Recently, the Philippines has issued an order to impose temporary anti-dumping duties on cement products exported from Vietnam to this country after 2 years of investigation.

In early 2021, the cement manufacturing industry in the Philippines filed a lawsuit against Vietnamese cement producers for dumping cement products in this country, causing serious damage to the domestic industry.

In April 2021, the Philippine Department of Trade and Industry (DTI) initiated an anti-dumping investigation against cement products originating from Vietnam based on a request from domestic cement manufacturers in this country.

After two years of investigation, the Philippines confirmed that the volume of exports from Vietnam to the Philippines did not cause serious damage to the country's domestic industry. The Philippine investigative agency said that other objective causes of significant damage to the country's domestic manufacturing industry came from the Covid-19 pandemic, the decline in domestic market demand, the impact of international tension,...

Thereby, the Philippines does not continue to extend the safeguard duty on cement products imported into the Philippines market, including cement products imported into Vietnam.

However, according to the previous announcement of the Vietnam Cement Association VNCA at the end of 2022, the agency projected that there will be 6 Vietnamese cement exporters to the Philippines that will not be subject to anti-dumping duties on some cement products. There are about 11 other businesses that will be taxed. The anti-dumping duty rate that Vietnamese enterprises have to bear ranges from 4% to 28% of the export price for OPC cement and from 3% to 55% for mixed cement.

However, that notice did not specify the names of businesses that were exempt or taxed.

Vietnamese cement manufacturers exporting to the Philippines are subject to anti-dumping duties

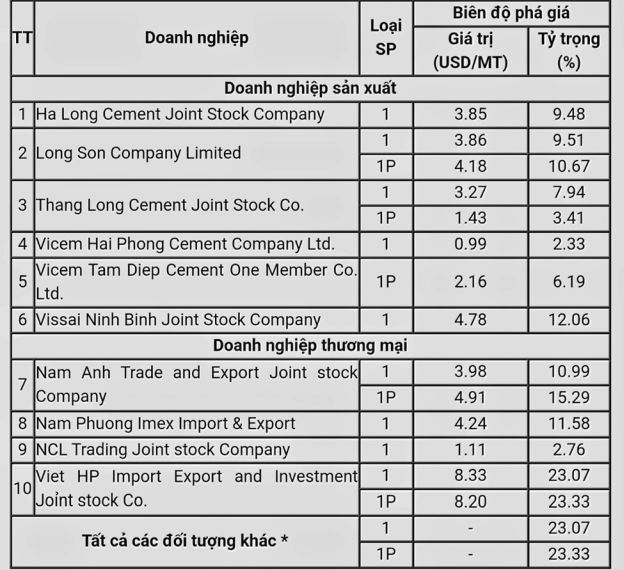

After the conclusion of the Department of Trade and Industry of the Philippines (DTI), the Philippine Customs Department has announced a list of Vietnam's cement exporters to this country that are subject to anti-dumping duties and not subject to anti-dumping duties.

Accordingly, the Philippines imposed a temporary anti-dumping duty with a period of 5 years on imports of ordinary portland cement type 1 (AHTN 2017/2022 subheading 2523.29.90) and mixed cement grade 1P (AHTN 2017/2022 subheading No. 2523.90.00).

The order to impose temporary anti-dumping duty takes effect from the date of its issuance.

Notably, cement manufacturing and exporting enterprises to the Philippines that do not cooperate with goodwill during the investigation process are subject to high tax rates (the highest compared to all Vietnamese cement manufacturing enterprises that have a fixed tax rate). Thereby, this decision shows the importance of fully cooperating with the investigating authority in the investigation process, illuminating the necessity to contact a reputable anti-dumping law firm to receive timely legal aid.

The exporters identified as having minimal and/or negative dumping margins include: Cam Pha Cement, Chinfon and some cement trading companies.

Some other famous cement manufacturers in Vietnam that are subject to temporary anti-dumping tax are listed as: Long Son Cement, Ha Long, Thang Long, Vissai Ninh Binh, Vicem Tam Diep, Vicem Hai Phong,...

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.