

J. Exchange Traded Funds (ETFs)

1. Type of FME: Only Registered FMEs (Retail) shall launch ETFs.

2. Type of ETFs: ETF shall be mandatorily listed and traded on a recognised stock exchange and shall include:

(a) Equity Index based ETFs

(b) Debt Index based ETFs

(c) Commodity based ETFs

(d) Hybrid ETFs (investing in 2 or more asset class)

(e) Actively Managed ETF

(f) Any other ETFs subject to approval of the concerned recognised

stock exchange and IFSCA

The IFSCA Fund Regulations provide for governing structures for the aforesaid ETF schemes.

K. Focus on Environment Social Governance (ESG)

1. The IFSCA Fund Regulations mandate a FME managing AUM above USD 3 Billion as at the close of a financial year or any other threshold of AUM as may be specified by IFSCA, to:

(a) establish policy on governance around material sustainability-related risks and opportunities

(b) disclose in its annual report how the FME identifies, assesses and manages material sustainability-related risks

(c) establish and disclose in its annual report the process of factoring sustainability-related risks and opportunities into fund manager's investment strategies and processes, including, where relevant, data and methodologies used

(d) comply with any other sustainability related requirements as may be specified by IFSCA

2. Further, a FME that launches a scheme related to ESG, is required to make full disclosure regarding investment objective, investment policy, strategy, material risk, benchmark, etc., in the manner as may be specified by the IFSCA.

3. Further, all scheme documents filed by FME with the IFSCA are required to disclose whether sustainability related risks are incorporated in the decision making. The FME shall provide details when sustainability related risks are incorporated in the decision making. A negative statement shall be included when sustainability related risks are not incorporated in the decision making.

L. Other Fund Management Services

| Provision | Explanation |

| Portfolio Management Services |

A Registered FME may offer portfolio management services to its clients.

Further, the IFSCA Fund Regulations provide for norms related to disclosures, reporting, investment restrictions and other general obligations of portfolio managers. |

| Investment Trusts |

(i) The IFSCA Fund Regulations provide for a detailed consolidated regulatory framework for REITs and InvITs. (ii) Any person from IFSC or India or a foreign jurisdiction desirous to operate an Investment Trust in the IFSCs shall obtain registration with IFSCA. (iii) An Investment Trust is permitted to raise funds through: (a) Public issue with units listed on a recognised stock exchange in IFSC; or (b) Private placement with units listed on a recognised stock exchange in IFSC; or (c) Private placement whose units are not proposed to be listed on any recognised stock exchange. (iv) In case of private placement, any Registered FME may act as Investment Manager to such Investment Trusts. (v) In case of a public issues, a Registered FME (Retail) shall only be eligible to be appointed as an Investment Manager. |

M. Listing of schemes/ units of FMEs

1. Listing of open-ended schemes: May be listed by FMEs at their discretion on recognized stock exchanges in IFSC.

2. Listing of close ended schemes: May be listed by FMEs at their discretion on recognized stock exchanges in IFSC. However, a close ended retail scheme shall be mandatorily listed on at least one of the recognised stock exchanges.

3. Listing of ETFs: Units of ETFs to be mandatorily listed on at least one of the recognised stock exchanges.

4. Listing of Investment Trusts: Units of Investment Trust (except for private placement of Investment Trust whose units are neither listed nor proposed to be listed on a recognized stock exchange) shall be listed on a recognized stock exchange within defined timelines.

The IFSCA Fund Regulations also provide for conditions of delisting of ETFs or Investment Trusts or schemes by recognized stock exchanges.

N. General Obligations and Responsibilities

| Provision | Explanation |

| Code of Conduct | Every FME, its fiduciaries, KMPs (including Principal officer, Fund Managers and Designated Compliance Officer) shall abide by the Code of Conduct as specified under the regulations |

| Records | Every FME shall keep and maintain proper books of account, records and documents, for each scheme so as to explain its transactions and to disclose at any point of time the financial position of each scheme and in particular give a true and fair view of the state of affairs of the scheme and intimate to IFSCA the place where such books of account, records and documents are maintained. |

| Business continuity plan | A registered FME shall maintain a business continuity plan identifying procedures relating to an emergency or significant business disruption and shall conduct an annual review of its business continuity plan |

| Cyber security | A registered FME to have a robust cyber security and cyber resilience framework in place |

| Advertisement | A detailed advertisement code is provided which is required to be adhered to. |

| Risk management system | A registered FME to have a sound risk management system for comprehensively managing all risks |

| Change in control | Prior approval of the IFSCA required in case of any direct or indirect change in control of the FME |

| Investment Committee | The FME may, at its discretion, constitute an Investment Committee to make investment decisions for the schemes. All responsibilities casted upon the FME and Fund Managers under the regulations to the extent applicable shall also be complied with by the members of such Investment Committee. |

| Annual report and Audit |

FME shall prepare in respect of each financial year an annual report of accounts of the schemes and abridged summary thereof and shall be submitted to the IFSCA not later than four months from the end of financial year. The Annual Report and abridged summary shall contain details that are necessary for the purpose of providing a true and fair view of the operations of the scheme.

|

| Merger/ demerger/ reconstruction of schemes | Merger/ demerger/ restructuring of schemes permissible, subject to the approval of the IFSCA / guidelines as may be issued by the IFSCA |

| Independent custodian |

The FME shall appoint an independent custodian to carry out the custodial services at least for the following schemes: (a) Retail schemes; (b) Open ended restricted schemes; and (c) All other schemes managing AUM above USD 70 Million. |

| Redemption | A close ended scheme shall be fully redeemed at the end of maturity period. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.