- in United States

- within Family and Matrimonial, Insolvency/Bankruptcy/Re-Structuring, Government and Public Sector topic(s)

- with readers working within the Law Firm industries

Dear Entrepreneurs welcome aboard!

Consider this a journey from startup ideation to operating a full-fledged business. Our next stop is hiring employees or independent consultants to help you conduct day-to-day business activities. Once you have secured the necessary capital and resources, you'll need to hire employees who will work for you. You may hire full-time, part-time, contractual employees or Independent Consultants depending on the needs of your venture.

As they say, if it isn't documented on paper, it never happens. Hence, you are going to need contracts. Contracts may come across as boring, lengthy documents loaded with legal jargon and no pictures, adding to their dullness. However, they are quite helpful in defining and governing the aspects of a relationship between multiple parties and saving your assets like capital and intellectual property, among other things.

So, hop on, mate! Let us unravel the complex world of contracts and key considerations you must remember while hiring fresh talent for your company.

(Oh, and do not worry; we have pictures and flowcharts to guide your imagination.)

Importance of Contracts

While the contracts may come across as a bit of an eyesore, trust me, it has some real benefits:

- Legal Responsibilities, Rights, and Liabilities: A well-drafted contract clearly defines the parties' roles, responsibilities, rights, and liabilities. It ensures transparency and minimizes the scope of confusion, preventing future conflicts and allowing for the smooth functioning of business operations.

- Legally Binding Nature: Contracts are legally binding, meaning that all parties are bound by the terms voluntarily agreed upon. Once the contract has been executed, no party can deviate from carrying out its obligations without a valid reason or unforeseen circumstances (and I do not feel like doing so is a legally valid reason).

- Legal Remedies: A clear, well-defined contract helps resolve disputes when any party falters in carrying out their commitments or there is some contractual breach. The mechanism to resolve any potential dispute can be decided beforehand. For example, instead of going straight to court, the parties may try to resolve disputes amicably through mediation or arbitration. This foresight reduces the stresses and ambiguity in disagreements, ensuring that the disputes are resolved promptly and efficiently with minimal disruption to business.

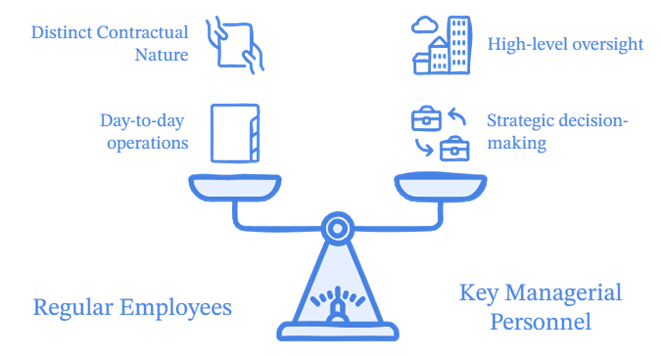

Employees of the Start-up

Employees fall into two major categories: the regular employees engaged in running the day-to-day business activities and the key managerial personnel ('KMP') who will oversee the business and help you make crucial decisions.

The term 'employee' is not explicitly defined in the Companies Act, 2013 ('Act'). However, it can be understood from the perspective of corporate governance and the rights and duties of individuals in employment relationships. An employee is an individual hired by the company or an organisation to perform duties/specific tasks in exchange for wages or salary. Employees can be hired on a full-time, part-time, contractual, or temporary basis, depending on the needs of the enterprise.

As per general business practice, an employee may fall under these broader umbrellas depending on their type of employment contract:

i. Permanent Employees: These employees are also commonly referred to as full-time employees. Upon being hired by the company, they cannot solicit any other work on the side (moonlighting is not an acceptable practice!). These employees need to adhere to the company's policy and standards. Being a full-time employee grants protection and benefits like using office space and property, insurance coverage, bonuses, retrenchment compensation, and other similar perquisites etc.

ii. Contractual Employees: These employees are hired short-term and can be full-time or part-time, depending on the company's requirements. They are entitled to lesser benefits than permanent staff, such as bonuses, PF, or gratuities.

