- within Employment and HR topic(s)

- in India

- within Employment and HR, Real Estate and Construction and Environment topic(s)

- with Inhouse Counsel

- with readers working within the Law Firm industries

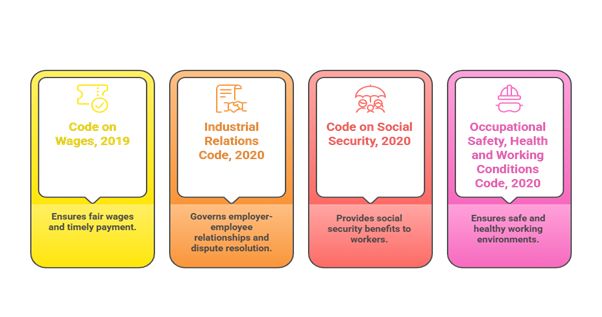

India has entered a new phase in employment regulation with the implementation of the four consolidated Labour Codes. Together, these Codes replace 29 central labour laws with a unified legislative framework on wages, industrial relations, social security and working conditions. This marks a decisive shift away from a fragmented, decades old regime that often left both employers and workers navigating redundancies, overlaps and outdated provisions.

The new framework aims to provide clarity and predictability. The following analysis sets out the substance of the Codes along with the expected on-ground realities businesses must prepare for.

I. Code on Wages, 2019

The Code on Wages streamlines four earlier laws into a single uniform statute governing minimum wages, payment of wages, bonus and equal remuneration. It ensures that every worker, irrespective of industry or skill category, receives legally mandated wage protection.Key Features

|

Area |

Provision |

|

Universal Minimum Wages |

All employees must receive minimum wages. The earlier limitation to scheduled employments no longer applies. |

|

Floor Wage |

A national floor wage will be notified, over which states must set their minimum wages. |

|

Standard Definition of Wages |

A single unified definition reduces disputes about basic wage components and brings uniformity in calculations for PF, ESIC, gratuity and bonus. |

|

Equal Remuneration |

Employers must ensure equal remuneration for similar work without any gender based differentiation. |

|

Timely Wage Payment |

Clear timelines for monthly, weekly and daily wage payments. |

|

Deductions and Overtime |

Standardised rules define lawful deductions and compensation for overtime. |

II. Industrial Relations Code, 2020

The Industrial Relations Code updates the law on trade unions, standing orders and industrial disputes. It seeks to create a balanced structure that protects workers while allowing businesses operational flexibility.Key Features

|

Area |

Provision |

|

Trade Union Recognition |

Framework for identifying negotiating unions or councils for collective bargaining. |

|

Standing Orders |

Mandatory for establishments employing 300 or more workers. These define service conditions, discipline and termination. Earlier the threshold was 100 workers |

|

Fixed Term Employment |

Fully recognised. Fixed term workers receive statutory benefits in proportion to their tenure, including gratuity. |

|

Thresholds for Retrenchment and Closure |

Prior approval requirement applies to establishments with 300 or more workers. |

|

Dispute Resolution |

Conciliation and tribunal processes have been rationalised for speed and consistency. |

III. Code on Social Security, 2020

This Code consolidates nine social security laws, expanding the social protection net significantly. It covers provident fund, ESIC, gratuity, maternity benefits, employee compensation and welfare schemes for unorganised, gig and platform workers.Key Features

|

Area |

Provision |

|

Universal Social Security |

Coverage extends to organised, unorganised, gig and platform workers. |

|

Gig and Platform Worker Schemes |

Contributions are mandated from aggregator platforms based on turnover. |

|

PF and ESIC |

Existing schemes continue with expanded coverage. ESIC becomes available nationwide. Hazardous activities trigger mandatory coverage even for establishments with a single employee. |

|

Gratuity |

A uniformone year eligibility thresholdnow applies to all establishments governed by Shops and Establishments Acts and to factories under the Factories Act. Fixed term employees receive gratuity on a pro rata basis. Working journalists continue with a shortened qualifying period. |

|

Maternity Benefit and Creche Facilities |

Continued with clearer compliance duties. |

|

Unified Registers |

Digital maintenance of registers and records is required. |

IV. Occupational Safety, Health and Working Conditions Code, 2020

This Code amalgamates 13 laws regulating workplace conditions, safety standards, licensing and working hours. It covers factories, mines, docks, construction and many other categories of establishments.Key Features

|

Area |

Provision |

|

Single Registration |

Consolidates multiple earlier registrations into one. |

|

Health and Safety Protocols |

Establishes uniform standards including ventilation, cleanliness, emergency procedures and medical facilities. |

|

Annual Health Check Ups |

Mandatory for all workers over 40 years of age. |

|

Appointment Letters |

Every worker must receive a formal appointment letter outlining terms of employment. |

|

Employment of Women |

Women are permitted to work in any role, including night shifts, with consent and safety measures. |

|

Inspector cum Facilitator |

Replaces traditional inspectors with a more guidance oriented approach. |

|

Common Licence |

A single licence can be obtained for factories, industrial premises and contract work. |

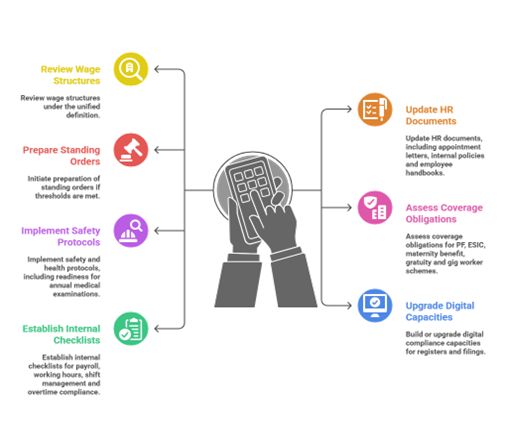

The Implementation Reality: What Employers Should Anticipate

The implementation date is significant because of its suddenness. Organisations must act promptly while also managing uncertainty in interpretation and state level rule making.

Key immediate priorities

Conclusion

The new Labour Codes represent a decisive modernisation of India's employment law framework. They bring clarity, consistency and a wider social protection net for workers, while offering businesses a simpler statutory structure. However, the transition will demand significant readiness from enterprises, particularly MSMEs and service sector employers. The first few months will determine how smoothly the regime settles, and both administrative authorities and employers will need to adopt a pragmatic, facilitative approach.

The structural benefits of the Codes are clear. The challenge is ensuring that the shift is implemented without disruption and with adequate support for smaller enterprises that form the backbone of India's economy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.