Key Managerial Personnel

As per s. 203 of the Act, public companies are mandatorily required to have certain KMPs. However, this requirement is relaxed for unlisted start-up companies. KMP, as per the definition in s. 2(51) of the Act refers to higher-ups or hot shots of the company, i.e., people calling the real shots. No, the definition under the Act does not say anything about the shots. I digress. The definition specifies the following positions as KMP:

- CEO, MD, or Manager

- Company Secretary

- Whole-Time Director

- CFO

- Any other officer as may be prescribed by the government later.

Start-ups are by nature ever-evolving and operate with greater flexibility. As adhering to this definition is not mandatory for unlisted start-ups, they can devise their own unique positions to suit their company's operational structure.

Hiring Talent

In the golden words of Suresh Venkat from ET Start-Up School, 'starting up a business is hard, really really hard. You are likely to lose both your sleep and your hair.'

We get it. The money is tight. The time and resources are limited. You would need a pool of talented individuals to work with you instead of just any random person from a premier institution or a reputable company. One of the most lucrative options is to provide ESOPs to attract the right people at the initial stages. Only the people who truly believe in your vision and contribute diligently towards the growth of your business would appreciate this option along with a nominal salary.

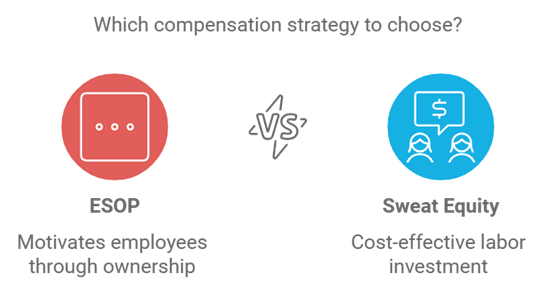

ESOPs and Sweat Equity

To reward your employees' hard work and faith in your venture, one may issue ESOPs or Sweat Equity as a token of appreciation. In the early stages, as the resources are limited and there are few to no appraisal events, perks like these can boost employees' motivation, engagement, and performance. Options like these make employees feel more connected to the company by allowing them to benefit directly from its growth. Both of these options, upon issue, need to be disclosed in the company's Board Report, as per the Act and the Share Based Employee Benefits and Sweat Equity Regulations, 2021 ('SBEB Regulations').

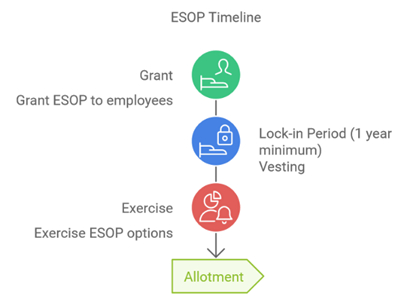

1) ESOPs (Employee Stock Ownership Plans)

- The employees are given the option to purchase company shares later. This option is governed by s. 62(1)(b) of the Act, along with the Share Capital and Debenture Rules, 2016 ('SCAD Rules').

- ESOPs have a mandatory lock-in period of one year from the time they are granted until the option is vested; however, companies are free to extend this period as they deem necessary for their commercial viability.

- This option allows the employees to purchase shares at a predetermined price per the agreement for a future date. The consideration for purchase needs to be cash, and there are no size limitations for issuance.

- Stages: Grant → Vesting → Exercise → Allotment

i. Grant: It is referred to the process of issuing ESOPs by the company to the employees.

ii. Vesting and Vesting period: Vesting refers to employees becoming entitled to receive the company's shares after completing the vesting period. Companies are at liberty to decide the duration of the vesting period.

iii. Exercise: When employees can finally exchange their options for company shares, the process of acquiring shares is called exercising.

2) Sweat Equity

- This refers to compensating the employees for their exemplary value in addition to the company by offering them equity shares at a discounted rate or in consideration other than cash for their technical expertise.

- Governed by s. 54 of the Act and SBEB Regulations for listed companies and SCAD Rules for unlisted companies.

- Issued to employees for their skills, know-how or any other contribution which does not involve direct monetary payment.

- Comes with a mandatory lock-in period of three years as per the rules.

- For those three years, it is non-transferable.

- R. 8 of the Companies (Share Capital and Debenture) Rules, 2014 specifies that sweat equity is to be capped per year at 15% of the total paid-up capital or Rs. 5 crores (whichever is higher) and should not go beyond 25% of the company's paid-up capital at any point in time.

Employment Contract

Employment contracts are vital tools for establishing a professional relationship between the parties and ensuring their rights and interests are protected in accordance with the statute. They are governed by the Indian Contract Act, 1872 and relevant labour laws. According to good business practice, the clauses in an employment contract must be elucidated to prevent ambiguity.

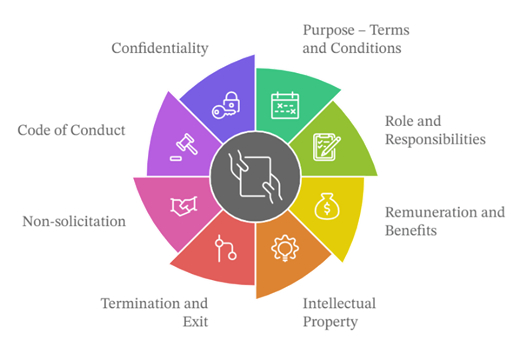

Here are some standard clauses which can be added to an employment contract:

- Purpose: This clause covers the terms and conditions of employment by clearly stating what is to be done and what is not.

- Role and responsibilities: This includes the regular day-to-day responsibilities of the employees, making sure that both parties are on the same page about what is expected of them. It sets out expectations and criteria for evaluation, future appraisal, promotions, etc. It gives a sense of stability and eliminates confusion.

- Remuneration and Benefits: As a standard practice, the salary is generally mentioned in the offer letter; however, a clear salary break-up can be mentioned in the employment contract. The deductions and perks are to be specifically noted to minimize future disputes benefitting both parties.

- Intellectual Property: The terms of usage for intellectual property are crucial. As a budding company, your USP is everything. An intellectual property clause highlights the usage and handover of the relevant data and information and prevents data breaches.

- Termination and Exit: This clause can specify guidelines for a notice period and severance pay.

- Non-solicitation & Confidentiality: The information shared with employees internally can be well-defined on a 'need to know' basis and should not be shared further with others, such as companies, clients, vendors, etc. This clause protects the interests of the company, ensuring their teams or information are not poached.

- Code of Conduct: Every company has its own policies and procedures to which employees must adhere. These include working hours, office culture, leave protocols, POSH guidelines, etc.

- Dispute Resolution: A separate clause for dispute resolution helps define a mechanism for navigating internal disputes. Companies may use internal committees to handle disputes or seek mediation or arbitration. As a general rule of thumb, litigation must be avoided at all costs for start-ups.

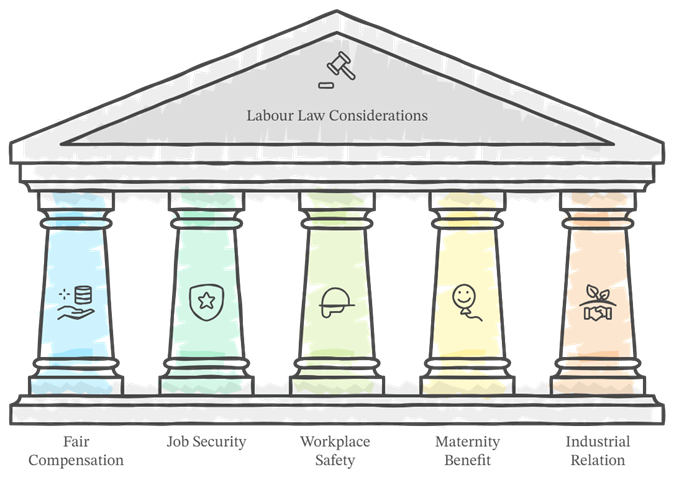

Labour Law Considerations

Every company or venture must adhere to the labour law provisions of the country in which it operates. Some of the Indian Labour laws are mentioned below.

- Payment of Wages Act, 1936: This act governs the timely payment of wages without unauthorised deductions. It protects employees against unjust deductions, delayed payments, and exploitation.

- Maternity Benefit Act, 1961: This act protects female employees and curbs unjust treatment of pregnant women in the organisation. Its provisions support female employees during pregnancy and post-childbirth.

- Payment of Bonus, 1965: This act encourages employee productivity by ensuring the payment of bonuses to employees who earn profits and/or productivity.

- Child Labour (Prohibition & Regulation) Act, 1986: This act prohibits the employment of children under 14 in hazardous working conditions and mandates a safe working environment in non-hazardous jobs.

- Occupational Safety, Health & Working Conditions Code, 2020: The provisions of the code coversafe working environments and health. This code focuses on curbing occupational hazards, reducing workplace accidents, and ensuring safety and health.

- Industrial Dispute Act, 1947: This act provides a mechanism for handling disputes between employees and employers and ensuring a well–balanced relationship within the organisation.

The Independent Consultants/Advisors in a Start-up

The independent consultants are not employees of the company but are hired on a project-to-project basis. The company does not have any control over these consultants. They are onboarded for their subject-matter expertise and/or experience. The necessary clauses and details of a retainer ship agreement are illustrated below.

- Retainership agreement: This agreement sets out the nature of the relationship as a retainership and not employment; hence, the consultants are not entitled to employee benefits.

- Deliverables: It is important that both parties are clear about

their respective expectations. The agreement must clearly state the

deliverables expected for a specific project and timeline. The

description of the final output and timeline must be explicitly

stated, along with the scope of the project. It is crucial to

mention that the consultant is not an employee of the organisation

and, hence, is not entitled to definitive perks. You may not tell

the consultants how to do what is to be done, but you can always

tell them what is to be done and when.

- Non-Disclosure Agreement: A confidentiality agreement or clause is necessary to protect sensitive information about your company, such as your financial data, business plan, client lists, and other proprietary details. It must specify the duration and extent of confidentiality obligations that would stand even if the business relationship between the parties were terminated.

- Intellectual Property: Any company or venture's intellectual property is of significant importance. IP refers to patents, trademarks, trade secrets (like the recipe of Coca-Cola), copyrighted information, etc. While dealing with consultants, it is crucial for the company to set out the terms of the handover of such IP from one party to another. The company can insert the clause of owning the intellectual property arising out of the said project and use it however it may without consulting its maker upon execution of the agreement.

- Remuneration: The payment structure needs to be specified, whether hourly, weekly, or monthly, as decided by the parties. One prevalent industry practice is the issue of Advisory Shares (detailed in the next segment). For advisory shares, it is advisable to include clear terms like vesting schedules, exercise prices, and any other special conditions one may deem fit.

- Data Privacy: Protecting sensitive information requires complying with data protection laws, such as the Digital Personal Data Protection Act, 2023, and SDPI Rules.

- Data Transfer: Third-party data transfer or access needs to be restricted, and specific measures need to be taken by the parties to add an additional layer of security and prevent data breaches.

- Anti-Bribery: This clause requires the consultant to report any instance of bribery or corruption. India's anti-bribery and corruption laws would then bind the consultant.

- Indemnity: The extent of liability for both parties can be specified and fixed in case of any loss, damages, or other legal expenses arising from this agreement.

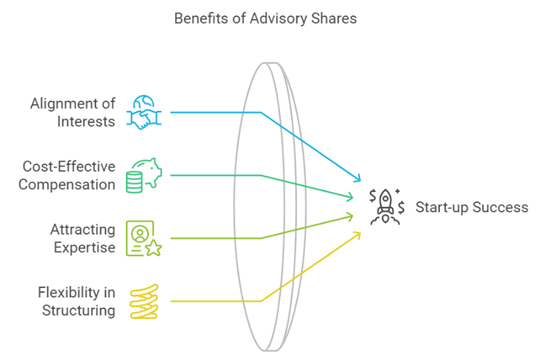

While engaging independent consultants or advisors, it becomes crucial to give the right incentives in order to ensure commitment and alignment with the company's goals and objectives. Given that these consultants are not your employees and hence not entitled to traditional benefits, start-ups often compensate for such services through creative arrangements, such as, let us be honest, you do not have the money to afford experts. Incentives like advisory shares ensure the company's success due to the vested interests. It is flexible in nature and saves cash you will be burning to get your venture running.

Advisory Shares

Like ESOPs are offered to employees, advisory shares are given to the advisors. Advisory Shares are a type of equity compensation given to advisors/consultants in a start-up setting, usually in the form of stock options. It allows start-ups to compensate advisors in a cashless manner, which is crucial in the initial stages when the companies have negative cash flow. The advisors typically get between 0.25% to 1% of the total equity of a start-up, and this amount may vary. Depending on their involvement, a company might allocate up to 5% of its equity to be split between the advisory members.

Types of advisory shares include Phantom Stocks, non-qualified stock options (NSOs), Restricted Stock Agreements (RSAs), which are not legally recognised in India, Celebrity Shares, etc.

Reasons to Consider Advisory Shares

i. Incentivize Advisors: Consultants are usually well-to-do individuals, and start-ups cannot afford them. Compensating them through advisory shares helps align their interests with the company's growth. This way, the consultants would be more motivated to work towards the company's success, as its growth will benefit them directly.

ii. Saves Cash: When money is tight in the initial stages, and you need an expert to get on board, offering up your equity in compensation is a great way to manage your finances efficiently.

Consideration for the Entrepreneurs/ Founders

i. Expert Advice: The advisors can provide critical insights and networks, boosting your company's growth. As these agreements are confidential in nature, one can rest assured that their company's information will be protected.

ii. Equity Dilution: A word of caution for the founders: Although this small percentage might seem insignificant in the early stage, it may become highly valuable in the later rounds or when the company goes public.

Advisors can be engaged in multiple ventures at a time, so it is important to ensure that they dedicate enough time and energy to yours. It is your baby, and you are responsible for its proper nourishment. Advisors are like doctors you may need from time to time.

Conclusion

Dear passengers, We are approaching our destination and will be making a stop shortly.While deboarding this train, please remember to keep it transparent in professional relationships; unlike in a situation, there is no room for wishy-washiness in business.

In the endlessly morphing realm of start-ups, where innovation and technology are developing lightning-fast, it is understandable to trivialise the importance of a solid contractual foundation. As entrepreneurs, please do not make this mistake! For maintaining sustainability and resilience, a robust legal mechanism is crucial for driving your business forward. Your business cannot run on its own; employees and expert advisors are quintessential assets of your company. Hence, to attract a splendid bunch, having coherent and orderly agreements is not a mere formality but a strategic necessity.

A systematic and well-drafted contract crystallises responsibility and rights and ensures trust between the parties, reflecting alignment with the company's growth and vision. Clauses like intellectual property, fixed compensation structures, labour law protection, data privacy, indemnification, and dispute resolution mechanisms provide a protective safeguard for the parties, allowing them to operate clearly and focus on scaling their operations rather than dealing with everyday squabbles.

Apart from your IP/USP, your talent is the foundation of your business's success, and contractual foresight empowers a start-up to build a team of committed, motivated and legally protected workforce. As they say, better safe than sorry. The more shielded your company is from the outset of your venture, the more equipped it will be to tackle the growth challenges and turn legal complexities into strategic advantages.

In conclusion, contracts are not mere formalities. They are vital for running and safeguarding a business – its people, innovation, and future. As you embark on your entrepreneurial ride full throttle, please consider contracts as both your safety net and your roadmap to guide you towards long-term success.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.